Fill Out Your 140Nr Form

The Arizona Form 140NR is a critical document for nonresidents who earned income from Arizona sources during the tax year. This form serves as the Nonresident Personal Income Tax Return and is essential for ensuring compliance with Arizona tax laws. Included within the 140NR booklet are several important components, such as the Schedule A(NR) for itemized deductions and Form 204 for requesting an extension. Nonresidents must file this form if they were not residents of Arizona but received income from wages, rental properties, or business activities within the state. The due date for filing is typically April 15, with an extension option available until October 15 for those who qualify. Taxpayers should be aware that the federal adjusted gross income used for the Arizona return may differ from that reported on the federal tax return. Additionally, the Arizona legislature periodically reviews and adopts changes to federal tax law, which can affect how taxpayers complete their returns. It is important to stay informed about these potential changes, as they may necessitate amendments to previously filed returns. For those looking to streamline their filing process, e-filing options are available, offering faster processing times and reduced errors compared to paper submissions. Understanding the nuances of the Form 140NR can significantly impact your tax obligations and potential refunds, making it vital for nonresidents with Arizona income to navigate this form effectively.

Guide to Writing 140Nr

Completing the Arizona Form 140NR is essential for nonresidents who earned income from Arizona sources. After filling out this form, you will need to submit it to the Arizona Department of Revenue by the due date. Ensure that you have all necessary documentation ready, including your federal tax return and any income statements from Arizona sources.

- Obtain the Arizona Form 140NR from the Arizona Department of Revenue website or a tax preparation office.

- Fill in your personal information at the top of the form, including your name, address, and Social Security number.

- Indicate your filing status (single, married filing jointly, married filing separately, or head of household).

- Enter your federal adjusted gross income (AGI) from your federal tax return.

- List all income earned from Arizona sources. This may include wages, rental income, or business income.

- Calculate your Arizona taxable income by subtracting any allowable deductions from your total income.

- Determine your tax liability using the appropriate Arizona tax tables.

- Complete any additional schedules required, such as Schedule A(NR) for itemized deductions.

- Sign and date the form to certify that the information provided is accurate and complete.

- Mail your completed Form 140NR to the address specified in the instructions, or e-file if eligible.

Browse Popular Forms

Arizona Jt-1 - The process can take time, so plan accordingly to avoid disruptions to your business.

What Is Post Training - This form is specific to Arizona's peace officer training requirements.

Common Questions

What is the Arizona Form 140NR?

The Arizona Form 140NR is a Nonresident Personal Income Tax Return. It is specifically designed for individuals who earned income from Arizona sources but were not residents of Arizona during the tax year. This form allows nonresidents to report their income and pay any applicable taxes owed to the state of Arizona.

Who needs to file the Form 140NR?

If you were not an Arizona resident but earned income from an Arizona source in the tax year, you must file Form 140NR. This includes income from wages, rental properties, business activities, or any other income derived from Arizona sources.

How do I check the status of my refund?

You can easily check your refund status by visiting www.AZTaxes.gov. This website provides up-to-date information about your refund and allows you to view your 1099-G online. Note that 1099-G forms will no longer be mailed, so it's important to access them online if needed.

What are the benefits of filing online?

Filing your taxes online offers several advantages. It typically results in faster processing of your refund, leading to quicker access to your money. Additionally, online filing reduces the likelihood of errors, as many programs guide you through the process to ensure you include all necessary information. For those who qualify, online filing can also be free, making it an affordable option. Lastly, e-filing is environmentally friendly, as it minimizes paper usage.

What should I know about itemized deductions on Form 140NR?

When filing Form 140NR, you must be aware that your federal adjusted gross income may differ from what you report on your Arizona return. If you choose to itemize deductions, you need to start with the amount shown on your federal Schedule A. Be mindful that any federal changes to itemized deductions may not automatically apply to your Arizona return unless the state legislature adopts those changes.

What happens if I don't file but am due a refund?

Even if you are not required to file a return based on your income, it is crucial to file if you had Arizona income tax withheld. Filing a return is the only way to claim a refund of any taxes that were withheld. Failing to file could result in losing out on money that is rightfully yours.

What is the deadline for filing Form 140NR?

The deadline for filing your 2020 individual income tax return, including Form 140NR, is April 15, 2021. If you file for an extension, your extended deadline will be October 15, 2021. It is important to ensure that you meet these deadlines to avoid penalties and interest on any taxes owed.

Dos and Don'ts

When filling out the Arizona Form 140NR, there are essential guidelines to follow. Below is a list of things you should and shouldn't do:

- Do ensure that you have all necessary documents ready, including your federal tax return.

- Do accurately report your federal adjusted gross income, as it may differ from your federal return.

- Do check the Arizona tax laws for any changes that may affect your filing.

- Do consider e-filing for faster processing and fewer errors.

- Do make sure to include all income derived from Arizona sources.

- Don't forget to check the income thresholds to determine if you need to file.

- Don't assume that federal deductions apply the same way on your Arizona return.

- Don't ignore the deadline for filing your return or requesting an extension.

- Don't overlook the importance of keeping copies of your submitted forms for your records.

Similar forms

The IRS Form 1040 is a primary document used for individual income tax returns in the United States. Similar to Form 140NR, it requires taxpayers to report their income, claim deductions, and calculate their tax liability. Both forms necessitate the use of federal adjusted gross income as a starting point. While Form 1040 is for residents, Form 140NR is specifically designed for nonresidents earning income from Arizona sources. This distinction emphasizes the importance of understanding residency status when filing taxes.

Form 1040-NR serves as the nonresident version of the IRS Form 1040. Like Arizona's Form 140NR, it is tailored for individuals who are not residents of the United States but have income sourced from within the country. Both forms require similar information, including income, deductions, and credits. However, the Form 1040-NR is used for federal tax purposes, while Form 140NR is specific to Arizona state taxes. The focus remains on accurately reporting income derived from sources within the respective jurisdictions.

Form 204 is an extension request form that allows taxpayers to extend their filing deadline. This form is relevant for both Arizona and federal tax filings. Similar to the provisions in Form 140NR, Form 204 requires taxpayers to estimate their tax liability and pay any owed taxes by the original due date to avoid penalties. Both forms emphasize the importance of timely payments and provide taxpayers with options to manage their filing schedules effectively.

Schedule A (Form 1040) allows taxpayers to itemize deductions on their federal tax returns. This form parallels Arizona's Schedule A(NR) used with Form 140NR, which also facilitates itemized deductions for nonresidents. Both schedules require taxpayers to provide detailed information about eligible expenses, such as medical costs and charitable contributions. The key difference lies in the specific rules and limits set by federal and state regulations, which taxpayers must navigate when claiming deductions.

Form 140 is the standard Arizona income tax return for residents. While it is similar to Form 140NR in that both require reporting income and calculating tax liabilities, the key difference is residency status. Form 140 is used by Arizona residents, while Form 140NR is for nonresidents. Both forms share common elements, such as income sources and deductions, but the applicable tax rates and credits may differ based on residency.

Form 140A is a simplified version of the Arizona tax return for certain taxpayers. Like Form 140NR, it allows for the reporting of income and deductions but is designed for those with simpler tax situations. Both forms require taxpayers to report income derived from Arizona sources, but Form 140A is limited to those who do not itemize deductions. This makes it easier for qualifying individuals to file their taxes without extensive documentation.

Form 140EZ is another simplified Arizona tax return designed for individuals with very basic tax situations. Similar to Form 140NR, it streamlines the filing process for eligible taxpayers. While both forms focus on reporting income from Arizona sources, Form 140EZ is specifically for those with lower income levels and fewer deductions. This ensures that taxpayers can efficiently complete their returns while complying with state tax requirements.

Form 140PY is the Arizona tax return for part-year residents. This form shares similarities with Form 140NR in that it accounts for income earned during a specific period. Both forms require taxpayers to report income from Arizona sources, but Form 140PY is used by individuals who lived in Arizona for only part of the year. This highlights the importance of accurately determining residency status when filing state tax returns.

Key takeaways

Here are key takeaways for filling out and using the Arizona Form 140NR:

- Eligibility: Use Form 140NR if you were not an Arizona resident but earned income from an Arizona source during the tax year.

- Refund Status: Check your refund status online at www.AZTaxes.gov. 1099-G forms will no longer be mailed; you can print them from the same website.

- Filing Options: Consider filing online for faster processing, fewer errors, and potential cost savings. Online filing is often free for those who qualify.

- Adjusted Gross Income: Be aware that your federal adjusted gross income may differ from what you report on your Arizona return. Verify this before filing.

- Itemized Deductions: To claim itemized deductions, start with the amount shown on your federal Schedule A. Changes to federal tax law may affect your deductions.

- Filing Deadlines: Your 2020 income tax return is due by midnight on April 15, 2021. If you file for an extension, the new deadline is October 15, 2021.

- Tax Credits: Nonresidents filing Form 140NR cannot claim the Arizona Family Tax Credit but may still qualify for the Dependent Tax Credit. Ensure you check your eligibility.

Common mistakes

-

Incorrect Federal Adjusted Gross Income: Many people mistakenly use the federal adjusted gross income from their federal tax return without realizing it may differ for Arizona. Always double-check this figure.

-

Missing Itemized Deductions: Some filers forget to start with the federal Schedule A amount when claiming itemized deductions. This step is crucial for accurate reporting.

-

Ignoring State-Specific Changes: Federal tax law changes may not apply to Arizona. Failing to consider these differences can lead to errors on your return.

-

Not Researching Federal Changes: If you opt to not adopt federal law changes, you must research and understand how they affect your return. Many overlook this requirement.

-

Overlooking Filing Deadlines: Missing the April 15 deadline can lead to penalties. If you file for an extension, remember that 90% of the tax due must be paid by the original due date.

-

Incorrectly Claiming Tax Credits: Nonresidents often mistakenly claim credits they are not eligible for, such as the Arizona Family Tax Credit. Always check your eligibility before claiming credits.

-

Failure to E-file: Many people still choose to mail their returns, which can lead to processing delays. E-filing is faster and reduces the chance of errors.

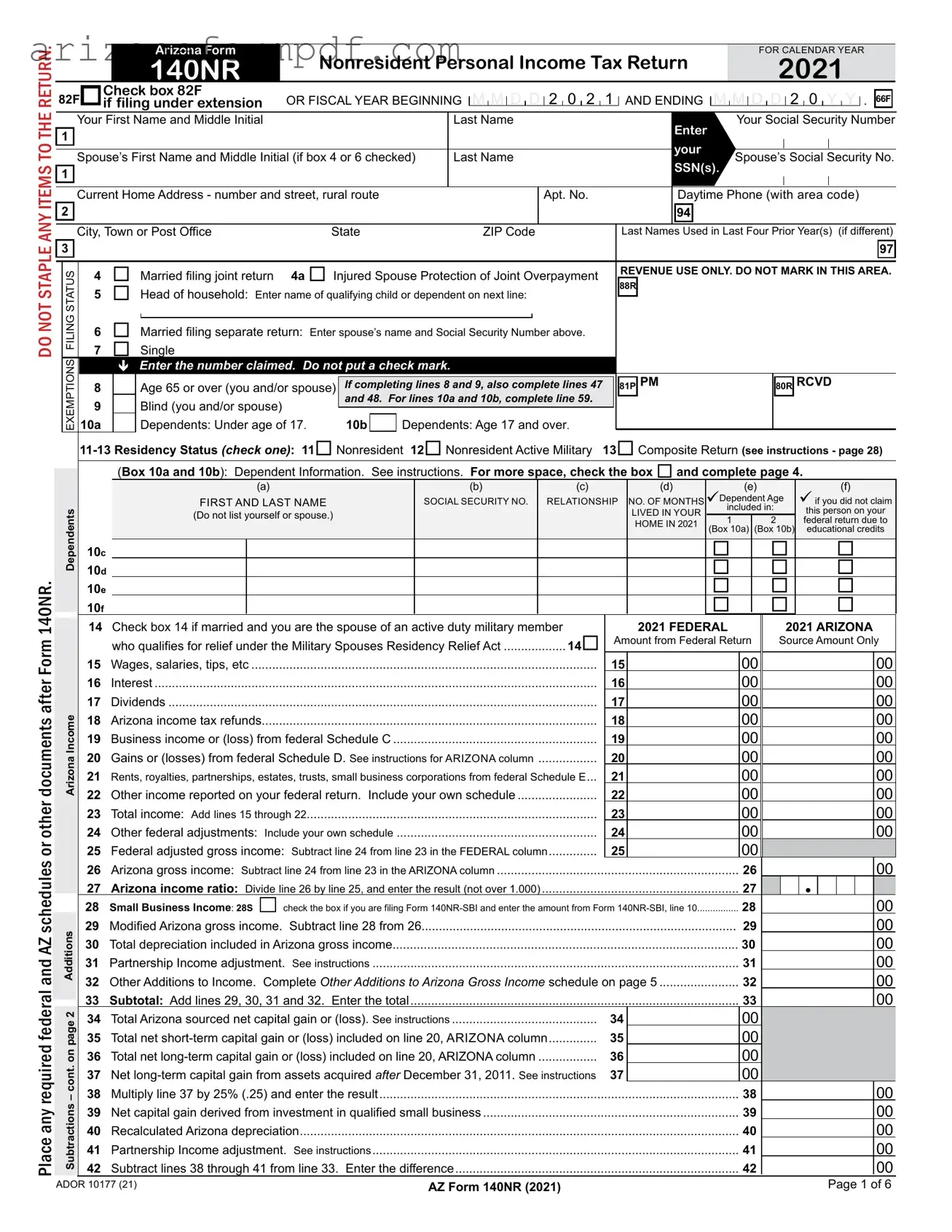

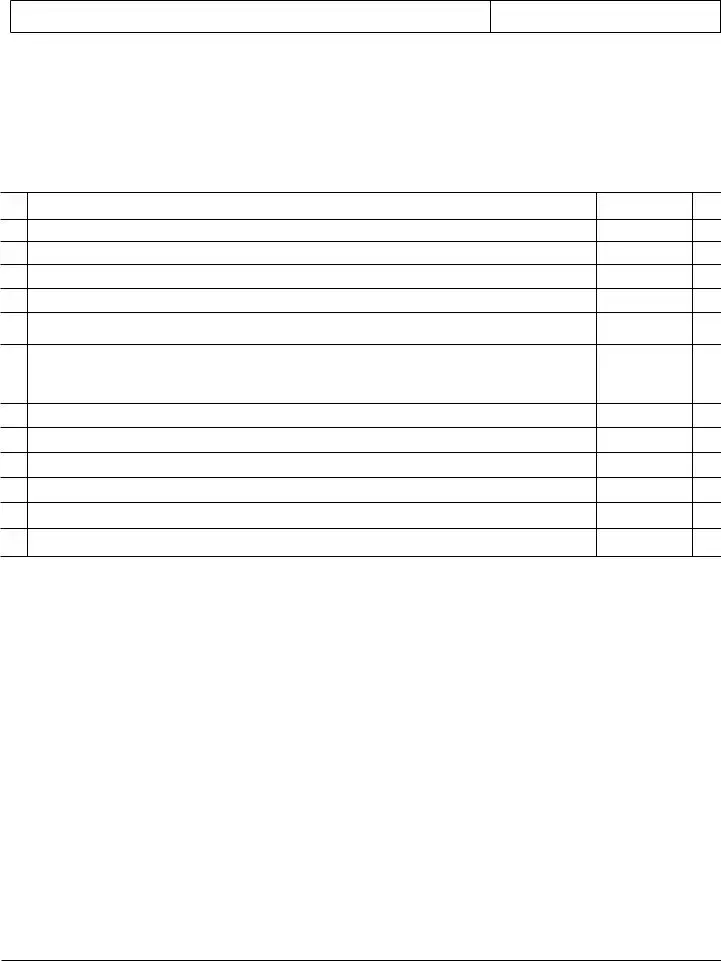

Document Preview

DO NOT STAPLE ANY ITEMS TO THE RETURN.

Place any required federal and AZ schedules or other documents after Form 140NR.

|

|

|

|

|

|

|

|

|

Arizona Form |

|

Nonresident Personal Income Tax Return |

|

|

|

|

|

|

|

FOR CALENDAR YEAR |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

140NR |

|

|

|

|

|

|

|

|

2021 |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

82F |

|

Check box 82F |

OR FISCAL YEAR BEGINNING |

M |

|

M |

|

D |

|

D |

|

2 |

|

0 |

|

2 |

|

1 |

AND ENDING |

|

M |

M |

|

|

D |

|

D |

|

2 |

|

|

0 |

|

|

Y |

|

Y |

. |

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

66F |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

if filing under extension |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Your First Name and Middle Initial |

|

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Social Security Number |

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Spouse’s First Name and Middle Initial (if box 4 or 6 checked) |

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Social Security No. |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN(s) |

. |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Current Home Address - number and street, rural route |

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. No. |

|

|

|

|

|

Daytime Phone (with area code) |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, Town or Post Office |

State |

|

|

|

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

Last Names Used in Last Four Prior Year(s) (if different) |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

97 |

|

|||

|

STATUS |

|

4 |

|

Married filing joint return |

4a Injured Spouse Protection of Joint Overpayment |

|

|

REVENUE USE ONLY. DO NOT MARK IN THIS AREA. |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

5 |

|

Head of household: Enter name of qualifying child or dependent on next line: |

|

|

|

|

|

|

|

|

|

|

88R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

FILING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

6 |

|

Married filing separate return: Enter spouse’s name and Social Security Number above. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

7 |

|

Single |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

EXEMPTIONS |

|

|

|

|

Enter the number claimed. Do not put a check mark. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

8 |

|

|

|

Age 65 or over (you and/or spouse) |

If completing lines 8 and 9, also complete lines 47 |

|

|

81P |

PM |

|

|

|

|

|

|

|

|

|

|

|

80R |

RCVD |

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

9 |

|

|

|

Blind (you and/or spouse) |

|

and 48. For lines 10a and 10b, complete line 59. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

10a |

|

|

|

Dependents: Under age of 17. |

10b |

|

Dependents: Age 17 and over. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

13Composite Return (see instructions - page 28) |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

(Box 10a and 10b): Dependent Information. See instructions. For more space, check the box and complete page 4. |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

(a) |

|

|

|

|

|

|

|

(b) |

|

|

|

|

(c) |

|

|

|

|

(d) |

|

|

|

|

(e) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(f) |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dependent Age |

|

if you did not claim |

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

FIRST AND LAST NAME |

|

|

|

|

SOCIAL SECURITY NO. |

|

|

RELATIONSHIP |

NO. OF MONTHS |

included in: |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Dependents |

|

|

|

|

|

|

(Do not list yourself or spouse.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIVED IN YOUR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

this person on your |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOME IN 2021 |

|

1 |

|

|

|

|

2 |

|

|

|

|

|

federal return due to |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Box 10a) |

(Box 10b) |

|

|

|

educational credits |

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

10c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

10d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

10e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

10f |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

14 Check box 14 if married and you are the spouse of an active duty military member |

|

|

|

|

2021 FEDERAL |

|

|

|

|

|

|

2021 ARIZONA |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

who qualifies for relief under the Military Spouses Residency Relief Act |

|

|

14 |

Amount from Federal Return |

|

|

|

|

Source Amount Only |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

15 |

|

Wages, salaries, tips, etc |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

||||||||||||||||||||||

|

|

|

|

16 |

|

Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

||||||||||||||||||||||

|

|

|

|

17 |

|

Dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

||||||||||||||||||||||

|

Income |

|

18 |

|

Arizona income tax refunds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||

|

|

19 |

|

Business income or (loss) from federal Schedule C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||||||

|

|

20 |

|

Gains or (losses) from federal Schedule D. See instructions for ARIZONA column |

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||||||||

|

Arizona |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

21 |

|

Rents, royalties, partnerships, estates, trusts, small business corporations from federal Schedule E... |

|

21 |

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

22 |

|

Other income reported on your federal return. Include your own schedule |

|

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

23 |

|

Total income: Add lines 15 through 22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||

|

|

|

|

24 |

|

Other federal adjustments: Include your own schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||||

|

|

|

|

25 |

|

Federal adjusted gross income: Subtract line 24 from line 23 in the FEDERAL column |

25 |

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

26 |

|

Arizona gross income: Subtract line 24 from line 23 in the ARIZONA column |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

|

00 |

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

27 |

|

Arizona income ratio: Divide line 26 by line 25, and enter the result (not over 1.000) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

28 |

|

Small Business Income: 28S |

check the box if you are filing Form |

28 |

|

|

|

|

|

|

|

|

|

00 |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Additions |

|

29 |

|

Modified Arizona gross income. Subtract line 28 from 26 |

........................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||

|

|

30 Total depreciation included in Arizona gross income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||

|

|

31 |

|

Partnership Income adjustment. See instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||||||||||

|

|

32 |

|

Other Additions to Income. Complete Other Additions to Arizona Gross Income schedule on page 5 |

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

33 |

|

Subtotal: Add lines 29, 30, 31 and 32. Enter the total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||||||||||

2 |

|

34 |

|

Total Arizona sourced net capital gain or (loss). See instructions |

|

|

|

|

|

|

|

|

34 |

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

page |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

35 |

|

Total net |

35 |

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

on |

|

36 |

|

Total net |

|

|

|

|

|

|

|

36 |

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

– cont. |

|

37 |

|

Net |

37 |

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

38 |

|

Multiply line 37 by 25% (.25) and enter the result |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||||||

|

Subtractions |

|

39 |

|

Net capital gain derived from investment in qualified small business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||||||||||||||||||

|

|

40 |

|

Recalculated Arizona depreciation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||||

|

|

41 |

|

Partnership Income adjustment. See instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||||||

|

|

42 |

|

Subtract lines 38 through 41 from line 33. |

Enter the difference |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

ADOR 10177 (21) |

AZ Form 140NR (2021) |

Page 1 of 6 |

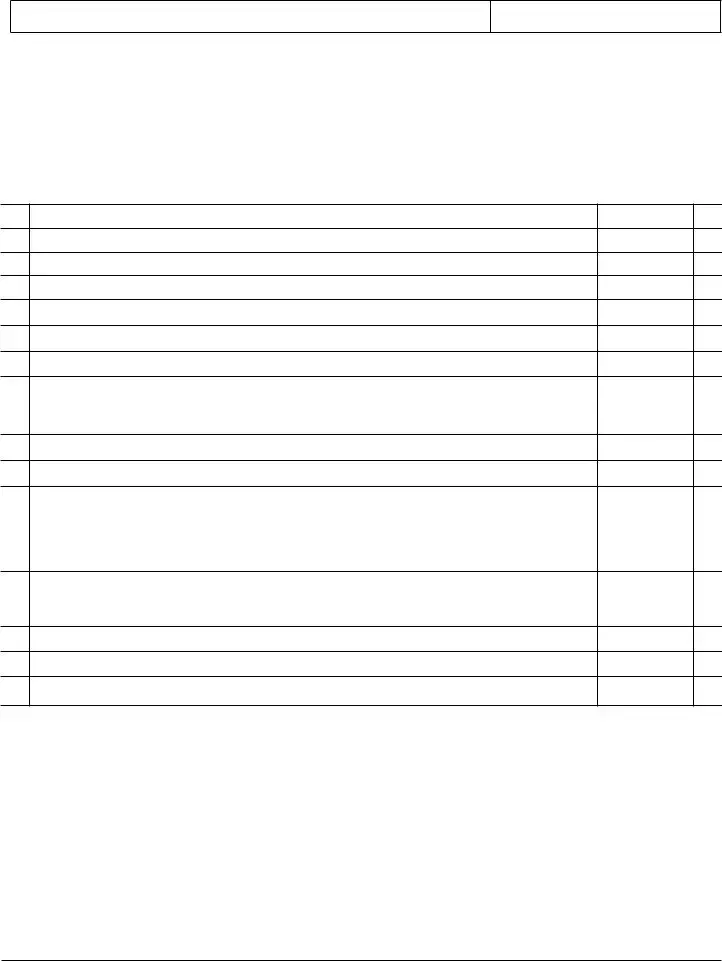

Subtractions |

cont. from page 1 |

|

|

|

Exemptions |

|

|

|

|

|

Balance of Tax |

|

|

|

|

Total Payments and |

Refundable Credits |

|

|

Tax Due or |

Overpayment |

|

|

|

|

|

Voluntary Gifts |

|

|

|

|

|

Penalty |

|

|

|

|

Refund or |

Amount Owed |

|

|

Your Name (as shown on page 1) |

Your Social Security Number |

|

|

43 |

Interest on U.S. obligations such as U.S. savings bonds and treasury bills |

|

|

|

|

|

|

|

43 |

||||||||||||

44 |

Agricultural crops contributed to Arizona charitable organizations |

|

|

|

|

|

|

|

44 |

||||||||||||

45 |

Other Subtractions from Income: Complete Other Subtractions from Arizona Gross Income schedule on page 6 |

|

|

45 |

|||||||||||||||||

46 |

Subtract lines 43, 44 and 45 from line 42. Enter the difference |

|

|

|

|

|

|

|

46 |

||||||||||||

47 |

Age 65 or over: Multiply the number in box 8 by $2,100 |

..................................................................... |

|

|

|

|

|

|

47 |

|

|

|

|

00 |

|||||||

48 |

Blind: Multiply the number in box 9 by $1,500 |

|

|

|

|

|

|

|

|

48 |

|

|

|

|

00 |

||||||

49 |

Other Exemptions: See instructions |

|

49E |

|

Multiply the number in box 49E by $2,300 |

49 |

|

|

|

|

00 |

||||||||||

50 |

Add lines 47, 48, and 49. Enter the total |

|

|

|

|

|

|

50 |

|

|

|

|

00 |

||||||||

51 |

..............................................................................................................Multiply line 50 by the Arizona ratio on line 27 |

|

|

|

|

|

|

|

|

|

|

|

|

51 |

|||||||

52 |

Arizona adjusted gross income: Subtract line 51 from line 46. If less than zero, enter “0” |

|

|

|

|

|

52 |

||||||||||||||

53 |

Deductions: Check box and enter amount. See instructions |

53IITEMIZED |

53SSTANDARD |

53 |

|||||||||||||||||

54 |

If you checked box 53S and claim charitable contributions, check 54C Complete page 3. See instructions |

|

|

54 |

|||||||||||||||||

55 |

Arizona taxable income: Subtract lines 53 and 54 from line 52. |

If less than zero, enter “0” |

|

|

|

|

|

55 |

|||||||||||||

56a |

Compute the tax using amount from line 55 and Tax Tables X and Y |

|

|

|

|

|

|

|

56a |

||||||||||||

56b |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

56b |

|

57 |

Tax from recapture of credits from Arizona Form 301, Part 2, line 30 |

|

|

|

|

|

|

|

57 |

||||||||||||

58 |

Subtotal of tax: Add lines 56a and 57. |

Enter the total |

|

|

|

|

|

|

|

|

|

|

|

|

58 |

||||||

59 |

Dependent Tax Credit. See instructions |

|

|

|

|

|

|

|

|

|

|

|

|

59 |

|||||||

60 |

Nonrefundable credits from Arizona Form 301, Part 2, line 61 |

|

|

|

|

|

|

|

60 |

||||||||||||

61 |

Balance of tax: Subtract lines 59 and 60 from line 58. |

If the sum of lines 59 and 60 is more than line 58, enter “0” |

|

|

61 |

||||||||||||||||

62 |

2021 AZ income tax withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

62 |

||

63 |

..2021 AZ estimated tax payments 63a |

|

|

|

|

00 |

Claim of Right 63b |

|

|

00 |

Add 63a and 63b. |

63c |

|||||||||

64 |

2021 AZ extension payment (Form 204) |

|

|

|

.............................................. |

|

64 |

||||||||||||||

65 |

Other refundable credits: Check the box(es) and enter the total amount |

|

65 |

||||||||||||||||||

66 |

Total payments and refundable credits: Add lines 62 through 65. Enter the total |

|

|

|

|

|

66 |

||||||||||||||

67 |

TAX DUE: If line 61 is larger than line 66, subtract line 66 from line 61. Enter amount of tax due. Skip lines 68, 69 and 70 |

|

|

67 |

|||||||||||||||||

68 |

OVERPAYMENT: If line 66 is larger than line 61, subtract line 61 from line 66. Enter amount of overpayment |

|

|

68 |

|||||||||||||||||

69 |

Amount of line 68 to be applied to 2022 estimated tax |

|

|

|

|

|

|

|

|

|

|

69 |

|||||||||

70 |

Balance of overpayment: Subtract line 69 from line 68. Enter the difference |

|

|

|

|

|

|

|

70 |

||||||||||||

71 - 81 Voluntary Gifts to: |

|

|

|

|

Solutions Teams |

71 |

|

00 |

Arizona Wildlife |

72 |

|

00 |

|

|

|||||||

|

|

|

|

Assigned to Schools |

|

|

|

|

|||||||||||||

|

Child Abuse Prevention |

73 |

|

00 |

Domestic Violence Services74 |

|

00 |

Political Gift |

75 |

|

00 |

|

|

||||||||

|

Neighbors Helping Neighbors..76 |

|

00 |

Special Olympics |

77 |

|

00 |

Veterans’ Donations Fund78 |

|

00 |

|

|

|||||||||

|

I Didn’t Pay Enough Fund |

79 |

|

00 |

Sustainable State Parks |

|

00 |

Spay/Neuter of Animals 81 |

|

00 |

|

|

|||||||||

|

|

and Road Fund |

80 |

|

|

|

|

||||||||||||||

82 |

Political Party (if amount is entered on line 75 - check only one): |

821Democratic |

822Libertarian |

823Republican |

|

|

|

||||||||||||||

83 |

Estimated payment penalty |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

83 |

||

84841Annualized/Other 842Farmer or Fisherman 843Form 221 included

85 |

Add lines 71 through 81 and 83. Enter the total |

........................................................................................................... |

85 |

|

86 |

REFUND: Subtract line 85 from line 70. If less than zero, enter amount owed on line 87 |

86 |

||

|

Direct Deposit of Refund: Check box 86A if your deposit will be ultimately placed in a foreign account; see instructions. 86A |

|

||

|

|

ROUTING NUMBER |

ACCOUNT NUMBER |

|

|

C Checking or |

|

|

|

|

98 S Savings |

|

|

|

87AMOUNT OWED: Add lines 67 and 85. Make check payable to Arizona Department of Revenue; write your SSN, 140NR on

payment |

87 |

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

PLEASE SIGN HERE

Under penalties of perjury, I declare that I have read this return and any documents with it, and to the best of my knowledge and belief, they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

YOUR SIGNATUREDATEOCCUPATION

SPOUSE’S SIGNATURE |

|

|

|

|

DATE |

|

SPOUSE’S OCCUPATION |

|||

|

|

|

|

|

|

|

|

|||

PAID PREPARER’S SIGNATURE |

|

|

DATE |

|

FIRM’S NAME (PREPARER’S IF |

|||||

|

|

|

|

|

|

|

|

|

|

|

PAID PREPARER’S STREET ADDRESS |

|

|

|

|

|

|

|

|

PAID PREPARER’S TIN |

|

|

|

|

|

|

|

( |

) |

|||

PAID PREPARER’S CITY |

STATE |

|

ZIP CODE |

|

|

|

|

|

PAID PREPARER’S PHONE NUMBER |

|

If you are sending a payment with this return, mail to Arizona Department of Revenue, PO Box 52016, Phoenix, AZ

ADOR 10177 (21) |

AZ Form 140NR (2021) |

Page 2 of 6 |

Your Name (as shown on page 1)

Your Social Security Number

2021 Form 140NR - Standard Deduction Increase

for Charitable Contributions

You must complete this worksheet if you are taking an increased standard deduction for charitable contributions. Include the completed worksheet with your tax return, when filed. If you do not include the completed worksheet, your standard deduction will not be increased.

Taxpayers electing to take the Standard Deduction may increase the standard deduction amount by 25% (.25) of the total amount of the taxpayer’s charitable deductions that would have been allowed if the taxpayer elected to claim itemized deductions on the Arizona tax return.

Charitable contributions (lines 1C, 2C, and 3C) are those gifts allowed on federal Form 1040 Schedule A (Gifts to Charity) that you would have claimed had you elected to take itemized deductions on your federal return.

NOTE 1: As a nonresident filing Form 140NR, you are required to apportion your allowable increased standard deduction based on your Arizona income ratio computed on page 1, line 27.

NOTE 2: You must reduce your contribution amount by the total charitable contributions you made during January 1, 2021 through December 31, 2021 for which you are claiming an Arizona tax credit under Arizona law for the current tax year return or claimed on the prior tax year return. Enter this amount on line 5C.

NOTE 3: If you itemized deductions on your federal return (1040 Schedule A) and were required to adjust the amount of your allowable contributions on your federal 1040 Schedule A for the amount claimed as a tax credit on your Arizona income tax return, include the amount of the federal contribution adjustment to line 1C and enter the amount of the Arizona tax credit on line 5C.

Complete the worksheet to determine your allowable increased standard deduction for charitable contributions.

1C |

2021 Gifts by cash or check |

1C |

|

|

|

2C |

2021 Other than by cash or check |

2C |

|

|

|

3C |

Carryover from prior year |

3C |

|

|

|

4C |

Add lines 1C through 3C and enter the total |

4C |

|

|

|

5C |

Total charitable contributions made in 2021 for which you are claiming a credit |

|

|

|

|

|

under Arizona law for the current (2021) or prior (2020) tax year |

5C |

|

|

|

6C |

Subtract line 5C from line 4C and enter the difference. If less than zero, enter |

|

|

|

|

|

“0” |

6C |

|

|

|

7C |

Multiply line 6C by 25% (.25) and enter the result |

7C |

|

|

|

8C |

Enter your Arizona income ratio from page 1, line 27 |

8C |

|

|

• |

|

|

||||

9C |

Multiply line 7C by the ratio on line 8C and enter the result |

9C |

|

|

|

|

|

|

|

|

|

00

00

00

00

00

00

00

00

•Enter the amount shown on line 9C on page 2, line 54

•Be sure to check box 53S for Standard Deduction on line 53.

•Check box 54C for charitable contributions on line 54. If you do not check this box, you may be denied the increased standard deduction.

ADOR 10177 (21) |

AZ Form 140NR (2021) |

Page 3 of 6 |

Your Name (as shown on page 1)

Your Social Security Number

2021 Form 140NR Dependent and Other Exemption Information

10g

10h

10i

10j

10k

10l

10m

10n

10o

10p

10q

1

2

3

4

5

6

7

8

9

10

Include page 4 with your return if:

•You are listing additional dependents (for box 10a and 10b) from page 1.

•You are claiming Other Exemptions on page 2, line 49.

Part 1: Dependents (Box 10a and 10b) continued from page 1

Information used to compute your allowable Dependent Tax Credit on page 2, line 59.

NOTE: If you have more than three qualifying dependents, you must complete Part 1 and the worksheet in the instructions to compute your Dependent Tax Credit on line 59.

|

(a) |

(b) |

(c) |

(d) |

|

(e) |

(f) |

|

FIRST AND LAST NAME |

SOCIAL SECURITY NO. |

RELATIONSHIP |

NO. OF MONTHS |

Dependent Age |

IF YOU DID NOT |

|||

|

|

|||||||

(Do not list yourself or spouse.) |

|

|

LIVED IN YOUR |

included in: |

CLAIM THIS PERSON |

|||

|

|

ON YOUR FEDERAL |

||||||

|

|

|

|

HOME IN 2021 |

|

|

|

|

|

|

|

|

|

|

|

RETURN DUE TO |

|

|

|

|

|

|

1 |

|

2 |

EDUCATIONAL |

|

|

|

|

|

(Box 10a) |

|

(Box 10b) |

CREDITS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 2: Other Exemptions

Information used to compute your allowable Other Exemptions on page 2, line 49.

|

(a) |

(b) |

|

(c) |

(d) |

|

FIRST AND LAST NAME |

SOCIAL SECURITY NO. |

AGE 65 OR OVER |

STILLBORN |

|||

(Do not list yourself or spouse.) |

|

(see instructions) |

CHILD IN 2021 |

|||

|

|

|

|

|

|

|

|

|

|

C1 |

|

C2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter the total number of individuals listed in Part 2 in box 49E on page 2, line 49.

ADOR 10177 (21) |

AZ Form 140NR (2021) |

Page 4 of 6 |

Your Name (as shown on page 1)

Your Social Security Number

2021 Form 140NR - Other Additions to Arizona Gross Income

Complete and include this schedule with your tax return only if you are making any adjustments increasing your Arizona Gross Income.

Note: If you are making any adjustments reducing your Arizona Gross Income complete page 6.

Other Additions to Arizona Gross Income - Line 32 (see instructions for more information)

A |

Fiduciary Adjustment from Arizona Form 141AZ Schedule |

A |

00 |

B |

Items Previously Deducted for Arizona Purposes………………………………………… |

B |

00 |

C |

Claim of Right Adjustment for Amounts Repaid in 2021……………………………………………………… |

C |

00 |

D |

Claim of Right Adjustment for Amounts Repaid in Prior Taxable Years…………………………… |

D |

00 |

E |

Addition to S corporation Income Due to Claiming |

E |

00 |

F |

Adjusted Basis in Property for Which You Have Claimed a Credit for Investment in Qualified Small |

|

|

|

Businesses (Form 338)…………………………………………………………………………………………… |

F |

00 |

G |

Sole Proprietorship Loss of an Arizona Nonprofit Medical Marijuana Dispensary Included in |

|

|

|

Federal Adjusted Gross Income. Sole Proprietorship loss of an Arizona dual licensee that has not elected to |

|

|

|

operate on a |

|

|

|

portion of the business that is included in their federal adjusted gross income |

G |

00 |

H |

Americans with Disabilities Act - Access Expenditures………………………………………………………… |

H |

00 |

I |

Amortization or Depreciation for Childcare Facility Before 1990………………………………… |

I |

00 |

J |

Net capital (loss) derived from the exchange of legal tender: See instructions |

J |

00 |

K |

Other Adjustments Related to Tax Credits |

K |

00 |

L |

Other Adjustments - see instructions |

L |

00 |

M |

Total Other Additions: Add all amounts and enter the total here and on page 1, line 32 |

M |

00 |

ADOR 10177 (21) |

AZ Form 140NR (2021) |

Page 5 of 6 |

Your Name (as shown on page 1)

Your Social Security Number

2021 Form 140NR - Other Subtractions from Arizona Gross Income

Complete and include this schedule with your tax return only if you are making any adjustments decreasing your Arizona Gross Income.

Note: If you are making any adjustments increasing your Arizona Gross Income complete page 5.

Other Subtractions From Arizona Gross Income - Line 45 (see instructions for more information)

A |

Certain Wages of American Indians.............................................................…………… |

A |

00 |

B |

Qualified Wood Stove, Wood Fireplace, or |

B |

00 |

C |

Claim of Right Adjustment for Amounts Repaid in Prior Taxable Years…… |

C |

00 |

D |

Certain Expenses Not Allowed for Federal Purposes (due to claiming federal tax credits)………………… |

D |

00 |

E |

Basis Adjustment for Property Sold or Otherwise Disposed of During the Taxable Year…………………… |

E |

00 |

F |

Fiduciary Adjustment from Arizona Form 141AZ Schedule |

F |

00 |

G |

Net Operating Loss Adjustment |

G |

00 |

H |

Sole Proprietorship Income of an Arizona Nonprofit Medical Marijuana Dispensary Included in Federal |

|

|

|

Adjusted Gross Income. In addition, Sole Proprietorship income of an Arizona dual licensee that has not |

|

|

|

elected to operate on a |

|

|

|

medical marijuana portion of the business |

H |

00 |

I |

Americans with Disabilities Act – Access Expenditures…………………………………………………… |

I |

00 |

J |

Exploration Expenses Deferred Before January 1, 1990 |

J |

00 |

K |

Sole Proprietorship of an Arizona Marijuana Establishment, Marijuana Testing Facilities and dual licensees |

|

|

|

that operate on a |

|

|

|

sales of recreational use products reported on Schedule DFE (line 16). An LLC that has elected to be treated |

|

|

|

as a disregarded entity for federal purposes, and also elected to operate on a |

|

|

|

total amount of ordinary and necessary expenses related to the sales of recreational use products reported |

|

|

|

on Schedule DFE (line 16) |

K |

00 |

L |

S corporation Shareholders of an Arizona Marijuana Establishment, Marijuana Testing Facilities and |

|

|

|

dual licensees that operate on a |

|

|

|

necessary expenses related to the sales of recreational use products as shown on your 120S Schedule |

|

|

|

L |

00 |

|

M |

Net capital gain derived from the exchange of legal tender: See instructions |

M |

00 |

N |

Other Adjustments - see instructions |

N |

00 |

O |

Total Other Subtractions: Add all amounts and enter the total here and on page 2, line 45 |

O |

00 |

ADOR 10177 (21) |

AZ Form 140NR (2021) |

Page 6 of 6 |

Form Breakdown

| Fact Name | Details |

|---|---|

| Form Purpose | The Arizona Form 140NR is used by nonresidents to report income earned from Arizona sources. |

| Eligibility | Nonresidents who earned income in Arizona during the tax year must file this form. |

| Filing Deadline | The due date for filing the 2020 Form 140NR is April 15, 2021, with extensions available until October 15, 2021. |

| Itemized Deductions | To claim itemized deductions, taxpayers must start with the federal Schedule A amount. |

| Standard Deduction | The 2020 standard deduction for single filers is $12,400, and for married couples filing jointly, it is $24,800. |

| Tax Credits | Nonresidents cannot claim the Arizona Family Tax Credit but may be eligible for the Dependent Tax Credit. |

| Federal Adjusted Gross Income | The federal adjusted gross income used on the Arizona return may differ from the federal return. |

| Online Filing Benefits | Filing online is faster, more accurate, and can be done for free if you qualify. |

| Income Reporting | Nonresidents must report all income derived from Arizona sources, including wages and rental income. |