Fill Out Your 290 Arizona Form

The Arizona Form 290, known as the Request for Penalty Abatement, serves as a formal mechanism for taxpayers seeking relief from penalties imposed by the Arizona Department of Revenue. This form is specifically designed for those who believe their penalties were incurred due to reasonable cause rather than willful neglect. To initiate the process, taxpayers must provide essential information, including their name, contact details, and the type of tax involved, such as individual income tax or corporate income tax. It is crucial to include the relevant taxpayer identification numbers and specify the periods or years associated with the penalties. The form also requires a detailed explanation of the circumstances that led to the penalty, along with supporting documentation that validates the request. This documentation may include canceled checks, tax returns, medical reports, or any other pertinent records. Once completed, the form must be signed by the appropriate authority, depending on the entity type, and submitted to the Penalty Review Unit of the Arizona Department of Revenue. Timely and accurate submission of this form can significantly impact the outcome of the penalty abatement request, making it essential for taxpayers to follow the instructions carefully.

Guide to Writing 290 Arizona

After completing Arizona Form 290, you will submit it to the Arizona Department of Revenue for review. The processing time can take up to six weeks. Ensure that all sections are filled out accurately and that you include any necessary documentation to support your request. This will help facilitate a smoother review process.

- Provide General Information: Fill in your name, daytime phone number, spouse’s name (if applicable), alternate phone number, and your present address.

- Specify Tax Type: Check the appropriate box for the type of tax related to your request. Include your taxpayer ID number or license number and the period or year associated with the penalty.

- Enter Penalty Amount: Write down the specific dollar amount of the penalty you are requesting to be abated.

- Explain Your Request: In the explanation section, detail the reasons for your request. Include any supporting documentation that justifies your claim, such as medical reports or canceled checks.

- Sign the Form: Ensure that the appropriate party signs the form. This could be you or a representative, depending on your situation.

- Mail the Form: Send the completed form to the address provided: Penalty Review Unit, Division 9, Arizona Department of Revenue, 1600 W Monroe St, Phoenix AZ 85007-2612. You may also fax it to 602-771-9912.

Browse Popular Forms

Arizona Financial - Reviewing the entire content carefully before submission is advisable for compliance with court standards.

Arizona Tax Forms - Help is available by phone for any licensing questions related to transaction privilege or withholding taxes.

Common Questions

What is Arizona Form 290?

Arizona Form 290 is a request for penalty abatement. Taxpayers use this form to ask the Arizona Department of Revenue to remove penalties imposed due to late filings or payments. The department may grant this request if it finds that the delay was due to reasonable cause and not willful neglect.

Who should use Form 290?

This form is intended for individuals or businesses that have incurred penalties related to various tax types, such as individual income tax, corporate income tax, or transaction privilege tax. However, it should not be used for penalties resulting from an audit. In those cases, taxpayers must contact the Audit Unit directly.

What information is required on the form?

When completing Form 290, you must provide your name, contact information, and the specific tax type related to the penalty. Additionally, you need to indicate the tax period in question and the amount of the penalty you are requesting to be abated. A detailed explanation of the circumstances leading to the penalty is also necessary.

What constitutes "reasonable cause" for penalty abatement?

Reasonable cause refers to circumstances beyond the taxpayer's control that prevented timely filing or payment. Examples may include serious illness, natural disasters, or other significant life events. It's essential to provide clear and concise documentation to support your claim for reasonable cause.

What kind of documentation should be included?

Supporting documentation is crucial for a successful request. This may include copies of canceled checks, tax returns, medical reports, or death certificates, among other relevant documents. Requests lacking proper documentation may be denied, so ensure you include everything necessary to substantiate your case.

How long does it take to process Form 290?

Once you submit Form 290, allow up to six weeks for processing. The Arizona Department of Revenue will review your request and supporting documents before making a decision regarding the abatement of penalties.

What if I want a representative to handle my request?

If you wish for a representative to communicate with the Arizona Department of Revenue on your behalf, you must complete and submit Arizona Form 285, the General Disclosure/Representation Authorization Form, along with Form 290. This ensures that your representative has the authority to act for you in this matter.

Where should I send Form 290?

Mail your completed Form 290 to the Penalty Review Unit at the Arizona Department of Revenue. The address is 1600 W Monroe St, Phoenix, AZ 85007-2612. Alternatively, you can fax the form to 602-771-9912 if that is more convenient.

Dos and Don'ts

When filling out the Arizona Form 290 for penalty abatement, there are important do's and don'ts to keep in mind. Here’s a list to guide you:

- Do read the instructions carefully before starting the form.

- Do provide accurate contact information, including your name, address, and phone number.

- Do check the appropriate tax type related to your request.

- Do include a detailed explanation of your reasons for requesting the abatement.

- Do attach supporting documentation to back up your request.

- Don't submit the form if the penalty is a result of an audit; contact the Audit Unit instead.

- Don't forget to sign the form where required, as unsigned forms may be rejected.

Follow these guidelines closely to enhance your chances of a successful abatement request. Time is of the essence, so act promptly.

Similar forms

The Arizona Form 285, General Disclosure/Representation Authorization Form, is similar to Form 290 in that it facilitates communication between taxpayers and the Arizona Department of Revenue. This form allows taxpayers to authorize a representative to act on their behalf. Like Form 290, it requires specific information about the taxpayer and the representative. Both forms aim to streamline the process of resolving tax issues, ensuring that the Department of Revenue can efficiently address requests and inquiries.

Another document, the Arizona Form 200, Request for Refund, shares similarities with Form 290 as it allows taxpayers to request a financial adjustment from the state. Both forms require detailed information about the taxpayer and the reason for the request. While Form 290 focuses on penalty abatement, Form 200 deals specifically with refunds. Each form necessitates supporting documentation to substantiate the request, reinforcing the need for clear and concise explanations.

The Arizona Form 140, Individual Income Tax Return, also bears resemblance to Form 290. Both forms require personal information from the taxpayer and involve the submission of financial data to the Arizona Department of Revenue. While Form 140 is used for filing income tax, Form 290 is for addressing penalties. Each form plays a critical role in ensuring compliance with tax laws and regulations, making it essential for taxpayers to complete them accurately.

Lastly, the Arizona Form 120, Corporate Income Tax Return, is akin to Form 290 in that it involves corporate entities and their tax obligations. Both forms require detailed information about the taxpayer and the specific financial circumstances. While Form 120 focuses on reporting income and tax liability, Form 290 is geared toward addressing penalties. Completing these forms correctly is vital for maintaining good standing with the Arizona Department of Revenue.

Key takeaways

Filling out and using the Arizona Form 290 for penalty abatement requires attention to detail. Here are key takeaways to guide you through the process:

- Understand the Purpose: This form is specifically for requesting an abatement of non-audit penalties. If the penalty arises from an audit, do not use this form.

- Gather Necessary Information: Ensure you have the taxpayer's name, address, and phone number ready. This information is essential for processing your request.

- Identify the Tax Type: Clearly check the appropriate tax type related to your abatement request. This could include individual income tax, corporate income tax, or transaction privilege tax.

- Provide Accurate Taxpayer ID: Use the correct identification number for the taxpayer, whether it’s an ITIN, SSN, EIN, or license number.

- Specify the Tax Period: Clearly indicate the specific periods or years for which you are requesting penalty abatement.

- Explain Your Reason: Offer a detailed explanation for the request. Highlight the reasonable cause for any delays in returns or payments.

- Include Supporting Documentation: Attach necessary documents that support your request. This may include canceled checks, tax returns, medical reports, or death certificates.

- Signature Requirement: Ensure that the appropriate individual signs the form. This could be the taxpayer, a principal officer, or a partner, depending on the entity type.

- Mailing Instructions: Send the completed form to the specified address. You can also fax it, but allow up to six weeks for processing.

By following these takeaways, you can effectively navigate the process of submitting Form 290 for penalty abatement in Arizona.

Common mistakes

-

Not Reading Instructions Carefully: Many individuals overlook the importance of reading the instructions before filling out the form. This can lead to errors that could delay processing.

-

Incomplete Information: Failing to provide all required information, such as the taxpayer's name, address, or tax type, can result in the form being rejected or delayed.

-

Omitting Supporting Documentation: Requests without the necessary documentation to support the claim for penalty abatement are often denied. This includes missing copies of canceled checks or relevant medical reports.

-

Incorrect Taxpayer Identification: Using the wrong taxpayer identification number, such as an ITIN or SSN when it should be a business EIN, can lead to complications in processing the request.

-

Failure to Sign: Not signing the form or having the appropriate parties sign it can result in automatic rejection. Each required signatory must provide their signature to validate the request.

Document Preview

Arizona Form 290 |

Request for Penalty Abatement |

UseTHE PURPOSEForm 290OFtoTHISrequestFORMan abatement of

The account for which the abatement request is being submitted must be in compliance. Compliance means there are no delinquent tax returns and all

The request will not be considered for processing if the form is incomplete or if the account is not in compliance. The abatement request form and documentation will be returned for correction. The form and documentation will then need to be resubmitted for consideration.

IMPORTANT: If the penalty being addressed is the result of an audit, do not use Form 290. Contact the Audit Unit at the phone number shown on the assessment. The Penalty Review Unit does not process audit assessed penalties.

INFORMATION

AllPARTrequests1 - GENERALfor abatementINFORMATIONof penalties must include the name, address, email address and telephone number of the taxpayer for which the request is being made.

If you want the Arizona Department of Revenue to work with your representative or third party, complete and include Arizona Form 285, General Disclosure/ Representation Authorization Form. Ensure boxes 4b and 4c or box 5 are indicated.

PART 2 - SPECIFIC DETAILS FOR ABATEMENT

ProvideCONSIDERATIONspecific details regarding the account and periods to be considered for abatement.

•TAXIfTYPEyour request is for an individual income tax return, use the Individual Taxpayer Identification Number (ITIN) number or social security number from the return.

• If your request is for a business account, use the Transaction Privilege Tax (TPT) or Marijuana Excise Tax (MET) license number.

• If your request is for a corporate or withholding account, use an Employer Identification Number (EIN).

EnterPERIOD(S)the specificOR YEAR(S)tax period(s) in date format, based on the filing frequency, that you want considered for the abatement.

For example:

• Annual filers:

• Quarterly filers:

• Monthly filers:

EnterPENALTYthe AMOUNTdollar amount for which you are requesting penalty abatement. There is no statutory provision that permits abatement of interest based on reasonable cause.

ExplainPART 3 - inEXPLANATIONdetail your&reason(s)DOCUMENTATIONfor requesting the abatement. You must provide specific details or reasons that directly contributed to the failure to file or pay timely for the period(s) you are requesting penalty abatement. Include in the explanation as to why there is reasonable cause for the returns and/or payments being late. Clear and concise information will allow for a prompt reply. Include additional pages if you need more space.

IMPORTANT: You must include Documentation that supports the basis of your request. Requests without

supporting documentation may be denied. Examples include:

• Proof of timely payment; including front and back of canceled checks.

• Medical reports and/or Death Certificate(s).

• Other pertinent documents that support your request for this abatement.

• Proof an extension has been filed.

BelowSituationsare someWh resituationsReasonablewhereCausereasonableMay Exist:cause may exist. There may be other situations where reasonable cause may exist. Accordingly, it’s important for you to provide specific details or reasons that directly contributed to the failure to. file or pay timely for the Circumstancesperiods you arebeyondrequestingthe control of the taxpayer while using reasonable and prudent business practices. A1.mathematicalMathematicalerroronrsa timely filed tax return.

2.Unexpected illness or unavoidable absence

A. aIndividual. Delay causedreturnsby serious illness of the taxpayer, or

member of the taxpayer’s immediate family. b. Delay caused by unavoidable absence of the

taxpayer. Vacation time is not acceptable as an unavoidable absence.

ADOR 11237 (05/23) |

Instructions |

Arizona Form 290 |

|

|

|

|

Request for Penalty Abatement |

||||||||||

|

|

B. Entity r turns |

|

|

|

|

|

|

If you want the Arizona Department of Revenue to work with |

||||||

|

|

|

In the caseof corporate, estate, trust or other business |

your representative or third party, complete and include |

|||||||||||

|

|

|

|

|

|

or |

|||||||||

|

|

|

returns, delay caused by unexpected serious illness of |

Arizona Form 285, General Disclosure/Representation |

|||||||||||

|

|

|

Authorization Form. Ensure boxes 4b and 4c box 5 are |

||||||||||||

|

|

|

the individual with sole authority to execute the return |

indicated. |

|

|

|

||||||||

|

|

|

or member of such individual’s immediate family. |

Handwritten signature, date, print the signer’s name and |

|||||||||||

|

|

|

Delay caused by unavoidable absence of the individual |

||||||||||||

If |

|

|

with sole authority to execute return. |

|

|

title. An electronic signature with a digital certificate is |

|||||||||

|

|

|

|

|

is the basis of the request for penalty |

accepted. |

|

|

|

||||||

abatement, the Department shall require proof of the date |

Type of Entity |

|

Who must sign |

|

|||||||||||

|

unexpected illness |

|

|

|

|

|

|

|

|

|

|

||||

of illness. This proof includes, but is not limited to, doctor |

|

|

|

|

|||||||||||

statements. |

|

|

|

|

|

|

|

Individuals, Joint |

The individual/joint filers/sole proprietor |

||||||

|

A. |

In the case of individual returns, delay caused by the |

Filers and Sole |

must sign. |

|

|

|||||||||

|

|

|

Proprietorships |

|

|

|

|||||||||

3. Death |

|

|

|

|

|

|

|

|

meaning of A.R.S. § |

||||||

death of a taxpayer or member of the taxpayer’s immediate |

|

||||||||||||||

family. |

|

|

|

|

|

|

|

Corporations |

A principal corporate officer within the |

||||||

|

|

|

|

|

|

|

|

person designated by a principal corporate |

|||||||

|

|

|

In the case of corporate, estate, trust or other business |

|

officer or any person designated in a resolution |

||||||||||

returns, the delay must have been caused by the death of an |

|

similar governing body, must sign. |

|||||||||||||

B. |

|

|

|

|

|

|

|

|

|

by the corporate board of directors or other |

|||||

individual with the sole authority to execute the return, or a |

|

|

|

|

|||||||||||

Limited Partnerships |

of the partnership must sign. |

|

|||||||||||||

member of such individual’s immediate family. |

|

|

|

||||||||||||

For both individual and business returns, a reasonable time |

Partnerships & |

A partner having authority to act in the name |

|||||||||||||

Trusts/Estates |

A trustee, executor/executrix or the personal |

||||||||||||||

frame should apply for filing the return and payment of tax. |

|

representative of the estate must sign. See |

|||||||||||||

A copy of the death certificate must be provided. |

|

|

|

Fiduciary Capacity. |

|

||||||||||

4. Absence of records |

|

|

|

|

|

Form 210, Notice of Assumption of Duties in a |

|||||||||

|

|

|

|

Limited Liability |

A member having authority to act in the name |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

The taxpayer is unable to obtain records necessary to |

|||||||||||||||

Companies |

of the company must sign. |

|

|||||||||||||

determine the amount of tax due for reasons beyond the |

Governmental |

An officer having authority to act on behalf of |

|||||||||||||

taxpayer’s control. An example would be a fire which |

MAIL,AgenciesFAX OR EMAILtheFORMgovernmental290 TO:agency must sign. |

||||||||||||||

destroys the taxpayer’s records. |

|

|

|

|

|

|

|

||||||||

|

|

|

ARIZONA DEPARTMENT OF REVENUE |

||||||||||||

1. Ignorance of the law or lack of awareness of filing and |

|||||||||||||||

|

paying requirements. |

|

|

|

|

PENALTY REVIEW UNIT |

|

|

|||||||

Situations Where Reason ble C use May NOT Exist: |

|

1600 W MONROE ST |

|

|

|||||||||||

2. Delegation of duties. |

|

|

|

|

|

|

|||||||||

3. Financial difficulties have no effect on the taxpayer’s |

|

PHOENIX AZ |

|

||||||||||||

|

ability to file returns in a timely fashion. |

|

|

Fax No. (602) |

|

|

|||||||||

1. Interest |

|

|

|

|

|

|

|

Email: PenaltyReview@azdor.gov |

|

||||||

Penalti and/or fees not considered for Abatement: |

Allow up to six (6) weeks for processing. |

|

|||||||||||||

2. TPT licensing fees |

|

|

|

|

|

|

|

||||||||

3. Audit assessed penalties |

|

|

|

|

|

|

|

||||||||

4. Any disallowed accounting credit(s) for TPT |

|

|

|

|

|

|

|||||||||

For additional information regarding reasonable cause, |

|

|

|

|

|||||||||||

please refer to the following: |

|

|

|

|

|

|

|

||||||||

• Arizona Revised Statutes § |

|

|

|

|

|||||||||||

• |

|

|

www.azleg.gov. |

|

|

of Revenue |

|

Ruling |

|

|

|

|

|||

|

|

(GTR) |

|

|

|

General Tax |

|

and |

|

|

|

|

|||

|

|

|

Arizona Department |

of Revenue |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Publication 700 |

|

|

|

|

|

|||

|

|

|

|

available at www.azdor.gov. |

|

|

|

|

|

|

|||||

PART 4 - SIGNATURE OF TAXPAYER OR AUTHORIZED TheREPRESENTATIVEform should be signed by one of those listed below or otherwise authorized by A.R.S. §

ADOR 11237 (05/23)

Print Form

Instructions

Arizona Form

290

Request for Penalty Abatement

PLEASE READ THE INSTRUCTIONS CAREFULLY. Ensure all applicable sections of the form are completed, all returns are filed, and taxes paid prior to submitting. The request will not be considered for processing if incomplete or the account is not in compliance. The abatement request form and

ThedocumentationArizona Departmentwill be returnedof Revenue,for correcon writtenion applicationnd must bebyresubmittedthe taxpayer,forshallconsiderationabate the penalty. if it determines that the conduct, or lack of conduct, that caused the penalty to be imposed was due to reasonable cause and not due to willful neglect.

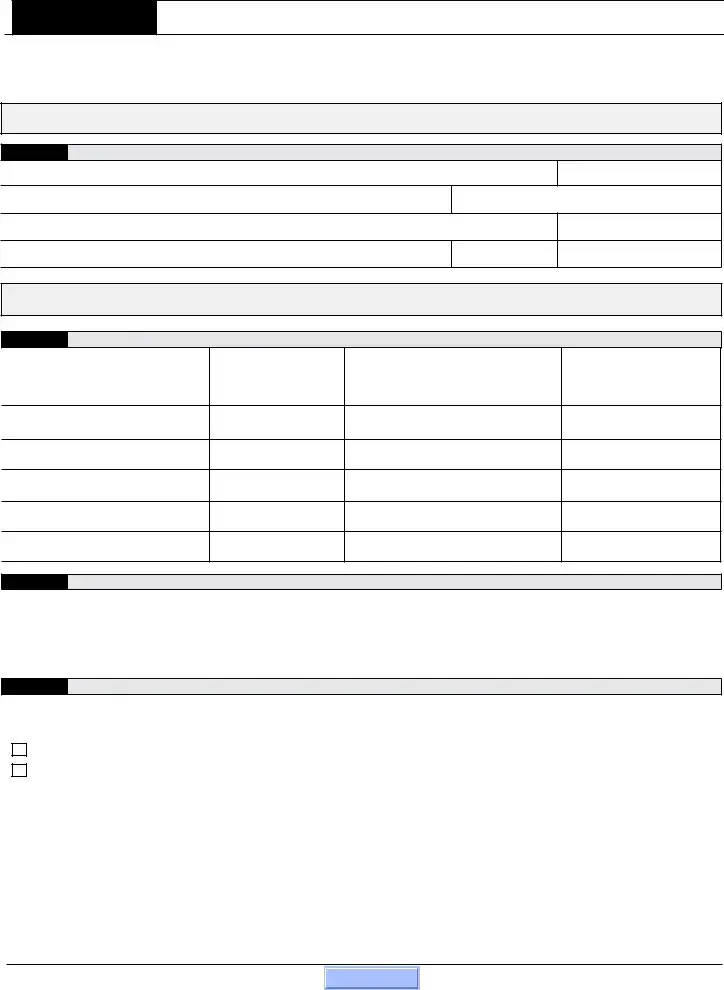

PART 1 |

GENERAL INFORMATION (REQUIRED) |

|

|

|

|

|

|||||

Taxpayer Name |

|

|

|

|

|

|

|

Daytime Phone (with area code) |

|||

Spouse’s Name (if joint return was filed) |

|

|

|

|

|

Email address: |

|

|

|

||

Present Address - number and street, rural route |

|

|

|

Apartment/Suite No. |

|

||||||

City, Town or Post Office |

|

|

|

|

|

|

State |

ZIP Code |

|

|

|

|

|

|

or |

|

|

|

|

|

|

|

|

If you want the Arizona Department of Revenue to work with your representative, complete and include Arizona Form 285, General Disclosure/Representation |

|||||||||||

Authorization Form. Ensure boxes 4b and 4c |

|

box 5 are marked. |

|

|

|

|

|

||||

PART 2 |

SPECIFIC DETAILS FOR ABATEMENT CONSIDERATION (REQUIRED) |

|

|

|

|||||||

|

TAX TYPE |

|

TAXPAYER ID |

|

Provide the |

SPECIFIC PERIOD(S) |

AMOUNT |

|

PENALTY |

||

Indicate the |

for the account |

|

Provide the associated |

|

Provide the total |

|

|||||

|

|

|

|

number for |

for the account requesting abatement |

|

for the account |

||||

requesting abatement |

|

the account requesting |

|

|

requesting abatement. |

||||||

Individual Income Tax |

|

|

ITIN or SSN |

|

|

(Do not include interest) |

|||||

|

abatement |

|

|

||||||||

|

|

|

|

|

|

|

|

|

$ |

|

|

License Number

$

EIN

$

EIN

$

EIN/License Number

$

PART 3 EXPLANATION & DOCUMENTATION (REQUIRED)

Provide specific details or reasons that directly contributed to the failure to file or pay timely for the periods you are requesting penalty abatement. Include additional pages if more space is needed and documentation to support the claim of reasonable cause.

_______________________________________________________________________________________________________________________________

PART 4 SIGNATURE OF TAXPAYER OR AUTHORIZED REPRESENTATIVE (Did you print and sign the form?)

Who can sign this form? The taxpayer (individual, principal corporate officer, LLC Member/Manager, Trustee, Partner) or other authorized by A.R.S. §

Check here if you are attaching a completed Arizona Form 285 with boxes 4b and 4c or box 5 indicated.

I certify that I have the authority, within the meaning of A.R.S. §

A.R.S. §

|

|

|

|

|

|

|

|

|

|

TAXPAYER’S SIGNATURE |

DATE |

SIGNATURE |

DATE |

|

|||

|

|

|

|

|

|

|

|

|

|

|

PRINT OR TYPE NAME |

|

|

|

PRINT OR TYPE NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

TITLE |

|

|

|

TITLE |

|

|

SEND THE COMPLETED FORM TO: ARIZONA DEPARTMENT OF REVENUE ● PENALTY REVIEW UNIT

●1600 W MONROE ST ● PHOENIX AZ

ADOR 11237 (05/23)

Print Form

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | Arizona Form 290 is used to request an abatement of non-audit penalties imposed by the Arizona Department of Revenue. |

| Governing Law | The abatement process is governed by Arizona Revised Statutes § 42-2003(A) and § 42-1127(B)(2). |

| Eligibility | Taxpayers can request penalty abatement if the penalty was due to reasonable cause and not willful neglect. |

| Required Information | The form must include the taxpayer's name, contact information, and details about the tax type and penalty amount. |

| Supporting Documentation | Requests must include documentation that supports the reason for the abatement, such as medical reports or canceled checks. |

| Signature Requirement | The form must be signed by the taxpayer or an authorized representative, depending on the entity type. |

| Processing Time | Allow up to six weeks for the Arizona Department of Revenue to process the request. |

| Joint Filers | If filing jointly, both spouses must sign the form to authorize the request. |

| Submission Method | The completed form can be mailed or faxed to the Penalty Review Unit at the Arizona Department of Revenue. |