Fill Out Your Ador 10759 Arizona Form

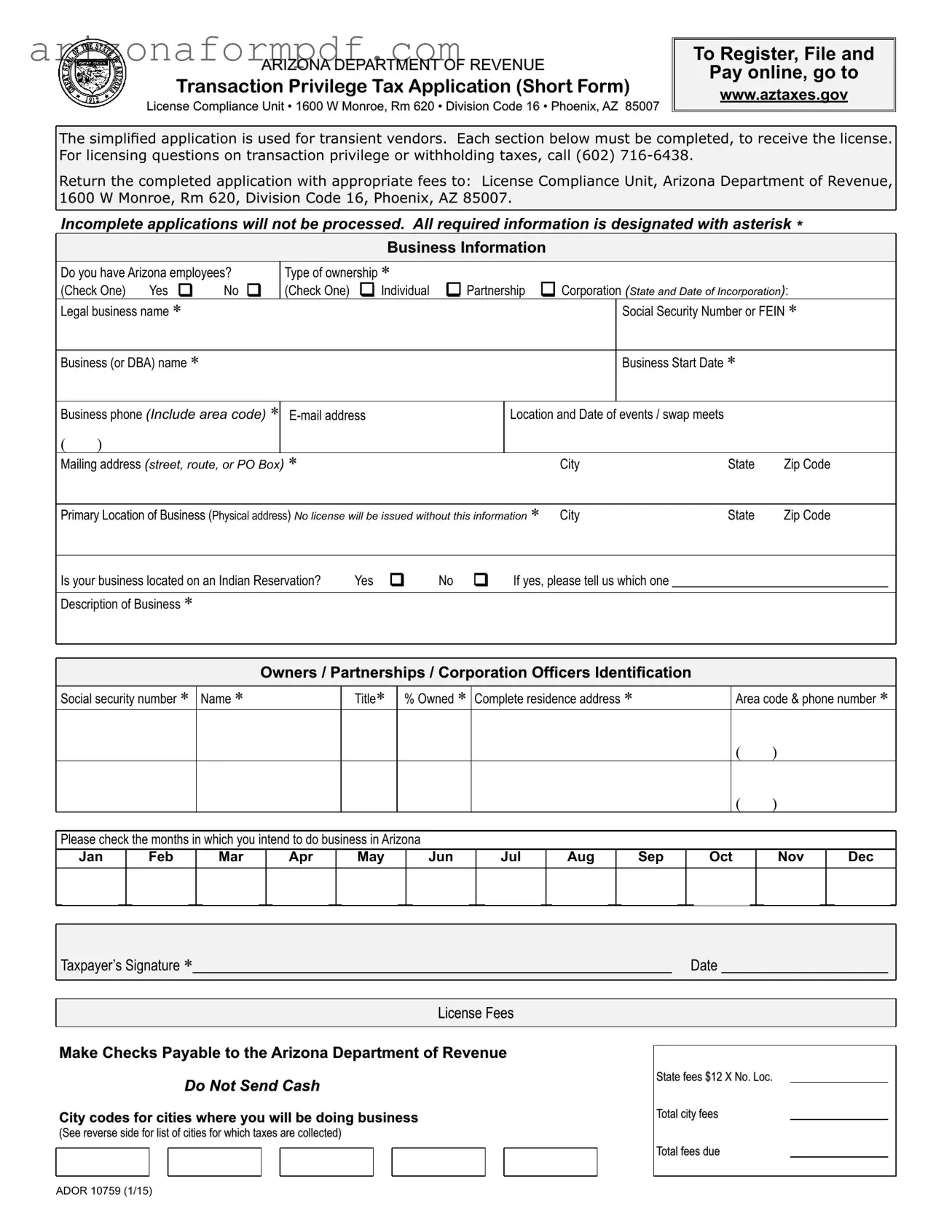

The Ador 10759 Arizona form serves as a crucial tool for transient vendors seeking to operate legally within the state. This simplified application is specifically designed for those participating in temporary selling events such as fairs, shows, and swap meets. To successfully obtain a transaction privilege tax license, applicants must complete all sections of the form, including business information, ownership type, and event details. Key components include the legal business name, Social Security Number or Federal Employer Identification Number (FEIN), and a description of the business activities. Additionally, the form requires details about the primary location of the business and any employees in Arizona. It is essential to provide accurate information, as incomplete applications will not be processed. The form also outlines the necessary fees, including a state fee and potential city fees, which vary based on the locations where business will be conducted. For vendors operating on Indian Reservations, specific questions regarding location must be addressed. Overall, the Ador 10759 form streamlines the licensing process for transient vendors while ensuring compliance with state tax regulations.

Guide to Writing Ador 10759 Arizona

Filling out the ADOR 10759 Arizona form is a straightforward process that requires attention to detail. This application is essential for transient vendors who wish to operate in Arizona, and it's important to ensure all sections are completed accurately to avoid delays in processing.

- Begin by providing your business information. Indicate whether you have Arizona employees by checking "Yes" or "No."

- Select the type of ownership by checking the appropriate box: Individual, Partnership, or Corporation. If you select Corporation, include the state and date of incorporation.

- Enter your legal business name, Social Security Number or FEIN, business name (or DBA), business start date, and business phone number, including the area code.

- Provide your email address.

- Fill in the location and date of events or swap meets. If the exact address is unknown, at least provide the city or town name.

- Complete the mailing address section, including street, city, state, and zip code.

- List the primary location of your business with a physical address. This is mandatory for the license issuance.

- Indicate whether your business is located on an Indian Reservation by checking "Yes" or "No." If yes, specify which one.

- Provide a description of your business, detailing the major activities, products, or services offered.

- Complete the owners/partners/corporation officers identification section. Include names, titles, percentage owned, and complete residence addresses. Attach a separate sheet if more space is needed.

- Check the months in which you intend to do business in Arizona by marking the corresponding boxes.

- Sign and date the application in the taxpayer’s signature section.

- Calculate the license fees. The state fee is $12. Add any applicable city fees based on the cities where you will conduct business.

- Make checks payable to the Arizona Department of Revenue and ensure to return the completed application with appropriate fees to the specified address.

Browse Popular Forms

Arizona Tax Forms - Personal representatives need to ensure all asset values are assessed at the date of death.

How to Check Credits for School - Provide your Social Security Number for identification purposes.

Common Questions

What is the purpose of the Ador 10759 Arizona form?

The Ador 10759 form, also known as the Transaction Privilege Tax Application (Short Form), is designed for transient vendors who participate in events such as fairs, shows, and swap meets in Arizona. This simplified application allows these vendors to register for a transaction privilege tax license, which is necessary for conducting business in the state.

Who needs to fill out this form?

This form is specifically intended for vendors who sell goods or services at temporary events. If you are a business owner planning to operate at fairs or swap meets, you will need to complete this application to obtain the required license. It is important to note that if you have employees in Arizona, you must indicate that on the form.

What information is required to complete the application?

To successfully complete the Ador 10759 form, you must provide various pieces of information. This includes your legal business name, business name (if different), ownership type, social security number or Federal Employer Identification Number (FEIN), business start date, and contact details. Additionally, you will need to specify the location and dates of the events where you will be selling, along with a description of your business activities.

What are the fees associated with this application?

The application requires a state fee of $12, which is applicable regardless of the number of events you plan to attend. However, if you will be doing business in multiple cities, you may incur additional city fees. Each city has its own fee structure, which must be added to the state fee on the application.

How do I submit the completed application?

You can submit your completed Ador 10759 form by mailing it to the License Compliance Unit at the Arizona Department of Revenue. The address is 1600 W Monroe, Room 620, Division Code 16, Phoenix, AZ 85007. It is crucial to ensure that all sections of the application are filled out completely, as incomplete applications will not be processed.

Can I apply for this license online?

Yes, you can register, file, and pay online through the Arizona Department of Revenue's website at www.aztaxes.gov. This option provides a convenient way to complete your application without the need to mail in physical documents.

What happens if I do not provide all required information?

If your application is incomplete, it will not be processed. This means you will not receive your transaction privilege tax license, which is essential for operating your business at transient events. To avoid delays, ensure that all required fields are filled out and double-check your application before submission.

Is there a specific signature requirement for the application?

The application must be signed by the individual owner or, in the case of partnerships or corporations, by two partners or corporate officers. This signature confirms the accuracy of the information provided and authorizes the application for processing.

What if my business is located on an Indian Reservation?

If your business operates on an Indian Reservation, you must indicate this on the application. Additionally, you will need to specify which reservation your business is located on, as this may affect your licensing requirements and tax obligations.

Dos and Don'ts

Do's:

- Complete all sections of the form to avoid delays.

- Include your Social Security Number or FEIN accurately.

- Check the appropriate boxes for ownership type and employee status.

- Provide a physical address for your primary location of business.

Don'ts:

- Do not leave any required fields blank; incomplete applications will be rejected.

- Avoid sending cash; use checks made payable to the Arizona Department of Revenue.

- Do not forget to include the city fees for each location where you will do business.

- Do not sign the application unless you are the individual owner or authorized signatory.

Similar forms

The Arizona Transaction Privilege Tax Application (Short Form) ADOR 10759 is similar to the Business License Application in many states. Both documents serve as a formal request for permission to operate a business legally within a specific jurisdiction. They require basic information about the business, such as its name, ownership structure, and contact details. Just like the ADOR 10759, the Business License Application often requires a fee and may necessitate additional permits depending on the type of business activities planned.

Another document comparable to the ADOR 10759 is the Sales Tax Permit Application. This form is essential for businesses that sell goods or services subject to sales tax. Similar to the ADOR 10759, it collects information about the business's ownership, location, and the nature of its activities. Both forms aim to ensure compliance with tax regulations and require the applicant to provide detailed information about their business operations.

The Vendor Registration Form is another document that shares similarities with the ADOR 10759. This form is typically used by vendors who participate in trade shows, fairs, or other events where they sell products. Like the ADOR 10759, it requires information about the business and its owners, as well as the specific events where the vendor intends to operate. Both forms help local authorities track vendors and ensure they comply with local tax laws.

Additionally, the Temporary Event Permit Application is akin to the ADOR 10759. This document is often required for businesses planning to operate at temporary events, such as festivals or fairs. Both applications gather information about the event, the business, and its ownership. They also ensure that the business complies with local regulations and tax requirements during the event.

The Application for a Business Tax Certificate also bears resemblance to the ADOR 10759. This certificate is often required by local governments to ensure businesses are registered for tax purposes. Like the ADOR form, it collects essential business information and may require a fee. Both documents serve to establish the legitimacy of the business in the eyes of the local government.

The Occupational License Application is another document similar to the ADOR 10759. This application is necessary for certain professions and trades and ensures that individuals meet local requirements to operate legally. Both forms require personal and business information and may include a fee. They serve to protect consumers by ensuring that businesses and professionals are properly licensed and regulated.

The Special Event Application is also comparable to the ADOR 10759. This document is used when businesses plan to participate in special events, such as fairs or markets. Both applications require information about the event, the business, and its ownership. They ensure that businesses comply with local regulations while participating in these events.

Finally, the Business Registration Form is similar to the ADOR 10759 in that it is used to register a business with the state or local government. This form collects essential information about the business, including its name, ownership structure, and type of business activities. Like the ADOR form, it is a crucial step in ensuring that the business operates legally and meets all regulatory requirements.

Key takeaways

Filling out the Ador 10759 Arizona form requires careful attention to detail. Here are five key takeaways to consider:

- Complete All Sections: Each section of the form must be filled out completely. Incomplete applications will not be processed, which could delay your ability to conduct business.

- Provide Accurate Business Information: Ensure that the legal business name, Social Security Number or FEIN, and business address are accurate. This information is crucial for licensing and tax purposes.

- Indicate Ownership Type: Clearly indicate the type of ownership—individual, partnership, or corporation. This affects how the application is processed and what additional information may be required.

- Understand Licensing Fees: The state fee is $12, but additional city fees may apply depending on where you will conduct business. Be sure to list all cities where you plan to operate.

- Sign the Application: The application must be signed by the individual owner or, in the case of partnerships or corporations, by two authorized individuals. This signature is a necessary part of the application process.

Common mistakes

-

Leaving Required Fields Blank: Each section marked with an asterisk (*) must be filled out. Incomplete applications will not be processed.

-

Incorrectly Identifying Ownership Type: Make sure to check the correct box for your business structure—individual, partnership, or corporation. Misidentifying this can lead to delays.

-

Providing Inaccurate Business Names: Ensure that the legal business name and the DBA (doing business as) name are correct and consistent. This avoids confusion later.

-

Omitting the Primary Business Location: A physical address is essential. Even if you mostly operate at events, provide a valid primary location.

-

Not Specifying Event Locations: If you are participating in swap meets or events, list the city or town where these will occur. This is crucial for determining city license requirements.

-

Forgetting to Sign the Application: The application must be signed by the owner or designated officers. A missing signature will lead to rejection.

-

Neglecting to Include Fees: Calculate and include the correct fees for state and city licenses. Double-check to avoid underpayment.

-

Incorrectly Filling Out Owner Information: Provide accurate social security numbers and titles for all owners or officers. Inaccuracies can cause issues with processing.

-

Failing to Check Business Months: Indicate all the months you plan to operate in Arizona. This is important for tax purposes and compliance.

Document Preview

ARIZONA DEPARTMENT OF REVENUE

Transaction Privilege Tax Application (Short Form)

License Compliance Unit • 1600 W Monroe, Rm 620 • Division Code 16 • Phoenix, AZ 85007

Compliance Unit • 1600 W Monroe, Rm 620 • Division Code 16 • Phoenix, AZ 85007

To Register, File and

Pay online, go to

www.aztaxes.gov

The simpliied application is used for transient vendors. Each section below must be completed, to receive the license. For licensing questions on transaction privilege or withholding taxes, call (602)

Return the completed application with appropriate fees to: License Compliance Unit, Arizona Department of Revenue, 1600 W Monroe, Rm 620, Division Code 16, Phoenix, AZ 85007.

Incomplete applications will not be processed. All required information is designated with asterisk *

|

|

|

Business Information |

Do you have Arizona employees? |

Type of ownership * |

||

(Check One) |

Yes q |

No q |

(Check One) q Individual q Partnership q Corporation (State and Date of Incorporation): |

Legal business name * |

|

Social Security Number or FEIN * |

|

Business (or DBA) name *

Business Start Date *

Business phone (Include area code) *

()

Location and Date of events / swap meets

Mailing address (street, route, or PO Box) * |

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

||||

Primary Location of Business (Physical address) No license will be issued without this information * |

City |

State |

Zip Code |

|||||

|

|

|

|

|

|

|

|

|

Is your business located on an Indian Reservation? |

Yes q |

No |

q |

If yes, please tell us which one |

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of Business * |

|

|

|

|

|

|

|

|

Owners / Partnerships / Corporation Oficers Identiication

Social security number *

Name *

Title*

% Owned *

Complete residence address *

Area code & phone number *

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please check the months in which you intend to do business in Arizona |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Jan |

|

Feb |

|

Mar |

|

Apr |

|

May |

|

|

Jun |

|

Jul |

|

Aug |

|

Sep |

|

Oct |

|

Nov |

|

Dec |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer’s Signature * |

|

Date |

|

|

|

|

|

|

|

License Fees

Make Checks Payable to the Arizona Department of Revenue

Do Not Send Cash

City codes for cities where you will be doing business

(See reverse side for list of cities for which taxes are collected)

State fees $12 X No. Loc.

Total city fees

Total fees due

ADOR 10759 (1/15)

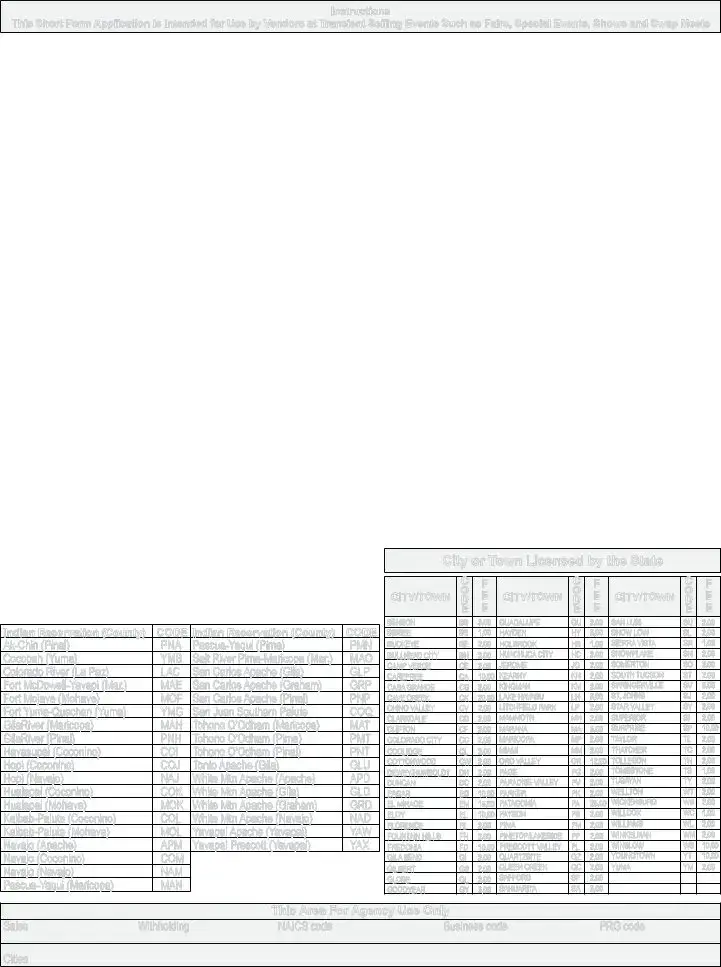

Instructions

This Short Form Application is Intended for Use by Vendors at Transient Selling Events Such as Fairs, Special Events, Shows and Swap Meets

Do you have employees? |

Check yes if you employ individuals in the state of Arizona. If you do not have employees or only have immediate family members |

|

who assist you during a special event or at a swap meet, check no. |

Type of ownership |

Check as applicable. Corporations and partnerships must provide the federal employer identiication number. |

Legal business name or |

Enter the individual’s and spouse’s name if Individual was selected for ownership type. |

owner name |

Enter all partner’s names if Partnership was selected for ownership type. Additional owners may be listed on a separate sheet |

and |

attached. |

|

Enter the organization name owning or controlling the business if Corporation was selected for ownership type. |

Business (or DBA) name |

Enter the name of the business/DBA (doing business as) name, if the same as legal business name, enter same. Commonly, the |

|

business name is the name by which the public knows your business/company/shop. If you wish correspondence to be sent to a name |

|

other than the owner, enter the name of the department or accountancy irm as “In Care Of” to ensure delivery by the postal service. |

Location and Date of event/ swap meet

Enter the address and date of the special event or swap meet. If you do not know the actual address of the event, enter the city/town name in which the event will be held. The location is very important in determining whether an additional city/town license must be obtained for those licensed by the state. Use the City or Town Licensed By The State chart below to determine if you must be licensed through the state for the location in which your event occurs. For cities not listed, please contact the city directly. Also add the city fee amount to the license fee which appears in the lower right corner of the front page.

Mailing address |

Enter mailing address where all correspondence is to be sent. You may elect to use your home address, corporate headquarters, or |

|

accounting irm’s address. |

Primary location of business |

Enter the street address for the primary location of the business. If you conduct most of your business at various special events or swap |

|

meets throughout the state, you may wish to enter your resident location. Even if your mailing address is a PO Box, you must provide a |

|

physical location. For example if you live in a rural community, your physical location may be the intersection of two roads, interstates, or |

|

milepost marker. |

Description of business |

Describe the major activity and principal product you manufacture or commodity sold or service performed. Your description of your business |

|

is very important because it determines your sales tax rate and provides a basis for state economic forecasting. |

Owners identiication |

Enter as many as applicable, attach a separate sheet if additional space is needed. The authority for mandatory requirement for social |

|

security numbers of owners is provided in ARS § |

Signature |

The application must be signed by either the individual owner or, for partnerships or corporation, two partners or two corporate oficers. |

Fees |

The state fee is $12 no matter how many special events you attend. |

|

However, a separate city license fee is required for each city unless |

|

you are currently licensed for the city in which an event will be held. |

|

List the cities in which you will be doing business on the front of the |

|

application form and total to determine the amount due. |

Indian Reservation (County) |

CODE |

Indian Reservation (County) |

CODE |

PNA |

PMN |

||

Cocopah (Yuma) |

YMB |

Salt River |

MAO |

Colorado River (La Paz) |

LAC |

San Carlos Apache (Gila) |

GLP |

Fort |

MAE |

San Carlos Apache (Graham) |

GRP |

Fort Mojave (Mohave) |

MOF |

San Carlos Apache (Pinal) |

PNP |

Fort |

YMG |

San Juan Southern Paiute |

COQ |

GilaRiver (Maricopa) |

MAH |

Tohono O’Odham (Maricopa) |

MAT |

GilaRiver (Pinal) |

PNH |

Tohono O’Odham (Pima) |

PMT |

Havasupai (Coconino) |

COI |

Tohono O’Odham (Pinal) |

PNT |

Hopi (Coconino) |

COJ |

Tonto Apache (Gila) |

GLU |

Hopi (Navajo) |

NAJ |

White Mtn Apache (Apache) |

APD |

Hualapai (Coconino) |

COK |

White Mtn Apache (Gila) |

GLD |

Hualapai (Mohave) |

MOK |

White Mtn Apache (Graham) |

GRD |

COL |

White Mtn Apache (Navajo) |

NAD |

|

MOL |

Yavapai Apache (Yavapai) |

YAW |

|

Navajo (Apache) |

APM |

Yavapai Prescott (Yavapai) |

YAX |

Navajo (Coconino) |

COM |

|

|

Navajo (Navajo) |

NAM |

|

|

MAN |

|

|

City or Town Licensed by the State

|

C |

F |

|

C |

F |

|

C |

F |

CITY/TOWN |

O |

E |

CITY/TOWN |

O |

E |

CITY/TOWN |

O |

E |

D |

D |

D |

||||||

|

E |

E |

|

E |

E |

|

E |

E |

BENSON |

BS |

5.00 |

GUADALUPE |

GU |

2.00 |

SAN LUIS |

SU |

2.00 |

BISBEE |

BB |

1.00 |

HAYDEN |

HY |

5.00 |

SHOW LOW |

SL |

2.00 |

BUCKEYE |

BE |

2.00 |

HOLBROOK |

HB |

1.00 |

SIERRA VISTA |

SR |

1.00 |

BULLHEAD CITY |

BH |

2.00 |

HUACHUCA CITY |

HC |

2.00 |

SNOWFLAKE |

SN |

2.00 |

CAMP VERDE |

CE |

2.00 |

JEROME |

JO |

2.00 |

SOMERTON |

SO |

2.00 |

CAREFREE |

CA |

10.00 |

KEARNY |

KN |

2.00 |

SOUTH TUCSON |

ST |

2.00 |

CASA GRANDE |

CG |

2.00 |

KINGMAN |

KM |

2.00 |

SPRINGERVILLE |

SV |

5.00 |

CAVE CREEK |

CK |

20.00 |

LAKE HAVASU |

LH |

5.00 |

ST. JOHNS |

SJ |

2.00 |

CHINO VALLEY |

CV |

2.00 |

LITCHFIELD PARK |

LP |

2.00 |

STAR VALLEY |

SY |

2.00 |

CLARKDALE |

CD |

2.00 |

MAMMOTH |

MH |

2.00 |

SUPERIOR |

SI |

2.00 |

CLIFTON |

CF |

2.00 |

MARANA |

MA |

5.00 |

SURPRISE |

SP |

10.00 |

COLORADO CITY |

CC |

2.00 |

MARICOPA |

MP |

2.00 |

TAYLOR |

TL |

2.00 |

COOLIDGE |

CL |

2.00 |

MIAMI |

MM |

2.00 |

THATCHER |

TC |

2.00 |

COTTONWOOD |

CW |

2.00 |

ORO VALLEY |

OR |

12.00 |

TOLLESON |

TN |

2.00 |

DEWEY/HUMBOLDT |

DH |

2.00 |

PAGE |

PG |

2.00 |

TOMBSTONE |

TS |

1.00 |

DUNCAN |

DC |

2.00 |

PARADISE VALLEY |

PV |

2.00 |

TUSAYAN |

TY |

2.00 |

EAGAR |

EG |

10.00 |

PARKER |

PK |

2.00 |

WELLTON |

WT |

2.00 |

EL MIRAGE |

EM |

15.00 |

PATAGONIA |

PA |

25.00 |

WICKENBURG |

WB |

2.00 |

ELOY |

EL |

10.00 |

PAYSON |

PS |

2.00 |

WILLCOX |

WC |

1.00 |

FLORENCE |

FL |

2.00 |

PIMA |

PM |

2.00 |

WILLIAMS |

WL |

2.00 |

FOUNTAIN HILLS |

FH |

2.00 |

PINETOP/LAKESIDE |

PP |

2.00 |

WINKELMAN |

WM |

2.00 |

FREDONIA |

FD |

10.00 |

PRESCOTT VALLEY |

PL |

2.00 |

WINSLOW |

WS |

10.00 |

GILA BEND |

GI |

2.00 |

QUARTZSITE |

QZ |

2.00 |

YOUNGTOWN |

YT |

10.00 |

GILBERT |

GB |

2.00 |

QUEEN CREEK |

QC |

2.00 |

YUMA |

YM |

2.00 |

GLOBE |

GL |

2.00 |

SAFFORD |

SF |

2.00 |

|

|

|

GOODYEAR |

GY |

5.00 |

SAHUARITA |

SA |

5.00 |

|

|

|

This Area For Agency Use Only

Sales |

Withholding |

NAICS code |

Business code |

PRG code |

Cities

ADOR 10759 (1/15)

Form Breakdown

| Fact Name | Fact Description |

|---|---|

| Purpose | The Ador 10759 Arizona form is a simplified application for transient vendors seeking to apply for a Transaction Privilege Tax license. |

| Governing Law | This form is governed by Arizona Revised Statutes, specifically ARS § 42-1105, which mandates the requirement for social security numbers of business owners. |

| Application Completeness | All sections of the application must be completed. Incomplete applications will not be processed, so attention to detail is crucial. |

| License Fees | The state fee for the license is $12, regardless of how many events you attend. Additional city fees may apply based on the locations where you do business. |

| Contact Information | For questions regarding licensing, vendors can call the Arizona Department of Revenue at (602) 716-6438. |

| Online Services | Vendors can register, file, and pay online at www.aztaxes.gov, making the process more convenient. |

| Indian Reservation | Vendors must indicate if their business is located on an Indian Reservation, which may affect licensing requirements. |

| Signature Requirement | The application must be signed by the individual owner or, for partnerships and corporations, by two authorized officers or partners. |