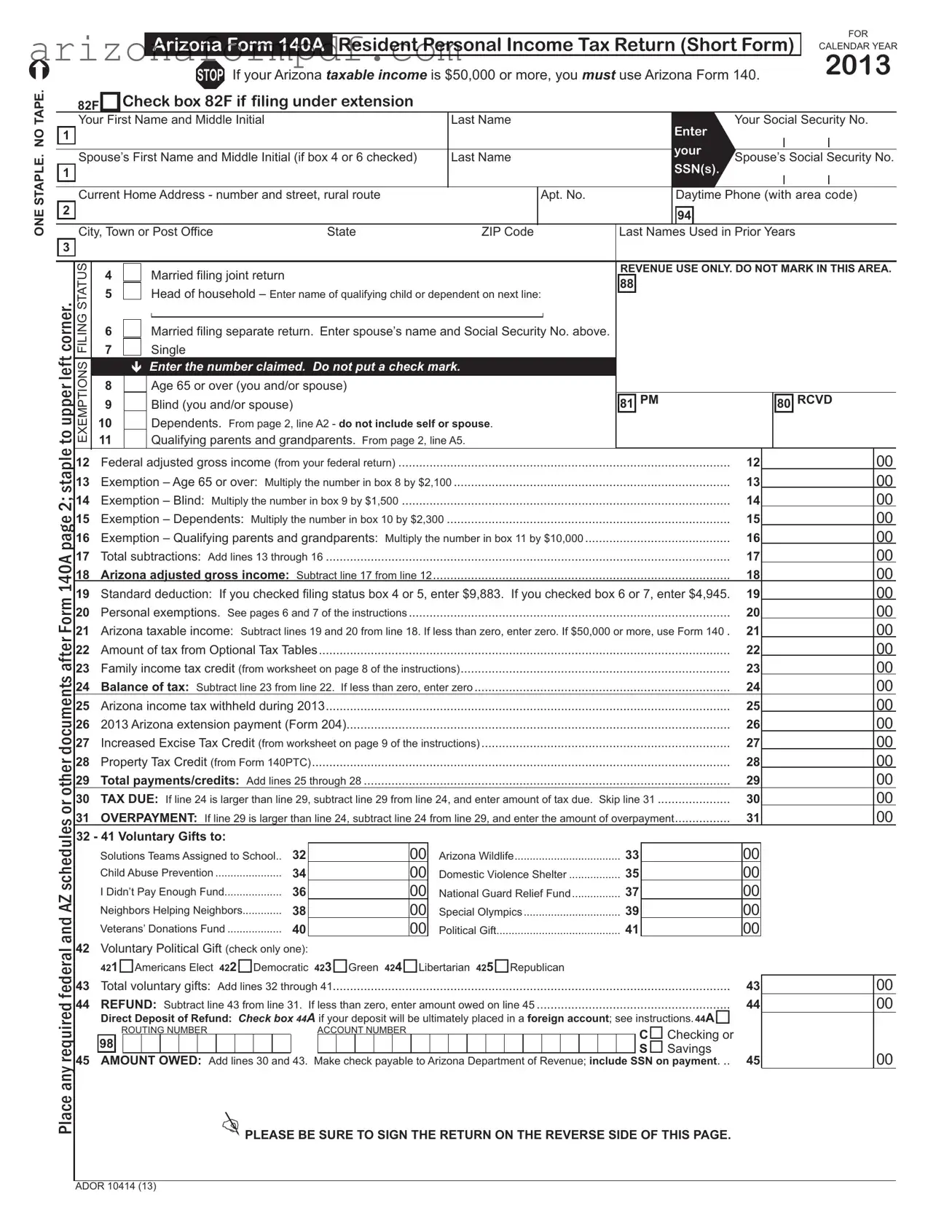

Fill Out Your Arizona 140A Form

The Arizona Form 140A is a crucial document for residents filing their personal income tax returns. Designed as a short form, it streamlines the tax filing process for individuals whose taxable income is below $50,000. This form requires basic personal information, including names, Social Security numbers, and addresses. Taxpayers must indicate their filing status, which can be single, married filing jointly, married filing separately, or head of household. The form also includes sections for claiming exemptions based on age, blindness, and dependents, which can significantly impact the total tax owed. Calculating Arizona adjusted gross income involves subtracting certain exemptions from federal adjusted gross income. Taxpayers can take advantage of standard deductions and various credits, such as the family income tax credit and property tax credit. Ultimately, the form guides users through determining their tax liability or potential refund, ensuring they comply with state tax laws while maximizing their financial benefits.

Guide to Writing Arizona 140A

Completing the Arizona Form 140A is an essential step in filing your personal income tax return. After you fill out the form, you will need to submit it to the Arizona Department of Revenue, ensuring that all information is accurate to avoid any delays or issues with processing your return.

- Begin by entering your first name, middle initial, and last name at the top of the form.

- Input your Social Security Number (SSN) in the designated area.

- If applicable, provide your spouse’s first name, middle initial, and last name, along with their Social Security Number.

- Fill in your current home address, including the street number, apartment number (if any), city, state, and ZIP code.

- Check the appropriate box for your filing status: Married filing joint, Head of household, Married filing separate, or Single.

- Enter the number of exemptions you are claiming, including any for age, blindness, dependents, and qualifying parents or grandparents.

- Record your federal adjusted gross income from your federal return.

- Calculate the total subtractions based on your exemptions and enter the amounts on the corresponding lines.

- Subtract the total subtractions from your federal adjusted gross income to find your Arizona adjusted gross income.

- Determine your standard deduction based on your filing status and enter that amount.

- Calculate your Arizona taxable income by subtracting the standard deduction and personal exemptions from your Arizona adjusted gross income.

- Use the Optional Tax Tables to find the amount of tax owed and enter it on the form.

- Complete the sections for any tax credits, payments, or overpayments.

- If applicable, indicate any voluntary gifts and calculate the total.

- Sign and date the return, ensuring that both you and your spouse (if filing jointly) have signed.

- Mail your completed form to the appropriate address based on whether you are sending a payment or expecting a refund.

Browse Popular Forms

Establishing Paternity in Arizona - The Acknowledgment of Paternity grants the child rights to know and benefit from having both parents legally recognized.

Arizona State Income Tax Form - For multiple deductions, complete each line fully and accurately.

Does Arizona Have an Inheritance Tax - This affidavit is applicable if the deceased's personal property value is under $50,000.

Common Questions

What is the Arizona Form 140A?

The Arizona Form 140A is a short personal income tax return designed for residents with a taxable income of less than $50,000. It simplifies the filing process for eligible individuals and allows them to report their income, exemptions, and tax credits efficiently.

Who should use Form 140A instead of Form 140?

If your Arizona taxable income is below $50,000, you can use Form 140A. However, if your income meets or exceeds this threshold, you are required to file Form 140. The choice of form directly impacts the complexity of your tax filing.

What information is required to complete Form 140A?

You will need to provide personal information such as your name, Social Security number, and address. Additionally, details about your income, exemptions, and any tax credits must be included. This includes information on dependents and qualifying parents or grandparents.

What exemptions can I claim on Form 140A?

Form 140A allows you to claim exemptions for age (if you or your spouse is 65 or older), blindness, dependents, and qualifying parents or grandparents. Each exemption has a specific dollar amount that will reduce your taxable income.

How do I determine my Arizona taxable income?

To find your Arizona taxable income, start with your federal adjusted gross income. From this amount, subtract any exemptions and the standard deduction applicable to your filing status. If your taxable income is less than zero, enter zero. If it is $50,000 or more, you must use Form 140.

What should I do if I owe taxes or expect a refund?

If you owe taxes, calculate the amount due and submit payment with your return. If you expect a refund, ensure you complete the appropriate section of Form 140A to receive your refund. You may also choose direct deposit for faster processing.

Can I file Form 140A electronically?

What is the deadline for filing Form 140A?

Where do I send my completed Form 140A?

If you are expecting a refund or owe no tax, mail your completed Form 140A to the Arizona Department of Revenue, PO Box 52138, Phoenix, AZ, 85072-2138. If you owe taxes and are sending a payment, send it to PO Box 52016, Phoenix, AZ, 85072-2016.

Dos and Don'ts

When filling out the Arizona 140A form, consider the following guidelines to ensure accuracy and compliance.

- Do read the instructions carefully before starting the form.

- Do provide accurate personal information, including Social Security numbers.

- Do use a black or blue pen to fill out the form.

- Do staple any additional documents to the upper left corner of the form.

- Don't use tape or any other adhesive materials on the form.

- Don't leave any required fields blank; fill in all necessary information.

- Don't forget to sign and date the return before submitting it.

- Don't send the form to the wrong address; ensure you use the correct mailing instructions based on your situation.

Similar forms

The Arizona Form 140 is a more comprehensive tax return document that is similar to the 140A form. While the 140A is designed for individuals with simpler tax situations, the 140 form accommodates those with more complex financial circumstances, specifically for taxpayers with a taxable income of $50,000 or more. It requires additional information, such as itemized deductions and various tax credits, which are not included in the short form. This distinction allows taxpayers to accurately report their financial details and potentially benefit from a more favorable tax outcome.

Another document that shares similarities with the Arizona Form 140A is the Federal Form 1040. This federal income tax return is the primary form used by individuals to report their annual income to the IRS. Like the 140A, the 1040 is structured to capture personal information, income sources, and deductions. However, the 1040 allows for more extensive reporting options, including additional schedules for specific deductions and credits. Taxpayers often use both forms in conjunction, as the information from the federal return is necessary for completing the state return.

The Arizona Form 140PTC, or Property Tax Credit form, is another document that complements the 140A. This form is specifically designed for Arizona residents who qualify for a property tax credit based on their income and property taxes paid. While the 140A focuses on personal income tax, the 140PTC provides a mechanism for taxpayers to claim relief on property taxes, which can significantly impact their overall tax liability. Both forms require detailed information about income and exemptions, but they serve different purposes in the tax filing process.

Lastly, the Arizona Form 204 is relevant for individuals who file for an extension on their tax return. This form allows taxpayers to request additional time to file their taxes without incurring penalties. Similar to the 140A, the Form 204 requires basic personal information and is relatively straightforward. However, it does not calculate tax liability; instead, it simply extends the filing deadline. Understanding the relationship between the 204 and the 140A is crucial for those who may need more time to gather their tax information while ensuring they remain compliant with state tax regulations.

Key takeaways

Filling out the Arizona Form 140A is a crucial step for residents filing their personal income tax. Below are key takeaways to keep in mind when completing and using this form.

- Eligibility: Use Form 140A only if your Arizona taxable income is less than $50,000. If it is $50,000 or more, you must use Arizona Form 140.

- Filing Status: Indicate your filing status accurately. Options include married filing jointly, head of household, married filing separately, and single.

- Exemptions: Be sure to enter the correct number of exemptions. This includes age, blindness, dependents, and qualifying parents or grandparents.

- Income Reporting: Report your federal adjusted gross income from your federal tax return. This figure is essential for calculating your Arizona adjusted gross income.

- Subtractions: Calculate total subtractions by adding various exemptions. This will help determine your Arizona adjusted gross income.

- Standard Deduction: Depending on your filing status, enter the appropriate standard deduction amount. This reduces your taxable income.

- Tax Calculation: Use the Optional Tax Tables provided to determine your tax amount based on your taxable income.

- Payments and Credits: Include any Arizona income tax withheld, extension payments, and credits such as the Family Income Tax Credit.

- Refund or Tax Due: Determine if you owe tax or are due a refund by comparing your total payments/credits with your tax amount.

- Signature Requirement: Don’t forget to sign the return. Both you and your spouse must sign if filing jointly.

Completing the Arizona Form 140A accurately is essential for a smooth tax filing experience. Ensure all information is correct to avoid delays or issues with the Arizona Department of Revenue.

Common mistakes

-

Not checking the income threshold. If your Arizona taxable income is $50,000 or more, you need to use Arizona Form 140 instead of Form 140A.

-

Forgetting to staple documents. Remember to staple any required documents to the upper left corner of the form. Do not use tape.

-

Leaving out Social Security numbers. Ensure you include your Social Security number and, if applicable, your spouse’s Social Security number.

-

Not filling in the current home address completely. Include your street number, street name, apartment number (if any), city, state, and ZIP code.

-

Incorrectly marking exemptions. Enter the number of exemptions without using a check mark.

-

Failing to include dependents. Make sure to list all qualifying dependents and not include yourself or your spouse in this count.

-

Missing the standard deduction. If you checked filing status boxes 4 or 5, enter $9,883. For boxes 6 or 7, enter $4,945.

-

Not signing the return. Both you and your spouse must sign the form. An unsigned return can lead to delays.

-

Incorrectly calculating tax due or overpayment. Double-check your math to ensure accuracy in the amounts you owe or expect to be refunded.

-

Not mailing the return to the correct address. If you are sending a payment, mail to the specified address. For refunds or no tax owed, use the other address provided.

Document Preview

Arizona Form 140A Resident Personal Income Tax Return (Short Form)

STOP If your Arizona taxable income is $50,000 or more, you must use Arizona Form 140.

FOR

CALENDAR YEAR

2013

ONE STAPLE. NO TAPE.

1

1

2

3

or other documents after Form 140A page 2; staple to upper left corner.

|

82F |

|

Check box 82F if filing under extension |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Your |

First Name and Middle Initial |

|

|

Last Name |

|

|

Enter |

|

Your Social Security No. |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Spouse’s First Name and Middle Initial (if box 4 or 6 checked) |

|

Last Name |

|

Spouse’s Social Security No. |

|||||||||||||||||||||

|

|

|

|

SSN(s) |

. |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Current Home Address - number and street, rural route |

|

|

|

Apt. No. |

|

|

|

|

Phone (with area code) |

|

|||||||||||||||

|

|

|

|

|

|

Daytime |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, Town or Post Office |

State |

|

ZIP Code |

|

|

|

|

94 |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

Last Names |

Used in Prior Years |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATUS |

|

4 |

|

|

|

|

Married filing joint return |

|

|

|

|

|

|

REVENUE USE ONLY. DO NOT MARK IN THIS AREA. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

88 |

|

|

|

|

|

|

|

|

|

|

|

||||

FILING |

|

5 |

|

|

|

|

Head of household – Enter name of qualifying child or dependent on next line: |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

Married filing separate return. Enter spouse’s name and Social Security No. above. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

7 |

|

|

|

|

Single |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ExEMPTIONS |

|

|

|

Enter the number claimed. Do not put a check mark. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

8 |

|

|

|

|

Age 65 or over (you and/or spouse) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

9 |

|

|

|

|

Blind (you and/or spouse) |

|

|

|

|

|

|

|

PM |

|

|

|

RCVD |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

81 |

|

|

80 |

|

|||||||||

|

|

10 |

|

|

|

|

Dependents. From page 2, line A2 - do not include self or spouse. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

11 |

|

|

|

|

Qualifying parents and grandparents. From page 2, line A5. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

12 |

|

................................................................................................Federal adjusted gross income (from your federal return) |

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

00 |

||||||||

13 |

|

Exemption – Age 65 or over: Multiply the number in box 8 by $2,100 |

|

|

|

|

|

13 |

|

|

|

|

|

00 |

||||||||||||

14 |

|

Exemption – Blind: Multiply the number in box 9 by $1,500 |

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

00 |

||||||||

15 |

|

Exemption – Dependents: Multiply the number in box 10 by $2,300 |

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

00 |

||||||||

16 |

|

Exemption – Qualifying parents and grandparents: Multiply the number in box 11 by $10,000 |

|

|

|

|

|

16 |

|

|

|

|

|

00 |

||||||||||||

17 |

|

Total subtractions: Add lines 13 through 16 |

..................................................................................................................... |

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

00 |

|||||||

18 |

|

Arizona adjusted gross income: Subtract line 17 from line 12 |

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

00 |

||||||||

19 |

|

Standard deduction: If you checked filing status box 4 or 5, enter $9,883. If you checked box 6 or 7, enter $4,945. |

19 |

|

|

|

|

|

00 |

|||||||||||||||||

20 |

|

Personal exemptions. See pages 6 and 7 of the instructions |

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

00 |

||||||||

21 |

|

Arizona taxable income: Subtract lines 19 and 20 from line 18. If less than zero, enter zero. If $50,000 or more, use Form 140 . |

21 |

|

|

|

|

|

00 |

|||||||||||||||||

22 |

|

Amount of tax from Optional Tax Tables |

|

|

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

00 |

|||||||

23 |

|

Family income tax credit (from worksheet on page 8 of the instructions) |

|

|

|

|

|

23 |

|

|

|

|

|

00 |

||||||||||||

24 |

|

Balance of tax: Subtract line 23 from line 22. If less than zero, enter zero |

|

|

|

|

|

24 |

|

|

|

|

|

00 |

||||||||||||

25 |

|

Arizona income tax withheld during 2013 |

..................................................................................................................... |

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

00 |

|||||||

26 |

|

2013 Arizona extension payment (Form 204) |

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

00 |

||||||||

27 |

|

Increased Excise Tax Credit (from worksheet on page 9 of the instructions) |

|

|

|

|

|

27 |

|

|

|

|

|

00 |

||||||||||||

28 |

|

Property Tax Credit (from Form 140PTC) |

|

|

|

|

|

|

|

|

|

|

28 |

|

|

|

|

|

00 |

|||||||

29 |

|

Total payments/credits: Add lines 25 through 28 |

|

|

|

|

|

|

|

|

|

29 |

|

|

|

|

|

00 |

||||||||

30 |

|

TAX DUE: If line 24 is larger than line 29, subtract line 29 from line 24, and enter amount of tax due. Skip line 31 |

30 |

|

|

|

|

|

00 |

|||||||||||||||||

31 |

|

OVERPAYMENT: If line 29 is larger than line 24, subtract line 24 from line 29, and enter the amount of overpayment |

31 |

|

|

|

|

|

00 |

|||||||||||||||||

and AZ schedules

32 - 41 Voluntary Gifts to: |

|

Solutions Teams Assigned to School.. |

32 |

Child Abuse Prevention |

34 |

I Didn’t Pay Enough Fund |

36 |

Neighbors Helping Neighbors |

38 |

Veterans’ Donations Fund |

40 |

42Voluntary Political Gift (check only one):

00

00

00

00

00

Arizona Wildlife |

33 |

Domestic Violence Shelter |

35 |

National Guard Relief Fund |

37 |

Special Olympics |

39 |

Political Gift |

41 |

00

00

00

00

00

Place any required federal

|

421Americans Elect 422Democratic 423Green 424Libertarian 425Republican |

|

|

|

|

|||||||||||||||||||||||||||||

43 |

Total voluntary gifts: Add lines 32 through 41 |

43 |

|

00 |

||||||||||||||||||||||||||||||

44 |

REFUND: Subtract line 43 from line 31. |

If less than zero, enter amount owed on line 45 |

44 |

|

00 |

|||||||||||||||||||||||||||||

|

Direct Deposit of Refund: Check box 44A if your deposit will be ultimately placed in a foreign account; see instructions. 44A |

|

|

|

||||||||||||||||||||||||||||||

|

|

ROUTING NUMBER |

|

ACCOUNT NUMBER |

C Checking or |

|

|

|

||||||||||||||||||||||||||

|

98 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S Savings |

45 |

|

00 |

|

AMOUNT OWED: Add lines 30 and |

43. Make check payable to Arizona Department of Revenue; include SSN on payment |

|

||||||||||||||||||||||||||||||||

PLEASE BE SURE TO SIGN THE RETURN ON THE REVERSE SIDE OF THIS PAGE.

ADOR 10414 (13)

Your Name (as shown on page 1)

Your Social Security No.

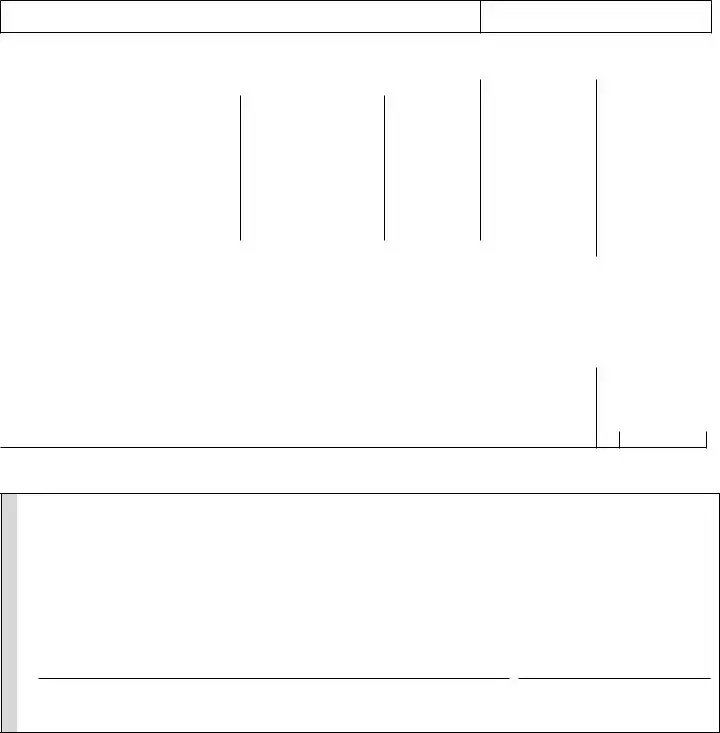

PART A: Dependents, Qualifying Parents and Grandparents – do not list yourself or spouse

A1 List children and other dependents. |

If more space is needed, attach a separate sheet. |

|

|

||

|

NO. OF MONTHS LIVED |

||||

|

FIRST AND LAST NAME |

SOCIAL SECURITY NO. |

RELATIONSHIP |

|

IN YOUR HOME IN 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A2 |

Enter total number of persons listed in A1 here and on the front of this form, box 10 |

TOTAL A2 |

|

|||||||||

A3 |

a Enter the names of the dependents listed above who do not qualify as your dependent on your federal return. See |

|

||||||||||

|

|

page 6 of the instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

b Enter dependents listed above who were not claimed on your federal return due to education credits: |

|||||||||||

A4 |

|

|

|

|

|

|

|

|

||||

List qualifying parents and grandparents. If more space is needed, attach a separate sheet. |

|

|

|

|

||||||||

|

You cannot list the same person here and also on line A1. For information on who is a |

|

|

|

|

|||||||

|

qualifying parent or grandparent, see page 6 of the instructions. |

|

|

NO. OF MONTHS LIVED |

||||||||

|

FIRST AND LAST NAME |

SOCIAL SECURITY NO. |

RELATIONSHIP |

IN YOUR HOME IN 2013 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A5 Enter total number of persons listed in A4 here and on the front of this form, box 11 |

TOTAL |

A5

PLEASE SIGN HERE

I have read this return and any attachments with it. Under penalties of perjury, I declare that to the best of my knowledge and belief, they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

|

|

|

|

|

|

|

|

YOUR SIGNATURE |

|

|

|

DATE |

|

OCCUPATION |

|

|

|

|

|

|

|

|

|

SPOUSE’S SIGNATURE |

|

|

|

DATE |

|

SPOUSE’S OCCUPATION |

|

|

|

|

|

|

|

||

|

PAID PREPARER’S SIGNATURE |

|

DATE |

|

FIRM’S NAME (PREPARER’S IF |

||

PAID PREPARER’S STREET ADDRESSPAID PREPARER’S TIN

|

|

|

( |

) |

|

PAID PREPARER’S CITY |

STATE |

ZIP CODE |

|

PAID PREPARER’S PHONE NO. |

|

If you are sending a payment with this return, mail to Arizona Department of Revenue, PO Box 52016, Phoenix, AZ,

If you are expecting a refund or owe no tax, or owe tax but are not sending a payment, mail to Arizona Department of Revenue, PO Box 52138, Phoenix, AZ,

ADOR 10414 (13) |

AZ Form 140A (2013) |

Page 2 of 2 |

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | The Arizona Form 140A is used for filing the Resident Personal Income Tax Return for individuals with simpler tax situations. |

| Income Threshold | If your Arizona taxable income is $50,000 or more, you must use Arizona Form 140 instead of Form 140A. |

| Filing Status Options | Taxpayers can choose from several filing statuses, including single, married filing jointly, married filing separately, and head of household. |

| Exemptions | Taxpayers can claim exemptions for age, blindness, dependents, and qualifying parents or grandparents, which can reduce taxable income. |

| Standard Deductions | The standard deduction for 2013 is $9,883 for married filing jointly or separately, and $4,945 for single filers. |

| Payment Instructions | If sending a payment, mail to the Arizona Department of Revenue at a specified address. Refunds or no tax owed should go to a different address. |

| Governing Law | This form is governed by Arizona Revised Statutes, Title 43, which covers state taxation laws. |