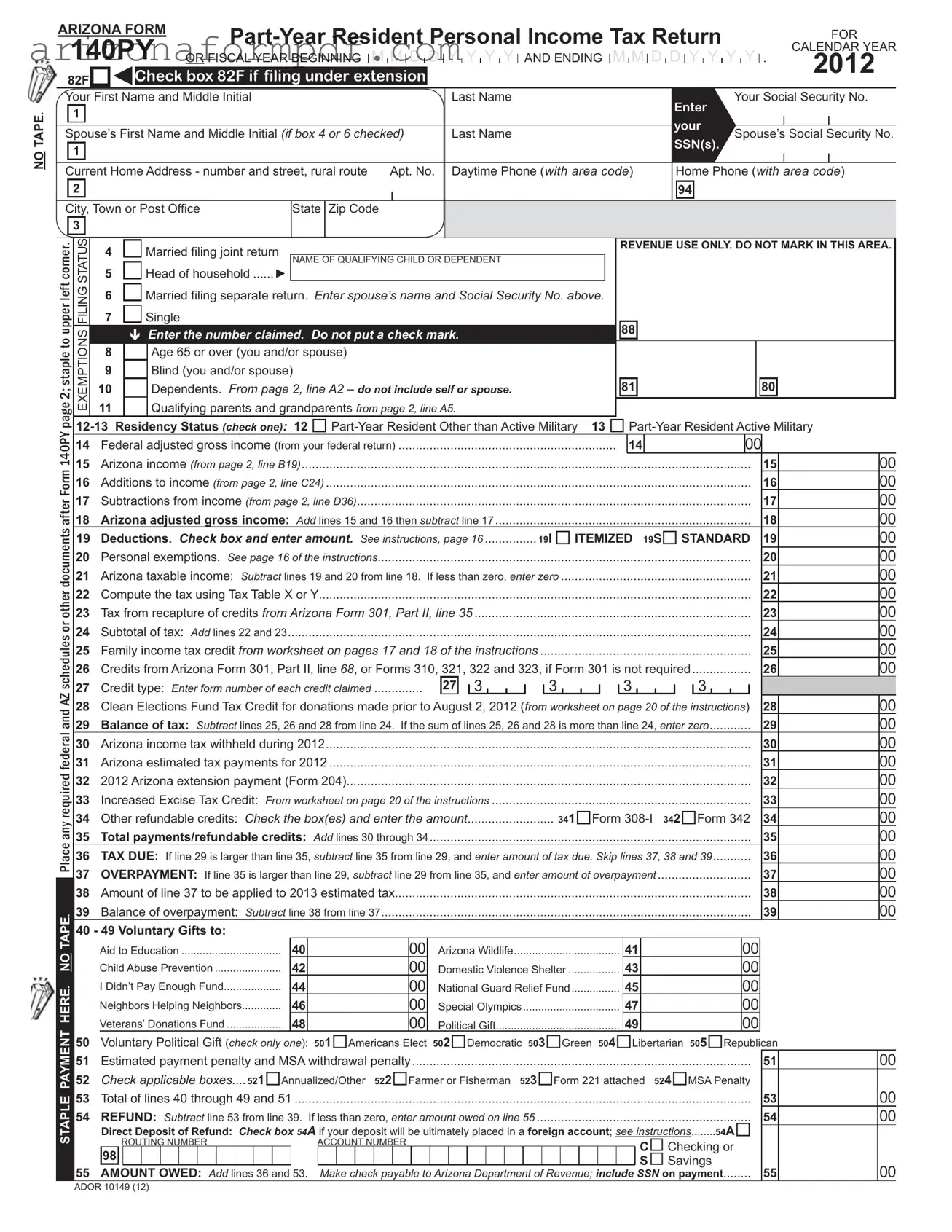

Fill Out Your Arizona 140Py Form

The Arizona 140PY form is an essential document for individuals who have lived in the state for part of the tax year and are required to file a personal income tax return. Designed specifically for part-year residents, this form allows taxpayers to report their income earned while residing in Arizona, along with any applicable deductions and credits. The form requires basic personal information, including names, Social Security numbers, and residency status. Taxpayers must detail their federal adjusted gross income and calculate their Arizona taxable income by accounting for various additions and subtractions specific to state regulations. Additionally, the 140PY form includes sections for claiming exemptions, which can reduce taxable income, and for reporting any tax credits that may apply. Understanding the nuances of this form is crucial, as it not only determines tax liability but also ensures compliance with state tax laws. Filing accurately can lead to potential refunds or reduced tax due, making it a significant component of the annual tax process for part-year residents in Arizona.

Guide to Writing Arizona 140Py

Filling out the Arizona 140PY form can seem daunting, but breaking it down into manageable steps makes the process much easier. Once you have completed the form, you'll be ready to submit it to the Arizona Department of Revenue, either for a refund or to settle any tax dues. Here’s how to navigate the form step-by-step.

- Begin by checking the box for filing under extension if applicable.

- Enter your first name, middle initial, and last name.

- Provide your Social Security Number (SSN).

- If applicable, fill in your spouse’s first name, middle initial, last name, and SSN.

- Complete your current home address, including street number, apartment number (if any), city, state, and zip code.

- Enter your daytime phone number and home phone number.

- Select your filing status: married filing jointly, head of household, married filing separately, or single.

- Claim exemptions by entering the number of exemptions you are entitled to, including age, blindness, and dependents.

- Indicate your residency status by checking the appropriate box for part-year resident, either active military or other than active military.

- Report your federal adjusted gross income from your federal return on line 14.

- Enter your Arizona income on line 15, as calculated on page 2.

- Fill in any additions to income on line 16.

- Complete line 17 for any subtractions from income.

- Calculate your Arizona adjusted gross income by adding lines 15 and 16, then subtracting line 17.

- Choose between itemized or standard deductions on line 19 and enter the amount.

- Enter personal exemptions on line 20 as per instructions.

- Calculate your Arizona taxable income by subtracting lines 19 and 20 from line 18.

- Use the tax table to compute your tax on line 22.

- Add any recapture of credits from Arizona Form 301 on line 23.

- Calculate the subtotal of tax on line 24 by adding lines 22 and 23.

- Report any family income tax credit on line 25.

- Claim any additional credits on line 26.

- List any specific credit types claimed on line 27.

- Complete lines 28 through 39 for tax due, overpayment, and voluntary gifts.

- Sign and date the form, ensuring all information is accurate.

- Mail the completed form to the appropriate address based on whether you are sending a payment or expecting a refund.

Browse Popular Forms

Arizona 676 - It requires the lien holder's signature and title documentation for processing.

How Much Does It Cost to File for Custody - This form can compel someone to testify or provide specific documents relevant to a court case.

Az State Income Tax Form - The Arizona DWM156 form is an application for a Public Weighmaster license.

Common Questions

What is the Arizona 140PY form?

The Arizona 140PY form is a personal income tax return specifically designed for part-year residents of Arizona. It allows individuals who lived in the state for only part of the tax year to report their income and calculate their tax liability accordingly. This form is essential for ensuring that taxpayers accurately reflect their residency status and income earned during their time in Arizona.

Who should file the Arizona 140PY form?

How do I determine my Arizona income for the 140PY form?

What exemptions can I claim on the Arizona 140PY form?

What should I do if I owe tax or am expecting a refund?

Dos and Don'ts

When filling out the Arizona 140PY form, it's essential to be thorough and accurate. Here are some important do's and don'ts to keep in mind:

- Do double-check all personal information, including names and Social Security numbers, for accuracy.

- Do ensure you have the correct residency dates clearly marked on the form.

- Do follow the instructions carefully, especially regarding exemptions and deductions.

- Do sign and date the form before submission to avoid delays.

- Don't use tape or any other adhesive on the form; it can cause processing issues.

- Don't leave any required fields blank; fill them out completely to prevent processing delays.

- Don't forget to keep a copy of your completed form for your records.

- Don't submit the form without checking for any errors or omissions.

Similar forms

The Arizona Form 140 is a personal income tax return for full-year residents. Like the 140Py, it is used to report income, claim deductions, and determine tax liability. The primary difference is that the 140 is for individuals who have lived in Arizona for the entire tax year, whereas the 140Py is specifically for part-year residents. Both forms require similar information, such as personal details, income sources, and exemptions, but the residency status section differs based on the duration of residency in Arizona.

The Arizona Form 140A is a simplified version of the 140 form, designed for taxpayers with a straightforward tax situation. Similar to the 140Py, it allows for the reporting of income and claiming of deductions. However, the 140A is limited to individuals who do not itemize deductions and have a lower income threshold. Both forms share common sections, such as personal information and tax calculation, but the 140A has fewer lines and requires less detailed reporting.

The Arizona Form 140NR is used by non-residents who earn income in Arizona. This form is similar to the 140Py in that both are designed for individuals who do not meet the full-year residency requirement. Both forms require taxpayers to report income earned within the state and allow for certain deductions. However, the 140NR focuses solely on income sourced from Arizona, while the 140Py encompasses income from both Arizona and other states during the part-year residency.

The Arizona Form 204 is an extension form that allows taxpayers to request additional time to file their tax returns. It is similar to the 140Py in that it requires personal information and tax year details. Both forms serve to inform the Arizona Department of Revenue about the taxpayer's status and intentions. However, the 204 does not calculate tax liability; it simply extends the deadline for filing the actual return.

The Arizona Form 301 is used for claiming various tax credits. It shares similarities with the 140Py in that both forms require taxpayers to provide information on income and tax liability. The 301 is specifically focused on credits that can reduce the overall tax owed, while the 140Py calculates the tax based on income and deductions. Taxpayers may use both forms together to ensure they maximize their tax benefits.

The Arizona Form 321 is a credit form for contributions to private school tuition organizations. This form is similar to the 140Py in that both require personal information and tax calculations. Taxpayers can use the 321 to claim a credit that directly reduces their tax liability, while the 140Py determines the overall tax owed based on income and deductions. Both forms are integral to the tax filing process in Arizona, particularly for those seeking to take advantage of available credits.

Key takeaways

When filling out and using the Arizona 140PY form, it is essential to keep several key points in mind to ensure accuracy and compliance. Here are four important takeaways:

- Residency Status Matters: Clearly indicate your residency status. You must check the appropriate box for either "Part-Year Resident Other than Active Military" or "Part-Year Resident Active Military." This designation affects your tax obligations.

- Accurate Income Reporting: Report your federal adjusted gross income accurately. This figure is crucial as it serves as the foundation for determining your Arizona taxable income. Ensure that you include all relevant income sources from your federal return.

- Claiming Exemptions: Carefully calculate and enter the number of exemptions you are claiming. This includes exemptions for age, blindness, and dependents. Each exemption can significantly affect your taxable income, so accuracy is vital.

- Filing Deadlines: Be aware of the filing deadlines. If you are filing under an extension, make sure to check the appropriate box. Timely submission can help you avoid penalties and interest on any tax due.

These takeaways will help you navigate the Arizona 140PY form more effectively. Always refer to the instructions provided with the form for specific guidance tailored to your situation.

Common mistakes

-

Neglecting to read the instructions: Many people skip the instructions altogether. The guidelines provide essential information that can prevent errors.

-

Incorrect residency dates: Failing to accurately enter the dates of Arizona residency can lead to complications. Ensure that the dates reflect your actual time living in Arizona.

-

Missing Social Security Numbers: Omitting your Social Security Number or that of your spouse can delay processing. Always double-check that all required SSNs are included.

-

Using check marks instead of numbers: Some individuals mistakenly mark checkboxes instead of entering the correct numerical values. This can result in misinterpretation of your claims.

-

Errors in income calculations: Miscalculating your federal adjusted gross income can have significant repercussions. Take your time to ensure accuracy when transferring numbers from your federal return.

-

Not claiming all eligible exemptions: Some filers overlook exemptions for age, blindness, or dependents. Review your situation carefully to maximize your potential deductions.

-

Failing to sign and date the form: A common mistake is forgetting to sign and date the return. Without your signature, the form is considered incomplete.

-

Incorrect mailing address: Sending your completed form to the wrong address can delay processing. Make sure to use the correct address based on whether you are sending a payment or expecting a refund.

-

Not keeping a copy: Many people forget to keep a copy of their completed form. Retaining a copy is crucial for your records and can help if questions arise later.

Document Preview

NO TAPE.

ARIZONA FORM |

|

|

|

|

|

|

FOR |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

140PY |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

CALENDAR YEAR |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

OR FISCAL YEAR BEGINNING |

|

M |

|

M |

|

D |

|

|

D |

|

Y |

|

Y |

|

Y |

|

Y |

|

AND ENDING |

|

M |

|

M |

|

D |

|

D |

|

Y |

|

Y |

|

Y |

|

Y |

|

. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012 |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

82F |

|

|

|

|

|

Check box 82F if filing under extension |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your First Name and Middle Initial |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter |

|

|

|

|

Your Social Security No. |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Spouse’s First Name and Middle Initial (if box 4 or 6 checked) |

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Social Security No. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN(s) |

. |

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Home Address - number and street, rural route |

|

|

|

Apt. No. |

Daytime Phone (with area code) |

|

|

|

Home Phone (with area code) |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, Town or Post Office |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

Married filing joint return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUE USE ONLY. DO NOT MARK IN THIS AREA. |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

5 |

|

|

|

Head of household |

► |

NAME OF QUALIFYING CHILD OR DEPENDENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

6 |

|

|

|

Married filing separate return. Enter spouse’s name and Social Security No. above. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

7 |

|

|

|

Single |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

page 2; staplecorner.uppertoleft |

|

EXEMPTIONSSTATUSFILING |

|

|

|

|

|

|

|

Enter the number claimed. Do not put a check mark. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

8 |

|

|

|

|

Age 65 or over (you and/or spouse) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

9 |

|

|

|

|

Blind (you and/or spouse) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

10 |

|

|

|

|

Dependents. From page 2, line A2 – do not include self or spouse. |

|

|

|

|

|

|

|

|

|

|

|

|

|

81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80 |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

11 |

|

|

|

|

Qualifying parents and grandparents from page 2, line A5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

12 |

|

|

13 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

140PY |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

14 |

|

Federal adjusted gross income (from your federal return) |

............................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

15 |

|

Arizona income (from page 2, line B19) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

00 |

||||||||||||||||

Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

16 |

|

Additions to income (from page 2, line C24) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

00 |

|||||||||||||||||||||||

|

17 |

|

Subtractions from income (from page 2, line D36) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

00 |

||||||||||||||||||||||

after |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

18 |

|

Arizona adjusted gross income: Add lines 15 and 16 then subtract line 17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

documents |

|

19 |

|

Deductions. Check box and enter amount. See instructions, page 16 |

19I |

|

|

ITEMIZED 19S |

|

|

|

STANDARD |

|

19 |

|

|

|

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

20 |

|

Personal exemptions. See page 16 of the instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

00 |

||||||||||||||||||||||||||||

|

21 |

|

Arizona taxable income: Subtract lines 19 and 20 from line 18. |

If less than zero, enter zero |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

|

|

|

|

00 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

other |

|

22 |

|

Compute the tax using Tax Table X or Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|||||||||||||||||||||||

|

23 |

|

Tax from recapture of credits from Arizona Form 301, Part II, line 35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

|

|

|

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

or |

|

24 |

|

Subtotal of tax: Add lines 22 and 23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

|

|

|

|

00 |

||||||||||||||

schedules |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

25 |

|

Family income tax credit from worksheet on pages 17 and 18 of the instructions |

............................................................. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

00 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

26 |

|

Credits from Arizona Form 301, Part II, line 68, or Forms 310, 321, 322 and 323, if Form 301 is not required |

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

27 |

|

Credit type: Enter form number of each credit claimed |

|

|

|

|

|

|

|

|

|

|

|

|

27 |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

.............. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

AZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

|

Clean Elections Fund Tax Credit for donations made prior to August 2, 2012 (from worksheet on page 20 of the instructions) |

|

28 |

|

|

|

|

00 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

29 |

|

Balance of tax: Subtract lines 25, 26 and 28 from line 24. |

If the sum of lines 25, 26 and 28 is more than line 24, enter zero |

|

|

|

|

|

|

|

|

|

|

29 |

|

|

|

|

00 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

federal |

|

30 |

|

Arizona income tax withheld during 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

00 |

||||||||||||||||||||||

|

31 |

|

Arizona estimated tax payments for 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

|

|

|

|

00 |

|||||||||||||||||||||||

required |

|

32 |

|

2012 Arizona extension payment (Form 204) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32 |

|

|

|

|

00 |

||||||||||||||||||||||

|

33 |

|

Increased Excise Tax Credit: From worksheet on page 20 of the instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

|

|

|

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

34 |

|

Other refundable credits: Check the box(es) and enter the amount |

|

|

341 |

|

Form |

342 |

|

|

|

Form 342 |

|

34 |

|

|

|

|

00 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

any |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

35 |

|

Total payments/refundable credits: Add lines 30 through 34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35 |

|

|

|

|

00 |

||||||||||||||||||||||||||||||||||||||||

Place |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

36 |

|

TAX DUE: If line 29 is larger than line 35, subtract line 35 from line 29, and enter amount of tax due. Skip lines 37, 38 and 39 |

|

|

|

|

|

|

|

|

|

|

36 |

|

|

|

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

37 |

|

OVERPAYMENT: If line 35 is larger than line 29, subtract line 29 from line 35, and enter amount of overpayment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

|

|

|

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

38 |

|

Amount of line 37 to be applied to 2013 estimated tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

00 |

|||||||||||||||||||||||||||

TAPE. |

|

39 |

|

Balance of overpayment: Subtract line 38 from line 37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39 |

|

|

|

|

00 |

|||||||||||||||||||||||||||

|

40 - 49 Voluntary Gifts to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

Aid to Education |

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

Arizona Wildlife |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

NO |

|

|

|

................................. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

Child Abuse Prevention |

|

42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

Domestic Violence Shelter |

|

|

|

|

|

43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

HERE. |

|

|

|

I Didn’t Pay Enough Fund |

|

44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

National Guard Relief Fund |

|

|

|

|

|

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

Neighbors Helping Neighbors |

|

46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

Special Olympics |

|

|

|

|

|

|

|

|

|

|

|

47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

Veterans’ Donations Fund |

|

48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

Political Gift |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

PAYMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

50 |

|

Voluntary Political Gift (check only one): |

501 Americans Elect |

502 |

|

|

|

Democratic 503 |

|

Green 504 Libertarian |

505 |

|

|

|

Republican |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

51 |

|

Estimated payment penalty and MSA withdrawal penalty |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51 |

|

|

|

00 |

||||||||||||||||||||||||||||||||||

|

52 |

|

....Check applicable boxes 521 |

Annualized/Other |

522 |

|

|

|

Farmer or Fisherman 523 |

|

|

|

Form 221 attached 524 |

|

MSA Penalty |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STAPLE |

|

53 |

|

Total of lines 40 through 49 and 51 |

.................................................................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

53 |

|

|

|

00 |

|||||||||||||||

|

54 |

|

REFUND: Subtract line 53 from line 39. |

If less than zero, enter amount owed on line 55 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

54 |

|

|

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

Direct Deposit of Refund: Check box 54A if your deposit will be ultimately placed in a foreign account; see instructions |

54A |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

ROUTING NUMBER |

|

|

|

ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

Checking or |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

98 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

55 |

|

AMOUNT OWED: Add lines 36 and 53. |

|

Make check payable to Arizona Department of Revenue; include SSN on payment |

55 |

|

|

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ADOR 10149 (12)

Your Name (as shown on page 1)

Your Social Security No.

|

|

A1 |

List children and other dependents. Do not list yourself or spouse. If more space is needed, |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

attach a separate sheet. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NO. OF MONTHS LIVED |

|

|

|

|

||||

|

|

|

FIRST AND LAST NAME |

|

|

|

|

|

|

|

|

|

|

|

SOCIAL SECURITY NO. |

RELATIONSHIP |

|

IN YOUR HOME IN 2012 |

|

|

|

|

||||||||||||||||||||||

|

DependentsA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

b Enter dependents listed above who were not claimed on your federal return due to education credits: |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

A2 |

Enter total number of persons listed in A1 here and on the front of this form, box 10 |

|

TOTAL |

|

A2 |

|

|

|

||||||||||||||||||||||||||||||||||

|

|

A3 |

a Enter the names of the dependents listed above who do not qualify as your dependent on your federal return: |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

PART |

|

|

|

|

|

|

|

|

|