Fill Out Your Arizona 140X Form

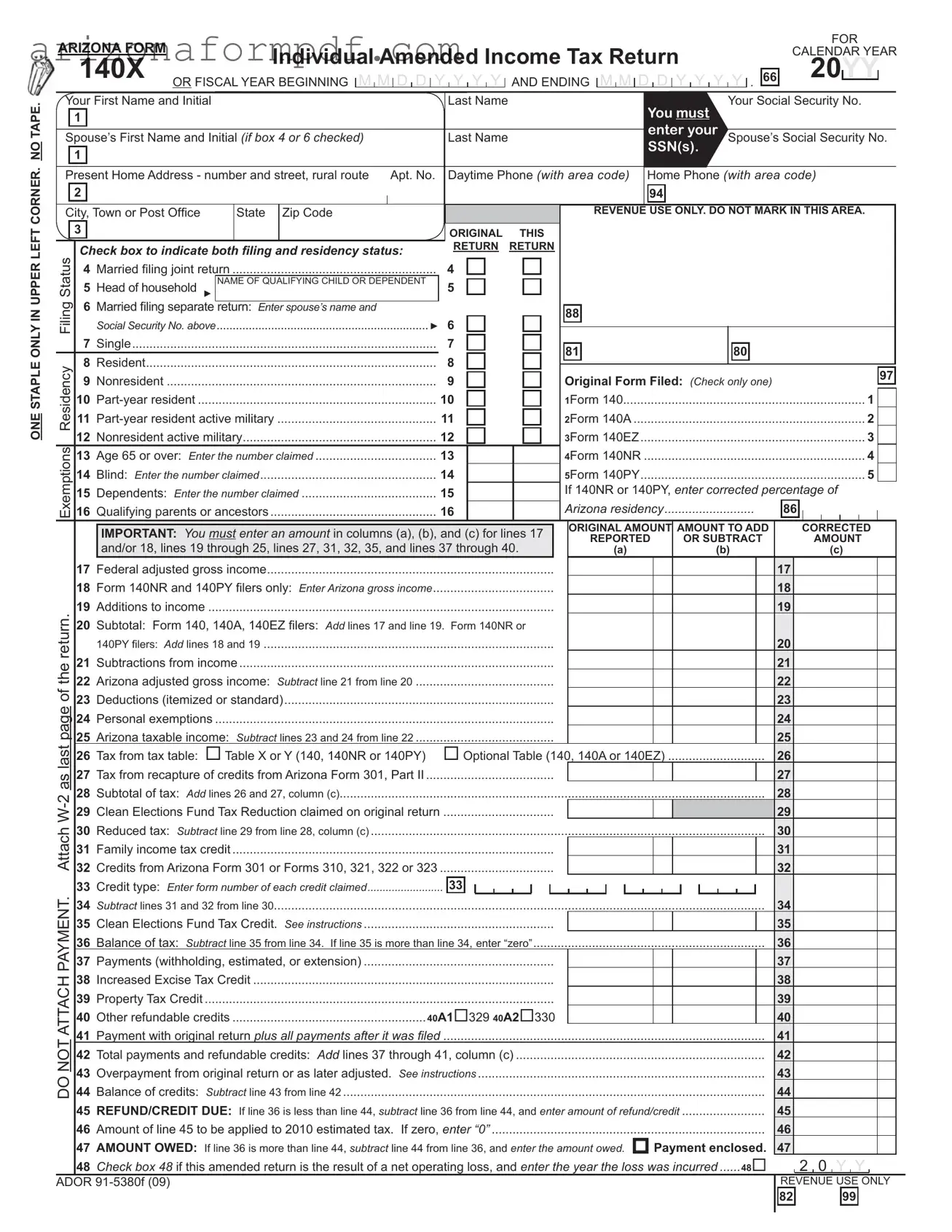

The Arizona 140X form is essential for individuals who need to amend their income tax returns for a calendar or fiscal year. This form allows taxpayers to correct errors or make adjustments to their previously filed returns. Whether it’s a change in income, deductions, or exemptions, the 140X form provides a structured way to report these modifications. Taxpayers must include their personal information, such as names, Social Security numbers, and addresses, ensuring accuracy in their filings. The form also requires details about filing status, residency, and any dependents claimed. Specific lines on the form guide users in reporting original amounts, corrected figures, and any additional credits or payments. It’s crucial to follow the instructions carefully, as incomplete or incorrect submissions can lead to delays in processing. Additionally, understanding the implications of any changes is vital for ensuring compliance and avoiding potential penalties.

Guide to Writing Arizona 140X

Completing the Arizona 140X form is essential for individuals who need to amend their income tax returns. The process involves providing accurate information regarding your amended return, ensuring that all necessary details are included to avoid delays or issues with the Arizona Department of Revenue.

- Obtain the Arizona 140X form from the Arizona Department of Revenue website or other official sources.

- Use a single staple to attach the form in the upper left corner. Avoid using tape.

- Fill in your first name, middle initial, last name, and Social Security number in the designated fields.

- If applicable, enter your spouse's first name, middle initial, last name, and Social Security number.

- Provide your current home address, including street number, apartment number (if applicable), city, state, and zip code.

- Indicate your filing status by checking the appropriate box: married filing jointly, head of household, married filing separately, or single.

- Check the residency status box that applies to you: resident, nonresident, or part-year resident.

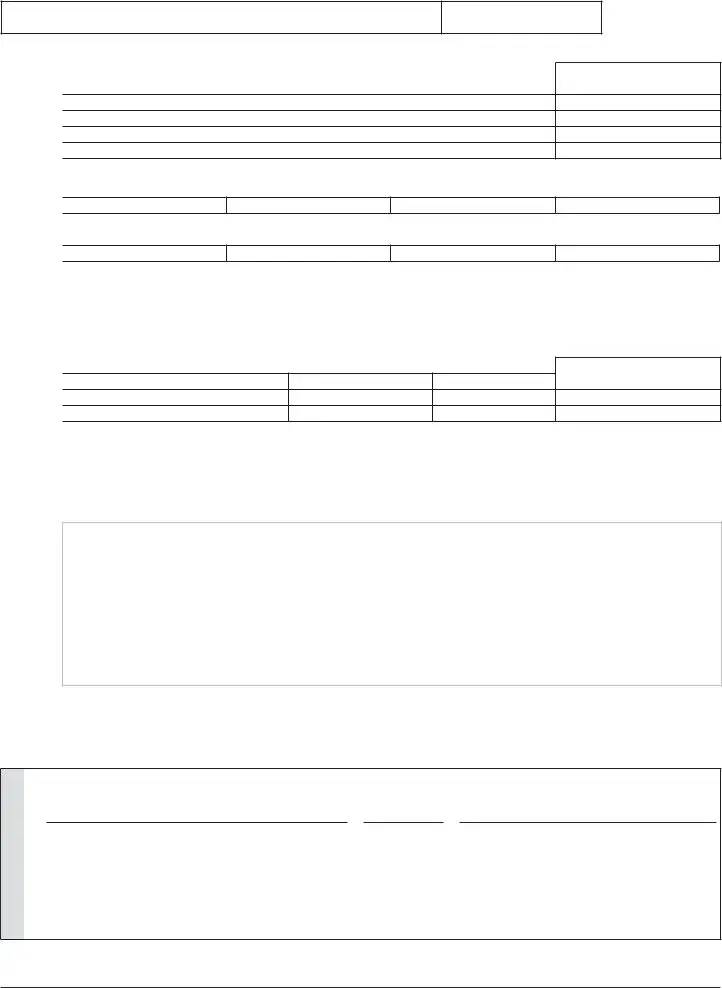

- Complete the section for exemptions, including the number of dependents, age, and any qualifying parents or ancestors.

- Report any changes to your income, deductions, and credits in the specified sections, ensuring you enter amounts in the columns provided.

- Calculate your total tax due or refund by following the instructions on the form, including any payments made or credits claimed.

- Sign and date the form, ensuring that both you and your spouse (if applicable) provide signatures.

- Mail the completed form to the appropriate address based on whether you are expecting a refund or are sending a payment.

Browse Popular Forms

Arizona State Tax Forms - Form 140 is necessary if your Arizona taxable income is $50,000 or more.

Arizona Tax Forms - Transient vendors must provide details about their business activities and event locations.

Common Questions

What is the Arizona 140X form?

The Arizona 140X form is used for filing an amended individual income tax return in Arizona. If you need to correct information on your original tax return, this is the form to use. It allows you to report changes in income, deductions, or credits that may affect your tax liability.

Who should file the 140X form?

You should file the 140X form if you have already submitted a tax return for a specific tax year and later realize that you made an error. This includes changes to your income, filing status, or any deductions and credits you claimed. It is important to amend your return to ensure that your tax records are accurate.

How do I fill out the 140X form?

When filling out the 140X form, start by entering your personal information, including your name, Social Security number, and address. Indicate your filing status and the original return you filed. Then, provide the corrected amounts for income, deductions, and credits. Be sure to follow the instructions carefully and enter amounts in the designated columns.

What if I am expecting a refund?

If you are expecting a refund after filing the 140X form, you will need to calculate the difference between what you owe and what you have already paid. If your amended return shows that you overpaid your taxes, you can claim a refund. Make sure to include your bank information if you want the refund directly deposited.

Is there a deadline for filing the 140X form?

Do I need to attach any documents with the 140X form?

Yes, you may need to attach supporting documents when filing the 140X form. This includes any relevant schedules or forms that support the changes you are making. If your amendments are related to an IRS audit, you should include a copy of the audit report as well.

What happens if I owe additional taxes after filing the 140X form?

If your amended return shows that you owe additional taxes, you will need to pay that amount when you submit the 140X form. Be sure to include a payment with your return if you are sending one. If you do not pay the additional tax owed, you may incur penalties and interest.

Where do I send the completed 140X form?

The mailing address for your completed 140X form depends on whether you are sending a payment or expecting a refund. If you are sending a payment, mail it to the Arizona Department of Revenue, PO Box 52016, Phoenix, AZ 85072-2016. If you are expecting a refund or do not owe any tax, send it to PO Box 52138, Phoenix, AZ 85072-2138.

Dos and Don'ts

When filling out the Arizona 140X form, it is essential to follow specific guidelines to ensure your amended return is processed smoothly. Here is a list of things you should and shouldn't do:

- Do use only one staple in the upper left corner of the form.

- Do clearly print your name and Social Security number at the top of the form.

- Do check the appropriate boxes for your filing and residency status.

- Do ensure all amounts are entered in the correct columns, especially for lines 17 through 40.

- Don't use tape to attach any documents or to secure the form.

- Don't forget to sign and date the form before submission.

- Don't leave any required fields blank; ensure all information is filled out completely.

- Don't forget to attach any supporting documents if your changes relate to an IRS audit.

Similar forms

The Arizona Form 140X is similar to the IRS Form 1040X, which is the federal amended tax return. Both forms serve the purpose of allowing taxpayers to correct errors or make changes to their originally filed tax returns. The 1040X requires taxpayers to provide information about the changes being made, including the reason for the amendments. Similarly, the 140X requires detailed reporting of changes in income, deductions, and credits, ensuring that taxpayers can accurately adjust their tax obligations at both the federal and state levels.

Another comparable document is the California Form 540X. Like the Arizona 140X, the California 540X allows taxpayers to amend their state income tax returns. Both forms require the taxpayer to indicate the original amounts reported and the corrected amounts. They also necessitate an explanation of the changes, which helps ensure transparency and accuracy in the reporting process. This similarity highlights the broader framework of state tax amendments in relation to federal guidelines.

The New York State Form IT-201-X is also akin to the Arizona 140X. This form is used to amend a New York personal income tax return. Taxpayers are required to provide a detailed account of the changes made, just as they do on the Arizona form. Both documents focus on ensuring that the correct tax liability is established after an amendment, thereby maintaining compliance with state tax laws.

Another document that shares similarities is the Texas Form 05-102, used for amending franchise tax reports. While the focus of the Texas form is on business taxes rather than individual income taxes, both forms require a clear indication of the original amounts and the corrected amounts. Additionally, both forms mandate an explanation for the changes, thereby fostering accuracy in tax reporting.

Finally, the Florida Form DR-501X is comparable to the Arizona 140X as it is used to amend property tax returns. Similar to the 140X, this form allows taxpayers to correct previously reported information. Both forms emphasize the importance of accuracy in tax filings and require taxpayers to provide details about the changes made, ensuring that any adjustments are properly documented and justified.

Key takeaways

Filing an amended income tax return using the Arizona 140X form requires attention to detail and understanding of the process. Here are some key takeaways to keep in mind:

- Single Staple Requirement: When submitting the form, ensure that you only use one staple in the upper left corner. Avoid using tape or additional staples.

- Correct Personal Information: Accurately enter your name, Social Security number, and address. If applicable, include your spouse’s information as well.

- Filing Status: Clearly indicate your filing status by checking the appropriate box. This includes options such as married filing jointly, head of household, or single.

- Complete All Necessary Lines: Pay careful attention to lines that require amounts in specific columns. This includes federal adjusted gross income and any subtractions or additions to income.

- Refund or Amount Owed: Determine whether you are due a refund or if you owe additional taxes. Complete the calculations accurately to avoid delays in processing.

By following these guidelines, you can effectively navigate the Arizona 140X form and ensure your amended return is processed smoothly.

Common mistakes

-

Incomplete Personal Information: Many individuals fail to provide complete details such as their first name, last name, and Social Security number. Ensure all fields are filled out accurately.

-

Incorrect Filing Status: Selecting the wrong filing status can lead to significant errors. Double-check the status box that corresponds to your situation, whether it’s married filing jointly, head of household, or single.

-

Missing Signatures: Some filers forget to sign the form. Both the taxpayer and spouse, if applicable, must sign the return. Unsigned forms may be rejected.

-

Failure to Attach Required Documents: Individuals often neglect to attach necessary supporting documents, such as copies of prior returns or IRS correspondence. Ensure all required attachments are included to avoid processing delays.

Document Preview

ONE STAPLE ONLY IN UPPER LEFT CORNER. NO TAPE.

ARIZONA FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR |

|||||||||||||

|

|

Individual Amended Income Tax Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CALENDAR YEAR |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

140X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

YY |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

OR FISCAL YEAR BEGINNING |

|

M |

|

M |

|

D |

|

D |

|

Y |

Y |

Y |

|

Y |

|

AND ENDING |

|

M |

|

M |

|

D |

D |

|

Y |

|

Y |

|

Y |

Y |

|

. 66 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Your First Name and Initial |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Social Security No. |

|||||||||||||||||||||||||||||||||||

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You must |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

enter your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Spouse’s First Name and Initial (if box 4 or 6 checked) |

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Social Security No. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN(s). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Present Home Address - number and street, rural route Apt. No. |

Daytime Phone (with area code) |

|

Home Phone (with area code) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, Town or Post Office |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUE USE ONLY. DO NOT MARK IN THIS AREA. |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORIGINAL |

THIS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

Check box to indicate both fi ling and residency status: |

|

|

|

|

RETURN RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

Status |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

4 |

|

Married fi ling joint return |

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

5 |

Head of household. ► |

NAME OF QUALIFYING CHILD OR DEPENDENT |

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Filing |

6 |

|

Married filing separate return: Enter spouse’s name and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

.................................................................. |

|

|

|

|

|

|

|

|

|

|

|

► 6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

Social Security No. above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

7 |

|

Single |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Residency |

8 |

|

Resident |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

97 |

|

|||||||||||||||||||||||||||

9 |

|

Nonresident |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

Original Form Filed: (Check only one) |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

10 |

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

1Form 140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

||||||||||||||||||||||||||||||||

11 |

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

2Form 140A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

12 |

|

Nonresident active military |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

3Form 140EZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

Exemptions |

13 |

|

Age 65 or over: Enter the number claimed |

13 |

|

|

|

|

|

|

|

|

|

|

|

|

4Form 140NR |

................................................................ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|||||||||||||||||||||||||||||||||||||||||

14 |

|

Blind: Enter the number claimed |

14 |

|

|

|

|

|

|

|

|

|

|

|

|

5Form 140PY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

||||||||||||||||||||||||||||||||||||||||||

15 |

|

Dependents: Enter the number claimed |

15 |

|

|

|

|

|

|

|

|

|

|

|

|

If 140NR or 140PY, enter corrected percentage of |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

16 |

|

Qualifying parents or ancestors |

16 |

|

|

|

|

|

|

|

|

|

|

|

|

..........................Arizona residency |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

86 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

IMPORTANT: You must enter an amount in columns (a), (b), and (c) for lines 17 |

|

|

ORIGINAL AMOUNT |

AMOUNT TO ADD |

|

|

CORRECTED |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

REPORTED |

OR SUBTRACT |

|

|

|

|

AMOUNT |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

and/or 18, lines 19 through 25, lines 27, 31, 32, 35, and lines 37 through 40. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

|

|

|

|

|

|

|

|

|

|

|

(b) |

|

|

|

|

|

|

(c) |

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

17 |

|

Federal adjusted gross income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

18 |

|

Form 140NR and 140PY fi lers only: Enter Arizona gross income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

return. |

19 |

|

Additions to income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

20 |

|

Subtotal: Form 140, 140A, 140EZ filers: Add lines 17 and line 19. |

Form 140NR or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

140PY filers: Add lines 18 and 19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

21 |

|

Subtractions from income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

22 |

|

Arizona adjusted gross income: Subtract line 21 from line 20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

23 |

|

Deductions (itemized or standard) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

page |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

24 |

|

Personal exemptions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

25 |

|

Arizona taxable income: Subtract lines 23 and 24 from line 22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

26 |

|

Tax from tax table: |

Table X or Y (140, 140NR or 140PY) |

|

|

|

|

Optional Table (140, 140A or 140EZ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

27 |

|

Tax from recapture of credits from Arizona Form 301, Part II |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

as |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

28 |

|

Subtotal of tax: Add lines 26 and 27, column (c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

W- |

29 |

|

Clean Elections Fund Tax Reduction claimed on original return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Attach |

30 |

|

Reduced tax: Subtract line 29 from line 28, column (c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

31 |

|

Family income tax credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

32 |

|

Credits from Arizona Form 301 or Forms 310, 321, 322 or 323 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

PAYMENT. |

33 |

|

Credit type: Enter form number of each credit claimed |

|

|

|

|

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

34 |

|

..............................................................................................................................................Subtract lines 31 and 32 from line 30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

35 |

|

Clean Elections Fund Tax Credit. See instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

36 |

|

Balance of tax: Subtract line 35 from line 34. If line 35 is more than line 34, enter “zero” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

37 |

|

Payments (withholding, estimated, or extension) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

ATTACH |

38 |

|

Increased Excise Tax Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

39 |

|

Property Tax Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

40 |

|

Other refundable credits |

40A1 329 40A2 |

330 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

41 |

|

Payment with original return plus all payments after it was filed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

NOT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

42 |

|

Total payments and refundable credits: Add lines 37 through 41, column (c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

43 |

|

Overpayment from original return or as later adjusted. See instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

DO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

44 |

|

Balance of credits: Subtract line 43 from line 42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

45 |

|

REFUND/CREDIT DUE: If line 36 is less than line 44, subtract line 36 from line 44, and enter amount of refund/credit |

........................ |

|

|

|

|

|

|

|

|

|

|

|

|

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

46 |

|

Amount of line 45 to be applied to 2010 estimated tax. If zero, enter “0” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

47 |

|

AMOUNT OWED: If line 36 is more than line 44, subtract line 44 from line 36, and enter the amount owed. |

|

|

Payment enclosed. |

47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

48 |

|

Check box 48 if this amended return is the result of a net operating loss, and enter the year the loss was incurred |

48 |

|

|

|

2 0 Y Y |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ADOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUE USE ONLY |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

82 |

|

99 |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Name (as shown on page 1)

Your Social Security No.

PART I: Dependent Exemptions - do not list yourself or spouse as dependents

List children and other dependents. If more space is needed, attach a separate sheet.

FIRST AND LAST NAME: |

SOCIAL SECURITY NO. |

RELATIONSHIP |

|

|

|

NO. OF MONTHS LIVED IN YOUR HOME DURING THE TAXABLE YEAR

Enter the names of the dependents listed above who do not qualify as your dependent on your federal return:

Enter dependents listed above who were not claimed on your federal return due to education credits:

PART II: Qualifying Parents and Ancestors of Your Parents Exemptions (Arizona residents only)

List below qualifying parents and ancestors of your parents for which you are claiming an exemption. If more space is needed, attach a separate sheet. Do not list the same person here that you listed in Part I, above, as a dependent. For information on who is a qualifying parent or ancestor of your parents, see the instructions for the original return that you filed.

FIRST AND LAST NAME:

SOCIAL SECURITY NO.

RELATIONSHIP

NO. OF MONTHS LIVED IN YOUR HOME DURING THE TAXABLE YEAR

PART III: Income, Deductions, and Credits

List the line reference from page 1 for which you are reporting a change then give the reason for each change. Attach any supporting documents required. If the change(s) pertain(s) to an IRS audit, please attach a copy of the agent’s report. If you filed an amended federal return with the IRS (Form 1040X), please attach a copy and all supporting schedules.

Part IV: Name and Address on Original Return

If your name and address is the same on this amended return as it was on your original return, write “same” on the line below.

Name |

Number and Street, R.R. |

Apt. No. |

City, Town or Post Office State Zip Code |

|

|

|

|

PLEASE SIGN HERE

I have read this return and any attachments with it. Under penalties of perjury, I declare that to the best of my knowledge and belief, they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

YOUR SIGNATURE |

|

|

|

|

DATE |

|

|

OCCUPATION |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE’S SIGNATURE |

|

|

|

|

DATE |

|

|

SPOUSE’S OCCUPATION |

||||

|

|

|

|

|

|

|

|

|

|

|

||

PAID PREPARER’S SIGNATURE |

|

|

DATE |

|

|

|

FIRM’S NAME (PREPARER’S IF |

|||||

|

|

|

|

|

|

|

|

|

|

|

||

PAID PREPARER’S TIN |

PAID PREPARER’S ADDRESS |

|

|

|

|

|

|

|

PAID PREPARER’S PHONE NO. |

|||

If you are sending a payment with this return, mail to Arizona Department of Revenue, PO Box 52016, Phoenix, AZ,

If you are expecting a refund or owe no tax, or owe tax but are not sending a payment, mail to Arizona Department of Revenue, PO Box 52138, Phoenix, AZ,

ADOR |

Form 140X (2009) |

Page 2 of 2 |

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Arizona 140X form is used for filing an amended individual income tax return. |

| Filing Period | This form can be used for the calendar year or a fiscal year, depending on the taxpayer's situation. |

| Residency Status | Taxpayers must indicate their residency status, which includes options for residents, nonresidents, and part-year residents. |

| Exemptions | Taxpayers can claim exemptions for dependents, qualifying parents, and ancestors on this form. |

| Amendment Requirements | Supporting documents must be attached when reporting changes due to an IRS audit or amended federal return. |

| Signature Requirement | Taxpayers must sign the form, declaring under penalties of perjury that the information is accurate and complete. |

| Governing Law | The Arizona 140X form is governed by Arizona Revised Statutes (ARS) Title 43, which covers taxation. |

| Submission Addresses | Depending on whether a payment is included or a refund is expected, the submission address varies within the Arizona Department of Revenue. |