Fill Out Your Arizona 285 Form

Understanding the Arizona 285 form is essential for taxpayers who wish to designate someone to receive their confidential tax information. This form, known as the Disclosure Authorization Form, serves a specific purpose: it allows the Arizona Department of Revenue to share sensitive taxpayer information with an appointed individual. It’s important to note that this form does not grant any powers of representation, meaning the appointee cannot act on behalf of the taxpayer in any legal or financial matters. The form requires detailed taxpayer information, including names, Social Security numbers, and contact details. Additionally, it collects information about the appointee(s) and specifies the tax matters for which the appointee is authorized to receive information. This includes various tax types, such as income tax, transaction privilege tax, and withholding tax, among others. By signing the form, the taxpayer confirms their understanding of its implications and certifies their authority to authorize the disclosure of their tax information. This introductory overview highlights the key elements of the Arizona 285 form, setting the stage for a deeper exploration of its significance and the process of completing it correctly.

Guide to Writing Arizona 285

Once you have gathered the necessary information, you can begin filling out the Arizona 285 form. This process involves providing your personal details, appointing individuals to receive confidential information, and specifying the tax matters involved. After completing the form, it will need to be signed to validate the authorization.

- Provide Taxpayer Information: Fill in your name, Social Security Number or ITIN, and if applicable, your spouse’s name and their Social Security Number or ITIN. Include your current address, employer identification number, and daytime phone number.

- Appointee Information: If you have an appointee, enter their name, current address, daytime phone number, and Social Security Number, ITIN, or other ID number. If there is a second appointee, repeat this step for them.

- Specify Tax Matters: Indicate the tax types and the corresponding years or periods for which the appointee is authorized to receive information. Choose from options like Income Tax, Transaction Privilege Tax, and others as applicable.

- Review Revocation Clause: Note that this form does not revoke any earlier authorizations on file with the department.

- Sign the Form: In section 5, sign and date the form. Ensure you have the authority to execute this authorization. If applicable, check the box confirming you are an officer of the corporation and sign again.

Browse Popular Forms

Arizona Divorce Petition - Families experiencing domestic violence may access immediate legal protections through the court system.

140x Form - The form includes sections for entering exemptions, income, deductions, and various credits.

Mvd Forms - Submit the Revocation Certificate to the required health professional for alcohol/drug-related cases.

Common Questions

What is the purpose of the Arizona 285 form?

The Arizona 285 form, also known as the Disclosure Authorization Form, allows taxpayers to authorize the Arizona Department of Revenue to release their confidential tax information to designated individuals. This form does not grant any powers of representation, which means the appointees cannot act on behalf of the taxpayer in any legal capacity.

Who needs to sign the Arizona 285 form?

The taxpayer must sign the Arizona 285 form in section 5. If the taxpayer is a corporation, an authorized officer must sign the form, certifying their authority to do so. This ensures that the Department of Revenue can legally disclose information to the appointed individuals.

What information is required on the Arizona 285 form?

The form requires detailed information, including the taxpayer's name, Social Security Number or ITIN, current address, and daytime phone number. If applicable, the spouse’s information must also be provided. Additionally, details about the appointed individuals, including their names, addresses, and contact information, are necessary. Tax matters for which the appointee is authorized to receive information must also be specified.

Can the Arizona 285 form revoke previous authorizations?

No, the Arizona 285 form does not revoke any prior Power of Attorney or other authorization forms that may be on file with the Department of Revenue. It serves as a separate authorization and does not affect any existing agreements.

What types of tax matters can be included on the Arizona 285 form?

The form allows for various tax matters to be specified, including income tax, transaction privilege tax, withholding tax, and more. Taxpayers can indicate the specific type of return or ownership, such as individual, corporation, partnership, or fiduciary estate/trust. This flexibility ensures that the appointee can access the relevant information needed for the specified tax types.

What are the consequences of providing false information on the Arizona 285 form?

Providing false or fraudulent information on the Arizona 285 form can lead to serious legal consequences. The form includes a certification statement indicating that knowingly preparing or presenting a fraudulent document is a class 5 felony under Arizona law. It is crucial for taxpayers to ensure that all information provided is accurate and truthful.

Dos and Don'ts

When filling out the Arizona 285 form, there are several important dos and don’ts to keep in mind. Following these guidelines can help ensure that your form is completed correctly and efficiently.

- Do print or type all information clearly. Legibility is crucial for processing.

- Do provide accurate taxpayer information, including Social Security Numbers or ITINs.

- Do sign the form in section 5. Your signature is required for authorization.

- Do check the box if you are certifying as an officer of a corporation, if applicable.

- Don’t leave any required fields blank. Incomplete forms can delay processing.

- Don’t confuse this form with a Power of Attorney. This form does not grant representation powers.

- Don’t submit the form without reviewing all the information for accuracy. Mistakes can lead to complications.

Similar forms

The Arizona 284 form, similar to the Arizona 285, serves as a disclosure authorization. It allows a taxpayer to designate an individual or organization to receive confidential information regarding their tax matters. Like the 285 form, it requires the taxpayer's signature to validate the authorization. However, the 284 form is specifically focused on allowing access to tax records for a particular tax type, making it a more streamlined option for those who need to provide limited access to their tax information.

The IRS Form 2848, known as the Power of Attorney and Declaration of Representative, is another document that shares similarities with the Arizona 285 form. This form allows taxpayers to appoint someone to represent them before the IRS. While the 285 form does not grant any powers of representation, the 2848 does. Both forms require the taxpayer's signature and provide a means for third parties to access confidential information, but the IRS form enables the appointee to act on behalf of the taxpayer in tax matters.

The Arizona Form 290 is also comparable to the Arizona 285 form. This form is used for granting a third party access to a taxpayer's information regarding property taxes. Like the 285 form, the 290 requires the taxpayer's signature to authorize the release of information. However, the 290 is specifically tailored for property tax issues, while the 285 covers a broader range of tax types, including income and transaction privilege taxes.

Lastly, the IRS Form 8821, Tax Information Authorization, is another document that is similar to the Arizona 285 form. This form allows taxpayers to authorize an individual or organization to receive their tax information from the IRS. While it does not grant the authority to represent the taxpayer like the Form 2848 does, it is a straightforward way to allow access to tax records. Both forms require the taxpayer's signature and serve to facilitate communication between the taxpayer and their designated representative, ensuring that sensitive information is handled appropriately.

Key takeaways

When filling out and using the Arizona 285 form, keep these key takeaways in mind:

- Signature Requirement: Ensure that you sign the form in section 5. This is crucial for the authorization to be valid.

- Confidential Information: The form allows the Department to share confidential taxpayer information with the appointed individuals, but it does not grant them power of attorney.

- Accurate Taxpayer Information: Provide accurate details such as the taxpayer's name, Social Security Number or ITIN, and current address. This information must be printed or typed clearly.

- Appointee Information: If you have more than one appointee, make sure to fill out the second appointee's information section accurately, including their contact details.

- Specify Tax Matters: Clearly indicate the tax matters for which the appointee is authorized to receive information. This includes specifying the type of return and the applicable years or periods.

- No Revocation: Understand that this form does not revoke any earlier authorizations or power of attorney documents already on file with the Department.

- Legal Consequences: Be aware that signing the form under false pretenses can lead to serious legal consequences, including felony charges.

Common mistakes

-

Neglecting to Sign the Form: The most common mistake is failing to sign in section 5. Without a signature, the form is invalid.

-

Incorrect Taxpayer Information: Providing inaccurate taxpayer names or Social Security Numbers can lead to processing delays.

-

Omitting Spousal Information: If applicable, not including a spouse’s name or Social Security Number can cause complications.

-

Incomplete Appointee Information: Failing to fill out all required fields for the appointee can result in the form being returned.

-

Using Incorrect Tax Types: Selecting the wrong tax type or failing to specify the type of return can delay processing.

-

Missing Contact Information: Not providing a daytime phone number can hinder communication regarding the form.

-

Incorrectly Filling Out the Address: Errors in the current address can lead to miscommunication or misdelivery of information.

-

Not Revoking Previous Authorizations: Failing to note that this form does not revoke prior authorizations can cause confusion.

-

Ignoring the Penalty of Perjury Statement: Not acknowledging the seriousness of the certification can lead to legal consequences.

-

Submitting Without Double-Checking: Not reviewing the completed form for accuracy before submission can result in unnecessary delays.

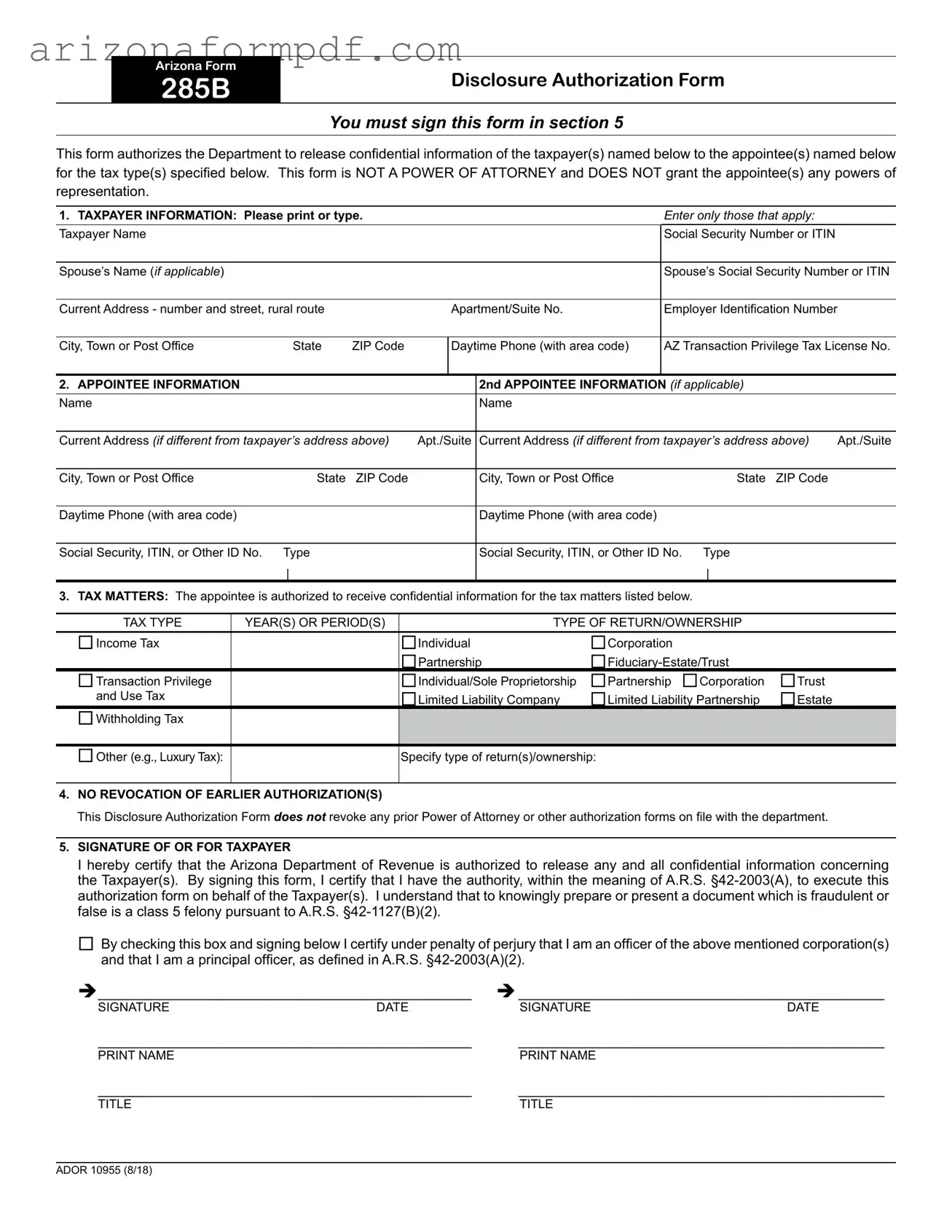

Document Preview

ARIZONA FORM

285B

DISCLOSURE AUTHORIZATION FORM

You must sign this form in section 5

This form authorizes the Department to release confidential information of the taxpayer(s) named below to the appointee(s) named below for the tax type(s) specified below. This form is NOT A POWER OF ATTORNEY and DOES NOT grant the appointee(s) any powers of representation.

1. TAXPAYER INFORMATION: Please print or type. |

|

|

|

Enter only those that apply: |

|

||

Taxpayer Name |

|

|

|

|

|

Social Security Number or ITIN |

|

|

|

|

|

|

|

|

|

Spouse’s Name (if applicable) |

|

|

|

|

|

Spouse’s Social Security Number or ITIN |

|

|

|

|

|

|

|

|

|

Current Address - number and street, rural route |

|

|

Apartment/Suite No. |

Employer Identification Number |

|

||

|

|

|

|

|

|

|

|

City, Town or Post Office |

State |

ZIP Code |

|

Daytime Phone (with area code) |

AZ Transaction Privilege Tax License No. |

||

|

|

|

|

|

|

|

|

2. APPOINTEE INFORMATION |

|

|

|

|

2nd APPOINTEE INFORMATION (if applicable) |

|

|

Name |

|

|

|

|

Name |

|

|

|

|

|

|

||||

Current Address (if different from taxpayer’s address above) |

Apt./Suite |

Current Address (if different from taxpayer’s address above) |

Apt./Suite |

||||

|

|

|

|

|

|

|

|

City, Town or Post Office |

State |

ZIP Code |

|

|

City, Town or Post Office |

State ZIP Code |

|

|

|

|

|

|

|

|

|

Daytime Phone (with area code) |

|

|

|

|

Daytime Phone (with area code) |

|

|

|

|

|

|

|

|

|

|

Social Security, ITIN, or Other ID No. |

Type |

|

|

|

Social Security, ITIN, or Other ID No. Type |

|

|

|

| |

|

|

|

|

| |

|

3.TAX MATTERS: The appointee is authorized to receive confidential information for the tax matters listed below.

|

TAX TYPE |

YEAR(S) OR PERIOD(S) |

TYPE OF RETURN/OWNERSHIP |

|

||

|

Income Tax |

|

|

|

Corporation |

|

|

|

Individual |

|

|

||

|

|

|

Partnership |

|

||

Transaction Privilege |

|

Individual/Sole Proprietorship |

Partnership Corporation |

Trust |

||

|

and Use Tax |

|

Limited Liability Company |

Limited Liability Partnership |

Estate |

|

Withholding Tax |

|

|

|

|

|

|

|

|

|

|

|

||

Other (e.g., Luxury Tax): |

|

Specify type of return(s)/ownership: |

|

|

||

|

|

|

|

|

|

|

4.NO REVOCATION OF EARLIER AUTHORIZATION(S)

This Disclosure Authorization Form does not revoke any prior Power of Attorney or other authorization forms on file with the department.

5.SIGNATURE OF OR FOR TAXPAYER

I hereby certify that the Arizona Department of Revenue is authorized to release any and all confidential information concerning the Taxpayer(s). By signing this form, I certify that I have the authority, within the meaning of A.R.S.

By checking this box and signing below I certify under penalty of perjury that I am an officer of the above mentioned corporation(s) and that I am a principal officer, as defined in A.R.S.

________________________________________________ |

_______________________________________________ |

||

SIGNATURE |

DATE |

SIGNATURE |

DATE |

________________________________________________ |

_______________________________________________ |

||

PRINT NAME |

|

PRINT NAME |

|

________________________________________________ |

_______________________________________________ |

||

TITLE |

|

TITLE |

|

ADOR 10955 (8/18)

Form Breakdown

| Fact Name | Details |

|---|---|

| Form Purpose | This form allows the Arizona Department of Revenue to share confidential taxpayer information with designated appointees. |

| Not a Power of Attorney | The Arizona 285 form does not grant any powers of representation to the appointee(s). |

| Signature Requirement | Taxpayers must sign in section 5 to authorize the release of their information. |

| Taxpayer Information | Taxpayer details, including names and Social Security Numbers, must be provided in the form. |

| Appointee Information | Information about the appointee(s) is required, including names and contact details. |

| Tax Matters | The form specifies the types of tax matters for which information can be disclosed, such as income tax and transaction privilege tax. |

| Prior Authorizations | This form does not revoke any previous powers of attorney or authorizations already on file. |

| Governing Law | The form is governed by Arizona Revised Statutes §42-2003(A) and §42-1127(B)(2). |