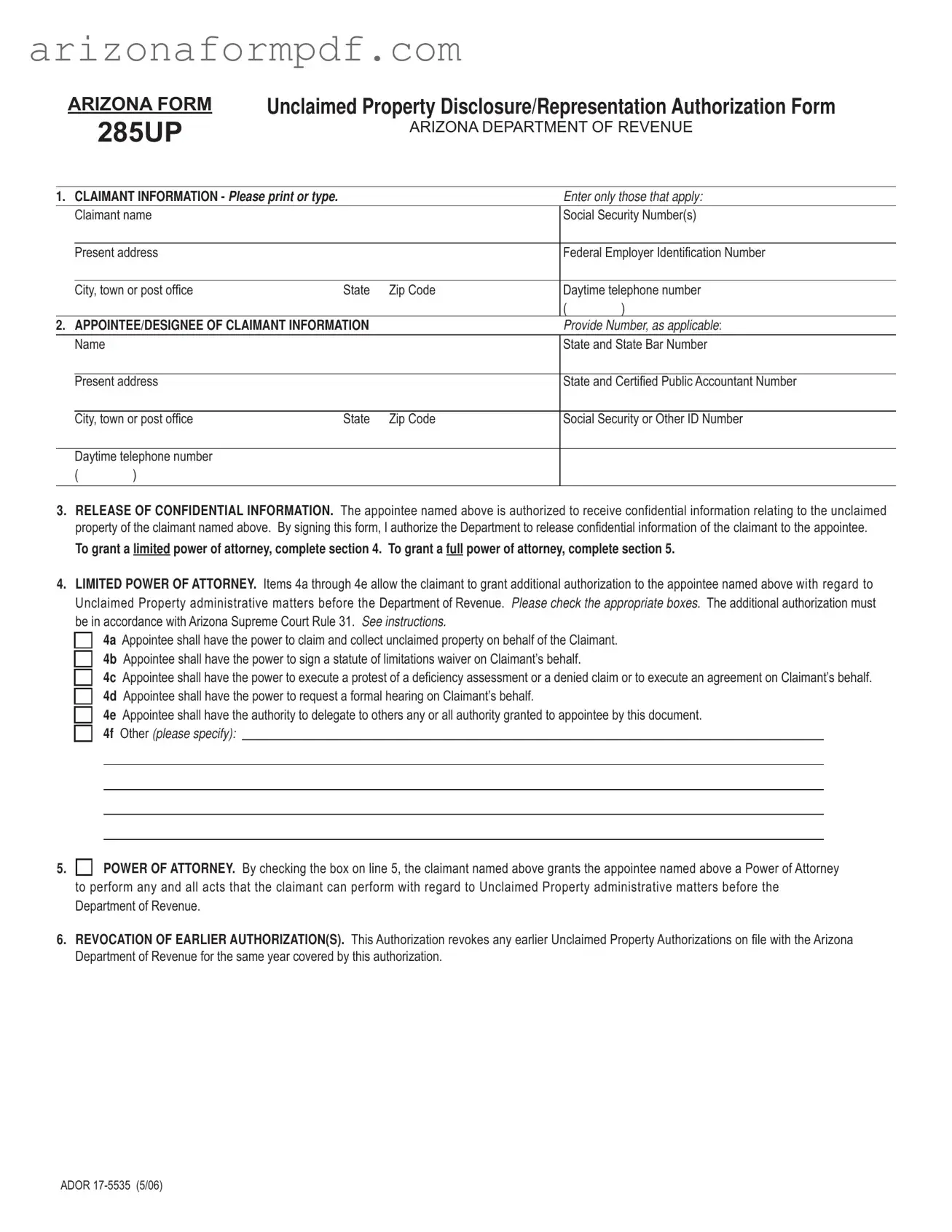

Fill Out Your Arizona 285Up Form

The Arizona 285Up form, officially known as the Unclaimed Property Disclosure/Representation Authorization Form, is a crucial document for individuals or entities seeking to claim unclaimed property in the state. This form is designed to collect essential information from claimants, including their name, Social Security number, and contact details. It also allows claimants to appoint a representative, or appointee, who can act on their behalf regarding unclaimed property matters. The form includes sections that authorize the release of confidential information to the appointee and grant varying levels of power of attorney, enabling the appointee to manage specific administrative tasks. Claimants can choose to provide limited powers, such as the ability to collect unclaimed property or sign waivers, or full powers to handle all related matters. Additionally, corporations can use this form to designate individuals to receive confidential information about their controlled subsidiaries. By completing the 285Up form, claimants ensure that their rights are protected while streamlining the process of recovering unclaimed assets.

Guide to Writing Arizona 285Up

Completing the Arizona 285Up form requires careful attention to detail. Once filled out, the form should be submitted to the Arizona Department of Revenue for processing. Below are the steps to ensure you accurately complete the form.

- Claimant Information: Begin by providing the claimant's name, Social Security Number(s), and present address. Include the city, state, zip code, and daytime telephone number.

- Appointee/Designee Information: Enter the name of the appointee along with their state and state bar number, if applicable. Provide their present address, city, state, zip code, Social Security or other ID number, and daytime telephone number.

- Release of Confidential Information: Sign the form to authorize the Department to release confidential information to the appointee.

- Limited Power of Attorney: If granting limited powers, check the appropriate boxes (4a to 4e) to specify the powers being granted to the appointee. If additional powers are needed, specify in section 4f.

- Power of Attorney: If granting full power of attorney, check the box in section 5 to allow the appointee to perform all acts related to Unclaimed Property matters.

- Revocation of Earlier Authorizations: Acknowledge that this form revokes any previous authorizations for the same year by signing in section 6.

- Corporations with Controlled Subsidiaries: If applicable, list the controlled subsidiaries in section 7, providing their names and federal ID numbers.

- Signature of Claimant: The claimant must sign and date the form in section 8, certifying their authority to execute the form.

- Declaration of Appointee: If the appointee is granted authority, they must complete section 9, indicating their qualifications and signing the declaration.

- Mail the Form: Once completed, mail the form to the Arizona Department of Revenue, Unclaimed Property Unit, at the provided address.

Browse Popular Forms

Arizona Income Tax Forms - Employees should retain a copy of their completed Form A-4 for their records.

Arizona 676 - Arizona law mandates watercraft be registered in the primary state of use.

How to Make Contracts for Business - Indemnification clauses may protect parties from potential liabilities that could arise post-sale.

Common Questions

What is the purpose of the Arizona 285Up form?

The Arizona 285Up form, officially known as the Unclaimed Property Disclosure/Representation Authorization Form, is designed to facilitate the process of claiming unclaimed property in Arizona. This form allows a claimant to authorize an appointee, such as an attorney or certified public accountant, to receive confidential information related to their unclaimed property. By completing this form, claimants can ensure that their representatives have the necessary authority to act on their behalf in administrative matters before the Arizona Department of Revenue.

Who should fill out the Arizona 285Up form?

This form should be completed by individuals or entities that believe they are entitled to unclaimed property held by the state of Arizona. Claimants can include individuals, businesses, or corporations. If a claimant wishes to appoint someone else, such as a lawyer or accountant, to manage the claim process, that appointee's information must also be included on the form. It's important for claimants to ensure that all information is accurate and complete to avoid delays in processing their claims.

What types of authority can be granted to an appointee using this form?

The Arizona 285Up form allows claimants to grant varying levels of authority to their appointees. Claimants can choose to provide limited powers, such as the ability to claim and collect unclaimed property, sign waivers, or execute agreements. Alternatively, a claimant can grant full power of attorney, which allows the appointee to perform any act that the claimant can do regarding unclaimed property matters. This flexibility enables claimants to tailor the authority they grant based on their specific needs and comfort level.

What happens if a claimant has previously authorized someone else?

If a claimant has previously authorized another individual to act on their behalf regarding unclaimed property, the new Arizona 285Up form will revoke any earlier authorizations for the same year. This means that the new appointee will have the authority to manage the claim, while any prior authorizations will no longer be valid. Claimants should ensure that they are aware of this revocation clause to avoid confusion or conflicts regarding representation.

Dos and Don'ts

When filling out the Arizona 285Up form, it’s crucial to follow specific guidelines to ensure your submission is successful. Here’s a list of what to do and what to avoid.

- Do print or type clearly to avoid any misinterpretation of your information.

- Do include all applicable claimant information, such as name, Social Security Number, and contact details.

- Do check the appropriate boxes for powers of attorney that you wish to grant to your appointee.

- Do ensure that the appointee's information is complete and accurate, including their State Bar Number if applicable.

- Don't leave any required fields blank; incomplete forms may be returned.

- Don't submit fraudulent information; this can lead to severe legal consequences.

- Don't forget to sign and date the form; missing signatures will result in rejection.

- Don't assume that verbal agreements or instructions will be accepted; all authorizations must be documented on the form.

Follow these guidelines closely to ensure a smooth process when submitting your Arizona 285Up form.

Similar forms

The Arizona 285Up form shares similarities with the IRS Form 2848, known as the Power of Attorney and Declaration of Representative. Both documents allow individuals to authorize someone else to act on their behalf regarding tax matters. Just as the 285Up form allows for the disclosure of confidential information related to unclaimed property, the IRS Form 2848 enables the appointed representative to receive sensitive tax information. This ensures that the appointed person can effectively manage the claims or disputes on behalf of the individual, streamlining communication with the respective government agency.

Another document that resembles the Arizona 285Up form is the California Form 540, which is used for individual income tax returns. Like the 285Up form, it requires personal information from the claimant and allows for the designation of a representative. This form provides a means for individuals to authorize someone to handle their tax affairs, ensuring that the representative has access to necessary information. Both forms emphasize the importance of granting authority to trusted individuals for efficient resolution of financial matters.

The New York State Form POA-1 also parallels the Arizona 285Up form in its function as a Power of Attorney document. This form enables individuals to designate an agent who can act on their behalf in various legal and financial matters. Similar to the 285Up form, it includes provisions for confidentiality and the scope of authority granted to the appointed individual. This ensures that the agent can effectively navigate the complexities of the system, whether it be for unclaimed property or other financial dealings.

The Florida Department of Revenue's Power of Attorney form is another document that shares key characteristics with the Arizona 285Up form. Both forms allow individuals to appoint a representative who can act in their stead for specific matters. The Florida form, like the 285Up, includes sections for identifying the claimant and the appointee, as well as the scope of authority granted. This facilitates clear communication and helps ensure that the representative can adequately advocate for the claimant's interests.

Finally, the IRS Form 8821, Tax Information Authorization, is similar to the Arizona 285Up form in that it allows individuals to authorize someone to receive their confidential tax information. While it does not grant the same level of authority as a Power of Attorney, it still provides a mechanism for individuals to ensure that their representatives can access the necessary information to assist them. This is crucial for managing claims and disputes effectively, whether it involves unclaimed property or tax matters.

Key takeaways

When filling out the Arizona 285UP form, keep these key takeaways in mind:

- Accurate Information: Ensure that all claimant details, including name and Social Security Number, are correct. Errors can delay the process.

- Appointee Details: If you designate someone to act on your behalf, provide their complete information, including their state bar number if applicable.

- Confidentiality: The form allows your appointee to receive confidential information about your unclaimed property. Make sure you trust this person.

- Power of Attorney: Decide if you want to grant limited or full power of attorney. This choice impacts what your appointee can do on your behalf.

- Limited Authority: If you choose limited power, check the specific boxes that outline what your appointee can do, such as claiming property or signing waivers.

- Revocation Clause: Be aware that signing this form revokes any previous authorizations for the same year. This ensures clarity in representation.

- Corporate Considerations: If you are representing a corporation, understand the rules about disclosing information related to controlled subsidiaries.

- Signature Requirement: The claimant must sign the form to certify that they have the authority to authorize the appointee.

- Declaration of Appointee: The appointee must declare their qualifications. This ensures they meet the necessary legal requirements to represent you.

- Mailing Instructions: After completing the form, send it to the Arizona Department of Revenue’s Unclaimed Property Unit to ensure proper processing.

Common mistakes

-

Incomplete Claimant Information: Failing to provide all required details such as the claimant's name, Social Security Number, and address can lead to delays. Ensure every applicable field is filled out accurately.

-

Incorrect Appointee Information: Providing wrong or incomplete details about the appointee can result in authorization issues. Double-check the appointee's name, state bar number, and contact information before submission.

-

Neglecting to Authorize Confidential Information Release: Forgetting to sign the section that allows the release of confidential information may hinder the appointee's ability to act on behalf of the claimant. Review this section carefully.

-

Not Specifying the Type of Power of Attorney: Failing to indicate whether a limited or full power of attorney is being granted can create confusion. Clearly check the appropriate box to avoid misunderstandings.

-

Missing Signatures: Omitting the claimant's signature or the date can result in the form being rejected. Always ensure that the form is signed and dated before submission.

Document Preview

ARIZONA FORM |

Unclaimed Property Disclosure/Representation Authorization Form |

||||

|

285UP |

|

ARIZONA DEPARTMENT OF REVENUE |

||

|

|

|

|

|

|

|

|

|

|

||

1. CLAIMANT INFORMATION - Please print or type. |

|

Enter only those that apply: |

|||

|

Claimant name |

|

|

Social Security Number(s) |

|

|

|

|

|

|

|

|

Present address |

|

|

Federal Employer Identification Number |

|

|

|

|

|

|

|

|

City, town or post office |

State |

Zip Code |

Daytime telephone number |

|

|

|

|

|

( |

) |

2. APPOINTEE/DESIGNEE OF CLAIMANT INFORMATION |

|

Provide Number, as applicable: |

|||

|

Name |

|

|

State and State Bar Number |

|

|

|

|

|

|

|

|

Present address |

|

|

State and Certified Public Accountant Number |

|

|

|

|

|

|

|

|

City, town or post office |

State |

Zip Code |

Social Security or Other ID Number |

|

Daytime telephone number

()

3.RELEASE OF CONFIDENTIAL INFORMATION. The appointee named above is authorized to receive confidential information relating to the unclaimed property of the claimant named above. By signing this form, I authorize the Department to release confidential information of the claimant to the appointee.

To grant a limited power of attorney, complete section 4. To grant a full power of attorney, complete section 5.

4.LIMITED POWER OF ATTORNEY. Items 4a through 4e allow the claimant to grant additional authorization to the appointee named above with regard to Unclaimed Property administrative matters before the Department of Revenue. Please check the appropriate boxes. The additional authorization must be in accordance with Arizona Supreme Court Rule 31. See instructions.

4a Appointee shall have the power to claim and collect unclaimed property on behalf of the Claimant.

4b Appointee shall have the power to sign a statute of limitations waiver on Claimant’s behalf.

4c Appointee shall have the power to execute a protest of a deficiency assessment or a denied claim or to execute an agreement on Claimant’s behalf. 4d Appointee shall have the power to request a formal hearing on Claimant’s behalf.

4e Appointee shall have the authority to delegate to others any or all authority granted to appointee by this document.

4f Other (please specify):

5.

POWER OF ATTORNEY. By checking the box on line 5, the claimant named above grants the appointee named above a Power of Attorney to perform any and all acts that the claimant can perform with regard to Unclaimed Property administrative matters before the Department of Revenue.

POWER OF ATTORNEY. By checking the box on line 5, the claimant named above grants the appointee named above a Power of Attorney to perform any and all acts that the claimant can perform with regard to Unclaimed Property administrative matters before the Department of Revenue.

6.REVOCATION OF EARLIER AUTHORIZATION(S). This Authorization revokes any earlier Unclaimed Property Authorizations on file with the Arizona Department of Revenue for the same year covered by this authorization.

ADOR

AZ FORM 285UP (2006) PAGE 2

7.CORPORATIONS HAVING CONTROLLED SUBSIDIARIES. A.R.S.

Include the following controlled subsidiaries. A controlled subsidiary, for purposes of A.R.S.

NAME |

FEDERAL I.D. NO. |

7a

7b

7c

7d

7e

7f

8.SIGNATURE OF CLAIMANT. I hereby certify that I have the authority, within the meaning of A.R.S.

►

SIGNATURE |

DATE |

PRINT NAME

TITLE

9.DECLARATION OF APPOINTEE. Complete if Appointee has been given authority under Section 4 or Section 5 or is otherwise authorized to pratice law as defined in Rule 31 of the Arizona Rules of the Supreme Court.

Under penalties of perjury, I, the above named appointee, declare that I am one of the following:

a A

b Attorney - an active member of the State Bar of Arizona.

c Certified Public Accountant - duly qualified to practice as a Certified Public Accountant in Arizona.

d Federally Authorized Tax Practitioner within the meaning of A.R.S. §

_______________________________________________________ |

___________________________ |

PRACTITIONER’S NAME |

CAF NUMBER |

eOther - This may be any individual, providing the total amount in dispute, including tax, penalties, and interest is less than $5,000.00.

DESIGNATION |

JURISDICTION |

|

Enter a letter (a, b, c d or e). |

(State) |

SIGNATURE |

|

|

|

If this Declaration of Appointee is not signed and dated, the representation authorization will be returned.

Mail completed form to:

Arizona Department of Revenue Unclaimed Property Unit

1600 W. Monroe Street Phoenix, AZ 85007

DATE

ADOR

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | The Arizona 285UP form is used to authorize an appointee to act on behalf of a claimant regarding unclaimed property matters. |

| Confidential Information | By signing the form, claimants allow their appointees to receive confidential information about their unclaimed property. |

| Power of Attorney | The form includes sections for granting limited or full power of attorney, enabling the appointee to perform various administrative tasks. |

| Revocation Clause | Submission of the 285UP form revokes any earlier unclaimed property authorizations for the same year on file with the Arizona Department of Revenue. |

| Governing Law | This form is governed by Arizona Revised Statutes (A.R.S.) §42-2003, which outlines the disclosure of confidential information for corporate taxpayers. |