Fill Out Your Arizona 5000 Form

The Arizona 5000 form, officially known as the Transaction Privilege Tax Exemption Certificate, serves a crucial role in the state's tax system by allowing certain purchasers to claim exemptions from transaction privilege tax (TPT). This form is specifically designed for use by individuals or businesses that qualify for tax deductions or exemptions under Arizona law. It must be filled out completely by the purchaser and presented to the vendor at the time of sale. Importantly, the vendor is required to retain the completed certificate for their records, either for single transactions or for a specified period. The form includes various sections where the purchaser must provide their name, address, and details about the nature of their business. They must also select the appropriate exemption category, which can range from tangible personal property leased in the ordinary course of business to specific exemptions for government entities and Native American transactions. It is essential to note that only one exemption category can be claimed per certificate, and incomplete forms are not accepted in good faith. Misuse of the Arizona 5000 form can lead to significant penalties, including tax liabilities and potential criminal charges, underscoring the importance of accuracy and compliance when utilizing this certificate.

Guide to Writing Arizona 5000

Filling out the Arizona 5000 form is a straightforward process, but it requires attention to detail. This form is essential for documenting tax exemptions for certain purchases. To ensure that your form is completed correctly, follow these steps closely.

- Provide Your Information: Fill in your name and address in section A. Include your email and telephone number if you wish.

- Choose the Certificate Type: Check the box for either "Single Transaction Certificate" or "Period Certificate" and specify the valid dates for the certificate.

- Vendor Information: Write the vendor's name in the designated space.

- Select Transaction Type: Choose one transaction type from the list provided in section C. This could be transactions with a business, Native Americans, or a U.S. government entity, among others.

- Provide License Numbers: If applicable, enter your Arizona Transaction Privilege Tax License Number, Tribal Business License Number, or other relevant tax license numbers.

- State the Reason for Exemption: In section D, check the box that corresponds to the reason for your exemption. If your reason is not listed, use Box 16 or 17 to provide the relevant authority.

- Describe the Purchase: In section E, describe the tangible personal property or service you are purchasing or leasing and its intended use. If you need more space, feel free to attach additional pages.

- Certification: In section F, print your full name, sign, and date the form. If you are signing on behalf of someone else, indicate your title.

After you complete the form, make sure to provide it to the vendor at the time of purchase. The vendor will keep this certificate for their records. Ensure that all information is accurate to avoid any issues with tax exemptions.

Browse Popular Forms

Mvd Forms - Incomplete packets will be returned, so careful attention to detail is necessary.

Arizona Tax Forms - The Ador 10759 Arizona form is a simplified application for transient vendors seeking a Transaction Privilege Tax License.

Common Questions

What is the purpose of the Arizona 5000 form?

The Arizona 5000 form, also known as the Transaction Privilege Tax Exemption Certificate, is used to document and establish a basis for state and city tax deductions or exemptions. When a purchaser fills out this form completely and provides it to the vendor at the time of sale, it helps ensure that the correct tax treatment is applied. The vendor must retain this certificate for single transactions or for the specified period indicated on the form. Incomplete forms are not accepted in good faith, so it’s important to provide all necessary information.

Who should use the Arizona 5000 form?

This form is intended for purchasers who are eligible to claim a tax exemption under specific conditions outlined by the Arizona Department of Revenue. It is not suitable for individuals claiming sales for resale; they should use Form 5000A instead. Additionally, non-TPT licensed contractors should use Form 5000M. Only one category of exemption can be claimed per certificate, so it's essential to choose the appropriate exemption that fits your situation.

How long is the Arizona 5000 form valid?

The validity period for the Arizona 5000 form can vary. While it is encouraged to limit the validity to a 12-month period, it can be accepted in good faith for up to 48 months if the vendor has documentation proving the TPT license is valid for each calendar year covered in the certificate. It's crucial to specify the dates for which the certificate will be valid, as this helps avoid confusion and ensures compliance with tax regulations.

What happens if the information on the Arizona 5000 form is incorrect?

If the information on the Arizona 5000 form is found to be inaccurate or incomplete, the vendor may still be held responsible for proving entitlement to the exemption. If the purchaser cannot establish the accuracy of the claimed exemption, they may be liable for the transaction privilege tax, along with any penalties and interest that would have applied if the vendor had not accepted the certificate. Misuse of this certificate can lead to significant penalties, including criminal charges, so it’s essential to ensure all details are correct before submission.

Dos and Don'ts

When filling out the Arizona 5000 form, it's important to follow certain guidelines to ensure that your application is processed smoothly. Here are six things you should and shouldn't do:

- Do fill out the form completely. Each section should be filled out accurately to avoid any delays.

- Don't use Form 5000 for resale claims. If you are claiming a sale for resale, you should use Form 5000A instead.

- Do provide your contact information. Including your email and phone number can help with any follow-up questions.

- Don't submit Form 5000 if you are a non-TPT licensed contractor. Instead, use Form 5000M for your exemption claim.

- Do choose only one category of exemption on the form. Multiple exemptions cannot be claimed on a single Certificate.

- Don't submit an incomplete form. Incomplete Certificates are not considered valid and may result in penalties.

Similar forms

The Arizona Form 5000, known as the Transaction Privilege Tax Exemption Certificate, is similar to the IRS Form W-9. Both documents require the identification of the individual or entity involved in a transaction. The W-9 is used to provide taxpayer information to businesses that will report income paid to the individual or entity to the IRS. Like the Arizona 5000, the W-9 must be completed accurately and submitted to the appropriate party to ensure compliance with tax laws.

Another document comparable to the Arizona 5000 is the IRS Form 1099. This form is used to report various types of income other than wages, salaries, and tips. Just as the Arizona 5000 certifies tax exemptions for specific transactions, the 1099 reports income that may be subject to different tax treatments. Both forms play crucial roles in ensuring that tax obligations are met, albeit in different contexts.

The Arizona 5000 also resembles the California Resale Certificate. This document allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. Like the Arizona form, the California Resale Certificate must be filled out completely and presented to the seller. Both forms aim to clarify the tax obligations of the purchaser and vendor in specific transactions.

Additionally, the Texas Sales and Use Tax Resale Certificate is similar to the Arizona 5000. This certificate allows a purchaser to buy items tax-free if they intend to resell them. Both documents require the purchaser to provide identifying information and specify the nature of the transaction. They serve to prevent tax from being applied at the point of sale for items that will ultimately be resold.

The Florida Annual Resale Certificate for Sales Tax is another document akin to the Arizona 5000. This certificate allows businesses to make tax-exempt purchases of goods intended for resale throughout the year. Like the Arizona form, it requires detailed information about the purchaser and the nature of the transaction, ensuring compliance with state tax regulations.

The New York State ST-120 Resale Certificate shares similarities with the Arizona 5000 as well. This form is used by buyers to purchase items without paying sales tax if those items are for resale. Both documents must be completed accurately and presented to the seller to avoid tax liability, highlighting the importance of proper documentation in tax-exempt transactions.

Another comparable document is the Illinois CRT-61 Sales Tax Exemption Certificate. This certificate allows certain organizations to purchase items without paying sales tax. Like the Arizona 5000, it requires the buyer to provide specific information about the transaction and the basis for the exemption, ensuring that tax laws are followed correctly.

The Pennsylvania Exempt Use Certificate is also similar to the Arizona 5000. This document allows purchasers to claim an exemption from sales tax for specific uses of tangible personal property. Both forms require detailed information about the purchaser and the transaction to validate the exemption claim, reinforcing the necessity of accurate documentation in tax matters.

The Michigan Sales and Use Tax Certificate of Exemption is another document that aligns with the Arizona 5000. This certificate is used by buyers to claim exemption from sales tax for certain purchases. Like the Arizona form, it requires the buyer to provide identifying information and the reason for the exemption, ensuring compliance with state tax laws.

Lastly, the Ohio Sales and Use Tax Exemption Certificate is similar to the Arizona 5000. This certificate allows certain entities to make tax-exempt purchases. Both documents require the purchaser to specify the nature of the transaction and provide necessary identification, emphasizing the importance of proper record-keeping in tax-exempt sales.

Key takeaways

- Purpose of the Form: The Arizona Form 5000 serves to document and establish a basis for state and city tax deductions or exemptions.

- Who Should Use It: Only licensed purchasers should fill out this form. Non-TPT licensed contractors should use Form 5000M, while those claiming sales for resale should use Form 5000A.

- Completeness is Key: The form must be filled out completely by the purchaser and provided to the vendor at the time of sale. Incomplete forms are not accepted in good faith.

- One Exemption Per Form: You can only claim one category of exemption on each Certificate. Be sure to choose the correct exemption that applies to your transaction.

- Retention of the Form: Vendors are required to keep the Certificate for single transactions or for the specified period indicated on the form.

- Consequences of Misuse: Misusing the Certificate can lead to penalties. If the information is inaccurate, the purchaser may be liable for transaction privilege tax, penalties, and interest.

Common mistakes

-

Using the Wrong Form: Many individuals mistakenly use Form 5000 to claim sales for resale. Instead, they should utilize Form 5000A for such claims.

-

Incorrect Form for Contractors: Non-TPT licensed contractors often fill out Form 5000. However, they should use Form 5000M instead.

-

Incomplete Information: Submitting an incomplete Certificate is a common error. Certificates lacking necessary details are not accepted in good faith.

-

Multiple Exemptions: Claiming more than one category of exemption on a single Certificate is a frequent mistake. Only one exemption can be claimed per Certificate.

-

Failure to Specify Dates: Some purchasers neglect to choose specific dates for the Certificate’s validity. It’s essential to indicate a clear time frame, ideally not exceeding 12 months.

-

Incorrect Transaction Type: Choosing the wrong transaction type is another common mistake. Each Certificate should only represent one transaction type, such as transactions with a business or with Native Americans.

-

Missing Certification: The certification section is crucial. Failing to sign or date the Certificate can lead to issues later, as it may be deemed invalid without proper certification.

Document Preview

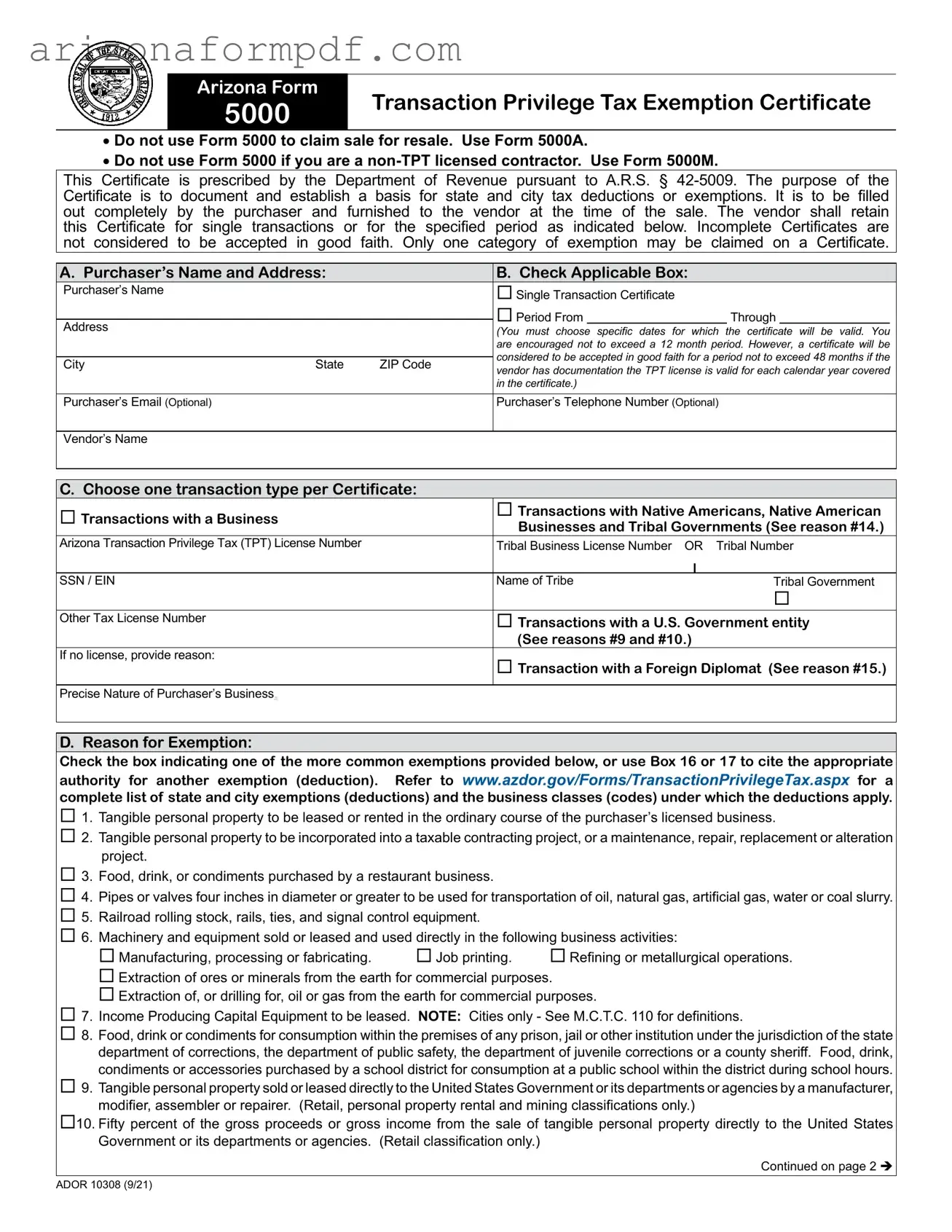

Arizona Form |

Transaction Privilege Tax Exemption Certificate |

|

5000 |

||

|

•Do not use Form 5000 to claim sale for resale. Use Form 5000A.

•Do not use Form 5000 if you are a

This Certificate is prescribed by the Department of Revenue pursuant to A.R.S. § |

||||||||||

Certificate is to document and establish a basis for |

state and city tax deductions or exemptions. It is to be filled |

|||||||||

out completely by the purchaser and furnished to |

the vendor at the time of |

the sale. The vendor shall retain |

||||||||

this Certificate for single transactions or |

for the specified period as indicated |

below. Incomplete Certificates are |

||||||||

not considered to be accepted in good faith. Only |

one category of exemption may be claimed on a Certificate. |

|||||||||

|

|

|

|

|

|

|

|

|

||

A. Purchaser’s Name and Address: |

|

|

B. Check Applicable Box: |

|||||||

Purchaser’s Name |

|

|

|

Single Transaction Certificate |

||||||

|

|

|

|

Period From |

|

|

|

Through |

|

|

Address |

|

|

|

|||||||

|

|

|

(You must choose specific |

dates for which the certificate will be valid. You |

||||||

|

|

|

|

are encouraged not to exceed a 12 month period. However, a certificate will be |

||||||

|

|

|

|

considered to be accepted in good faith for a period not to exceed 48 months if the |

||||||

City |

State |

ZIP Code |

|

|||||||

|

vendor has documentation the TPT license is valid for each calendar year covered |

|||||||||

|

|

|

|

|||||||

|

|

|

|

in the certificate.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Purchaser’s Email (Optional) |

|

|

|

Purchaser’s Telephone Number (Optional) |

||||||

|

|

|

|

|

|

|

|

|

|

|

Vendor’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

C. Choose one transaction type per Certificate: |

|

|

|

|

|

|

|

|

||

Transactions with a Business |

|

|

|

Transactions with Native Americans, Native American |

||||||

|

|

|

Businesses and Tribal Governments (See reason #14.) |

|||||||

|

|

|

|

|||||||

Arizona Transaction Privilege Tax (TPT) License Number |

|

|

Tribal Business License Number OR Tribal Number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN / EIN |

|

|

|

Name of Tribe |

|

|

Tribal Government |

|||

|

|

|

|

|

|

|

|

|

||

Other Tax License Number |

|

|

|

Transactions with a U.S. Government entity |

||||||

|

|

|

|

(See reasons #9 and #10.) |

||||||

If no license, provide reason: |

|

|

|

Transaction with a Foreign Diplomat (See reason #15.) |

||||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Precise Nature of Purchaser’s Business. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Reason for Exemption:

Check the box indicating one of the more common exemptions provided below, or use Box 16 or 17 to cite the appropriate authority for another exemption (deduction). Refer to www.azdor.gov/Forms/TransactionPrivilegeTax.aspx for a complete list of state and city exemptions (deductions) and the business classes (codes) under which the deductions apply.

1. Tangible personal property to be leased or rented in the ordinary course of the purchaser’s licensed business.

2. Tangible personal property to be incorporated into a taxable contracting project, or a maintenance, repair, replacement or alteration project.

3. Food, drink, or condiments purchased by a restaurant business.

4. Pipes or valves four inches in diameter or greater to be used for transportation of oil, natural gas, artificial gas, water or coal slurry.

5. Railroad rolling stock, rails, ties, and signal control equipment.

6. Machinery and equipment sold or leased and used directly in the following business activities:

Manufacturing, processing or fabricating. |

Job printing. |

Refining or metallurgical operations. |

Extraction of ores or minerals from the earth for commercial purposes.

Extraction of, or drilling for, oil or gas from the earth for commercial purposes.

7. Income Producing Capital Equipment to be leased. NOTE: Cities only - See M.C.T.C. 110 for definitions.

8. Food, drink or condiments for consumption within the premises of any prison, jail or other institution under the jurisdiction of the state department of corrections, the department of public safety, the department of juvenile corrections or a county sheriff. Food, drink, condiments or accessories purchased by a school district for consumption at a public school within the district during school hours.

9. Tangible personal property sold or leased directly to the United States Government or its departments or agencies by a manufacturer, modifier, assembler or repairer. (Retail, personal property rental and mining classifications only.)

10. Fifty percent of the gross proceeds or gross income from the sale of tangible personal property directly to the United States Government or its departments or agencies. (Retail classification only.)

Continued on page 2

ADOR 10308 (9/21)

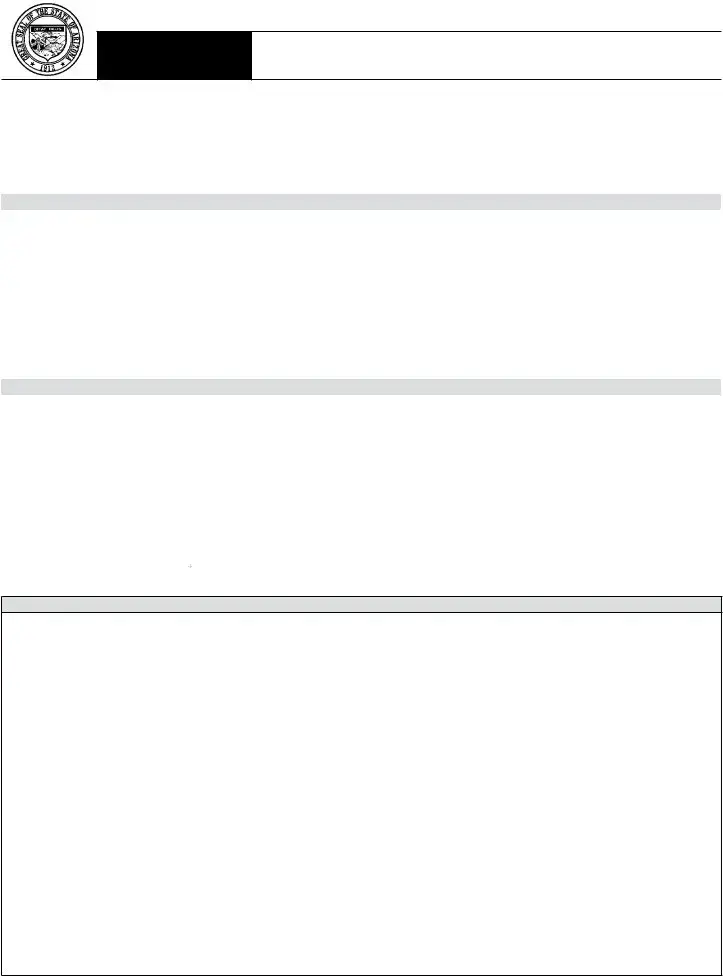

Your Name (as shown on page 1)

Arizona Transaction Privilege Tax License Number

11. Electricity, natural gas or liquefied petroleum gas sold to a qualified manufacturing or smelting business. A manufacturing or smelting business that claims this exemption authorizes the release by the vendor of the information required to be provided to the Department of Revenue pursuant to A.R.S. §

12. Electricity or natural gas to a business that operates an international operations center in this state and that is certified by the Arizona Commerce Authority. NOTE: Certification must be attached. (Utilities classification only.) (Not available for all Cities.)

13. Computer data center equipment sold to the owner, operator or qualified colocation tenant of a computer data center that is certified by the Arizona Commerce Authority pursuant to A.R.S. §

14. Sale or lease of tangible personal property to affiliated Native Americans if the order is placed from and delivered to the reservation. NOTE: The vendor shall retain adequate documentation to substantiate the transaction.

15. Foreign diplomat. NOTE: Limited to authorization on the U.S. Department of State Diplomatic Tax Exemption Card. The vendor shall retain a copy of the U.S. Department of State Diplomatic Tax Exemption Card and any other documentation issued by the U.S. Department of State. Motor vehicle purchases or leases must be

16.*Other Deduction: Cite the Arizona Revised Statutes authority for the deduction. A.R.S. §

Description:

17.*Other Cities Deduction: Cite the Model City Tax Code authority for the deduction. M.C.T.C. § Description:

*Refer to www.azdor.gov/TransactionPrivilegeTax(TPT)/RatesandDeductionCodes.aspx for a complete list of state and city exemptions (deductions) and the business classes (codes) under which the deductions apply.

E.Describe the tangible personal property or service purchased or leased and its use below. (Use additional pages if needed.)

F. Certification

A vendor that has reason to believe that this Certificate is not accurate or complete will not be relieved of the burden of proving entitlement to the exemption. A vendor that accepts a Certificate in good faith will be relieved of the burden of proof and the purchaser may be required to establish the accuracy of the claimed exemption. If the purchaser cannot establish the accuracy and completeness of the information provided in the Certificate, the purchaser is liable for an amount equal to the transaction privilege tax, penalty and interest which the vendor would have been required to pay if the vendor had not accepted the Certificate. Misuse of this Certificate will subject the purchaser to payment of the A.R.S. §

I, (print full name) |

, hereby certify that these transactions are |

exempt from Arizona transaction privilege tax and that the information on this Certificate is

on this Certificate is true, accurate and complete. Further, if

true, accurate and complete. Further, if purchasing or leasing as an agent or officer, I

purchasing or leasing as an agent or officer, I certify that I

certify that I am authorized to execute this Certificate on behalf of the purchaser named above.

am authorized to execute this Certificate on behalf of the purchaser named above.

SIGNATURE OF PURCHASER |

|

DATE |

|

TITLE |

ADOR 10308 (9/21)

Page 2 of 2

Print Form

Reset Form

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The Arizona 5000 form is used to document and establish a basis for state and city tax deductions or exemptions. |

| Governing Law | This form is prescribed by the Arizona Department of Revenue under A.R.S. § 42-5009. |

| Usage Restrictions | Form 5000 should not be used for sales for resale; Form 5000A is required for that purpose. |

| Contractor Guidelines | Non-TPT licensed contractors must use Form 5000M instead of Form 5000. |

| Completeness Requirement | The purchaser must fill out the form completely; incomplete forms are not accepted in good faith. |

| Exemption Categories | Only one category of exemption may be claimed on a single certificate. |

| Retention of Certificate | Vendors must retain the certificate for single transactions or for the specified period indicated on the form. |