Fill Out Your Arizona 600A Form

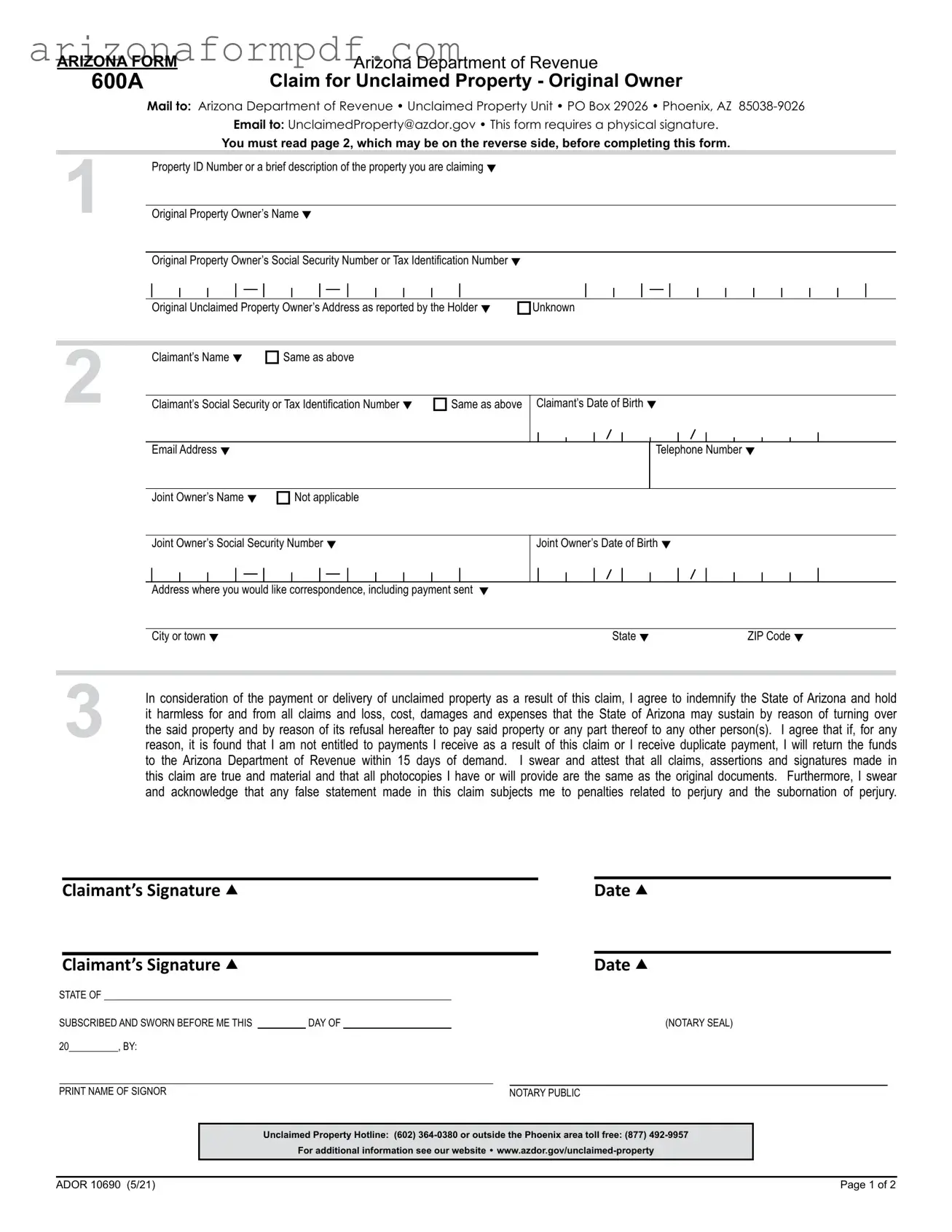

The Arizona 600A form serves as a crucial tool for individuals seeking to claim unclaimed property as the original owner. This form is specifically designed for those who can prove their ownership of the property in question. It requires essential information, including the property ID number or a brief description of the asset being claimed, as well as the original owner's name, Social Security number, and address as reported by the holder. Claimants must also provide their own details, including contact information and, if applicable, information about any joint owners. The form emphasizes the importance of accuracy, as it requests a physical signature and may require notarization or valid identification. Additionally, claimants must submit evidence to substantiate their claims, such as proof of identity and ownership. The Arizona Department of Revenue outlines clear instructions for completing the form, ensuring that all necessary information is provided to facilitate the return of unclaimed assets. Failure to adhere to these requirements could result in delays or denial of the claim. For those navigating the process, understanding the specifics of the Arizona 600A form is essential to successfully reclaiming lost property.

Guide to Writing Arizona 600A

After completing the Arizona 600A form, you will need to gather the necessary documentation and submit it to the Arizona Department of Revenue. Ensure that you have all required signatures and proof of identity before mailing or emailing your claim. This will help expedite the processing of your claim.

- Obtain the Arizona 600A form from the Arizona Department of Revenue website or through direct request.

- Fill in the Property ID Number or provide a brief description of the property you are claiming.

- Provide the Original Property Owner’s Name, Social Security Number or Tax Identification Number, and the Address as reported by the holder.

- In Section 2, enter your Claimant’s Name. If it’s the same as the original owner, check the appropriate box.

- Complete your Social Security Number or Tax Identification Number, Date of Birth, Email Address, and Telephone Number.

- If applicable, fill in the Joint Owner’s Name and their details.

- Specify the Address where you want correspondence and payment sent, including City, State, and ZIP Code.

- Read Section 3 carefully, then sign and date the form. A physical signature is required.

- Choose to have the form notarized or attach a legible photocopy of valid government-issued photo identification.

- Gather and attach proof of your identity, proof of ownership, and proof of your social security number if applicable.

- If there are joint owners, ensure they also sign the claim form.

- Mail the completed form and all required documentation to: Arizona Department of Revenue • Unclaimed Property Unit • PO Box 29026 • Phoenix, AZ 85038-9026. Alternatively, you may email it to UnclaimedProperty@azdor.gov.

Browse Popular Forms

Arizona State Income Tax Form - Report transaction details in Section II of the form.

What Is Post Training - Attendees are encouraged to complete the form in a timely manner.

Maricopa County Superior Court Fees - Forms are available for both temporary and permanent guardianship applications.

Common Questions

What is the Arizona 600A form used for?

The Arizona 600A form is designed for individuals who wish to claim unclaimed property of which they are the original owner. This includes various types of property, such as bank accounts, stocks, or uncashed checks that have been turned over to the state. If you are not the original owner but are claiming property as an heir or beneficiary, you will need to use a different form, such as the 600B.

How do I complete the Arizona 600A form?

To complete the form, you will need to provide specific information about yourself and the property you are claiming. This includes your name, Social Security number, and address, as well as details about the original owner. You should also describe the property or provide its Property ID number if known. Remember to read the instructions carefully and ensure that all sections are filled out accurately.

What documents do I need to submit with the form?

When submitting the Arizona 600A form, you must include proof of your identity, such as a government-issued photo ID or a notarized signature. Additionally, provide evidence of ownership, which may include documents that show you lived at the address reported for the original owner. If applicable, you may need to submit proof of a name change or documents related to joint ownership if there are multiple claimants.

How will I know if my claim has been received?

If you provide an email address on the form, you will receive a receipt of your claim within 15 to 20 business days. This is a convenient way to track your claim status and ensure that the Arizona Department of Revenue has received your submission. If you do not include an email address, you may not receive confirmation until your claim is processed.

What happens if my claim is denied?

If your claim is denied, the Arizona Department of Revenue may request additional information to support your claim. Each claim is unique, and they will work with you to clarify any issues. If you cannot provide the requested evidence, it is advisable to submit the claim form with the documentation you do have, along with a note explaining your situation. A claims specialist may reach out to assist you further.

Where do I send the completed Arizona 600A form?

You can mail the completed form to the Arizona Department of Revenue, Unclaimed Property Unit, at PO Box 29026, Phoenix, AZ 85038-9026. Alternatively, you may email the form to UnclaimedProperty@azdor.gov. Keep in mind that a physical signature is required, so ensure that your form is properly signed before submission.

Dos and Don'ts

When filling out the Arizona 600A form, it's crucial to approach the task with care and attention to detail. Here’s a list of things to do and avoid to ensure a smooth process.

- Do read the instructions carefully before starting. Understanding the requirements will save you time and frustration.

- Do provide accurate and complete information. This includes your name, address, and any other required details.

- Do include a physical signature. The form cannot be processed without it.

- Do submit proof of identity. A clear copy of your government-issued photo ID is essential.

- Do ensure that your contact information is current. This will help expedite communication regarding your claim.

- Don't leave sections blank unless specifically instructed. Incomplete forms may lead to delays or denials.

- Don't forget to notarize your signature if required. Alternatively, you may provide a legible photocopy of your ID.

- Don't submit the form without the necessary supporting documents. Missing paperwork can hinder your claim.

- Don't use the 600A form if you are not the original owner. Ensure you are using the correct form for your situation.

By following these guidelines, you can navigate the process of claiming unclaimed property in Arizona more effectively. Take your time, double-check your information, and ensure all required documents are included. This will help facilitate a smoother experience and increase the chances of a successful claim.

Similar forms

The Arizona Form 600B is used for claiming unclaimed property as an heir or beneficiary of a deceased owner. Like the 600A form, it requires specific information about the claimant and the original owner. Claimants must provide proof of their relationship to the deceased, such as a death certificate, and may also need to submit documents that establish their identity. Both forms require a physical signature and may necessitate notarization, ensuring that the claims are legitimate and properly documented.

The Arizona Form 600C is intended for agents representing an entity that is claiming unclaimed property. This form is similar to the 600A in that it requires the agent to provide information about the entity and the property being claimed. The agent must submit proof of their authority to act on behalf of the entity, such as a corporate resolution or power of attorney. Both forms emphasize the importance of accurate information and may require notarization to validate the claim.

The Arizona Form 600D is for agents acting on behalf of a living owner. It shares similarities with the 600A form, including the need for identification and proof of ownership. The agent must provide documentation that demonstrates their relationship to the living owner, such as a signed authorization letter. Both forms require a physical signature, reinforcing the need for authenticity in the claims process.

The Arizona Form 601 is a request for information about unclaimed property. While it is not a claim form, it serves a similar purpose by allowing individuals to inquire about property that may belong to them. Like the 600A, it collects personal information and requires proof of identity. Both forms aim to assist individuals in recovering lost assets, though the 601 is more about gathering information rather than making a claim.

The Arizona Form 602 is used for reporting unclaimed property to the state. This form is similar to the 600A in that it requires detailed information about the property and its owner. However, instead of claiming property, it is focused on the reporting process for businesses and entities. Both forms emphasize the need for accurate information to ensure proper handling of unclaimed assets.

The Arizona Form 603 is a notice of claim for unclaimed property. It is similar to the 600A form in that it allows individuals to assert their right to property. The 603 form requires claimants to provide their personal information and details about the property. Both forms are designed to facilitate the recovery of unclaimed assets, ensuring that rightful owners can reclaim what is theirs.

Key takeaways

Filling out and using the Arizona 600A form for claiming unclaimed property can be straightforward if you keep a few key points in mind. Here are seven essential takeaways:

- Understand the Purpose: The Arizona 600A form is specifically for original property owners to claim unclaimed property. If you are claiming as an heir or agent, different forms are required.

- Provide Accurate Information: Ensure that all details, especially your name and contact information, are correct. This will help avoid delays in processing your claim.

- Property Description: While it's not mandatory to include a property ID, providing a brief description of the unclaimed property can assist in identifying your claim.

- Signature Requirement: A physical signature is necessary. You can also choose to have the form notarized or include a photocopy of a valid government-issued ID.

- Proof of Identity: You must submit proof of your identity, such as a clear copy of your photo ID. If your name has changed, documentation supporting this change is also required.

- Joint Owners: If there are joint owners, they must file the claim together unless certain conditions, like death or divorce, apply. In such cases, appropriate documentation must be provided.

- Follow Up: After submitting your claim, you can expect a receipt via email within 15 to 20 business days. Keep track of your claim and be prepared to provide additional information if requested.

By following these guidelines, you can navigate the process of claiming unclaimed property in Arizona more effectively.

Common mistakes

-

Incomplete or Incorrect Information: Failing to provide accurate details in any section can lead to delays or denials. Ensure that all names, addresses, and identification numbers are correct.

-

Missing Signature: The form requires a physical signature. Omitting this step will result in the claim being rejected.

-

Not Providing Required Documentation: Applicants often forget to include proof of identity and ownership. Without these documents, the claim cannot be processed.

-

Ignoring Notary Requirements: If applicable, failing to have the form notarized or not providing a valid government-issued ID can cause complications.

-

Incorrect Property ID or Description: Not including a property ID or providing a vague description can hinder the search process. If known, always include specific details.

-

Providing Outdated Contact Information: Using an old address or phone number can prevent the Arizona Department of Revenue from reaching you regarding your claim.

Document Preview

ARIZONA FORM |

Arizona Department of Revenue |

600A |

Claim for Unclaimed Property - Original Owner |

Mail to: Arizona Department of Revenue • Unclaimed Property Unit • PO Box 29026 • Phoenix, AZ

Email to: UnclaimedProperty@azdor.gov • This form requires a physical signature.

You must read page 2, which may be on the reverse side, before completing this form.

1 |

|

Property ID Number or a brief description of the property you are claiming |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Original Property Owner’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

Original Property Owner’s Social Security Number or Tax Identification Number |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Original Unclaimed Property Owner’s Address as reported by the Holder |

Unknown |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

2 |

|

Claimant’s Name |

Same as above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

Claimant’s Social Security or Tax Identification Number |

Same as above |

Claimant’s Date of Birth |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Joint Owner’s Name |

Not applicable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Joint Owner’s Social Security Number

Joint Owner’s Date of Birth

Address where you would like correspondence, including payment sent

City or town |

State |

ZIP Code |

3In consideration of the payment or delivery of unclaimed property as a result of this claim, I agree to indemnify the State of Arizona and hold it harmless for and from all claims and loss, cost, damages and expenses that the State of Arizona may sustain by reason of turning over the said property and by reason of its refusal hereafter to pay said property or any part thereof to any other person(s). I agree that if, for any reason, it is found that I am not entitled to payments I receive as a result of this claim or I receive duplicate payment, I will return the funds to the Arizona Department of Revenue within 15 days of demand. I swear and attest that all claims, assertions and signatures made in this claim are true and material and that all photocopies I have or will provide are the same as the original documents. Furthermore, I swear and acknowledge that any false statement made in this claim subjects me to penalties related to perjury and the subornation of perjury.

Claimant’s Signature

Claimant’s Signature

STATE OF |

|

|

|

|

|

|

SUBSCRIBED AND SWORN BEFORE ME THIS |

|

DAY OF |

||||

20 |

|

|

, BY: |

|

|

|

Date

Date

(NOTARY SEAL)

PRINT NAME OF SIGNOR |

|

NOTARY PUBLIC |

Unclaimed Property Hotline: (602)

For additional information see our website •

ADOR 10690 (5/21) |

Page 1 of 2 |

ARIZONA FORM |

Arizona Department of Revenue |

600A |

Claim for Unclaimed Property - Original Owner |

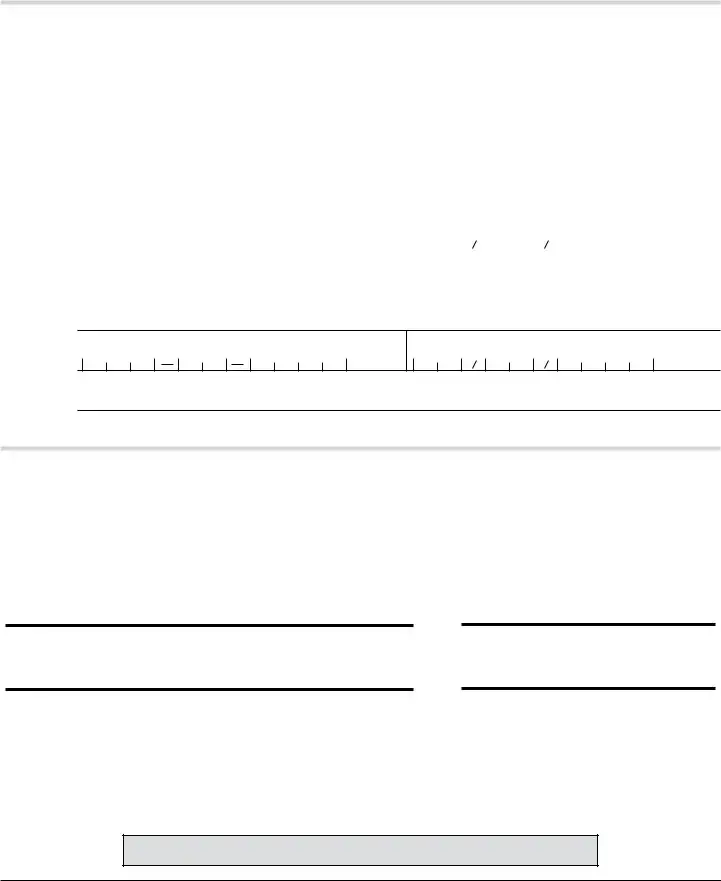

This form should only be used to claim property of which you are the original owner.

If you are claiming property as the heir or beneficiary of a deceased owner (Form 600B), the agent of an entity (Form 600C) or the agent of a living owner (Form 600D), you must complete the appropriate form.

FORM INSTRUCTIONS

Section 1 of page 1

Regardless of how you answer this Section, we will do a complete search of our database to identify and work to return all unclaimed property belonging to the pertinent owner.

•In this section, we ask that you please provide the property ID or a brief description of the property you are claiming. It is not required to complete this section but we ask, if known, that you provide the property ID, if not known it is not required nor helpful to collect this number. If you do not know the property ID number, but are looking for a specific lost asset, it is helpful to give us a brief description, such as, “Southwest Cactus Wren Federal Credit Union Money Order Check #1008 321 6587” or “IRA funds from employer Jackson and Lynch Welding”. Lastly, if you simply wish to collect all miscellaneous unclaimed property you may leave the section blank.

•In the remaining questions in this section, you are required to provide the name of the individual you believe to be the owner, this may be your name, and if known, the address, and tax ID number reported by the business or entity that remitted the property to the State of Arizona. If unknown you may leave this Section blank.

Section 2 of page 1

It is very important that you complete this Section fully and accurately. You are required to provide us with your current or correct name and your current/correct contact information. If you provide an email address, we will provide you with a receipt of your claim with 15 to 20 business days of receipt; this information is no longer provided in hard copy. Providing an email address also expedites communication and helps us more efficiently serve you. The address that you record in this Section will be the address that payment will be sent to should your claim be approved.

Section 3 of page 1

You must sign and date the form, we require a physical signature. In this section, please read the declarations carefully. There is a notary section under the signature, you may choose to have the form notarized or provide a legible photocopy of valid government issued photo identification; such as a driver’s license or passport. If there are joint owners, they must also sign the claim form (see evidence requirements below for all joint owner exceptions).

YOU ARE REQUIRED TO SUBMIT THE FOLLOWING EVIDENCE WITH THIS FORM:

You must provide proof of your identity as the claimant. Please provide a clear copy of official photo identification or have your signature on the claim form notarized. If your name has changed since the property was reported to the State of Arizona, you must provide verification of your name change, such as, a court order, marriage license or divorce decree.

You must provide proof of ownership. The Arizona Unclaimed Property Section does not release funds based on name similarity alone, must provide a match to another reported factor, most commonly social security number or match to the reported (not current) address.

•Provide proof that you lived at or received mail at the address reported to the State of Arizona as the last known address of the original owner. If you do not know what address was reported to the State of Arizona, you can complete an inquiry at www. missingmoney.com. Acceptable proof includes; the original financial instrument, a statement from the entity that originally held the asset, a canceled envelope addressed to you, a credit report, lease/mortgage, property/income tax documentation, school/military records, past government issued identification or utility bills/statements. Please see our website:

•Provide proof of your social security number. Providing your Social Security number (SSN) is optional. However, if you choose not to provide your SSN, there may be insufficient information available to determine whether you are the owner of the unclaimed property held by the Section and in some cases may result in your claim being denied. If you provide your SSN, the Section will only disclose it to employees involved in paying your claim and to the federal government as required by law.

Joint owners must file together unless:

•One of the owners is deceased. In this case, a copy of the joint owner’s death certificate is required.

•The owners are now divorced. In this case, a certified copy of the divorce decree and complete property settlement are required.

•The owners have lost contact. In this case, a notarized statement that confirms that the owners had no marital relationship, and have lost all contact is required.

Please be aware that each claim is unique and that once your claim is received, the Section may need to request additional information and will allow you an opportunity to provide the additional evidence rather than denying your claim. If you have any questions or

cannot provide the evidence requested we recommend that you complete the claim form and submit the evidence, you can provide, along with a note explaining your circumstances. A claims specialist may be able to clarify and assist you with the evidence requirement.

Mail to: Arizona Department of Revenue • Unclaimed Property Unit • PO Box 29026 • Phoenix, AZ

Email to: UnclaimedProperty@azdor.gov • This form requires a physical signature.

For additional information see our website •

ADOR 10690 (5/21) |

Page 2 of 2 |

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose of the Form | The Arizona 600A form is used to claim unclaimed property by the original owner. |

| Governing Law | This form is governed by Arizona Revised Statutes Title 44, Chapter 3, which pertains to unclaimed property. |

| Submission Methods | Claimants can submit the form via mail or email to the Arizona Department of Revenue. |

| Signature Requirement | A physical signature is required on the form for it to be valid. |

| Identification Proof | Claimants must provide proof of identity, such as a government-issued photo ID or notarization. |

| Claimant Information | Section 2 requires accurate contact information for the claimant, including email and phone number. |

| Joint Ownership | If there are joint owners, they must file the claim together unless certain exceptions apply. |

| Deadline for Returning Funds | If a claimant receives funds they are not entitled to, they must return it within 15 days upon demand. |