Fill Out Your Arizona 650A Form

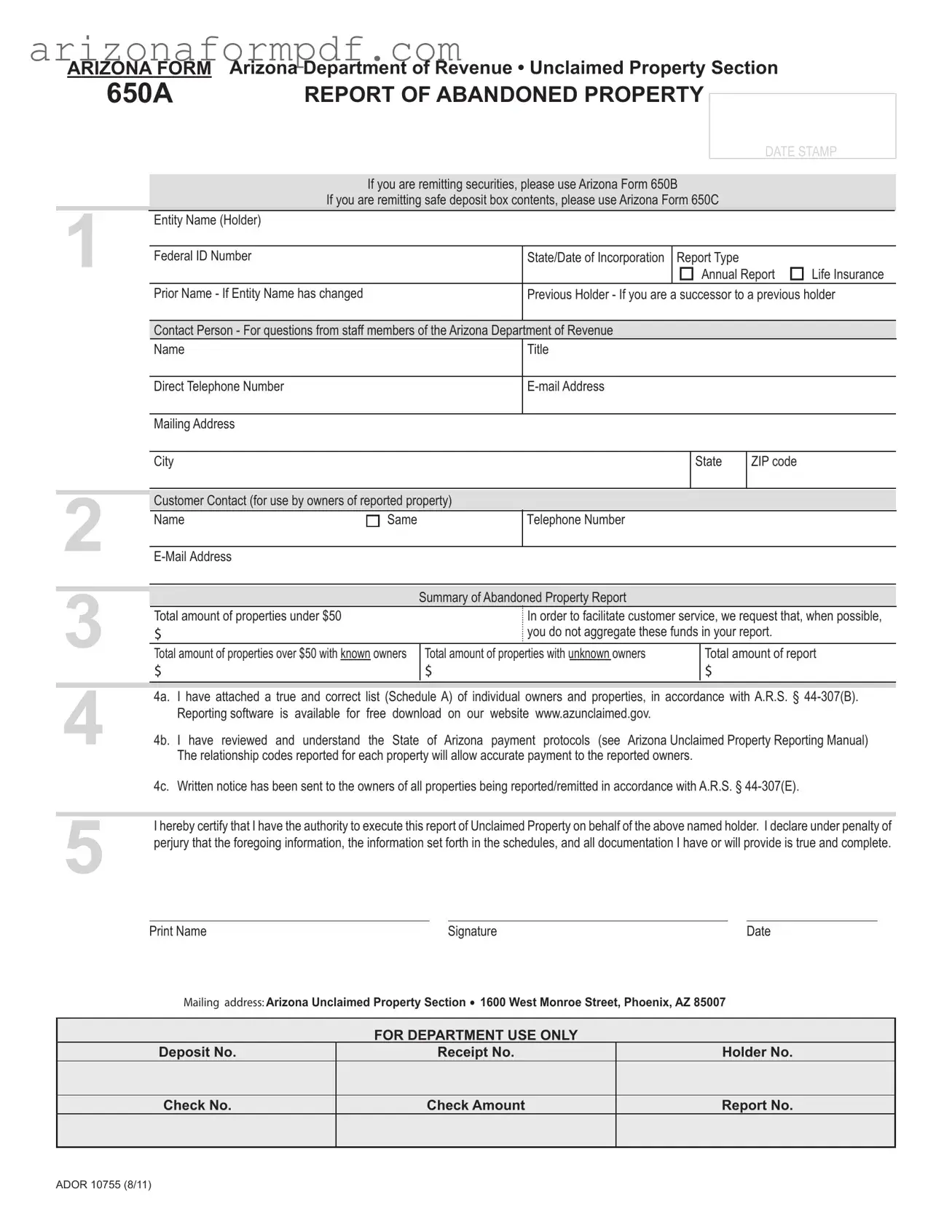

The Arizona 650A form is a crucial document for businesses and organizations that need to report unclaimed property to the Arizona Department of Revenue. This form serves as a comprehensive report of abandoned property, which includes various types of assets that have remained unclaimed by their rightful owners for a specified period. When completing the 650A, entities must provide essential information such as their name, federal ID number, and the type of report being submitted—whether it’s an annual report or related to life insurance. Additionally, the form requires details about the properties being reported, including the total amounts for properties under and over $50, as well as those with known and unknown owners. To ensure accuracy and compliance, filers must attach a true and correct list of individual owners and properties, as mandated by Arizona law. Furthermore, the form includes a certification section where the holder affirms their authority to submit the report and attests to the truthfulness of the information provided. This process not only helps the state manage unclaimed assets but also facilitates the return of funds to rightful owners, making the 650A form an important tool in the realm of unclaimed property management.

Guide to Writing Arizona 650A

Filling out the Arizona 650A form is a straightforward process that requires attention to detail. Make sure you have all necessary information at hand before you begin. Once completed, the form will need to be submitted to the Arizona Department of Revenue.

- Entity Information: Enter the name of your entity (holder) and its Federal ID number. Include the state and date of incorporation. Select the report type, whether it’s an annual report or for life insurance. If your entity name has changed, provide the prior name. If you are a successor to a previous holder, list that information as well.

- Contact Person: Fill in the name and title of the contact person for any questions. Provide a direct telephone number and email address, along with the mailing address, city, state, and ZIP code.

- Customer Contact: Enter the name, telephone number, and email address of the customer contact for the owners of the reported property.

- Summary of Abandoned Property Report: List the total amount of properties under $50. It’s best to avoid aggregating these funds. Then, provide the total amount of properties over $50 with known owners and the total amount of properties with unknown owners. Finally, calculate the total amount of the report.

- Attachments: Indicate if you have attached a true and correct list (Schedule A) of individual owners and properties, as required by A.R.S. § 44-307(B).

- Payment Protocols: Confirm that you have reviewed and understand the State of Arizona payment protocols. This is essential for accurate payment to reported owners.

- Owner Notification: Verify that written notice has been sent to the owners of all properties being reported/remitted, in accordance with A.R.S. § 44-307(E).

- Certification: Certify that you have the authority to execute this report on behalf of the holder. Sign and date the form. Print your name below your signature.

- Mailing Address: Send the completed form to the Arizona Unclaimed Property Section at 1600 West Monroe Street, Phoenix, AZ 85007.

Browse Popular Forms

Pre Approved Meaning - The lender gathers necessary information from the buyer.

Arizona Tax Forms - The timing of wage payments can influence deposit schedules, which employers should consider.

Common Questions

What is the Arizona 650A form used for?

The Arizona 650A form is used to report abandoned property to the Arizona Department of Revenue. This includes unclaimed funds or assets that have been inactive for a certain period. If you are remitting securities or safe deposit box contents, you will need to use Arizona Form 650B or 650C, respectively.

Who needs to file the Arizona 650A form?

Any entity that holds unclaimed property, such as businesses, banks, or insurance companies, must file the Arizona 650A form. This includes those who have assets that have not been claimed by the rightful owners for a specified period.

What information is required on the form?

The form requires details such as the entity name, federal ID number, contact information, and a summary of the abandoned property. You will also need to provide a list of individual owners and properties being reported. This information helps the state process the report accurately.

What is the significance of the summary section on the form?

The summary section helps categorize the abandoned properties. It includes the total amount of properties under $50, properties over $50 with known owners, and those with unknown owners. This breakdown aids in managing the claims process and ensures proper communication with property owners.

Is there a deadline for submitting the Arizona 650A form?

Yes, the Arizona 650A form must be submitted annually. The specific deadline can vary, so it’s essential to check the Arizona Department of Revenue’s website or contact them directly for the exact due date each year.

What happens if I don’t file the form?

Failure to file the Arizona 650A form can result in penalties. The state may impose fines, and you could face legal repercussions for not complying with the unclaimed property laws. It's crucial to file on time to avoid these issues.

Can I get help with filling out the Arizona 650A form?

Yes, assistance is available. The Arizona Department of Revenue provides resources, including a reporting manual and free reporting software on their website. You can also reach out to their staff for guidance if you have specific questions.

What should I do if I have questions about my submission?

If you have questions about your submission, contact the Arizona Department of Revenue directly. The contact person you list on the form will be the point of communication for any inquiries regarding your report.

Dos and Don'ts

When filling out the Arizona 650A form, it’s essential to be thorough and accurate. Here’s a list of things you should and shouldn’t do:

- Do double-check the entity name and Federal ID number for accuracy.

- Do provide complete contact information for both the holder and the customer.

- Do include a true and correct list of individual owners and properties as required.

- Do ensure that you have sent written notices to all owners of reported properties.

- Don’t aggregate funds under $50; report them separately to facilitate customer service.

- Don’t leave any sections blank; incomplete forms can lead to delays.

- Don’t forget to review the Arizona Unclaimed Property Reporting Manual for payment protocols.

- Don’t submit the form without signing and dating it; your certification is crucial.

Similar forms

The Arizona Form 650B is closely related to the 650A form, as it is specifically designed for remitting securities. Like the 650A, the 650B requires detailed information about the entity holding the securities, including the federal ID number and contact information. Both forms serve the purpose of reporting unclaimed property, but the 650B focuses solely on securities, ensuring that holders can accurately report and remit these types of assets to the state. The similarity in structure and required information makes it essential for holders to understand both forms when dealing with unclaimed securities.

Arizona Form 650C is another document that parallels the 650A form. This form is used for reporting safe deposit box contents that have been abandoned. Both forms necessitate the identification of the holder and the reporting of properties, but the 650C specifically addresses the unique nature of safe deposit boxes. It requires holders to provide a detailed inventory of the contents, which may include items of significant sentimental or monetary value. The emphasis on accurate reporting ensures that rightful owners can reclaim their property.

The IRS Form 1099 is also similar to the Arizona 650A form, particularly in its function of reporting income or payments made to individuals. While the 650A focuses on unclaimed property, both forms require the reporting entity to provide identifying information and a summary of the reported items. The 1099 serves as a mechanism for transparency and accountability in financial transactions, much like the 650A aims to facilitate the return of unclaimed assets to their rightful owners.

Another document that bears resemblance to the Arizona 650A form is the Uniform Unclaimed Property Act (UUPA). While not a form per se, the UUPA provides a framework for the reporting and handling of unclaimed property across various states, including Arizona. The principles outlined in the UUPA guide the requirements of the 650A, ensuring consistency in how unclaimed property is managed. This alignment helps protect the interests of both holders and owners of abandoned property.

The California Form RU-1 is similar to the Arizona 650A form in that it also serves as a report for unclaimed property. The RU-1 is specifically tailored for holders operating in California, requiring similar information regarding the entity and the properties being reported. Both forms emphasize the importance of accurate reporting and the necessity of notifying owners about their abandoned property. This shared purpose highlights the need for compliance with state regulations governing unclaimed assets.

Finally, the Florida Form UP-1 is another document comparable to the Arizona 650A form. This form is utilized for reporting unclaimed property in Florida and shares many structural similarities with the 650A. Both forms require the holder to disclose their information and the details of the abandoned property. The UP-1 also emphasizes the importance of due diligence in notifying owners, reinforcing the shared goal of reuniting individuals with their lost assets. This commonality underscores the collaborative effort among states to manage unclaimed property effectively.

Key takeaways

When filling out and using the Arizona 650A form, keep these key takeaways in mind:

- Entity Information: Provide accurate details about your entity, including the name, federal ID number, and state of incorporation.

- Contact Information: Designate a contact person for inquiries. Include their title, phone number, and email address to ensure smooth communication.

- Customer Contact: Include a customer contact for owners of reported property. This helps owners reach out easily if they have questions.

- Property Summary: Clearly outline the total amounts of properties under $50, over $50 with known owners, and those with unknown owners. Avoid aggregating small amounts to enhance customer service.

- Attachments: Attach a true and correct list of individual owners and properties as required by law. This is often referred to as Schedule A.

- Payment Protocols: Familiarize yourself with the state’s payment protocols. This ensures that payments are processed accurately for reported owners.

- Owner Notification: Confirm that written notice has been sent to all owners of the properties being reported. This is a legal requirement.

- Certification: Sign and date the report, certifying that all information provided is true and complete. This declaration is crucial for compliance.

Filling out the Arizona 650A form correctly is essential to avoid potential penalties and ensure that unclaimed properties are handled appropriately. Take the time to review each section carefully.

Common mistakes

-

Incorrect Entity Name: Many individuals fail to accurately fill in the entity name. The name should match exactly with official documents. A mismatch can lead to delays in processing.

-

Missing Federal ID Number: It's essential to include the correct Federal ID Number. Omitting this information can result in the form being rejected or returned.

-

Aggregation of Funds: Some people mistakenly aggregate amounts under $50. This goes against the recommendation to report these amounts separately, which can complicate customer service efforts.

-

Failure to Notify Owners: Not sending written notice to property owners before reporting is a common oversight. This step is required under A.R.S. § 44-307(E) and is crucial for compliance.

Document Preview

ARIZONA FORM Arizona Department of Revenue • Unclaimed Property Section |

|

|||||||

|

650A |

REPORT OF ABANDONED PROPERTY |

|

|

||||

|

DATE STAMP |

|||||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

If you are remitting securities, please use Arizona Form 650B |

|

|||

|

|

|

If you are remitting safe deposit box contents, please use Arizona Form 650C |

|

||||

1 |

|

Entity Name (Holder) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal ID Number |

|

|

State/Date of Incorporation |

Report Type |

|

||

|

|

|

|

|

Annual Report |

Life Insurance |

||

|

|

Prior Name - If Entity Name has changed |

|

Previous Holder - If you are a successor to a previous holder |

||||

|

|

|

|

|

|

|

|

|

Contact Person - For questions from staff members of the Arizona Department of Revenue

Name

Title

Direct Telephone Number

Mailing Address

City

State

ZIP code

2 |

Customer Contact (for use by owners of reported property) |

|

|||

Name |

Same |

|

Telephone Number |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

Summary of Abandoned Property Report |

|

|

Total amount of properties under $50 |

|

|

In order to facilitate customer service, we request that, when possible, |

||

$ |

|

|

you do not aggregate these funds in your report. |

||

|

|

|

|||

Total amount of properties over $50 with known owners |

Total amount of properties with unknown owners |

Total amount of report |

|||

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

44a. I have attached a true and correct list (Schedule A) of individual owners and properties, in accordance with A.R.S. §

The relationship codes reported for each property will allow accurate payment to the reported owners.

4c. Written notice has been sent to the owners of all properties being reported/remitted in accordance with A.R.S. §

5I hereby certify that I have the authority to execute this report of Unclaimed Property on behalf of the above named holder. I declare under penalty of perjury that the foregoing information, the information set forth in the schedules, and all documentation I have or will provide is true and complete.

Print Name |

Signature |

Date |

Mailing address: Arizona Unclaimed Property Section  1600 West Monroe Street, Phoenix, AZ 85007

1600 West Monroe Street, Phoenix, AZ 85007

FOR DEPARTMENT USE ONLY

Deposit No. |

Receipt No. |

Holder No. |

Check No.

Check Amount

Report No.

ADOR 10755 (8/11)

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The Arizona 650A form is used to report unclaimed property, including securities and safe deposit box contents. |

| Governing Law | This form is governed by A.R.S. § 44-307, which outlines the requirements for reporting abandoned property in Arizona. |

| Entity Information | Reporters must provide their entity name, federal ID number, and contact information, ensuring accurate communication with the Arizona Department of Revenue. |

| Reporting Requirements | Reporters must attach a true and correct list of individual owners and properties as per A.R.S. § 44-307(B). |

| Certification | The form requires a certification statement, confirming the authority to execute the report and the truthfulness of the information provided. |