Fill Out Your Arizona 652 Form

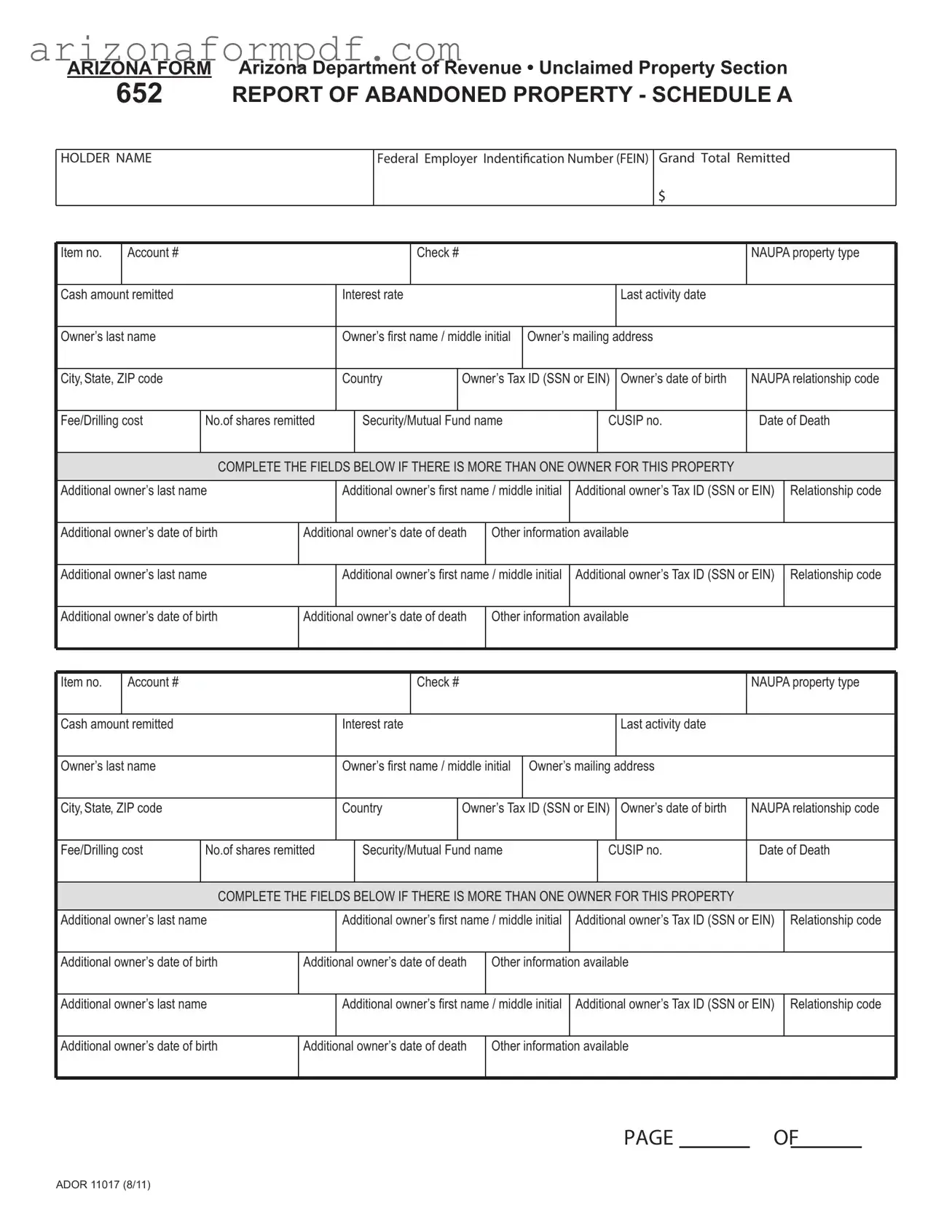

The Arizona 652 form, officially known as the Report of Abandoned Property, is an essential document for individuals and businesses managing unclaimed assets in the state. This form is primarily utilized by holders of unclaimed property, which can include cash, securities, or other financial instruments that have remained inactive for a specified period. When completing the Arizona 652 form, holders must provide detailed information about each unclaimed asset, including the owner's name, last known address, and tax identification number. Additionally, details such as the account number, the cash amount remitted, and the interest rate associated with the property must be accurately reported. If there are multiple owners for a single property, the form accommodates this by allowing for additional owner information to be included, ensuring that all potential claimants are accounted for. The form also requires the reporting of significant dates, such as the last activity date and, in cases of deceased owners, the date of death. By collecting and reporting this information, the Arizona 652 form plays a crucial role in the process of reuniting individuals with their unclaimed property, thereby promoting transparency and accountability within the financial system.

Guide to Writing Arizona 652

Filling out the Arizona 652 form requires careful attention to detail. This form is essential for reporting abandoned property, and accuracy is crucial to ensure compliance with state regulations. Follow these steps to complete the form correctly.

- Begin by entering the Holder Name in the designated field at the top of the form.

- Provide the Federal Employer Identification Number (EIN) next to the Holder Name.

- In the Grand Total Remitted section, input the total amount of property being reported.

- For each item, fill in the following fields:

- Item No. - Assign a unique number to each item.

- Account # - Enter the account number associated with the property.

- Check # - If applicable, include the check number.

- NAUPA Property Type - Specify the type of property as per NAUPA guidelines.

- Cash Amount Remitted - Indicate the cash amount being reported.

- Interest Rate - Provide the applicable interest rate.

- Last Activity Date - Enter the date of the last activity related to the property.

- Owner’s Last Name - Fill in the last name of the property owner.

- Owner’s First Name / Middle Initial - Include the first name and middle initial of the owner.

- Owner’s Mailing Address - Write the complete mailing address.

- City, State, ZIP Code - Fill in the city, state, and ZIP code of the owner.

- Country - Specify the country of the owner.

- Owner’s Tax ID (SSN or EIN) - Enter the owner’s Social Security Number or Employer Identification Number.

- Owner’s Date of Birth - Provide the date of birth of the owner.

- NAUPA Relationship Code - Indicate the relationship code as per NAUPA standards.

- Fee/Drilling Cost - If applicable, include any fees or drilling costs.

- No. of Shares Remitted - Specify the number of shares being reported.

- Security/Mutual Fund Name - Enter the name of the security or mutual fund.

- CUSIP No. - Provide the CUSIP number associated with the security.

- Date of Death - If applicable, include the date of death of the owner.

- If there are additional owners for the property, complete the fields for each additional owner:

- Additional Owner’s Last Name

- Additional Owner’s First Name / Middle Initial

- Additional Owner’s Tax ID (SSN or EIN)

- Relationship Code

- Additional Owner’s Date of Birth

- Additional Owner’s Date of Death

- Other Information Available

- Repeat the previous step for each additional owner, ensuring all information is accurate and complete.

- Review the entire form for any errors or omissions before submission.

Browse Popular Forms

How to Make Contracts for Business - Documentation regarding repairs or inspections must be exchanged directly between buyer and seller for transparency.

Arizona 676 - The Arizona Game and Fish Department provides this form to streamline the process.

Alarm Permit Application - Ensure all sections of the form are completed before submission.

Common Questions

What is the Arizona 652 form?

The Arizona 652 form, also known as the Report of Abandoned Property - Schedule A, is a document used to report unclaimed property to the Arizona Department of Revenue. This form is essential for holders of unclaimed property, such as financial institutions or businesses, to fulfill their reporting obligations under state law.

Who needs to file the Arizona 652 form?

Any individual or entity that holds unclaimed property, which has been abandoned for a specified period, must file the Arizona 652 form. This includes banks, insurance companies, and other financial institutions, as well as businesses that may have unclaimed funds or assets belonging to customers or employees.

What information is required on the Arizona 652 form?

The form requires detailed information about the unclaimed property, including the holder's name, federal employer identification number, and the total amount remitted. Additionally, it asks for details about the owners of the property, such as their names, addresses, tax identification numbers, and dates of birth. If there are multiple owners, information for each must be included.

How do I determine if property is considered abandoned?

Property is generally considered abandoned if there has been no activity for a specific period, which can vary depending on the type of property. For example, bank accounts may be deemed abandoned after three years of inactivity. It's important to check Arizona's unclaimed property laws to understand the specific timeframes for different types of assets.

What happens if I fail to file the Arizona 652 form?

Failure to file the Arizona 652 form can lead to penalties and fines. The Arizona Department of Revenue may impose financial consequences on holders who do not comply with reporting requirements. Additionally, unclaimed property may remain unreported and unreturned to rightful owners, which can lead to further complications.

Is there a deadline for filing the Arizona 652 form?

Yes, there is a deadline for filing the Arizona 652 form. Typically, the form must be submitted by November 1st of each year for property that has been abandoned during the previous reporting period. It is crucial to adhere to this deadline to avoid penalties and ensure compliance with state regulations.

Where can I obtain the Arizona 652 form?

The Arizona 652 form can be obtained from the Arizona Department of Revenue's website. It is available for download in a printable format. Additionally, the department may provide guidance and resources to assist in the completion of the form, ensuring that all required information is accurately reported.

Dos and Don'ts

When filling out the Arizona 652 form, it’s important to be thorough and accurate. Here are five things you should and shouldn’t do:

- Do double-check all information before submitting the form.

- Do ensure that names and addresses match official records.

- Do include all required details for each owner, especially Tax IDs.

- Do keep a copy of the completed form for your records.

- Do submit the form by the deadline to avoid penalties.

- Don’t leave any fields blank; incomplete forms can be rejected.

- Don’t use abbreviations or nicknames for names.

- Don’t forget to sign and date the form where required.

- Don’t submit the form without reviewing the instructions carefully.

- Don’t ignore any specific guidelines related to multiple owners.

Similar forms

The Arizona 652 form, which is used for reporting abandoned property, shares similarities with the Uniform Unclaimed Property Act (UUPA). The UUPA serves as a guiding framework for states to create their own unclaimed property laws. Like the Arizona 652 form, the UUPA requires holders of unclaimed property to report detailed information about the property, including owner identification and the nature of the property. Both documents aim to reunite owners with their lost assets while ensuring compliance with state regulations.

Another document similar to the Arizona 652 form is the California Form 3500, which is also designed for unclaimed property reporting. This form collects information about unclaimed funds, including the owner’s name, address, and the amount of unclaimed property. Just as the Arizona 652 form requires detailed owner information, the California Form 3500 ensures that the state has the necessary data to process and potentially return unclaimed funds to rightful owners.

The Florida Form UP-1 is another comparable document. This form is used to report unclaimed property in Florida and requires detailed information about the property and its owners, similar to what is required in the Arizona 652 form. Both forms emphasize the importance of providing accurate owner details, including Social Security numbers and last known addresses, to facilitate the return of unclaimed assets.

The Texas Unclaimed Property Report is also akin to the Arizona 652 form. This report mandates that businesses and organizations report unclaimed property, including financial accounts and securities. Like the Arizona form, it seeks to gather comprehensive information about the owners, ensuring that the state can efficiently manage and return unclaimed property to its rightful owners.

The New York State Report of Unclaimed Funds is another relevant document. This report requires similar information, including the owner’s name, address, and the amount of unclaimed property. Both the New York report and the Arizona 652 form focus on transparency and accuracy, ensuring that unclaimed assets can be tracked and returned to individuals who may not even be aware of their existence.

The Illinois Report of Unclaimed Property aligns closely with the Arizona 652 form as well. This document requires detailed reporting of unclaimed property, including owner identification and property type. Both forms share the goal of safeguarding unclaimed assets while providing a clear process for reporting and potential reclamation by owners.

In addition, the Pennsylvania Unclaimed Property Report bears similarities to the Arizona 652 form. This report collects detailed information about unclaimed property and its owners, including the last known address and Social Security numbers. Both documents are designed to ensure that unclaimed assets are properly documented and can be returned to their rightful owners, fostering accountability and transparency in handling unclaimed property.

Lastly, the Ohio Unclaimed Funds Report is comparable to the Arizona 652 form. This report requires holders to provide detailed information about unclaimed funds, including the owner’s name and address. Both forms aim to facilitate the return of unclaimed assets to individuals, emphasizing the importance of accurate record-keeping and diligent reporting in the unclaimed property process.

Key takeaways

Here are key takeaways for filling out and using the Arizona 652 form:

- The Arizona 652 form is used to report abandoned property to the Arizona Department of Revenue.

- Ensure that you provide accurate information for the holder name and federal employer identification number.

- List the total amount remitted clearly at the top of the form.

- Each item must include details such as account number, check number, and NAUPA property type.

- Record the cash amount remitted and the interest rate associated with the property.

- Include the last activity date for each item to establish its status as abandoned.

- Owner information must be complete, including last name, first name, mailing address, and tax ID.

- If there are multiple owners, complete the additional owner fields for each one.

- Make sure to provide the relationship code for each owner, along with their date of birth and date of death if applicable.

- Double-check all entries for accuracy before submission to avoid delays in processing.

Common mistakes

-

Failing to provide accurate owner information. This includes the owner's last name, first name, and middle initial. Any discrepancies can lead to processing delays.

-

Omitting the Tax ID number. Whether it is a Social Security Number (SSN) or Employer Identification Number (EIN), this information is crucial for identification purposes.

-

Not including the date of birth for the owner. This detail helps verify the identity of the owner and is often required.

-

Incorrectly completing the NAUPA property type. Ensure that the property type is selected correctly, as this affects the classification of the property.

-

Forgetting to list all additional owners if applicable. If there is more than one owner, all necessary information must be provided for each additional owner.

-

Neglecting to enter the last activity date. This date is important for determining the status of the property and its eligibility for reporting.

-

Leaving out the cash amount remitted. This figure should reflect the total amount being reported and must be accurate to avoid issues.

-

Submitting the form without verifying all entries. A final review can catch errors that may have been overlooked during the initial completion.

Document Preview

ARIZONA FORM Arizona Department of Revenue • Unclaimed Property Section

652 REPORT OF ABANDONED PROPERTY - SCHEDULE A

HOLDER NAME

Federal Employer Indenti

Grand Total Remitted

$

Item no. |

Account # |

|

|

|

|

|

Check # |

|

|

|

|

|

NAUPA property type |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash amount remitted |

|

|

|

Interest rate |

|

|

|

|

|

|

Last activity date |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Owner’s last name |

|

|

|

Owner’s first name / middle initial |

Owner’s mailing address |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

City, State, ZIP code |

|

|

|

Country |

|

Owner’s Tax ID (SSN or EIN) |

Owner’s date of birth |

NAUPA relationship code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

Fee/Drilling cost |

No.of shares remitted |

|

Security/Mutual Fund name |

|

|

CUSIP no. |

Date of Death |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPLETE THE FIELDS BELOW IF THERE IS MORE THAN ONE OWNER FOR THIS PROPERTY |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional owner’s last name |

|

|

Additional owner’s first name / middle initial |

Additional owner’s Tax ID (SSN or EIN) |

Relationship code |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Additional owner’s date of birth |

|

Additional owner’s date of death |

Other information available |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Additional owner’s last name |

|

|

Additional owner’s first name |

/ middle initial |

Additional owner’s Tax ID (SSN or EIN) |

Relationship code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Additional owner’s date of birth |

|

Additional owner’s date of death |

Other information available |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item no. |

Account # |

|

|

|

|

|

Check # |

|

|

|

|

|

NAUPA property type |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash amount remitted |

|

|

|

Interest rate |

|

|

|

|

|

|

Last activity date |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Owner’s last name |

|

|

|

Owner’s first name / middle initial |

Owner’s mailing address |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

City, State, ZIP code |

|

|

|

Country |

|

Owner’s Tax ID (SSN or EIN) |

Owner’s date of birth |

NAUPA relationship code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

Fee/Drilling cost |

No.of shares remitted |

|

Security/Mutual Fund name |

|

|

CUSIP no. |

Date of Death |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPLETE THE FIELDS BELOW IF THERE IS MORE THAN ONE OWNER FOR THIS PROPERTY |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional owner’s last name |

|

|

Additional owner’s first name / middle initial |

Additional owner’s Tax ID (SSN or EIN) |

Relationship code |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Additional owner’s date of birth |

|

Additional owner’s date of death |

Other information available |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Additional owner’s last name |

|

|

Additional owner’s first name |

/ middle initial |

Additional owner’s Tax ID (SSN or EIN) |

Relationship code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Additional owner’s date of birth |

|

Additional owner’s date of death |

Other information available |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAGE OF

ADOR 11017 (8/11)

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Arizona 652 form is used to report abandoned property to the Arizona Department of Revenue. |

| Governing Law | This form is governed by Arizona Revised Statutes, Title 44, Chapter 3, which outlines the unclaimed property laws. |

| Holder Information | Holders must provide their name and Federal Employer Identification Number (FEIN) on the form. |

| Owner Details | Information about the property owner, including name, mailing address, and Tax ID, is required. |

| Multiple Owners | The form allows for the inclusion of additional owners if more than one person is associated with the property. |

| Property Types | Various types of property can be reported, including cash, securities, and mutual funds, as indicated by NAUPA property types. |

| Remittance | Holders must report the total cash amount remitted along with any applicable fees or costs associated with the property. |