Fill Out Your Arizona 74 Form

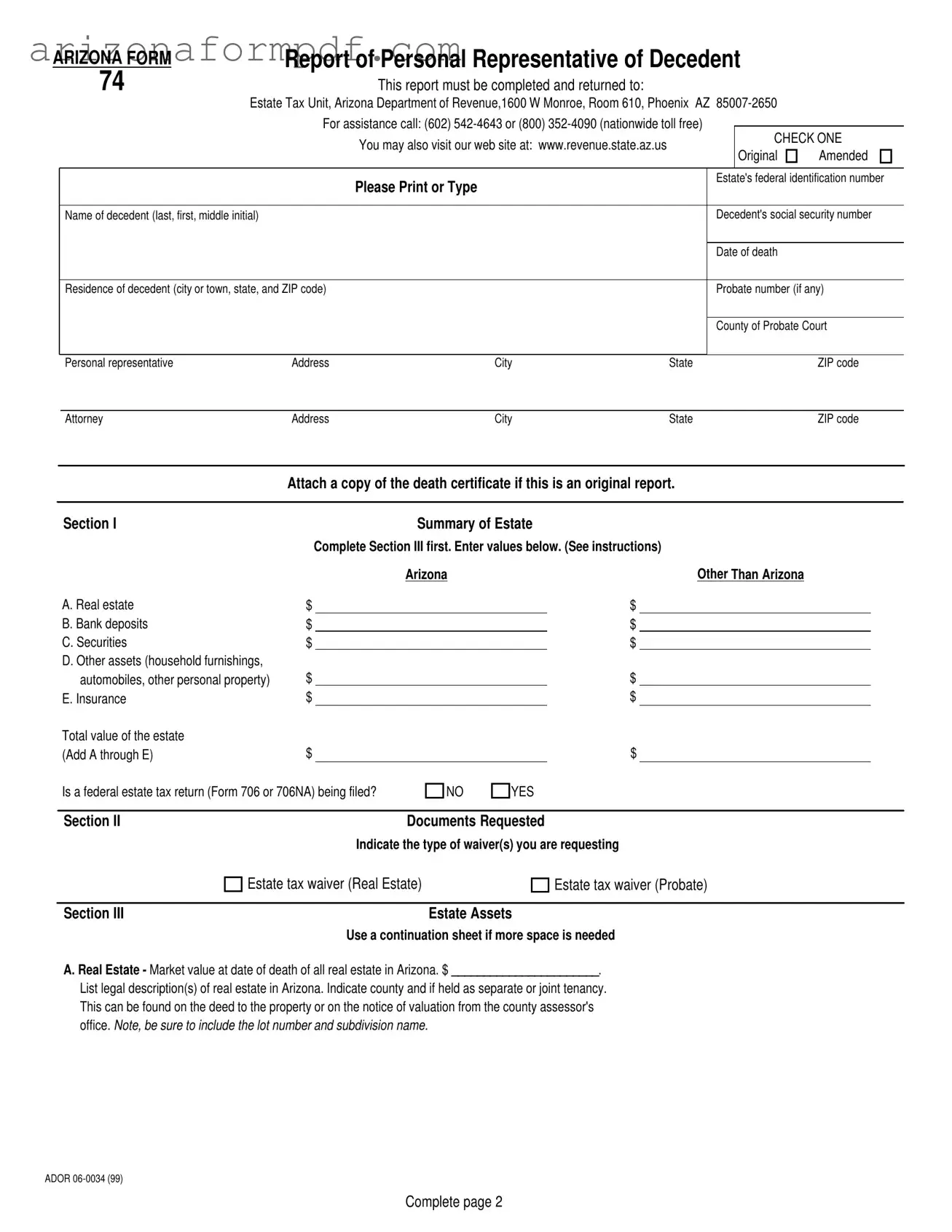

The Arizona 74 form, officially known as the Report of Personal Representative of Decedent, is a crucial document for those managing the estate of a deceased individual in Arizona. This form must be completed and submitted to the Estate Tax Unit of the Arizona Department of Revenue. It serves as a comprehensive report detailing the decedent's assets, liabilities, and estate value. Key information required includes the decedent's name, social security number, date of death, and residence. Additionally, the personal representative is responsible for providing a summary of the estate, which encompasses real estate, bank deposits, securities, and other assets. If applicable, the form also allows for the request of estate tax waivers. The completion of this form is essential for ensuring compliance with state tax regulations and facilitating the probate process. A copy of the death certificate must be attached if this is the original report being filed. Clear instructions guide the personal representative through each section, ensuring that all necessary details are accurately reported.

Guide to Writing Arizona 74

Completing the Arizona 74 form requires careful attention to detail. This form is essential for reporting information related to the estate of a decedent. After filling out the form, submit it to the Estate Tax Unit at the Arizona Department of Revenue. Ensure all required documents, such as the death certificate for original reports, are attached.

- Obtain the form: Download the Arizona 74 form from the Arizona Department of Revenue website or request a physical copy.

- Check the type: Indicate whether this is an original or amended report by checking the appropriate box at the top of the form.

- Enter the estate's federal identification number: Fill in the federal identification number associated with the estate.

- Provide decedent's information: Input the name (last, first, middle initial), social security number, date of death, and residence (city, state, ZIP code) of the decedent.

- Include probate details: If applicable, enter the probate number and the county of the Probate Court.

- Fill in personal representative's information: Provide the name, address, city, state, and ZIP code of the personal representative.

- Provide attorney's information: If applicable, enter the attorney's name, address, city, state, and ZIP code.

- Attach the death certificate: Include a copy of the death certificate if this is an original report.

- Complete Section I: Summarize the estate's value by filling in the respective amounts for real estate, bank deposits, securities, other assets, and insurance. Calculate the total value of the estate.

- Indicate federal estate tax return: Specify whether a federal estate tax return (Form 706 or 706NA) is being filed by checking the appropriate box.

- Complete Section II: Indicate the type of waiver(s) being requested by checking the relevant options for estate tax waivers.

- Fill in Section III: List the estate assets, including real estate, bank deposits, securities, other assets, and insurance. Provide detailed descriptions and values as necessary.

- Sign the report: The personal representative, surviving joint tenant, or attorney must sign and date the report. Include the typed or printed name, social security number or federal employer identification number, address, and phone number.

- Submit the form: Send the completed form and any attachments to the Estate Tax Unit at the Arizona Department of Revenue.

Browse Popular Forms

How Much Does It Cost to File for Custody - Submitting the required paperwork ensures compliance with the court's rules and procedures.

Alarm Permit Application - Failure to register may result in increased fines for false alarms.

Common Questions

What is the purpose of the Arizona 74 form?

The Arizona 74 form, also known as the Report of Personal Representative of Decedent, serves as a formal report to the Arizona Department of Revenue regarding the estate of a deceased individual. This document is crucial for the administration of the estate, as it provides a comprehensive summary of the estate's assets and liabilities. It also assists in determining any potential estate tax obligations.

Who is required to file the Arizona 74 form?

The personal representative of the decedent's estate is responsible for completing and submitting the Arizona 74 form. This individual is often appointed by the probate court and is tasked with managing the estate, settling debts, and distributing assets according to the decedent's wishes or state law.

What information must be included in the Arizona 74 form?

The form requires detailed information about the decedent, including their name, Social Security number, date of death, and residence. Additionally, the personal representative must provide a summary of the estate's assets, which includes real estate, bank deposits, securities, and other personal property. It is also necessary to indicate whether a federal estate tax return is being filed.

What should I do if I need assistance completing the form?

If you encounter difficulties while filling out the Arizona 74 form, assistance is available. You can contact the Estate Tax Unit at the Arizona Department of Revenue by calling (602) 542-4643 or (800) 352-4090 for nationwide toll-free support. Additionally, the department's website offers further resources and guidance.

Is it necessary to attach a death certificate when submitting the form?

Yes, if you are submitting the Arizona 74 form as an original report, you must attach a copy of the decedent's death certificate. This document serves as proof of the decedent's passing and is essential for the processing of the estate report.

What happens if I need to amend the Arizona 74 form?

If you discover that changes are necessary after submitting the original form, you can file an amended version of the Arizona 74 form. Be sure to check the "Amended" box on the form and provide the updated information. This ensures that the Arizona Department of Revenue has the most accurate and current details regarding the estate.

Where do I send the completed Arizona 74 form?

The completed Arizona 74 form should be mailed to the Estate Tax Unit at the Arizona Department of Revenue, located at 1600 W Monroe, Room 610, Phoenix, AZ 85007-2650. It is important to ensure that the form is sent to the correct address to avoid delays in processing.

Dos and Don'ts

When filling out the Arizona 74 form, it’s important to approach the task with care. Here are some things you should and shouldn’t do:

- Do read the instructions carefully before starting.

- Do provide accurate information about the decedent, including their full name and social security number.

- Do include the estate's federal identification number.

- Do attach a copy of the death certificate if this is an original report.

- Do ensure that all values for estate assets are current and correct.

- Don't leave any sections blank unless specifically instructed to do so.

- Don't forget to indicate whether this is an original or amended report.

- Don't use abbreviations or shorthand; write clearly and legibly.

- Don't submit the form without reviewing it for errors or omissions.

Similar forms

The Arizona 74 form, also known as the Report of Personal Representative of Decedent, shares similarities with the IRS Form 706, which is the United States Estate (and Generation-Skipping Transfer) Tax Return. Both documents are essential for reporting the value of a decedent's estate. The Arizona 74 form focuses on state-level estate tax obligations, while Form 706 addresses federal estate tax requirements. Each form requires detailed information about the decedent's assets, liabilities, and the overall value of the estate, ensuring compliance with tax laws at both levels.

Another document akin to the Arizona 74 form is the California Form 706, which is specific to the state of California. Like the Arizona form, it serves to report the assets of a deceased individual. The California version includes similar sections for listing real estate, bank accounts, and other assets. Both forms aim to provide a comprehensive overview of the estate's value, although the California form may have different thresholds and requirements based on state law.

The New York State Estate Tax Return (ET-706) is another document that parallels the Arizona 74 form. This return is used to report the estate of a decedent who passed away in New York. Similar to the Arizona form, it requires detailed asset listings and values. Both forms also include sections for claiming any applicable tax waivers. The main difference lies in the specific regulations and tax rates that apply in each state.

The Florida Form DR-1, known as the Florida Estate Tax Return, is also comparable to the Arizona 74 form. This document requires the personal representative to report the decedent's estate value and any assets. Both forms necessitate a thorough accounting of the estate's contents and are submitted to the respective state tax authorities. However, Florida has unique tax laws that may affect how the estate is evaluated and taxed.

In addition, the Texas Estate Tax Return serves a similar purpose. Although Texas does not impose a state estate tax, the form is still used to report the estate's value for other legal and administrative purposes. Like the Arizona 74 form, it requires a detailed account of the decedent's assets. Both documents help ensure that all necessary information is collected for proper estate management, even if the tax implications differ.

The Illinois Estate Tax Return (Form 700) is another document similar to the Arizona 74 form. This return is used to report the estate of a decedent who lived in Illinois. It shares common elements, such as asset valuation and listing, which are crucial for determining any estate tax liabilities. Both forms require the personal representative to provide accurate information to comply with state laws.

The Massachusetts Estate Tax Return (Form M-706) also mirrors the Arizona 74 form in its purpose. This form is required for estates exceeding a certain value threshold and requires similar information about the decedent's assets. Both forms aim to provide a clear picture of the estate for tax assessment purposes, ensuring compliance with state regulations.

Lastly, the Pennsylvania Inheritance Tax Return (Form REV-1500) is comparable to the Arizona 74 form. While it focuses on inheritance tax rather than estate tax, it requires a detailed account of the decedent's assets and their value. Both forms serve to report the estate's worth, although the specific tax obligations may vary based on the state’s laws and regulations.

Key takeaways

When filling out the Arizona Form 74, here are some key takeaways to keep in mind:

- Purpose: This form is used to report the estate of a decedent and must be submitted to the Arizona Department of Revenue.

- Submission: Send the completed form to the Estate Tax Unit at the specified address in Phoenix, AZ.

- Contact Information: For help, you can call the provided numbers for assistance.

- Original or Amended: Be sure to check the appropriate box to indicate whether this is an original report or an amended one.

- Information Required: Fill in the decedent's federal identification number, name, social security number, date of death, and residence details.

- Estate Values: Complete Section III before entering values in Section I. This includes real estate, bank deposits, securities, and other assets.

- Waivers: Indicate if you are requesting any estate tax waivers, such as for real estate or probate.

- Documentation: Attach a copy of the death certificate if this is the original report.

- Signature: The personal representative must sign the form, confirming that all information is accurate and complete.

Common mistakes

-

Not providing the correct federal identification number: The estate's federal identification number is crucial. Omitting or entering an incorrect number can delay processing.

-

Failing to attach the death certificate: If this is an original report, a copy of the death certificate must be included. Forgetting this step can lead to rejection of the form.

-

Incorrectly completing Section I: Section I requires a summary of the estate. Ensure that the values for assets in Arizona and other states are clearly separated and accurately calculated.

-

Not indicating the type of waivers requested: If you are seeking waivers, it is essential to check the appropriate boxes in Section II. Failing to do so may result in unnecessary delays.

-

Neglecting to sign and date the form: The personal representative or attorney must sign and date the report. An unsigned form is considered incomplete and will not be processed.

Document Preview

ARIZONA FORM |

Report of Personal Representative of Decedent |

|

|

||||||||

74 |

|

|

This report must be completed and returned to: |

|

|

|

|

|

|||

|

Estate Tax Unit, Arizona Department of Revenue,1600 W Monroe, Room 610, Phoenix AZ |

|

|

||||||||

|

|

|

For assistance call: (602) |

|

|

|

|||||

|

|

|

|

You may also visit our web site at: www.revenue.state.az.us |

|

|

CHECK ONE |

||||

|

|

|

|

|

|

Original |

Amended |

||||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Print or Type |

|

|

|

Estate's federal identification number |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of decedent (last, first, middle initial) |

|

|

|

|

|

|

Decedent's social security number |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of death |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Residence of decedent (city or town, state, and ZIP code) |

|

|

|

|

Probate number (if any) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County of Probate Court |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal representative |

Address |

City |

|

State |

|

|

|

ZIP code |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Attorney |

Address |

City |

|

State |

|

|

|

ZIP code |

||

|

|

|

|

|

|

|

|

|

|

||

|

|

Attach a copy of the death certificate if this is an original report. |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Section I |

|

|

Summary of Estate |

|

|

|

|

|

|

|

|

|

Complete Section III first. Enter values below. (See instructions) |

|

|

|

|

|

||||

|

|

|

|

Arizona |

|

|

Other Than Arizona |

|

|

||

|

A. Real estate |

$ |

|

|

$ |

|

|

|

|

|

|

|

B. Bank deposits |

$ |

|

|

$ |

|

|

|

|

|

|

|

C. Securities |

$ |

|

|

$ |

|

|

|

|

|

|

|

D. Other assets (household furnishings, |

|

|

|

|

|

|

|

|

|

|

|

automobiles, other personal property) |

$ |

|

|

$ |

|

|

|

|

|

|

|

E. Insurance |

$ |

|

|

$ |

|

|

|

|

|

|

|

Total value of the estate |

|

|

|

|

|

|

|

|

|

|

|

(Add A through E) |

$ |

|

|

$ |

|

|

|

|

|

|

Is a federal estate tax return (Form 706 or 706NA) being filed?

NO

YES

Section II |

Documents Requested |

Indicate the type of waiver(s) you are requesting

Estate tax waiver (Real Estate)

Estate tax waiver (Probate)

Section III |

Estate Assets |

|

Use a continuation sheet if more space is needed |

A. Real Estate - Market value at date of death of all real estate in Arizona. $ _______________________.

List legal description(s) of real estate in Arizona. Indicate county and if held as separate or joint tenancy. This can be found on the deed to the property or on the notice of valuation from the county assessor's

office. NOTE, BE SURE TO INCLUDE THE LOT NUMBER AND SUBDIVISION NAME.

ADOR

Complete page 2

Form 74 Page 2

B. Bank Deposits - List accounts in financial institutions.

Name of bank or other institution |

Type of account |

Balance at date of death |

|

|

|

Total Value |

$ __________________ |

|

|

|

|

|

C. Securities - List all stocks, bonds, and other securities that were owned by the decedent. |

|

|

||

Name of company |

Number of shares |

Value at date of death |

||

Total Value |

$ __________________ |

D. Other Assets - List other assets (household furnishings, motor vehicles, and other personal property).

Total Value |

$ __________________ |

E. Insurance - Insurance on decedent's life (owned by the decedent).

Total Value $ __________________

Under penalty of perjury, I declare that I have examined this report, including any accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Personal Representative / Surviving Joint Tenant / Attorney

Name (typed or printed) |

|

Social security number or federal employer identification number |

|

|

|

Address |

|

|

|

|

|

City |

State |

ZIP code |

|

|

|

Signature of representative |

Date |

Phone number |

ADOR

Form Breakdown

| Fact Name | Detail |

|---|---|

| Form Purpose | The Arizona 74 form is used to report the estate of a decedent and provide necessary information to the state regarding estate taxes. |

| Governing Law | This form is governed by Arizona Revised Statutes, specifically Title 42, which pertains to taxation. |

| Filing Requirement | It must be completed and submitted to the Estate Tax Unit at the Arizona Department of Revenue. |

| Contact Information | For assistance, individuals can call (602) 542-4643 or (800) 352-4090 toll-free. |

| Original vs. Amended | The form allows filers to check whether they are submitting an original or amended report. |

| Required Attachments | A copy of the decedent's death certificate must be attached if this is the original report. |

| Estate Valuation | Section I requires a summary of the estate's total value, including real estate, bank deposits, and other assets. |

| Federal Estate Tax Return | Filers must indicate whether a federal estate tax return (Form 706 or 706NA) is being filed. |

| Declaration of Truth | The personal representative or attorney must declare under penalty of perjury that the information provided is true and complete. |