Fill Out Your Arizona A 4 Form

The Arizona A-4 form plays a crucial role in the state’s tax system, particularly for employees working within its borders. Designed for both new and current employees, this form allows individuals to elect a specific percentage of their gross taxable wages for Arizona income tax withholding. Employees can choose from a range of percentages, from 0.8% to 5.1%, or even opt for zero withholding if they anticipate no tax liability for the year. This flexibility is essential for managing personal finances, as the amount withheld directly impacts the tax due when filing an Arizona income tax return. The form also includes provisions for those who wish to have an additional amount withheld from each paycheck, providing further customization based on individual financial situations. For new employees, timely completion within the first five days of employment is critical; otherwise, a default withholding rate of 2.7% will apply. Current employees seeking to adjust their withholding must also submit this form to reflect any changes. Additionally, nonresident employees working temporarily in Arizona may find it beneficial to use the A-4 form to elect withholding, depending on their specific circumstances. Understanding the nuances of this form is vital for ensuring compliance with Arizona tax laws while optimizing personal tax strategies.

Guide to Writing Arizona A 4

Completing the Arizona A-4 form is essential for selecting the appropriate withholding percentage for Arizona income tax. This form must be filled out accurately to ensure that the correct amount is withheld from your wages. Below are the steps to complete the form.

- Type or print your full name in the designated space at the top of the form.

- Enter your social security number in the provided field.

- Fill in your home address, including the number and street or rural route.

- Provide your city or town, state, and ZIP code in the appropriate sections.

- Choose one of the Arizona withholding percentage options by checking only one box. Options include:

- 0.8%

- 1.3%

- 1.8%

- 2.7%

- 3.6%

- 4.2%

- 5.1%

- If you want an additional amount withheld per paycheck, enter that amount in the specified field.

- If you wish to elect a withholding percentage of zero, check the corresponding box and certify that you expect no Arizona tax liability for the current taxable year.

- Sign the form to certify that you have made the percentage election marked above.

- Include the date next to your signature.

After completing the form, submit it to your employer. They will use this information to determine the amount of Arizona income tax to withhold from your paychecks going forward.

Browse Popular Forms

Unclaimed Property Arizona - CUSIP numbers for securities are also required in the report.

Wood Infestation Report - Conditions that contribute to infestations are documented in detail.

Common Questions

What is the Arizona A-4 form?

The Arizona A-4 form is an Employee’s Arizona Withholding Percentage Election form. It allows employees to choose the percentage of their gross taxable wages that will be withheld for Arizona state income tax. This form is essential for ensuring that the correct amount of tax is withheld from each paycheck based on the employee's individual tax situation.

Who needs to fill out the Arizona A-4 form?

New employees must complete the Arizona A-4 form within the first five days of employment to select their withholding percentage. Current employees may also fill out the form if they wish to change their withholding amount. If the form is not submitted, the employer will automatically withhold 2.7% of gross taxable wages.

What are "gross taxable wages"?

Gross taxable wages refer to the total wages reported in box 1 of your federal Form W-2. This amount is your gross wages minus any pretax deductions, such as health insurance premiums. Understanding this term is crucial, as the withholding percentage is applied to these wages.

Can I elect a withholding percentage of zero?

Yes, you can elect a withholding percentage of zero if you expect to have no Arizona income tax liability for the current year. However, choosing zero withholding does not exempt you from paying any taxes due when you file your Arizona income tax return. If your tax situation changes during the year, you should submit a new A-4 form to select a different withholding percentage.

What should I do with the completed A-4 form?

Once you have filled out the A-4 form, submit it to your employer. They will use the information provided to adjust the amount of state income tax withheld from your paychecks. It is important to keep a copy for your records.

What happens if I do not submit the A-4 form?

If you do not submit the A-4 form, your employer is required to withhold 2.7% of your gross taxable wages. This could result in a higher withholding amount than necessary, depending on your actual tax liability.

Can nonresident employees use the Arizona A-4 form?

Yes, nonresident employees who earn compensation while working in Arizona may also use the Arizona A-4 form. They can elect to have Arizona income taxes withheld from their wages, depending on their individual circumstances. It is important for nonresidents to assess their tax liability before making this election.

What if my tax situation changes during the year?

If your tax situation changes and you expect to have a tax liability, you should promptly fill out a new A-4 form. This will allow you to adjust your withholding percentage to better match your expected tax obligation for the remainder of the year.

How does the withholding affect my tax return?

The amount withheld from your paycheck is applied to your Arizona income tax due when you file your tax return. If too much tax is withheld, you may receive a refund. Conversely, if too little is withheld, you may owe additional taxes when you file your return. It is important to choose an appropriate withholding percentage to avoid surprises at tax time.

Dos and Don'ts

When filling out the Arizona A-4 form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do print your full name clearly at the top of the form.

- Do choose only one withholding percentage option from the list provided.

- Do sign and date the form to validate your election.

- Do submit the completed form to your employer within the first five days of employment.

- Do keep a copy of the form for your records.

- Don't leave any required fields blank; this can delay processing.

- Don't select more than one withholding percentage option, as this will create confusion.

- Don't forget to update your withholding percentage if your tax situation changes during the year.

- Don't assume that zero withholding means you have no tax obligations; you may still owe taxes when filing.

- Don't submit the form without checking for errors, as mistakes can lead to incorrect withholding.

Similar forms

The Arizona A-4 form is similar to the IRS Form W-4, which is used by employees to indicate their tax withholding preferences to their employers. Both forms allow individuals to select a percentage of their income to be withheld for tax purposes. The W-4 focuses on federal income tax withholding, while the A-4 specifically addresses Arizona state income tax. Employees can indicate their desired withholding rate on both forms, ensuring that the correct amount is deducted from their paychecks to meet their tax obligations.

Another document similar to the Arizona A-4 is the California Form DE 4. Like the A-4, the DE 4 allows employees to choose their state income tax withholding rates. California residents can select a percentage of their wages to be withheld, just as Arizona employees do. Both forms serve the same purpose of ensuring that the correct amount of state tax is withheld from employees’ paychecks, but they are tailored to the specific tax laws of their respective states.

The New York State Form IT-2104 is also comparable to the Arizona A-4. This form is used by New York employees to determine their state income tax withholding. Employees can select their desired withholding allowances, which directly impacts the amount withheld from their paychecks. Similar to the A-4, the IT-2104 requires employees to assess their tax situation and choose a withholding rate that aligns with their expected tax liability for the year.

The Texas Employee Withholding Certificate serves a similar function, although Texas does not impose a state income tax. This document is used to indicate whether an employee should have federal taxes withheld from their pay. While the A-4 focuses on state income tax, both documents require employees to provide information about their tax situation to ensure proper withholding from their earnings.

The Florida Employee Withholding Certificate is another relevant document. Like Texas, Florida does not have a state income tax, but this form is used for federal tax withholding. Employees can indicate their withholding preferences to ensure that the right amount of federal taxes is deducted from their paychecks. Although the A-4 is specific to state income tax, both forms share the common goal of helping employees manage their tax liabilities effectively.

Similarly, the Illinois Employee's Withholding Allowance Certificate (Form IL-W-4) allows employees to specify their state income tax withholding preferences. Employees in Illinois can claim allowances that affect their withholding amount, similar to how Arizona employees can choose a percentage on the A-4. Both forms are essential for ensuring that the correct amount of state taxes is withheld based on individual circumstances.

Lastly, the Massachusetts Employee’s Withholding Exemption Certificate is akin to the Arizona A-4. This form allows Massachusetts employees to claim exemptions and determine their state income tax withholding. Like the A-4, it requires employees to evaluate their tax situation and select an appropriate withholding amount. Both documents are crucial for helping employees manage their tax obligations and ensuring compliance with state tax laws.

Key takeaways

When filling out and using the Arizona A-4 form, keep these key takeaways in mind:

- Understand Your Withholding Options: You can choose a withholding rate ranging from 0.8% to 5.1% of your gross taxable wages. Alternatively, you can elect to have no withholding if you expect no tax liability.

- Complete the Form Promptly: New employees should fill out the A-4 form within the first five days of employment to ensure the correct withholding rate is applied to their paychecks.

- Changing Your Withholding: Current employees can change their withholding percentage at any time by submitting a new A-4 form to their employer.

- Provide Accurate Information: Ensure that all personal information, including your name, Social Security number, and address, is filled out accurately to avoid issues with tax withholding.

- Know Your Responsibilities: Electing a zero withholding percentage does not exempt you from paying taxes. If your tax situation changes during the year, update your withholding by submitting a new form.

Common mistakes

-

Neglecting to Provide Accurate Personal Information: Many individuals fail to accurately fill in their full name, social security number, or home address. This can lead to processing delays or complications with tax filings.

-

Choosing More Than One Withholding Rate: Some people mistakenly check multiple boxes for the withholding percentage options. Only one option should be selected to ensure correct tax withholding.

-

Forgetting to Sign and Date the Form: A common oversight is not signing or dating the form. Without a signature and date, the form is considered incomplete and may not be accepted by the employer.

-

Misunderstanding Gross Taxable Wages: Individuals often confuse gross taxable wages with net pay. It is crucial to understand that gross taxable wages refer to the total earnings before any deductions.

-

Not Submitting the Form in a Timely Manner: New employees should complete the form within the first five days of employment. Delays can result in automatic withholding at the default rate of 2.7%.

-

Failing to Update the Form When Necessary: Current employees sometimes forget to file a new Form A-4 when their tax situation changes. If a tax liability arises, it is important to update the withholding percentage accordingly.

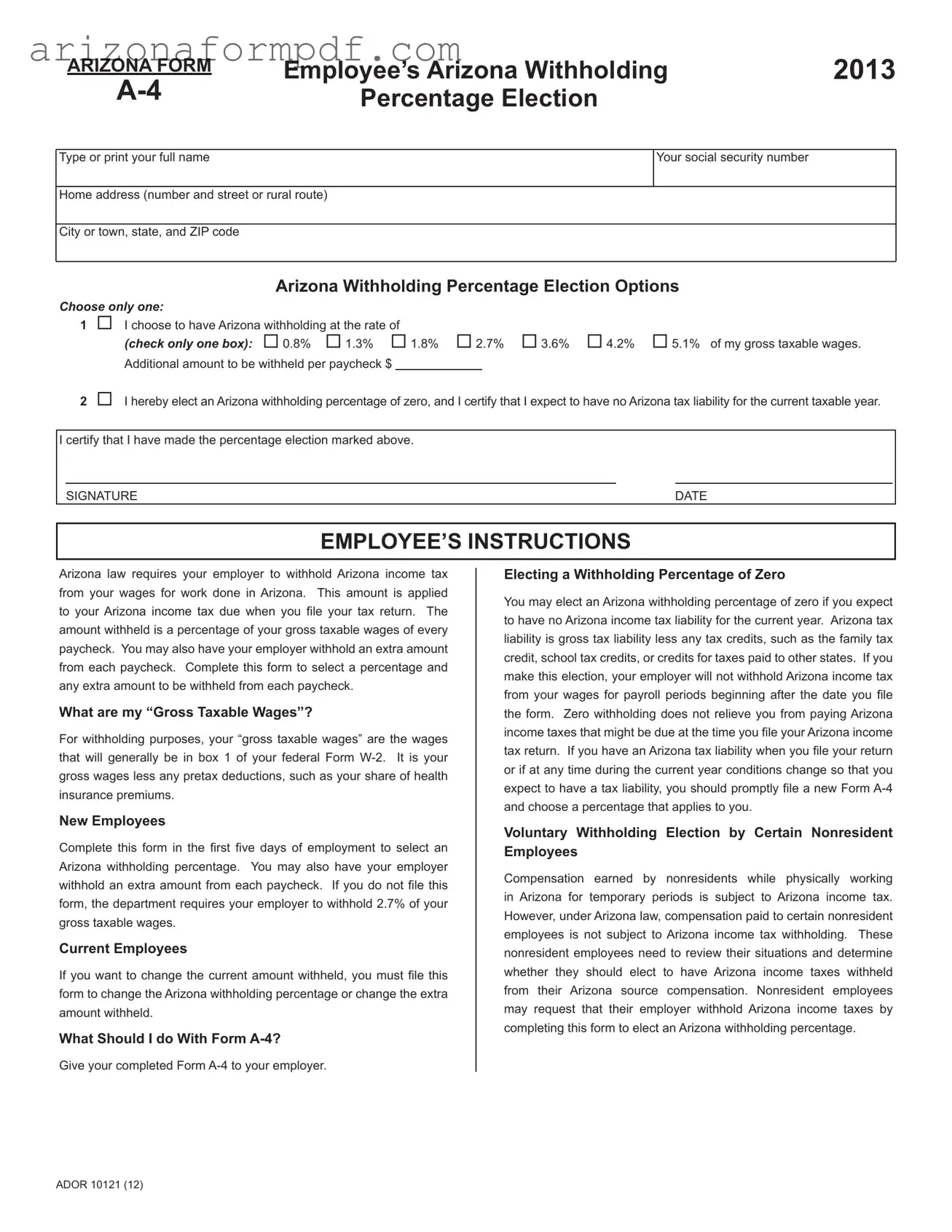

Document Preview

ARIZONA FORM |

Employee’s Arizona Withholding |

2013 |

|

Percentage Election |

|

||

|

|

Type or print your full name

Your social security number

Home address (number and street or rural route)

City or town, state, and ZIP code

Arizona Withholding Percentage Election Options

Choose only one:

1I choose to have Arizona withholding at the rate of

(check only one box): |

0.8% |

1.3% |

1.8% |

2.7% |

3.6% |

4.2% |

5.1% of my gross taxable wages. |

|

Additional amount to be withheld per paycheck $ |

|

|

|

|

|

|

||

2I hereby elect an Arizona withholding percentage of zero, and I certify that I expect to have no Arizona tax liability for the current taxable year.

I certify that I have made the percentage election marked above.

SIGNATURE |

DATE |

EMPLOYEE’S INSTRUCTIONS

Arizona law requires your employer to withhold Arizona income tax from your wages for work done in Arizona. This amount is applied to your Arizona income tax due when you file your tax return. The amount withheld is a percentage of your gross taxable wages of every paycheck. You may also have your employer withhold an extra amount from each paycheck. Complete this form to select a percentage and any extra amount to be withheld from each paycheck.

What are my “Gross Taxable Wages”?

For withholding purposes, your “gross taxable wages” are the wages that will generally be in box 1 of your federal Form

New Employees

Complete this form in the first five days of employment to select an Arizona withholding percentage. You may also have your employer withhold an extra amount from each paycheck. If you do not file this form, the department requires your employer to withhold 2.7% of your gross taxable wages.

Current Employees

If you want to change the current amount withheld, you must file this form to change the Arizona withholding percentage or change the extra amount withheld.

What Should I do With Form

Give your completed Form

Electing a Withholding Percentage of Zero

You may elect an Arizona withholding percentage of zero if you expect to have no Arizona income tax liability for the current year. Arizona tax liability is gross tax liability less any tax credits, such as the family tax credit, school tax credits, or credits for taxes paid to other states. If you make this election, your employer will not withhold Arizona income tax from your wages for payroll periods beginning after the date you file the form. Zero withholding does not relieve you from paying Arizona income taxes that might be due at the time you file your Arizona income tax return. If you have an Arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should promptly file a new Form

Voluntary Withholding Election by Certain Nonresident Employees

Compensation earned by nonresidents while physically working in Arizona for temporary periods is subject to Arizona income tax. However, under Arizona law, compensation paid to certain nonresident employees is not subject to Arizona income tax withholding. These nonresident employees need to review their situations and determine whether they should elect to have Arizona income taxes withheld from their Arizona source compensation. Nonresident employees may request that their employer withhold Arizona income taxes by completing this form to elect an Arizona withholding percentage.

ADOR 10121 (12)

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose of Form A-4 | The Arizona A-4 form allows employees to select a percentage of their gross taxable wages for state income tax withholding. |

| Withholding Rates | Employees can choose from several withholding rates: 0.8%, 1.3%, 1.8%, 2.7%, 3.6%, 4.2%, or 5.1% of their gross taxable wages. |

| Zero Withholding Option | Employees may elect a withholding percentage of zero if they expect no Arizona tax liability for the current taxable year. |

| Filing Deadline for New Employees | New employees must complete the A-4 form within the first five days of employment to select their withholding percentage. |

| Governing Law | The Arizona A-4 form is governed by Arizona Revised Statutes § 43-401, which outlines income tax withholding requirements. |