Fill Out Your Arizona A 4P Form

The Arizona A 4P form is a crucial document for individuals receiving annuity or pension payments in the state. Designed to facilitate voluntary income tax withholding, it provides options for recipients to choose their preferred withholding rate from their taxable distributions. This form allows annuitants to select from several percentage rates, ranging from 0.8% to 5.1%, enabling them to manage their tax obligations effectively. Additionally, it includes the option to specify an additional amount to be withheld per distribution, further tailoring the withholding process to individual financial situations. It's important to note that this form is not applicable to all types of payments; for instance, it cannot be used for lump sum distributions or certain government pensions. Once completed, the A 4P form should be sent directly to the payor of the annuity or pension, rather than to the Arizona Department of Revenue. Furthermore, annuitants have the flexibility to terminate their withholding election at any time, either by using the A 4P form again or by submitting a written request to their payor. Understanding the nuances of this form can help individuals navigate their tax responsibilities with greater ease.

Guide to Writing Arizona A 4P

Completing the Arizona A-4P form is straightforward. Follow the steps below carefully to ensure your information is accurate. After filling out the form, submit it to the payor of your annuity or pension. Do not send it to the Arizona Department of Revenue.

- Provide your full name. Write your last name, first name, and middle initial in the designated space.

- Enter your Social Security number. Fill in the appropriate box with your SSN.

- Fill in your home address. Include the number and street or rural route, city or town, state, and ZIP code.

- Provide your telephone number. Write your contact number in the specified area.

- Include your annuity contract claim or ID number. This number should be listed clearly.

- Select your withholding option. Choose only one of the two options provided:

- Option 1: Elect to have Arizona income taxes withheld. Check the box for your chosen withholding rate (0.8%, 1.3%, 1.8%, 2.7%, 3.6%, 4.2%, or 5.1%). If you want an additional amount withheld, specify that amount.

- Option 2: Elect to terminate any prior election for withholding.

- Sign and date the form. Your signature and the date are required to validate the form.

Browse Popular Forms

Arizona Income Tax Forms - By signing the form, employees certify their withholding choices and eligibility.

How to Make Contracts for Business - Seller disclosures are key in this contract to alert buyers of any known issues with the property.

140a - Voluntary donations to various funds may also be included on the form.

Common Questions

What is the purpose of the Arizona A 4P form?

The Arizona A 4P form is used by individuals who receive annuity or pension payments to request voluntary withholding of Arizona income tax from those payments. By completing this form, you can choose a specific percentage of your taxable distribution to be withheld for state income tax purposes, helping you manage your tax obligations more effectively.

Who is eligible to use the Arizona A 4P form?

This form is available to anyone receiving an annuity or pension that qualifies under Arizona law. It is important to note that not all payments are eligible. For example, you cannot use this form for nonperiodic payments, lump sum distributions, or distributions from individual retirement accounts that do not meet the definition of an annuity. Additionally, Social Security pensions, Veteran’s Administration annuities, and Railroad Retirement pensions are also excluded.

How do I submit the Arizona A 4P form?

To submit the form, you should send it directly to the payor of your annuity or pension. It is crucial not to send the form to the Arizona Department of Revenue, as it will not be processed there. Ensure that all required information, such as your name, Social Security number, and the selected withholding percentage, is filled out accurately to avoid any delays.

Can I change or terminate my withholding election after submitting the form?

Yes, you can change or terminate your voluntary withholding election at any time. To do this, you can either submit a new Arizona A 4P form indicating your desire to terminate withholding or send a written notice to your payor requesting the termination. It is advisable to keep a copy of any correspondence for your records.

What information will I receive regarding the income tax withheld?

Your payor will provide you with a statement detailing the total amount of your pension or annuity payments and the total Arizona income tax withheld from these payments for the calendar year. This statement is typically sent to you in early the following year, allowing you to accurately report your income and tax withholding when filing your state tax return.

Dos and Don'ts

When filling out the Arizona A-4P form, it is essential to ensure that your submission is accurate and complete. Here are some important do's and don'ts to consider:

- Do print your full name clearly, including your last name, first name, and middle initial.

- Do provide your social security number to avoid any processing delays.

- Do indicate your home address accurately, including the city, state, and ZIP code.

- Do choose only one withholding option from the provided percentage rates.

- Don't forget to sign and date the form before submission.

- Don't send the form to the Arizona Department of Revenue; it should go to the payor of your annuity or pension.

- Don't elect withholding for nonperiodic payments or distributions that do not qualify as annuities.

- Don't overlook the option to terminate your withholding election if your circumstances change.

Similar forms

The Arizona A 4P form is similar to the IRS Form W-4, which is used for federal income tax withholding. Both forms allow individuals to specify how much tax should be withheld from their payments. While the W-4 is generally used for wages and salaries, the A 4P is specific to annuity and pension payments. Each form requires the individual to provide personal information and select a withholding rate, ensuring that the appropriate amount of tax is deducted from their income.

Another comparable document is the IRS Form W-4P, which is specifically designed for pension and annuity payments. Like the A 4P form, the W-4P allows recipients to choose their withholding options based on their tax situation. Both forms provide options for withholding a specific percentage or a flat dollar amount, enabling individuals to manage their tax liabilities effectively. The W-4P, however, is used at the federal level, while the A 4P focuses on state income tax withholding in Arizona.

The Arizona A 4P form is also similar to the IRS Form 1099-R, which reports distributions from pensions, annuities, and other retirement plans. While the 1099-R itself does not determine withholding, it provides essential information about the amounts distributed and the taxes withheld. The A 4P form relies on the information from the 1099-R to calculate the appropriate state tax withholding, making them interconnected in the tax reporting process.

In addition, the California Form DE 4 serves a similar purpose for California residents. This form allows individuals to request state income tax withholding from their wages, similar to how the A 4P allows for withholding from annuity payments. Both forms require personal information and allow individuals to specify their withholding preferences, though they are specific to their respective states.

The New York State IT-2104 form is another document that shares similarities with the Arizona A 4P form. IT-2104 is used to determine withholding for New York state income tax. Like the A 4P, it requires individuals to provide personal information and select a withholding rate. Both forms aim to help taxpayers manage their tax obligations based on their income sources, whether from pensions or wages.

The Florida W-4 form, while not directly related to pensions, is also a similar document in terms of income tax withholding. It allows employees to choose how much state income tax is withheld from their paychecks. Although Florida does not have a state income tax, the structure of the W-4 mirrors the A 4P in that it collects personal information and allows for withholding elections.

The Texas Form W-4 is another document that, like the A 4P, facilitates income tax withholding. Texas, however, does not impose a state income tax. The W-4 form allows employees to determine their federal withholding, which can be similar in purpose to the A 4P in terms of managing tax obligations. Both forms require individuals to provide personal details and withholding preferences, even if the tax implications differ by state.

The Massachusetts Form M-4 is similar to the Arizona A 4P form in that it allows individuals to specify their state income tax withholding preferences. Both forms require personal information and provide options for withholding rates. While the A 4P is specific to annuity payments, the M-4 is used for wages and other income types, illustrating the common purpose of managing tax withholding across different income sources.

Finally, the Pennsylvania Form REV-419 is relevant as it relates to state income tax withholding. This form allows employees to specify their Pennsylvania state tax withholding. Like the A 4P, it requires personal information and offers options for withholding amounts. Both forms serve to ensure that individuals meet their tax obligations based on their income, whether from pensions or employment.

Key takeaways

When filling out and using the Arizona A-4P form, consider the following key takeaways:

- Eligibility: This form is for individuals receiving annuity or pension payments who wish to have Arizona income tax withheld.

- Personal Information: Provide your full name, social security number, home address, and contact details accurately.

- Withholding Options: You can choose a specific percentage for withholding from your annuity or pension payments, ranging from 0.8% to 5.1%.

- Termination of Withholding: If you wish to stop withholding, you can either submit a new A-4P form or send a written notice to your payor.

- Non-Eligible Payments: Arizona income tax cannot be withheld from nonperiodic payments, lump sum distributions, or certain retirement benefits like Social Security.

- Submission: Send the completed form directly to the payor of your annuity or pension, not to the Arizona Department of Revenue.

- Confirmation: After submitting, the payor will provide a statement detailing the total amount withheld for the year.

- Ongoing Withholding: The withholding will continue until you notify the payor to stop it.

- Record Keeping: Keep a copy of the completed form for your records in case of future inquiries.

- Annual Reporting: You will receive a summary of your income tax withheld early in the following year, which is essential for tax filing.

Common mistakes

-

Incorrect Personal Information: One common mistake is failing to provide complete and accurate personal details. This includes your full name, social security number, and home address. Any errors can delay processing or lead to issues with tax withholding.

-

Choosing Multiple Withholding Rates: Another frequent error occurs when individuals check more than one withholding rate option. The form clearly states to select only one rate. Selecting multiple options can cause confusion and may result in the form being rejected.

-

Missing Signature: It’s essential to remember to sign the form. Some people forget this step, which is crucial for validating your request. Without a signature, the form cannot be processed.

-

Incorrect Submission: Many individuals mistakenly send the form to the Arizona Department of Revenue instead of the payor of their annuity or pension. This can lead to delays and complications, as the form must go to the right place for processing.

-

Not Understanding Eligibility: Lastly, some people fill out the form without realizing they may not be eligible for withholding. It's important to understand the definitions of an annuity and the types of payments that qualify. Failing to do so can result in unnecessary complications.

Document Preview

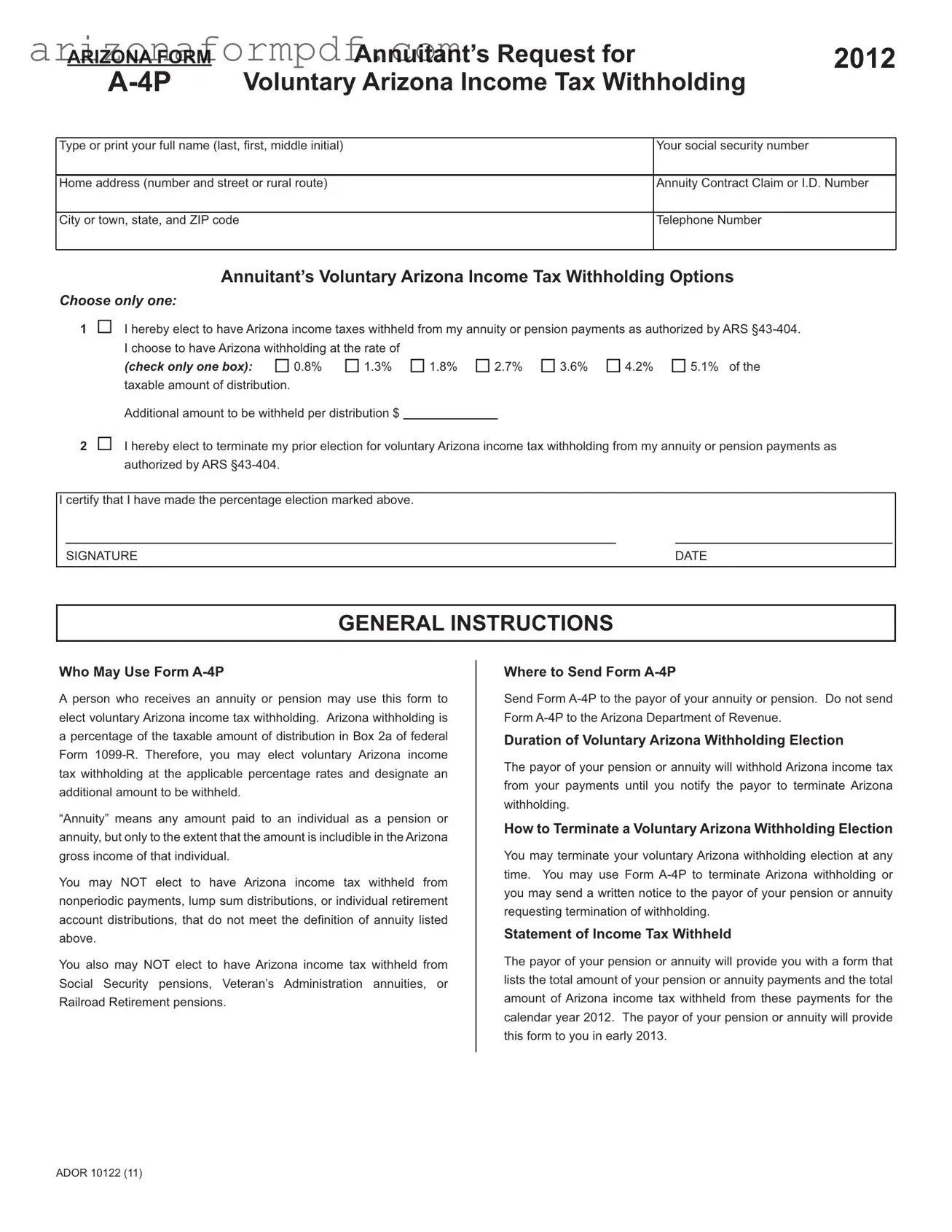

ARIZONA FORM |

Annuitant’s Request for |

2012 |

Voluntary Arizona Income Tax Withholding |

|

Type or print your full name (last, fi rst, middle initial)

Your social security number

Home address (number and street or rural route)

Annuity Contract Claim or I.D. Number

City or town, state, and ZIP code

Telephone Number

Annuitant’s Voluntary Arizona Income Tax Withholding Options

Choose only one:

1! I hereby elect to have Arizona income taxes withheld from my annuity or pension payments as authorized by ARS

(check only one box): ! 0.8% ! 1.3% ! 1.8% ! 2.7% ! 3.6% ! 4.2% ! 5.1% of the taxable amount of distribution.

Additional amount to be withheld per distribution $

2! I hereby elect to terminate my prior election for voluntary Arizona income tax withholding from my annuity or pension payments as authorized by ARS

I certify that I have made the percentage election marked above.

SIGNATURE |

DATE |

GENERAL INSTRUCTIONS

Who May Use Form

A person who receives an annuity or pension may use this form to elect voluntary Arizona income tax withholding. Arizona withholding is a percentage of the taxable amount of distribution in Box 2a of federal Form

“Annuity” means any amount paid to an individual as a pension or annuity, but only to the extent that the amount is includible in the Arizona gross income of that individual.

You may NOT elect to have Arizona income tax withheld from nonperiodic payments, lump sum distributions, or individual retirement account distributions, that do not meet the defi nition of annuity listed above.

You also may NOT elect to have Arizona income tax withheld from Social Security pensions, Veteran’s Administration annuities, or Railroad Retirement pensions.

Where to Send Form

Send Form

Duration of Voluntary Arizona Withholding Election

The payor of your pension or annuity will withhold Arizona income tax from your payments until you notify the payor to terminate Arizona withholding.

How to Terminate a Voluntary Arizona Withholding Election

You may terminate your voluntary Arizona withholding election at any time. You may use Form

Statement of Income Tax Withheld

The payor of your pension or annuity will provide you with a form that lists the total amount of your pension or annuity payments and the total amount of Arizona income tax withheld from these payments for the calendar year 2012. The payor of your pension or annuity will provide this form to you in early 2013.

ADOR 10122 (11)

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose of Form A-4P | This form allows individuals receiving annuity or pension payments to elect voluntary Arizona income tax withholding. |

| Governing Law | Form A-4P is authorized under Arizona Revised Statutes (ARS) §43-404, which outlines the rules for income tax withholding. |

| Withholding Options | Annuitants can choose from various withholding rates, ranging from 0.8% to 5.1%, based on the taxable amount of the distribution. |

| Submission Instructions | Form A-4P must be sent directly to the payor of the annuity or pension, not to the Arizona Department of Revenue. |