Fill Out Your Arizona A1 Wp Form

The Arizona A1-WP form plays a crucial role for employers in managing their withholding tax obligations. This form is specifically designed for those who need to make multiple Arizona withholding payments within a calendar quarter. It’s important to note that employers who are required to make only quarterly payments should not use this form, as it is tailored for those with more frequent payment schedules. The A1-WP requires essential information such as the Employer Identification Number (EIN), the quarter and year for which the payment is made, and the total amount being submitted. Employers must also provide their contact information, ensuring that the Arizona Department of Revenue can easily reach them if necessary. Timeliness is critical; Arizona law mandates that certain taxpayers align their withholding tax payments with federal withholding deadlines. Missing these deadlines can lead to significant penalties. For those who prefer electronic options, there are alternatives available, including electronic funds transfer (EFT) and online payments, although these require separate processes and do not involve the A1-WP form. Understanding the nuances of this form is essential for compliance and to avoid unnecessary penalties.

Guide to Writing Arizona A1 Wp

Filling out the Arizona A1-WP form requires careful attention to detail. This process ensures that your withholding tax payments are submitted correctly. Below are the steps to complete the form accurately.

- Obtain the form: Download the Arizona A1-WP form from the Arizona Department of Revenue website or obtain a physical copy.

- Fill in your Taxpayer Information: In the designated section, type or print your name, address, and business telephone number. If you have a foreign address, follow the specific format for entering that information.

- Enter your Employer Identification Number (EIN): Write your EIN in the appropriate box. If you do not have one, you can obtain it from the Internal Revenue Service.

- Select the Quarter: Choose the quarter for which you are making the payment (1, 2, 3, or 4) based on the months indicated on the form.

- Enter the Year: Write the four-digit year for which the payment is being made.

- Fill in the Amount of Payment: Clearly indicate the total amount you are enclosing. Remember, do not submit the form if the payment is zero or if you are listing prior payments.

- Make your Payment: Write a check payable to the Arizona Department of Revenue. Ensure that you include your EIN on the check.

- Mail the Form: Send the top portion of the completed form along with your payment to: Arizona Department of Revenue, PO Box 29085, Phoenix, AZ 85038-9085.

Once you have completed these steps, your payment will be processed by the Arizona Department of Revenue. It is crucial to ensure that all information is accurate to avoid any penalties or delays. Stay informed about your obligations to maintain compliance with Arizona tax laws.

Browse Popular Forms

Az Unclaimed - Protecting consumer interests is a priority of the report.

Child's Immunization Record - The exemption applies to children attending preschools and child care facilities.

Common Questions

What is the Arizona A1-WP form used for?

The Arizona A1-WP form is used by employers to make withholding tax payments to the Arizona Department of Revenue. It is specifically designed for those employers who need to submit more than one payment within a calendar quarter. Employers making quarterly payments or those using electronic funds transfer should not use this form.

Who is required to use the A1-WP form?

Employers who are required to make multiple withholding tax payments during a calendar quarter must use the A1-WP form. If an employer anticipates their Arizona withholding tax liability for the year to be $5,000 or more, they are required to make payments via electronic funds transfer instead of using this form.

How do I fill out the A1-WP form?

To complete the A1-WP form, you need to provide your employer identification number (EIN), the quarter and year for which the payment is being made, and the amount of the payment. Ensure that all information is typed or printed clearly in the designated boxes. If you have a foreign address, follow the specified format for entering your information.

Where do I send the completed A1-WP form?

Once you have completed the A1-WP form, mail the top portion along with your payment to the Arizona Department of Revenue at PO Box 29085, Phoenix, AZ 85038-9085. Make sure to include your EIN on the payment check, which should be made payable to the Arizona Department of Revenue.

What happens if I fail to submit the A1-WP form on time?

Failure to submit the A1-WP form and the corresponding payment on time may result in a 25% penalty, in addition to other penalties and interest that may apply. It is crucial to adhere to the deadlines to avoid these financial repercussions.

Can I make payments electronically instead of using the A1-WP form?

Yes, employers can make their withholding payments electronically through the Arizona Department of Revenue's website at www.AZTaxes.gov. This option is available for registered users and allows payments via e-check or credit card, though a fee may apply for credit card transactions.

What if my payment amount is zero?

If the payment amount is zero or if no payment is enclosed, do not submit the A1-WP form. Additionally, do not use this form to list prior payments made during the quarter or to claim a credit as an overpayment.

What are the penalties for not using electronic funds transfer when required?

Employers who are required to make withholding payments via electronic funds transfer but fail to do so will face a penalty of 5% of the amount that was not paid through EFT. It is essential to comply with the electronic payment requirements to avoid these penalties.

How can I find more information about the A1-WP form?

For more detailed information regarding the A1-WP form and the associated requirements, you can refer to the Arizona Department of Revenue's website or consult the relevant Arizona Administrative Code rules. This will provide you with comprehensive guidance on your obligations as an employer.

Dos and Don'ts

When filling out the Arizona A1-WP form, it’s important to follow specific guidelines to ensure your submission is correct. Here’s a list of things to do and avoid:

- Do ensure that your Employer Identification Number (EIN) is entered correctly.

- Do make your check payable to the Arizona Department of Revenue and include your EIN on the payment.

- Do mail the top portion of the form along with your payment to the specified address.

- Do enter the correct quarter and year for which you are making the payment.

- Don't submit the form if your payment amount is zero or if no payment is enclosed.

- Don't use this form if you are making payments electronically or if you are required to use electronic funds transfer (EFT).

Similar forms

The Arizona Form A1-WP is similar to the IRS Form 941, which is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. Both forms require employers to report tax payments on a quarterly basis. While the A1-WP focuses specifically on Arizona state income tax withholding, Form 941 encompasses federal withholding obligations. Employers must ensure timely submission of both forms to avoid penalties, highlighting the importance of understanding state versus federal requirements.

Another document that parallels the A1-WP is the Arizona Form A1-APR, which is the annual reconciliation of withholding tax. Like the A1-WP, the A1-APR is used to report withholding tax amounts, but it consolidates data for the entire year rather than quarterly. This form is essential for employers to reconcile their quarterly payments and ensure that they have met their annual withholding obligations. Both forms require accurate taxpayer information and payment amounts, underscoring the necessity for employers to maintain precise records throughout the year.

The California Employer's Quarterly Payroll Tax Form (DE 9) is also similar to the A1-WP. Employers in California use this form to report wages paid and taxes withheld from employees. Both forms are filed quarterly and require similar information, such as the employer's identification number and total payment amounts. However, the DE 9 is specific to California state taxes, while the A1-WP pertains to Arizona. This similarity emphasizes the common practices across states in managing payroll tax responsibilities.

Form 943, the Employer's Annual Federal Tax Return for Agricultural Employees, shares characteristics with the A1-WP as well. This form is used by agricultural employers to report and pay federal income tax withheld from their employees. Both forms require employers to submit payments based on the amount of tax withheld. While the A1-WP is state-specific, Form 943 caters to a particular industry, highlighting the tailored approach to tax reporting based on employment type and location.

The New York State Form NYS-1 is another document that resembles the A1-WP. This form is used by New York employers to report and pay withholding tax for their employees. Similar to the A1-WP, NYS-1 is filed periodically, and employers must provide details such as the amount of tax withheld and their identification number. Both forms underscore the importance of compliance with state tax laws, as failure to submit them accurately can lead to penalties.

Employers may also encounter the Texas Form 05-102, which is the Texas Employer's Quarterly Report. This form is comparable to the A1-WP in that it is used to report wages and taxes withheld from employees on a quarterly basis. While the A1-WP focuses on Arizona state income tax, the Texas form addresses unemployment taxes. This highlights the diverse nature of tax reporting requirements across states while maintaining a consistent quarterly reporting structure.

Another similar document is the IRS Form 945, which is used to report federal income tax withheld from nonpayroll payments. Like the A1-WP, this form requires employers to report the total amount of tax withheld, but it specifically targets nonpayroll income. Both forms necessitate accurate record-keeping and timely submission to avoid penalties, showcasing the critical nature of compliance in different payment contexts.

Lastly, the Florida Form RT-6 serves a similar purpose to the A1-WP. This form is used by Florida employers to report and pay state unemployment tax on a quarterly basis. Both forms require detailed information about the employer and the amounts owed. While the A1-WP focuses on income tax withholding, the RT-6 addresses unemployment tax, illustrating the variety of tax obligations that employers must navigate depending on their location.

Key takeaways

Here are key takeaways about filling out and using the Arizona A1-WP form:

- Purpose: The A1-WP form is used by employers to transmit Arizona withholding payments when multiple payments are due within a calendar quarter.

- Quarterly Payments: This form should not be used for employers making quarterly withholding payments; it is specifically for those making more than one payment per quarter.

- Electronic Payments: Employers making payments electronically or via the Internet should not use this form. Instead, they can register online at www.AZTaxes.gov.

- Employer Identification Number: Ensure to include your Employer Identification Number (EIN) on the form, which can be obtained from the IRS.

- Payment Amount: Clearly enter the amount of the payment. Do not submit the form if the payment is zero or if no payment is enclosed.

- Penalties: Failure to make required payments on time may result in a 25% penalty, in addition to other penalties and interest.

- Foreign Addresses: If applicable, enter foreign addresses in the specified order and avoid abbreviating the country’s name.

- Mailing Instructions: Send the completed top portion of the form along with payment to the Arizona Department of Revenue at the designated address.

Common mistakes

-

Inaccurate Employer Identification Number (EIN): One common mistake is entering an incorrect EIN. This number is crucial for the Arizona Department of Revenue to identify your business. Double-check the number to ensure it matches what you received from the IRS.

-

Incorrect Quarter or Year: Failing to select the correct quarter or year can lead to complications. Each quarter corresponds to specific months, and entering the wrong information could delay processing or result in penalties. Always verify your entries against the provided charts.

-

Omitting Required Payment Amount: Another frequent error is leaving the payment amount blank or entering zero. The form should only be submitted if a payment is enclosed. If there is no payment, do not submit the A1-WP form, as it is unnecessary and could cause confusion.

-

Failure to Follow Submission Guidelines: Many individuals overlook the instructions for mailing the form. Ensure that you send the top portion with payment to the correct address: Arizona Department of Revenue, PO Box 29085, Phoenix, AZ 85038-9085. This step is vital to avoid delays in processing your payment.

Document Preview

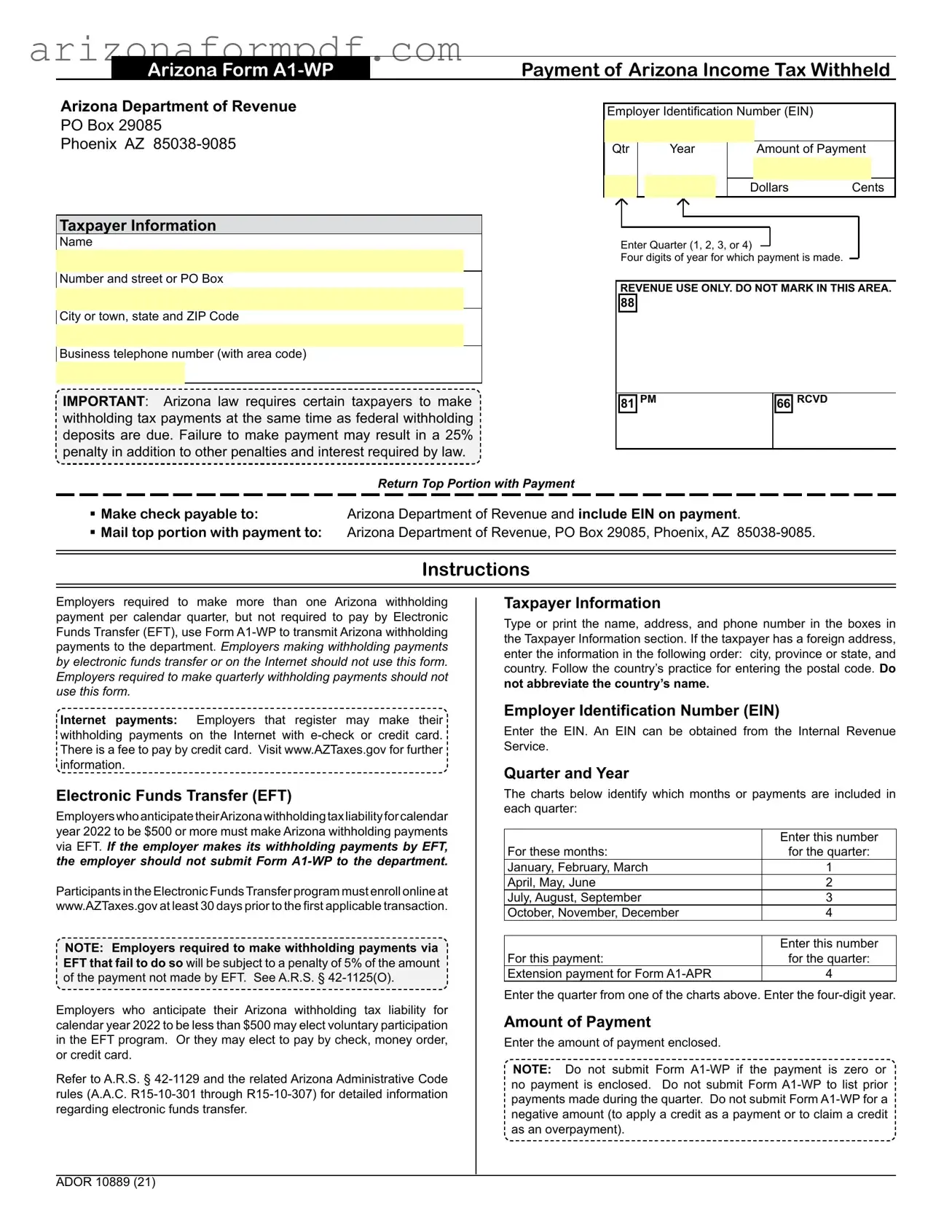

Arizona Form

Payment of Arizona Income Tax Withheld

Arizona Department of Revenue

PO Box 29085

Phoenix AZ

Employer Identification Number (EIN) |

|

||

Qtr |

Year |

Amount of Payment |

|

Q Y Y Y Y |

Dollars |

Cents |

|

Taxpayer Information

Name

Number and street or PO Box

City or town, state and ZIP Code

Business telephone number (with area code)

IMPORTANT: Arizona law requires certain taxpayers to make withholding tax payments at the same time as federal withholding deposits are due. Failure to make payment may result in a 25% penalty in addition to other penalties and interest required by law.

Return Top Portion with Payment

Enter Quarter (1, 2, 3, or 4)

Four digits of year for which payment is made.

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

88

81 PM |

66 RCVD |

|

|

Make check payable to:Arizona Department of Revenue and include EIN on payment.

Mail top portion with payment to: Arizona Department of Revenue, PO Box 29085, Phoenix, AZ

Instructions

Employers required to make more than one Arizona withholding payment per calendar quarter, but not required to pay by Electronic Funds Transfer (EFT), use Form

Internet payments: Employers that register may make their withholding payments on the Internet with

Electronic Funds Transfer (EFT)

EmployerswhoanticipatetheirArizonawithholdingtaxliabilityforcalendar year 2022 to be $500 or more must make Arizona withholding payments via EFT. If the employer makes its withholding payments by EFT, the employer should not submit Form

Participants in the Electronic FundsTransfer program must enroll online at www.AZTaxes.gov at least 30 days prior to the first applicable transaction.

NOTE: Employers required to make withholding payments via EFT that fail to do so will be subject to a penalty of 5% of the amount of the payment not made by EFT. See A.R.S. §

Employers who anticipate their Arizona withholding tax liability for calendar year 2022 to be less than $500 may elect voluntary participation in the EFT program. Or they may elect to pay by check, money order, or credit card.

Refer to A.R.S. §

Taxpayer Information

Type or print the name, address, and phone number in the boxes in the Taxpayer Information section. If the taxpayer has a foreign address, enter the information in the following order: city, province or state, and country. Follow the country’s practice for entering the postal code. Do

not abbreviate the country’s name.

Employer Identification Number (EIN)

Enter the EIN. An EIN can be obtained from the Internal Revenue Service.

Quarter and Year

The charts below identify which months or payments are included in each quarter:

|

Enter this number |

For these months: |

for the quarter: |

January, February, March |

1 |

April, May, June |

2 |

July, August, September |

3 |

October, November, December |

4 |

|

|

|

Enter this number |

For this payment: |

for the quarter: |

Extension payment for Form |

4 |

Enter the quarter from one of the charts above. Enter the

Amount of Payment

Enter the amount of payment enclosed.

NOTE: Do not submit Form

ADOR 10889 (21)

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Arizona A1-WP form is used by employers to transmit withholding tax payments to the Arizona Department of Revenue. |

| Filing Requirement | Employers who are required to make more than one Arizona withholding payment per calendar quarter must use this form. |

| Electronic Funds Transfer | Employers anticipating a withholding tax liability of $5,000 or more must use electronic funds transfer and are not permitted to submit Form A1-WP. |

| Payment Penalties | Failure to make timely payments may result in a 25% penalty, in addition to other penalties and interest as required by Arizona law. |

| Governing Laws | The form is governed by A.R.S. § 42-1125 and A.R.S. § 42-1129, along with the Arizona Administrative Code rules A.A.C. R15-10-301 through R15-10-307. |