Fill Out Your Arizona Annual Report Form

The Arizona Annual Report form serves as a crucial document for businesses operating within the state, particularly those under the jurisdiction of the Arizona Corporation Commission's Utilities Division. This form is designed to collect essential information about a company's operations, management, and financial status for the year ending December 31. Companies must provide their current business name, mailing address, and contact details, ensuring that all information is accurate and up-to-date. Additionally, the form requires companies to disclose any significant changes during the year, such as ownership transfers or compliance notifications from regulatory authorities. Businesses will also indicate their ownership structure, whether they are a sole proprietor, corporation, or limited liability company, among other classifications. Furthermore, companies must specify the counties they serve and the types of services they are authorized to provide, ranging from telecommunications to other utilities. Lastly, statistical information specific to telecommunications utilities, such as customer numbers and revenue figures, is required to give a comprehensive view of the company's operations in Arizona. Completing this form accurately is vital for maintaining compliance and ensuring continued service authorization in the state.

Guide to Writing Arizona Annual Report

Filling out the Arizona Annual Report form is an important step for companies operating in the state. It ensures that your business remains compliant with state regulations. Below are the steps to complete the form accurately.

- Obtain the Arizona Annual Report form from the Arizona Corporation Commission website or your local office.

- Check the pre-printed company name on the form. If it is incorrect, click the provided link to update it.

- Fill in your current company name and any "doing business as" (DBA) name, if applicable.

- Provide your mailing address, including street, city, state, and zip code.

- Enter your telephone number, fax number, cell number, and email address.

- If applicable, fill in the local office mailing address with the same details as above.

- List your customer service phone number and website address.

- Provide management information, including the name and title of your management contact, and their contact details.

- Fill in the regulatory contact information, including name and contact details.

- List your statutory agent's name and contact information.

- Provide the attorney's name and contact information, if applicable.

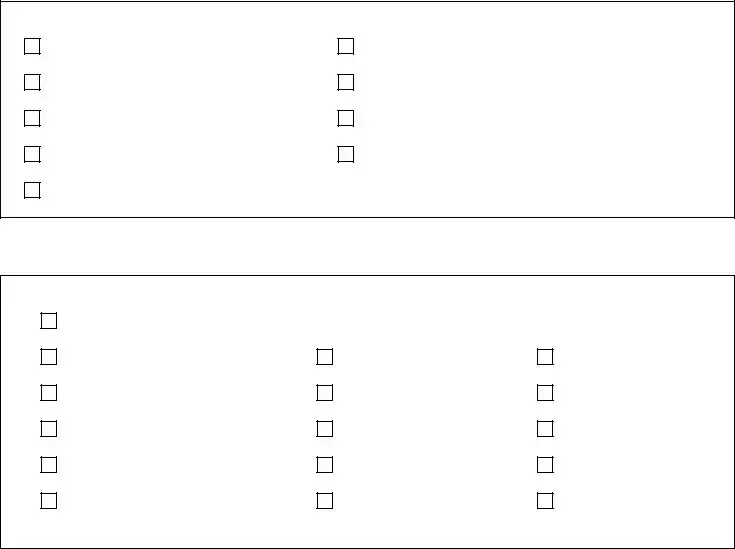

- Indicate if there have been any important changes during the year by checking "Yes" or "No." If yes, provide details.

- Check the appropriate box for your company's ownership type (e.g., Sole Proprietor, Corporation, LLC).

- Select the counties in which your company is certified to provide services.

- Check all services that your company is authorized to provide.

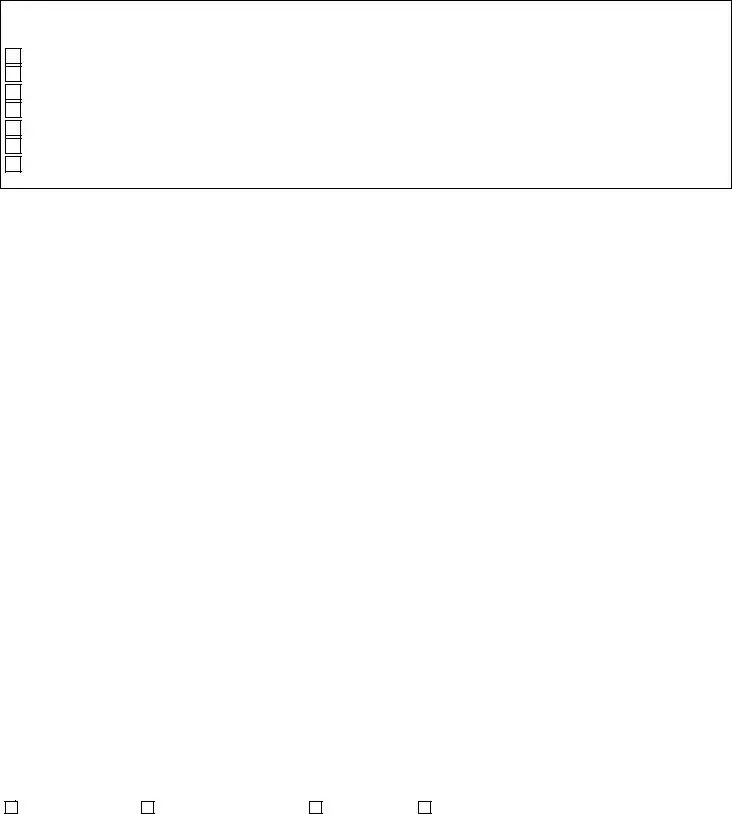

- Complete the statistical information section with the required data related to your telecommunications services.

- Finally, review all information for accuracy before submitting the form.

Browse Popular Forms

Arizona Tax Forms - Applicants should check all relevant boxes to avoid confusion regarding their business operations.

Does Arizona Have Income Tax - Completing the A-4 correctly helps ensure appropriate tax withholding throughout the year.

Arizona Income Tax Forms - Employees can adjust their tax withholding amounts as their financial situations change through the A-4 form.

Common Questions

What is the Arizona Annual Report form?

The Arizona Annual Report form is a document that businesses must submit to the Arizona Corporation Commission. It provides essential information about the company, including its name, address, management details, and services provided. This report helps ensure that the company remains compliant with state regulations.

Who needs to file the Arizona Annual Report?

All corporations, limited liability companies, and certain other business entities operating in Arizona are required to file the Annual Report. This includes those providing telecommunications services. Filing is necessary to maintain good standing with the state and to continue operations legally.

When is the Arizona Annual Report due?

The Annual Report is typically due by December 31st of each year. Companies should plan to submit their report well in advance to avoid any late fees or penalties. It is crucial to check for any specific deadlines that may apply to your business type.

What information is required on the form?

The form requires various details, including the company's name, mailing address, management contacts, statutory agent information, and the services the company is authorized to provide. Additionally, statistical information regarding the company's operations must be included, particularly for telecommunications companies.

What should I do if my company name has changed?

If the pre-printed company name on the form is not current, you can make necessary changes directly on the form. There is a designated section to list the correct company name, including any "doing business as" (DBA) names. Ensure that this information is accurate to avoid compliance issues.

Are there any penalties for failing to file the Annual Report?

Yes, failing to file the Annual Report by the deadline can result in penalties, including late fees and potential loss of good standing with the state. In severe cases, the business may face administrative dissolution. Timely submission is essential to avoid these consequences.

How can I submit the Arizona Annual Report?

The Arizona Annual Report can typically be submitted online through the Arizona Corporation Commission's website. Alternatively, it may be mailed to the appropriate office. It is important to follow the submission guidelines provided on the form to ensure proper processing.

Dos and Don'ts

When filling out the Arizona Annual Report form, there are several important guidelines to keep in mind. Here’s a helpful list of things you should and shouldn’t do:

- Do ensure that the company name is current and matches your legal documents.

- Do provide accurate and complete contact information for all management and regulatory contacts.

- Do check the boxes that accurately reflect the services you are authorized to provide.

- Do include any important changes in ownership or compliance notifications that occurred during the year.

- Don’t leave any sections blank unless they are truly not applicable to your company.

- Don’t forget to double-check your numbers, especially for statistical information related to customers and revenues.

- Don’t neglect to sign and date the form before submission.

- Don’t submit the form without ensuring that all required attachments are included, if applicable.

By following these guidelines, you can help ensure that your Arizona Annual Report is filled out correctly and submitted on time. This not only helps maintain compliance but also reflects positively on your business.

Similar forms

The Arizona Annual Report form shares similarities with the Annual Report form used in Delaware. Both documents require companies to provide essential information about their business, including the company name, address, and contact details. In Delaware, the Annual Report also requires details about the company's directors and officers, similar to the management information section in Arizona's form. Both reports serve the purpose of keeping state authorities informed about the company's current status and ensuring compliance with state regulations.

Another document comparable to the Arizona Annual Report is the California Statement of Information. This form, like Arizona's, must be filed annually and includes information about the company’s business address, management, and statutory agent. Both forms aim to maintain transparency and provide the state with updated information on the company’s operations. The California form also includes sections for disclosing any changes in ownership or management, paralleling the ownership information section found in the Arizona report.

The Texas Franchise Tax Report is another document that resembles the Arizona Annual Report. While the Texas report focuses on the company's financial status and tax obligations, it also requires basic company information, including the name and address. Both reports are essential for maintaining good standing with the respective state authorities. They ensure that companies remain compliant with state laws and regulations, providing a snapshot of the business's operational status.

The New York Biennial Statement is similar in that it requires companies to report their basic information to the state. Although it is filed every two years rather than annually, it serves the same purpose of updating the state on the company’s status. Both documents include sections for management information and statutory agent details, ensuring that state authorities have access to current information about the company’s operations and management structure.

The Florida Annual Report shares characteristics with the Arizona Annual Report as well. Both forms require businesses to provide their official name, address, and contact information. They also include sections for reporting changes in ownership or management. The Florida report, like Arizona's, is crucial for maintaining active status in the state and ensuring compliance with local regulations.

The Illinois Annual Report is another document that mirrors the Arizona form. Both require basic company information, including the name and address, and information about management and ownership. The Illinois report emphasizes the importance of keeping the state informed about the company's structure and operations, similar to the objectives of the Arizona Annual Report.

Finally, the Michigan Annual Corporation Filing is akin to the Arizona Annual Report. Both documents ask for essential details such as the company name, address, and management information. They serve as a means for companies to report their status to the state and ensure compliance with applicable laws. This filing is essential for maintaining good standing and protecting the company's legal status within the state.

Key takeaways

Filing the Arizona Annual Report form is a critical task for businesses operating in the state. Here are key takeaways to ensure a smooth process:

- Update Company Information: Verify that the company name and any "doing business as" (dba) names are current. If changes are needed, make them directly on the form.

- Provide Accurate Contact Details: Ensure all contact information, including addresses, phone numbers, and emails, is correct. This information is vital for regulatory communications.

- Report Changes: If there have been changes in ownership or compliance notifications from regulatory authorities, disclose these details clearly in the designated sections.

- Complete Statistical Information: For telecommunications companies, accurately report statistics such as the number of customers and revenue. This data is essential for compliance and regulatory assessments.

Common mistakes

-

Incorrect Company Name: Failing to update the company name or doing business as (dba) name can lead to significant issues. Ensure that the name matches official records.

-

Incomplete Contact Information: Omitting essential contact details, such as telephone numbers or email addresses, can hinder communication. Double-check that all fields are filled out completely.

-

Missing Ownership Information: Not indicating the correct ownership type can create confusion. Be sure to select the appropriate box for your business structure, whether it is a corporation, partnership, or sole proprietorship.

-

Ignoring Changes During the Year: Failing to report changes in ownership or compliance issues can lead to regulatory penalties. If there have been any changes, provide detailed information as required.

-

Inaccurate Statistical Information: Providing incorrect statistics, such as the number of customers or revenue figures, can misrepresent the company’s status. Carefully verify all numerical data before submission.

-

Neglecting to Check for Compliance: Not confirming whether the company is current on regulatory assessments can result in fines. Ensure that all compliance boxes are checked accurately.

Document Preview

ARIZONA CORPORATION COMMISSION

UTILITIES DIVISION

ANNUAL REPORT MAILING LABEL – MAKE CHANGES AS NECESSARY

Please click here if

Please click here if

Please list current Company name including dba here:

__________________________________________________________________________

ANNUAL REPORT

FOR YEAR ENDING

12

31

2020

FOR COMMISSION USE

ANN 03

20

COMPANY INFORMATION

Company Name (Business Name) _________________________________________________________

Mailing Address ____________________________________________________________________________

(Street)

_________________________________________________________________________________________

(City)(State)(Zip)

__________________________________________________________________________________________

Telephone No. (Include Area Code)Fax No. (Include Area Code)Cell No. (Include Area Code)

Email Address______________________________________________________________________________

Local Office Mailing Address _______________________________________________________________

(Street)

__________________________________________________________________________________________

(City)(State)(Zip)

Customer Service Phone No. (Include Area Code)

Website address ___________________________________________________________________________

MANAGEMENT INFORMATION

Management Contact:_________________________________________________________________________________

Management Contact:_________________________________________________________________________________

(Name)(Title)

_______________________________________________________________________________________________________________________

(Street) |

(City) |

(State) |

(Zip) |

|

|

|

|

Telephone No. (Include Area Code) |

Fax No. (Include Area Code) |

Cell No. (Include Area Code) |

|

Email Address______________________________________________________________________________

Regulatory Contact:___________________________________________________________________

Regulatory Contact:___________________________________________________________________

(Name)

(Street) |

(City) |

(State) |

(Zip) |

|

|

|

|

Telephone No. (Include Area Code) |

Fax No. (Include Area Code) |

Cell No. (Include Area Code) |

|

Email Address______________________________________________________________________________

2

Statutory Agent:__________________________________________________________________________

(Name)

________________________________________________________________________________________________________________________

(Street)(City)(State)(Zip)

____________________________________________________________________________________________________________

Telephone No. (Include Area Code)Fax No. (Include Area CodeCell No. (Include Area Code)

Attorney:________________________________________________________________________________

|

|

(Name) |

|

|

|

|

|

(Street) |

(City) |

(State) |

(Zip) |

_______________________________________________________________________________________________________________________

Telephone No. (Include Area Code)Fax No. (Include Area Code)Cell No. (Include Area Code)

Email Address:_____________________________________________________________________________

Important Changes During the Year

Yes __ No __

For those companies not subject to the affiliated interest rules, has there been a change in ownership or direct control during the year?

If yes, please provide specific details in the box below.

Yes __ No __

Has the company been notified by any other regulatory authorities during the year that they are out of compliance?

If yes, please provide specific details in the box below.

3

OWNERSHIP INFORMATION

Check the following box that applies to your company:

Sole Proprietor (S)

Partnership (P)

Bankruptcy (B)

Receivership (R)

CCorporation (C) (Other than

Other (Describe)______________________________________________________________________

COUNTIES SERVED

Check the box below for the counties in which you are certificated to provide service:

STATEWIDE

APACHE

GILA

LA PAZ

NAVAJO

SANTA CRUZ

COCHISE

GRAHAM

MARICOPA

PIMA

YAVAPAI

COCONINO

GREENLEE

MOHAVE

PINAL

YUMA

4

SERVICES AUTHORIZED TO PROVIDE

Check the following box(es) for the services that you are authorized to provide:

Resold Long Distance/Interexchange Telecommunications Services (RLD) Resold Local Exchange Telecommunications Services (RLEC)

Facilities Based Private Line Telecommunications Services Alternative Operator Service Provider

Other (Specify)______________________________________________________________________

STATISTICAL INFORMATION

TELECOMMUNICATION UTILITIES ONLY

Total number of residential local exchange access lines

Total number of residential local exchange customers

Total number of business local exchange access lines

Total number of business local exchange customers

Total quantity of phone numbers assigned to Company

Total phone numbers assigned to Customers by Company

Total number of long distance residential customers

Total number of long distance business customers

Total intrastate local exchange revenue from Arizona operations

Total intrastate long distance/interexchange revenue from Arizona operations Total intrastate revenue from Arizona operations

Total intrastate income from Arizona operations

Value of Company’s total assets in Arizona Value of Company’s total assets

(Value of Company’s total assets in Arizona)/(Value of company’s total assets)

Current amount of deposits, prepayments, and advances from customers

(not including monthly service bills)

Current amount of performance bond

Current amount of Irrevocable Sight Draft Letter of Credit

Check box if Company is current on payments for:

Regulatory Assessment |

AZ Universal Service Fund |

AZ 911/E911 |

Circuit |

Voice over Internet |

Switched |

Protocol (“VoIP”) |

_______________ |

________________ |

_______________ |

________________ |

_______________ |

________________ |

_______________ |

________________ |

__________________________________

RetailOther

_______________ ________________

__________________________________

__________________________________

$_________________________________

$_________________________________

$_________________________________

$_________________________________

$_________________________________

$_________________________________

%_________________________________

$_________________________________

$_________________________________

$_________________________________

AZ Telephone Relay Service

5

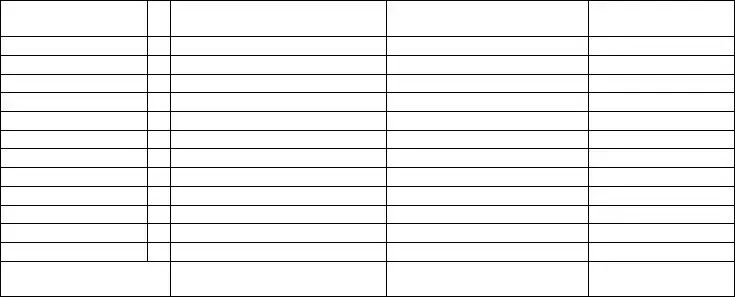

UTILITY SHUTOFFS/DISCONNECTS

MONTH

Termination without Notice

Termination with Notice

OTHER

TOTALS →

OTHER (description):

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

6

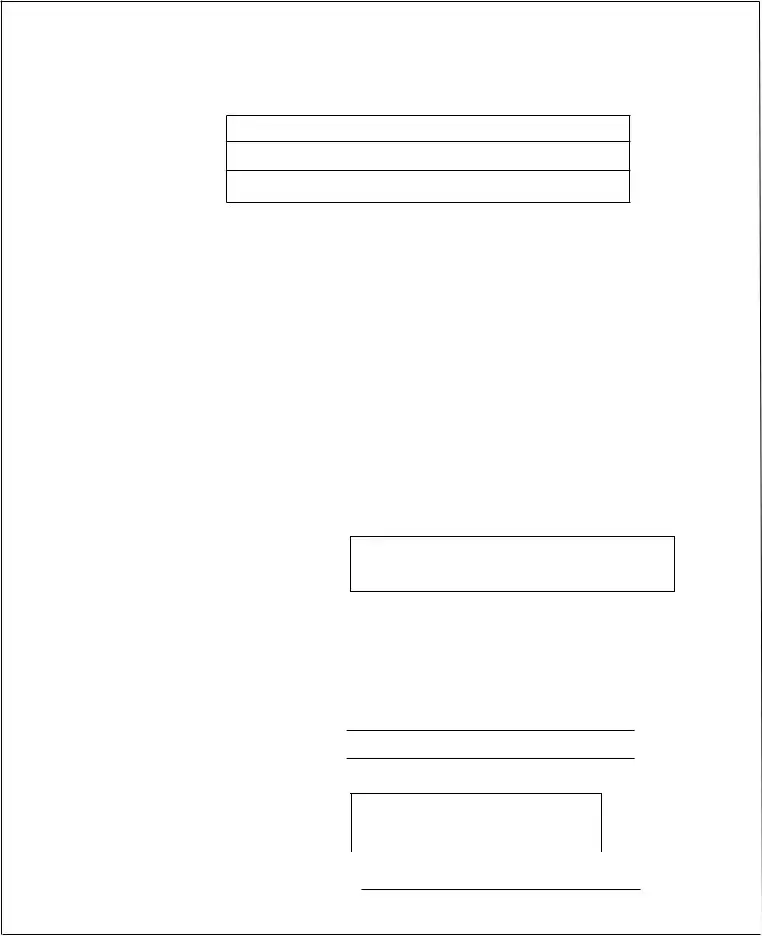

VERIFICATION

AND

SWORN STATEMENT

VERIFICATION

STATE OF ________________

I, THE UNDERSIGNED OF THE

Intrastate Revenues Only

COUNTY OF (COUNTY NAME)

NAME (OWNER OR OFFICIAL) TITLE

COMPANY NAME

DO SAY THAT THIS ANNUAL UTILITY REPORT TO THE ARIZONA CORPORATION COMMISSION

FOR THE YEAR ENDING

MONTH |

DAY |

YEAR |

12 |

31 |

2020 |

HAS BEEN PREPARED UNDER MY DIRECTION, FROM THE ORIGINAL BOOKS, PAPERS AND RECORDS OF SAID UTILITY; THAT I HAVE CAREFULLY EXAMINED THE SAME, AND DECLARE THE SAME TO BE A COMPLETE AND CORRECT STATEMENT OF BUSINESS AND AFFAIRS OF SAID UTILITY FOR THE PERIOD COVERED BY THIS REPORT IN RESPECT TO EACH AND EVERY MATTER AND THING SET FORTH, TO THE BEST OF MY KNOWLEDGE, INFORMATION AND BELIEF.

SWORN STATEMENT

IN ACCORDANCE WITH THE REQUIREMENT OF TITLE 40, ARTICLE 8, SECTION 40- 401, ARIZONA REVISED STATUTES, IT IS HEREIN REPORTED THAT THE GROSS OPERATING REVENUE OF SAID UTILITY DERIVED FROM ARIZONA INTRASTATE UTILITY OPERATIONS DURING CALENDAR YEAR 2020 WAS:

Arizona Intrastate Gross Operating Revenues Only ($)

$___________________________

(THE AMOUNT IN BOX ABOVE

INCLUDES $_________________

IN SALES TAXES BILLED, OR COLLECTED)

**REVENUE REPORTED ON THIS PAGE MUST INCLUDE SALES TAXES BILLED OR COLLECTED. IF FOR ANY OTHER REASON, THE REVENUE REPORTED ABOVE DOES NOT AGREE WITH TOTAL OPERATING REVENUES ELSEWHERE REPORTED, ATTACH THOSE STATEMENTS THAT RECONCILE THE DIFFERENCE. (EXPLAIN IN DETAIL)

SIGNATURE OF OWNER OR OFFICIAL

TELEPHONE NUMBER

SUBSCRIBED AND SWORN TO BEFORE ME

A NOTARY PUBLIC IN AND FOR THE COUNTY OF

THIS |

|

DAY OF |

(SEAL)

MY COMMISSION EXPIRES____________________________

COUNTY NAME

MONTH |

20__ |

|

|

SIGNATURE OF NOTARY PUBLIC

7

VERIFICATION

AND

SWORN STATEMENT

RESIDENTIAL REVENUE

STATE OF ARIZONA

I, THE UNDERSIGNED

OF THE

INTRASTATE REVENUES ONLY

COUNTY OF (COUNTY NAME)

NAME (OWNER OR OFFICIAL) |

TITLE |

|

|

COMPANY NAME

DO SAY THAT THIS ANNUAL UTILITY REPORT TO THE ARIZONA CORPORATION COMMISSION

FOR THE YEAR ENDING

MONTH DAY YEAR

12 31 2020

HAS BEEN PREPARED UNDER MY DIRECTION, FROM THE ORIGINAL BOOKS, PAPERS AND RECORDS OF SAID UTILITY; THAT I HAVE CAREFULLY EXAMINED THE SAME, AND DECLARE THE SAME TO BE A COMPLETE AND CORRECT STATEMENT OF BUSINESS AND AFFAIRS OF SAID UTILITY FOR THE PERIOD COVERED BY THIS REPORT IN RESPECT TO EACH AND EVERY MATTER AND THING SET FORTH, TO THE BEST OF MY KNOWLEDGE, INFORMATION AND BELIEF.

SWORN STATEMENT

IN ACCORDANCE WITH THE REQUIREMENTS OF TITLE 40, ARTICLE 8, SECTION 40- 401.01, ARIZONA REVISED STATUTES, IT IS HEREIN REPORTED THAT THE GROSS OPERATING REVENUE OF SAID UTILITY DERIVED FROM ARIZONA INTRASTATE UTILITY OPERATIONS RECEIVED FROM RESIDENTIAL CUSTOMERS DURING CALENDAR YEAR 2020 WAS:

ARIZONA INTRASTATE GROSS OPERATING REVENUES

$_________________________

(THE AMOUNT IN BOX AT LEFT INCLUDES $_____________________________

IN SALES TAXES BILLED, OR COLLECTED)

*RESIDENTIAL REVENUE REPORTED ON THIS PAGE MUST INCLUDE SALES TAXES BILLED.

SUBSCRIBED AND SWORN TO BEFORE ME

A NOTARY PUBLIC IN AND FOR THE COUNTY OF

THIS |

|

DAY OF |

|

|

|

(SEAL)

MY COMMISSION EXPIRES

SIGNATURE OF OWNER OR OFFICIAL

TELEPHONE NUMBER

NOTARY PUBLIC NAME

COUNTY NAME

MONTH |

20__ |

|

|

SIGNATURE OF NOTARY PUBLIC

8

FINANCIAL INFORMATION

Income Statements:

Attach to this annual report a copy of the company’s

Alternative templates are provided for this information. Please select one from Figure 1A, Figure 1B or Figure 1C.

(All

Arizona Administrative Code, R14.2.1115.F, states that one of the items required in this Annual Report is a statement of income for the reporting year

Balance Sheets:

Alternative templates are provided for this information. Please select one from Figure 2A or Figure 2B.

(All

Arizona Administrative Code, R14.2.1115.F, states that one of the items required in this Annual Report is a balance sheet as of the end of the reporting year

ALL INFORMATION MUST BE

RESULTS IN ARIZONA.

9

Docket No. _____________________Year Ending:

Company Name: ___________________________________________________

FIGURE 1A

Account Description |

$ Amount |

Revenues:

Expenses:

Operating Income:

Net Income:

Attachment 1

10

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Arizona Annual Report form is used to provide essential information about a company to the Arizona Corporation Commission. |

| Filing Requirement | All companies operating in Arizona must file an annual report to maintain good standing with the state. |

| Governing Law | The Arizona Revised Statutes, Title 10, Chapter 29 governs the requirements for annual reports. |

| Deadline | The report must be filed by December 31st each year, covering the previous year’s activities. |

| Company Information | Companies must provide their current name, mailing address, and contact details in the report. |

| Management Contacts | Details of management contacts, including names and titles, must be included in the report. |

| Ownership Structure | Companies must indicate their ownership structure, such as sole proprietorship, partnership, or corporation. |

| Counties Served | Companies must list all counties in Arizona where they provide services. |

| Services Authorized | The report requires companies to specify the telecommunications services they are authorized to provide. |

| Statistical Information | Telecommunication utilities must include various statistics, such as the number of customers and revenue details. |