Fill Out Your Arizona Estate Form

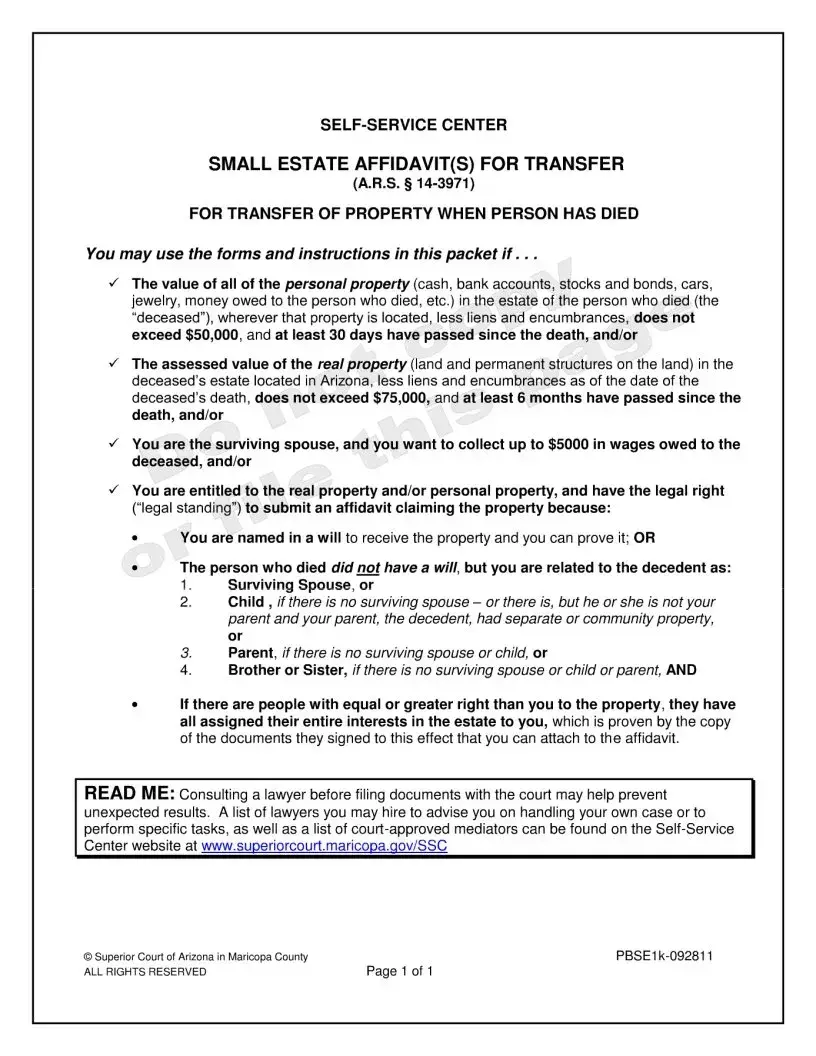

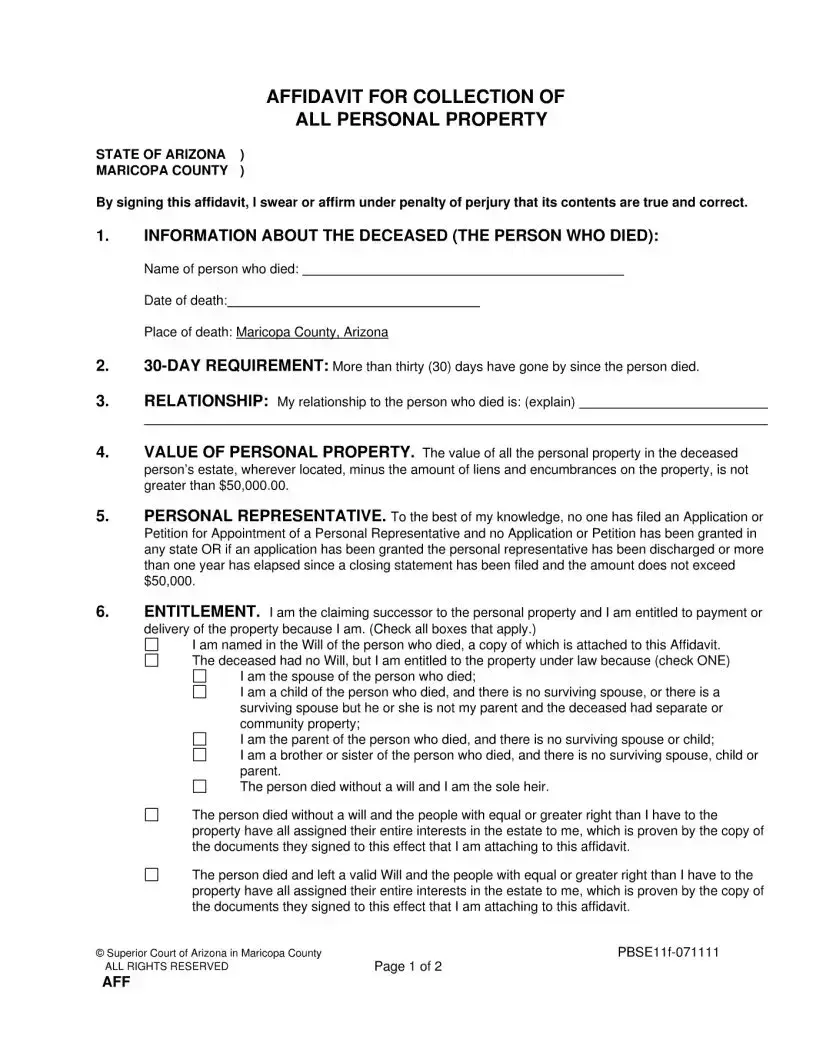

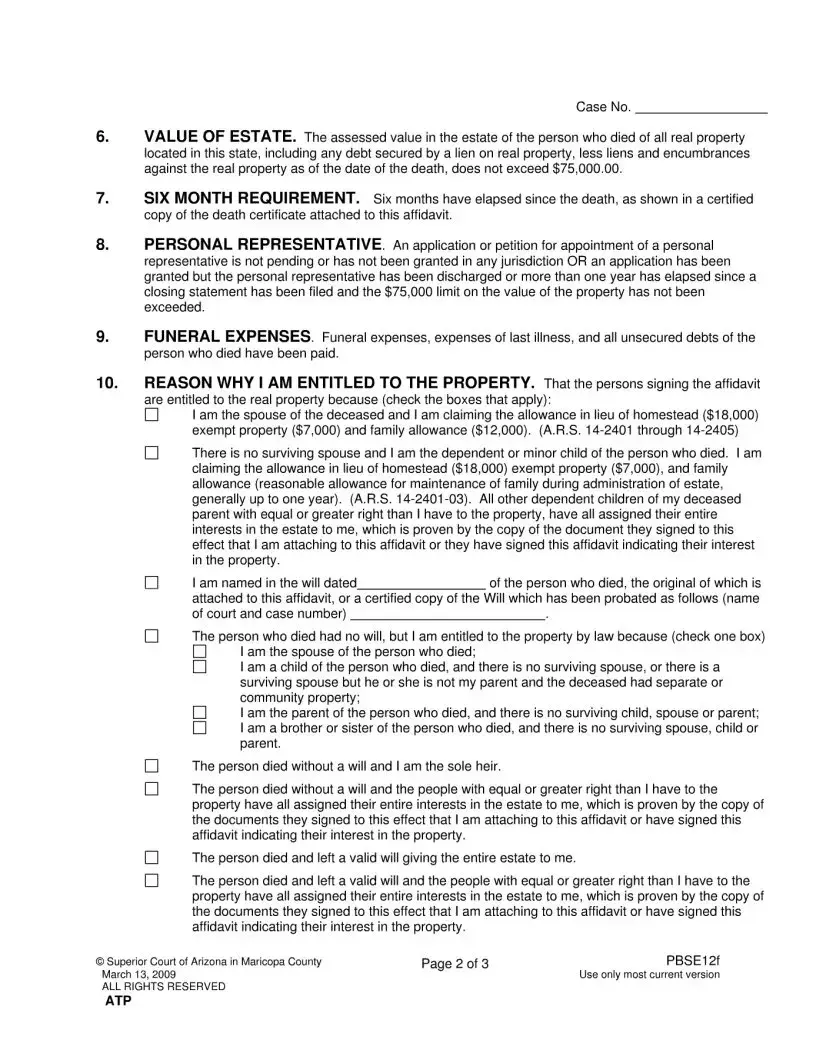

Navigating the complexities of estate management can be daunting, especially after the loss of a loved one. In Arizona, the Small Estate Affidavit offers a streamlined process for transferring property when someone passes away, provided certain conditions are met. This form is designed for situations where the total value of personal property, including cash, bank accounts, and other assets, does not exceed $50,000, and at least 30 days have passed since the individual's death. Additionally, if real property is involved, its assessed value must be under $75,000, and six months should have elapsed since the death. The form allows surviving spouses, children, parents, and siblings to claim their rightful inheritance without the need for a lengthy probate process, simplifying what can often be an overwhelming experience. Key requirements include demonstrating legal standing to claim the estate, either through a will or by being a direct relative. It’s crucial to ensure all necessary documentation is in order, as this will facilitate a smoother transition of assets. Consulting with a lawyer before filing can also help avoid potential pitfalls, ensuring that your rights are protected during this sensitive time.

Guide to Writing Arizona Estate

Completing the Arizona Estate form involves gathering specific information about the deceased and your relationship to them. This process ensures that the transfer of property can proceed smoothly and legally. Follow these steps carefully to fill out the Small Estate Affidavit accurately.

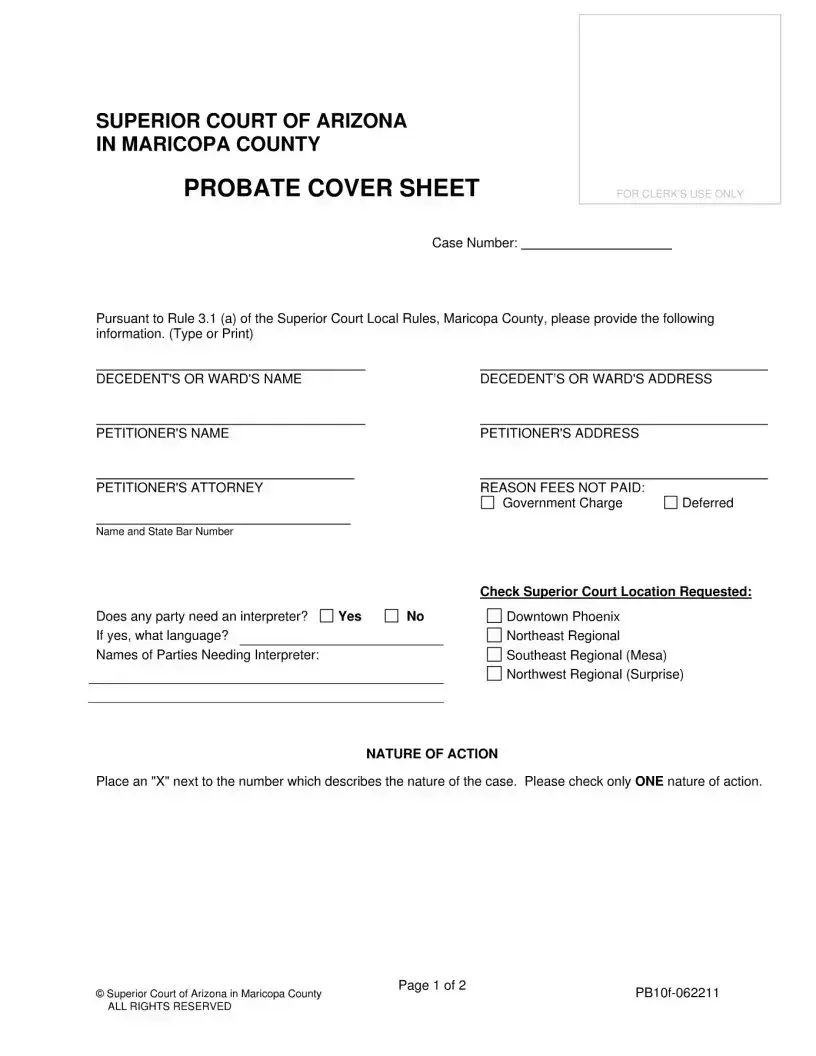

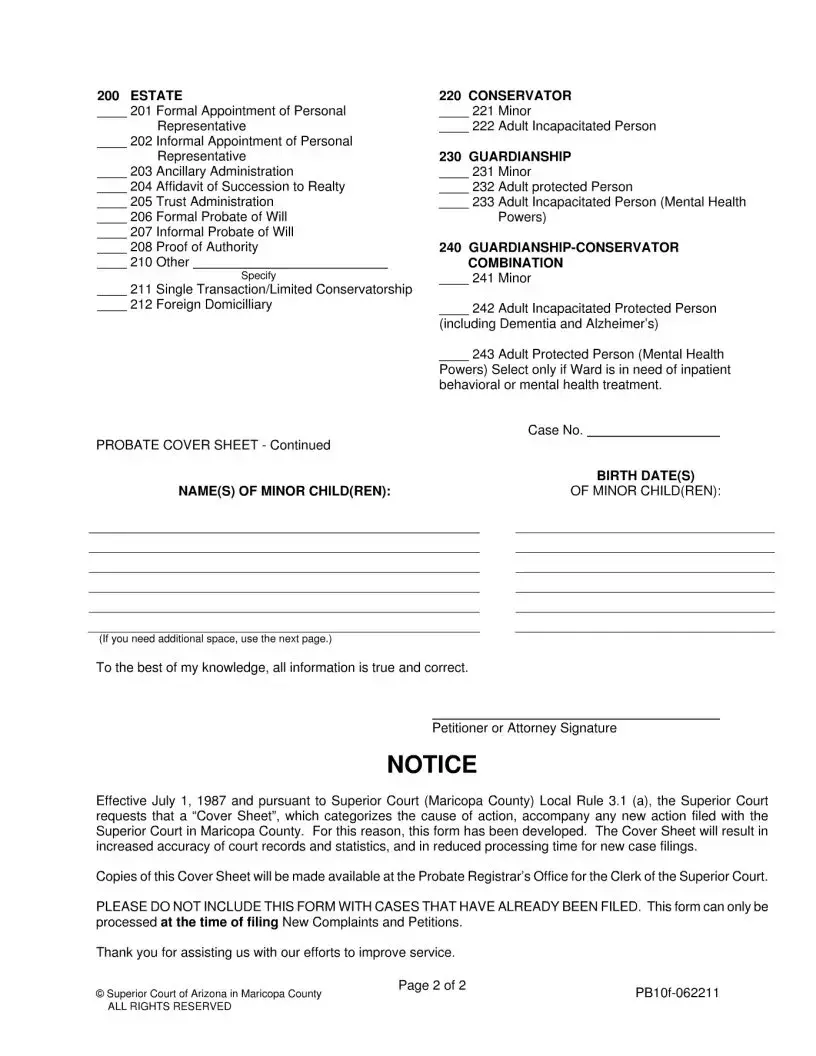

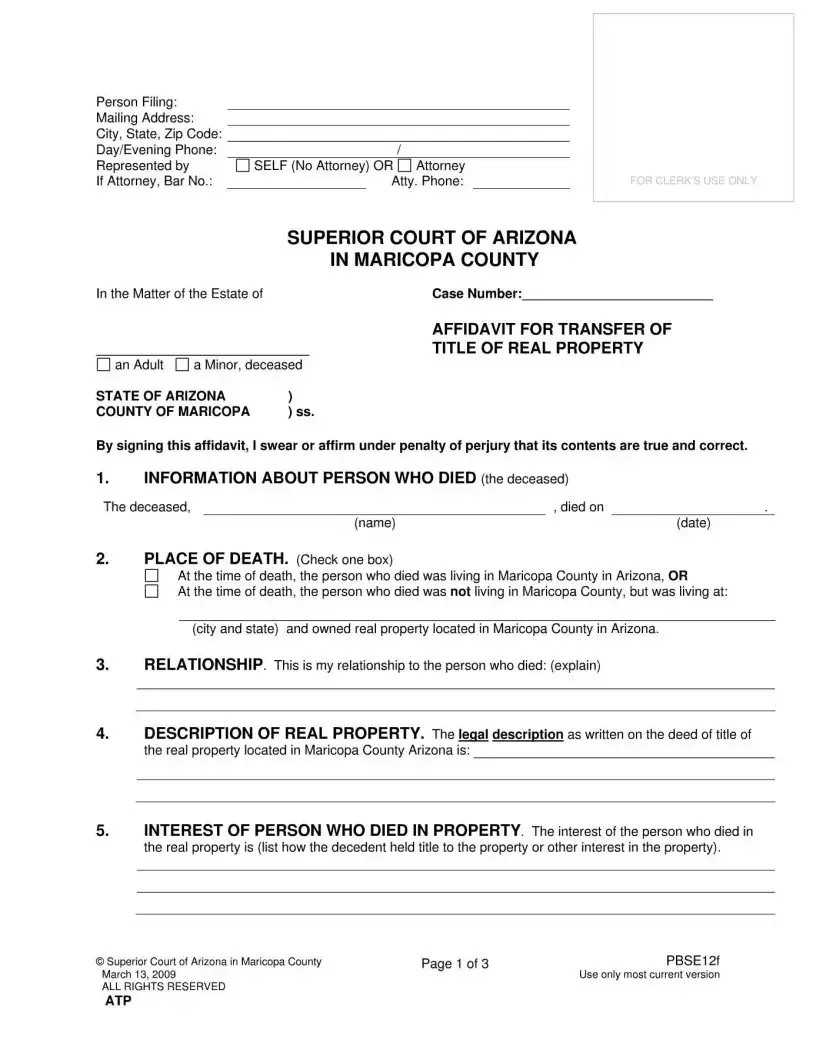

- Begin by obtaining the Small Estate Affidavit form from the Superior Court of Arizona in Maricopa County.

- Fill in the deceased’s name, date of death, and place of death in the designated sections.

- Confirm that more than thirty days have passed since the death by checking the appropriate box.

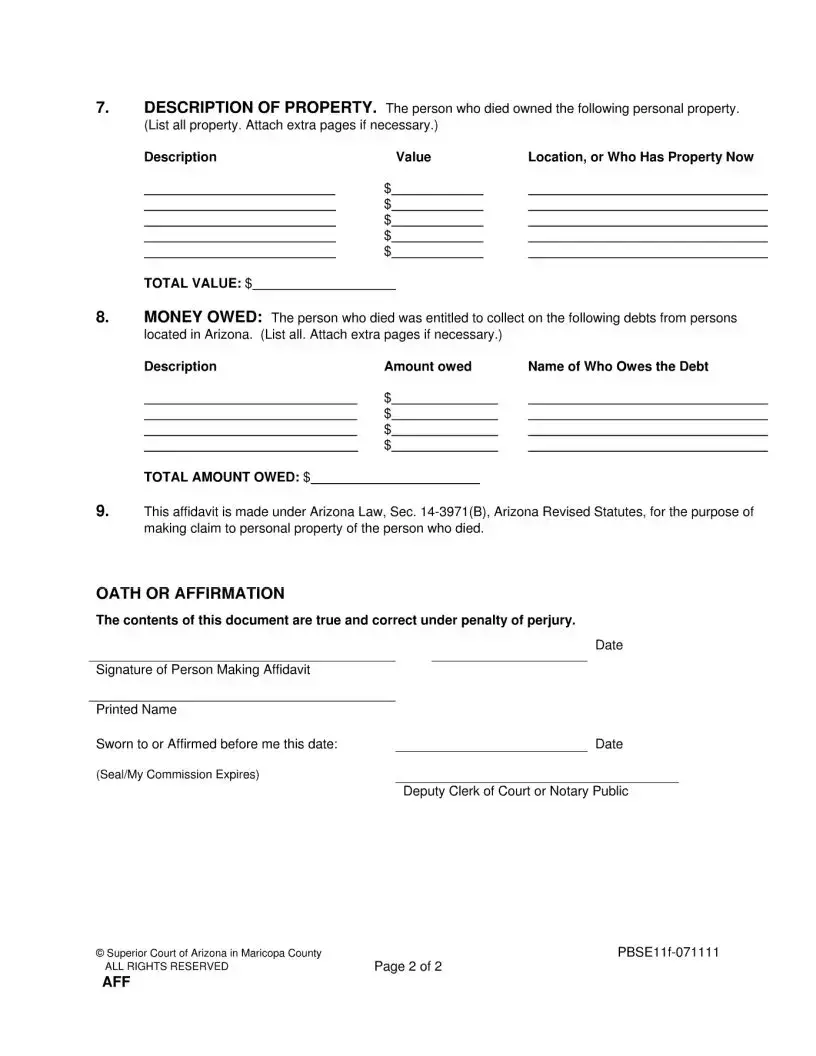

- State your relationship to the deceased clearly in the specified area.

- Calculate the total value of the personal property in the estate, ensuring it does not exceed $50,000. Subtract any liens or encumbrances.

- Indicate whether a personal representative has been appointed. If none has been appointed, check the corresponding box.

- Identify your entitlement to the property by checking all applicable boxes. Provide documentation as needed, such as a copy of the will or any assignments from others with equal or greater rights.

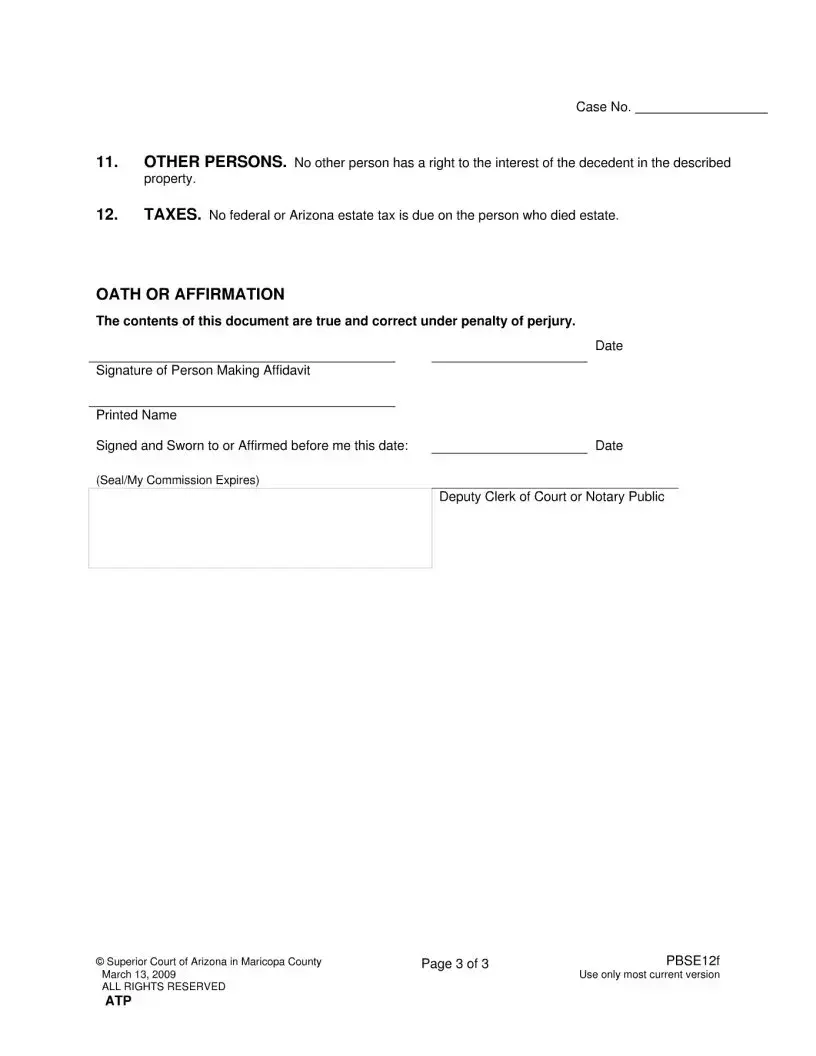

- Sign the affidavit, affirming that the information provided is true and correct.

- Gather any additional documents required, such as the will or assignments, and attach them to the affidavit.

- Submit the completed affidavit and any attachments to the appropriate court or agency as instructed.

After completing the form, be sure to keep copies for your records. The next steps will typically involve filing the affidavit with the court and possibly notifying interested parties, depending on your specific situation.

Browse Popular Forms

Wood Infestation Report - The report serves as a valuable tool in property transactions and pest management.

Child's Immunization Record - Understanding the risks helps parents make informed choices about exemptions.

Common Questions

What is the Arizona Small Estate Affidavit?

The Arizona Small Estate Affidavit is a legal document that allows certain individuals to transfer property from a deceased person's estate without going through the lengthy probate process. This form can be used when the total value of personal property is less than $50,000 or when the assessed value of real property is less than $75,000. It simplifies the transfer of assets for eligible individuals, making it easier to settle the estate of a loved one who has passed away.

Who can use the Small Estate Affidavit?

You can use the Small Estate Affidavit if you meet specific criteria. If the total value of the deceased's personal property is under $50,000 and at least 30 days have passed since their death, you may qualify. Alternatively, if the assessed value of the real property in Arizona is less than $75,000 and at least six months have elapsed since the death, you can also use this affidavit. Additionally, surviving spouses can claim up to $5,000 in wages owed to the deceased.

What information do I need to provide in the affidavit?

When filling out the affidavit, you will need to provide details about the deceased, including their name, date of death, and place of death. You must also explain your relationship to the deceased and confirm that more than 30 days have passed since their death. Lastly, you'll need to state the value of the personal property and confirm that no personal representative has been appointed or that any appointed representative has been discharged.

What types of property can be transferred using this affidavit?

The Small Estate Affidavit can be used to transfer personal property such as cash, bank accounts, stocks, bonds, cars, jewelry, and any other assets that belong to the deceased. If you are dealing with real property, the affidavit can also facilitate the transfer of land and permanent structures, as long as the assessed value meets the specified limits.

What if the deceased had a will?

If the deceased left a will, you must be named in it to claim the property. You’ll need to attach a copy of the will to the affidavit. If the deceased did not have a will, you can still claim property based on your relationship to them, as outlined in the affidavit. It’s essential to understand your legal standing to ensure a smooth transfer of the estate.

Are there any restrictions on who can file the affidavit?

Yes, there are restrictions. You must have legal standing, which means you either need to be named in the will or related to the deceased in a specific way. This includes being a spouse, child, parent, or sibling. If there are others with equal or greater rights to the property, they must assign their interests to you, which should be documented and attached to the affidavit.

Should I consult a lawyer before filing the affidavit?

Dos and Don'ts

When filling out the Arizona Estate form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are nine things you should and shouldn't do:

- Do: Confirm that you meet the eligibility requirements for using the Small Estate Affidavit.

- Do: Provide accurate information about the deceased, including their name, date of death, and place of death.

- Do: Ensure that the total value of personal property does not exceed $50,000, minus any liens and encumbrances.

- Do: Attach necessary documents, such as the will, if applicable, or any signed assignments from others with equal or greater rights.

- Do: Verify that at least 30 days have passed since the death before submitting the affidavit.

- Don't: Leave any sections of the form blank. Complete all required fields to avoid delays.

- Don't: Misrepresent your relationship to the deceased. Provide truthful information to prevent legal issues.

- Don't: Submit the affidavit without checking that all attachments are included and properly signed.

- Don't: Ignore the importance of consulting a lawyer if you have questions about the process or your eligibility.

Similar forms

The Arizona Small Estate Affidavit is similar to the California Small Estate Affidavit. Both documents allow heirs to claim property without going through the lengthy probate process. In California, the limit for the value of the estate is also set at $166,250, which is significantly higher than Arizona’s limits. Like Arizona, California requires that a certain period has elapsed since the decedent's death before the affidavit can be filed. This process simplifies the transfer of small estates for those who qualify, ensuring that heirs can access their inheritance more quickly.

Another comparable document is the Florida Small Estate Affidavit. Florida's version allows for the transfer of personal property valued at $75,000 or less, mirroring Arizona's approach. Both states require that at least 30 days pass after the death before filing the affidavit. The Florida affidavit also provides a streamlined process for heirs, enabling them to claim property without formal probate, thus reducing the administrative burden on families during a difficult time.

The Texas Small Estate Affidavit shares similar features with the Arizona form. In Texas, the affidavit can be used when the value of the estate is under $75,000. Like Arizona, Texas requires that at least 30 days have passed since the decedent's death. Both documents aim to expedite the transfer of property to rightful heirs, allowing them to bypass the more complex probate procedures, which can be time-consuming and costly.

The New York Affidavit for Collection of Personal Property is another document that serves a similar purpose. In New York, heirs can use this affidavit if the total value of the personal property is under $50,000. The requirement of waiting 30 days post-death is consistent with Arizona's regulations. This document simplifies the process for heirs, allowing for a more efficient transfer of assets without the need for probate court intervention.

In Illinois, the Small Estate Affidavit provides a similar function. Heirs can use this affidavit if the estate's value does not exceed $100,000. The Illinois process also requires that a minimum period has elapsed since the decedent's passing. Both Arizona and Illinois aim to facilitate the transfer of small estates, enabling heirs to access their inheritance more swiftly and with less legal complexity.

The Washington Small Estate Affidavit is another document that aligns closely with Arizona's form. In Washington, the limit for using the affidavit is $100,000 for personal property. Like Arizona, the process requires that at least 40 days have passed since the death. This document allows heirs to claim their rightful property without engaging in the probate process, thus easing the burden during a challenging time.

The Nevada Affidavit for Collection of Personal Property serves a similar purpose as the Arizona form. In Nevada, heirs can use the affidavit if the estate's total value is under $25,000. The requirement of a waiting period post-death is also a common feature. This document streamlines the process for heirs, allowing them to claim property without navigating through the complexities of probate court.

The Ohio Small Estate Affidavit is another comparable document. In Ohio, heirs can use the affidavit if the estate's value does not exceed $35,000. The requirement for a waiting period of 30 days after death is consistent with Arizona's guidelines. This affidavit simplifies the process for heirs, enabling a more efficient transfer of assets without the need for formal probate proceedings.

The Georgia Small Estate Affidavit is similar in its intent and function. In Georgia, the affidavit can be used when the estate is valued at $10,000 or less. The requirement of waiting 30 days after the decedent's death is a shared feature with Arizona. This document provides a streamlined method for heirs to claim their inheritance without the complications associated with probate, thus easing the transition during a difficult time.

Lastly, the South Carolina Small Estate Affidavit also mirrors the Arizona form. In South Carolina, heirs can utilize this affidavit if the estate's value is under $25,000. A waiting period of 30 days post-death is required, aligning with Arizona's regulations. This process allows heirs to efficiently access their inheritance while avoiding the lengthy probate process, providing a much-needed relief during a challenging period.

Key takeaways

When dealing with the Arizona Estate form, particularly the Small Estate Affidavit, there are several important points to keep in mind. Here are four key takeaways:

- Eligibility Criteria: You can use this affidavit if the total value of personal property in the deceased's estate is under $50,000, and at least 30 days have passed since their death. For real property, the assessed value must not exceed $75,000, and at least six months should have elapsed since the death.

- Relationship Matters: Your relationship to the deceased is crucial. You must demonstrate that you are entitled to the property, whether through a will or by being a close relative, such as a spouse, child, or sibling.

- Documentation is Key: Ensure you have all necessary documents ready. This includes the affidavit itself and any supporting documents, like a will or proof of relationship. If there are others with equal rights to the property, their consent must also be documented.

- Legal Advice is Recommended: While you can fill out the affidavit on your own, consulting with a lawyer can help clarify any uncertainties and prevent potential issues down the line. This can be especially helpful if the estate situation is complex.

Understanding these points can make the process smoother and help ensure that you are following the correct procedures when handling an estate in Arizona.

Common mistakes

-

Inaccurate Personal Information: One common mistake is failing to provide accurate information about the deceased, such as their full name, date of death, or place of death. This information is crucial for proper identification and processing of the affidavit.

-

Missing Signatures: Applicants often forget to sign the affidavit. A signature is necessary to validate the document and affirm that the information provided is true and correct.

-

Not Meeting Time Requirements: Some individuals submit the affidavit before the required time has passed. It is essential to ensure that more than 30 days have elapsed since the death before filing for personal property or that at least 6 months have passed for real property.

-

Incorrect Value Assessment: Mistakes can occur in calculating the total value of the estate. The value of all personal property must not exceed $50,000, and it is important to subtract any liens or encumbrances accurately.

-

Failure to Attach Required Documents: Applicants sometimes neglect to include necessary supporting documents, such as a copy of the will or proof of relationship to the deceased. These documents are vital for establishing entitlement to the property.

-

Ignoring Legal Standing: Some individuals may submit the affidavit without confirming their legal right to claim the property. It is crucial to ensure that you are either named in a will or meet the legal criteria outlined for heirs.

-

Submitting Outdated Forms: Using outdated forms can lead to complications. It is important to verify that the forms being used are the most current versions available to avoid unnecessary delays or rejections.

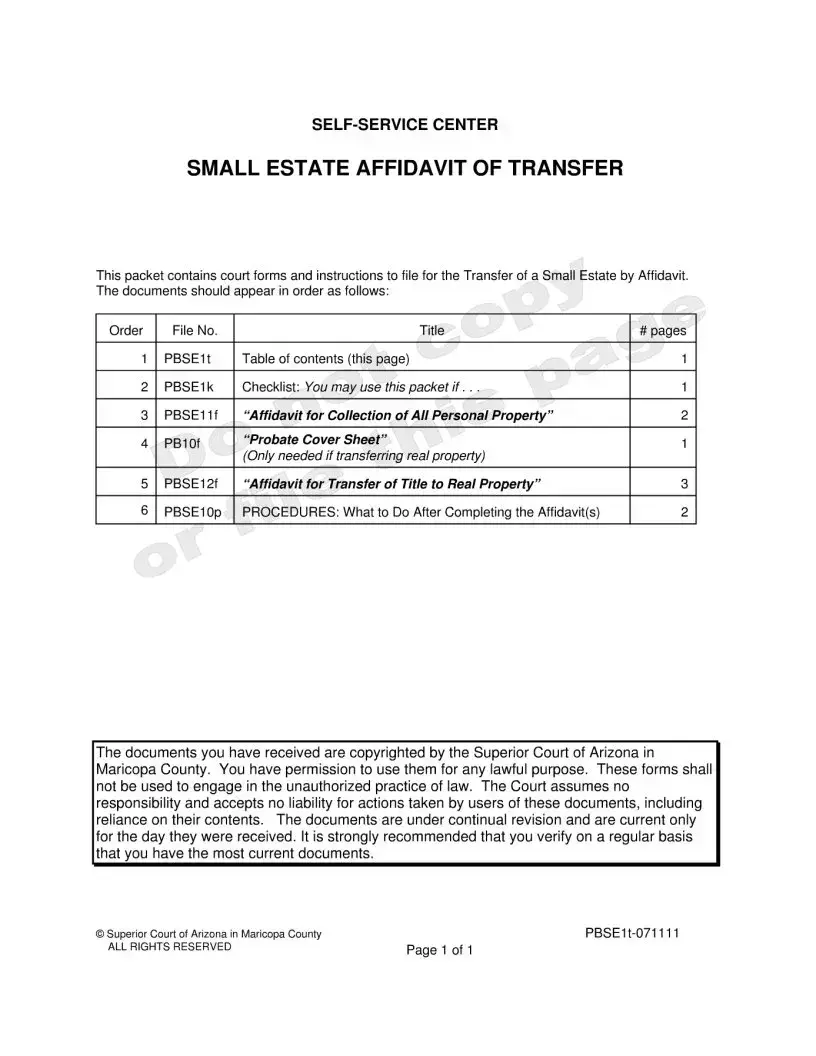

Document Preview

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Small Estate Affidavit allows individuals to transfer property of a deceased person without going through probate, streamlining the process for eligible estates. |

| Value Limits | The total value of personal property must not exceed $50,000, while the assessed value of real property must not exceed $75,000, excluding liens and encumbrances. |

| Time Requirement | At least 30 days must have passed since the death of the individual before the affidavit can be filed for personal property. For real property, a minimum of 6 months is required. |

| Eligibility | Eligible individuals include the surviving spouse, children, parents, or siblings of the deceased, provided they have legal standing to claim the property. |

| Governing Law | This affidavit is governed by Arizona Revised Statutes (A.R.S.) § 14-3971, which outlines the requirements and procedures for small estate transfers. |