Fill Out Your Arizona Financial Form

The Arizona Financial form is a critical document utilized in family law cases, particularly when addressing issues such as child support, spousal maintenance, and financial disclosures during divorce proceedings. This form requires individuals to provide comprehensive information about their financial circumstances, including income, expenses, and assets. It begins with basic identifying details such as names, addresses, and contact information for the parties involved. It also prompts individuals to disclose their employment status, detailing job titles, employers, and income sources. Furthermore, the form includes sections for reporting household members, monthly expenses, and any support obligations. Notably, the form emphasizes the importance of accuracy, stating that any false information may lead to serious consequences, including perjury charges. Individuals must carefully complete each section, ensuring they provide all required documentation, such as recent pay stubs and tax returns. This thoroughness not only aids the court in making informed decisions but also helps to ensure that both parties are treated fairly in the legal process.

Guide to Writing Arizona Financial

Completing the Arizona Financial form is a crucial step in your legal process. This document requires careful attention to detail and accuracy. Each section must be filled out completely, as missing information can lead to complications or penalties. Ensure you have all necessary documents and information at hand before starting.

- Use a black pen to fill out the entire Affidavit. If you run out of space, attach additional sheets with your answers.

- Answer every question thoroughly. If you are unsure about an answer, indicate that clearly. For questions that do not apply to you, write “NA” to show you have read them.

- Round all monetary amounts to the nearest dollar.

- Respond to the Yes or No statements. If you answer No, provide an explanation on a separate sheet and attach it to the Affidavit.

- Fill in your general information, including your name, address, and any relevant dates, such as marriage and divorce.

- List all individuals living in your household, including their names, birth dates, relationships to you, and their gross monthly incomes.

- Provide details about any other individuals you support, including their names and ages.

- Indicate any attorney’s fees you have paid and the source of those funds.

- Detail your employment information, including your current job title, employer’s name and address, and your pay frequency.

- If you are not currently employed, explain why.

- List your previous employment details, including job title, employer, and gross monthly pay.

- Summarize your total gross income from the last three years, providing the amounts for each year.

- Calculate and enter your year-to-date income for the current year.

- Document your educational background, including schools attended and degrees earned.

- List all sources of income you receive, detailing the amounts and types of income.

- If you are self-employed, provide relevant business information and attach your Schedule C and income/expense statement.

- Complete the schedule of all monthly expenses for children, indicating health insurance costs and child care expenses.

- Detail any court-ordered child support or spousal maintenance payments you are responsible for.

- List your monthly expenses, ensuring to average out any variable costs.

Browse Popular Forms

Tax Id Number Arizona - The form has been recognized as legitimate verification for payment purposes by the State of Arizona.

Arizona Tax Forms - It is vital to attach accurate legal descriptions of any real estate listed.

Arizona Tort Claim - The form allows for the opportunity to provide an email address for communication.

Common Questions

What is the purpose of the Arizona Financial form?

The Arizona Financial form is designed to collect detailed financial information from individuals involved in family law cases, such as divorce or child custody disputes. This form helps the court understand each party's financial situation, including income, expenses, and obligations. By providing accurate and complete information, both parties can ensure that the court makes informed decisions regarding child support, spousal maintenance, and other financial matters. It is crucial that all sections of the form are filled out thoroughly to avoid potential penalties.

Who needs to complete the Arizona Financial form?

Both parties involved in a family law case must complete the Arizona Financial form. This includes the petitioner, who initiates the case, and the respondent, who responds to the petition. Each party is required to disclose their financial information to ensure transparency and fairness during the proceedings. If one party fails to provide this information, it may lead to sanctions or fines imposed by the court.

What happens if I provide inaccurate information on the form?

Providing inaccurate information on the Arizona Financial form can have serious consequences. If a party knowingly submits false information, it may be considered perjury, which is a criminal offense. Additionally, the court may impose sanctions, including fines or other penalties, for failing to provide accurate financial details. It is essential to take the time to review and ensure that all information is correct before submitting the form to avoid these potential repercussions.

How should I submit the Arizona Financial form once completed?

Once you have completed the Arizona Financial form, it is important to provide copies to all relevant parties involved in the case, including the other party and the judge. Ensure that you keep a copy for your records as well. The form should be submitted to the Superior Court of Arizona in Maricopa County, along with any required supporting documents, such as pay stubs and tax returns. Be mindful of any deadlines associated with your case to ensure timely submission.

Dos and Don'ts

When filling out the Arizona Financial form, it is essential to be thorough and accurate. Below are ten guidelines to help you navigate this process effectively.

- Do complete the entire Affidavit using black ink.

- Do use separate sheets if the spaces provided are not enough.

- Do answer every question completely, even if you need to indicate "NA" for questions that do not apply.

- Do round all monetary amounts to the nearest dollar.

- Do provide copies of your two most recent pay stubs.

- Don't leave any blanks unanswered; if you don't know an answer, state that clearly.

- Don't provide false information; this could lead to serious legal consequences.

- Don't forget to attach copies of your federal income tax returns for the last three years.

- Don't list expenses for children who do not live with you unless you are paying those expenses.

- Don't overlook the importance of this document; it is crucial for your case.

Similar forms

The Arizona Financial Affidavit is similar to the Financial Disclosure Statement used in divorce proceedings. Both documents require individuals to provide a detailed account of their financial situation, including income, expenses, and assets. The purpose is to ensure transparency between parties during the divorce process. Just like the Arizona form, the Financial Disclosure Statement mandates that all information be accurate and complete to avoid penalties or sanctions.

Another comparable document is the Affidavit of Support, commonly used in immigration cases. This affidavit requires a sponsor to demonstrate their financial ability to support an immigrant. Both forms emphasize the necessity of accurate financial information. They are sworn statements, meaning that providing false information can lead to serious legal consequences, including perjury charges.

The Child Support Worksheet is another document that shares similarities with the Arizona Financial Affidavit. It also requires detailed financial information to calculate child support obligations. Like the Arizona form, it includes sections for income, expenses, and any additional financial responsibilities. Both documents aim to create a clear picture of the financial circumstances affecting children involved in legal proceedings.

The Statement of Net Worth used in family law cases is similar as well. This document provides a comprehensive overview of an individual's financial status, including assets and liabilities. Both the Statement of Net Worth and the Arizona Financial Affidavit require individuals to disclose their financial history accurately. They help courts make informed decisions about asset division and support obligations.

The Income and Expense Declaration is another document that parallels the Arizona Financial Affidavit. It is often used in family law cases to assess a party's financial situation. Both documents require detailed listings of income sources and monthly expenses. This information is crucial for determining spousal support or child support, ensuring that both parties are fully informed of each other's financial capabilities.

Similarly, the Financial Affidavit used in bankruptcy cases serves a comparable purpose. It requires individuals to disclose their financial condition, including income, expenses, and debts. Both documents aim to provide a transparent view of one’s financial status to facilitate fair legal proceedings. Inaccurate information on either form can lead to significant legal repercussions.

The Financial Information Form used in court-ordered mediation also shares similarities with the Arizona Financial Affidavit. This form collects financial data to help mediators understand the parties' financial situations. Both documents require comprehensive and accurate disclosures to assist in reaching equitable agreements. Transparency in financial matters is essential in both mediation and court settings.

Lastly, the IRS Form 433-A, used for collection of tax liabilities, is comparable as well. This form requires taxpayers to provide detailed financial information, including income and expenses, to the IRS. Both the IRS form and the Arizona Financial Affidavit emphasize the importance of accuracy and completeness. Failure to provide truthful information can result in serious consequences, including legal penalties or fines.

Key takeaways

Filling out the Arizona Financial form is a crucial step in legal proceedings, particularly in family law cases.

Use black ink to complete the form. If you run out of space, attach additional sheets as necessary.

Answer every question completely. If you do not know the answer, indicate that clearly.

Mark questions as YES or NO and provide explanations for any NO answers on a separate piece of paper.

Include your gross monthly income from all sources, ensuring you provide accurate figures.

Attach copies of your two most recent pay stubs and your federal income tax returns for the last three years.

Be aware that providing false information can lead to serious consequences, including perjury charges.

List all household members and their financial contributions to give a complete picture of your financial situation.

Submit copies of the completed Affidavit to both the other party and the judge to comply with court requirements.

Common mistakes

-

Failing to complete the entire Affidavit in black ink. Always use black ink to ensure legibility.

-

Leaving blanks in the form. Every question must be answered. If unsure, state "unknown" or "NA" for not applicable.

-

Not attaching necessary documentation. Copies of pay stubs, tax returns, and other required documents should be included.

-

Providing inaccurate income figures. Round all amounts to the nearest dollar and ensure they reflect true earnings.

-

Not explaining "NO" answers. If any question is answered "NO," a detailed explanation must be attached.

-

Forgetting to include all sources of income. All income, whether taxable or not, should be reported.

-

Neglecting to list household members. Include all individuals living in the household along with their income and relationship.

-

Overlooking the need for signatures. Ensure that the Affidavit is signed and dated by the person making the statement.

Document Preview

Name:

Mailing Address:

City, State, Zip Code:

Daytime Phone Number:

Evening Phone Number:

Representing:

Self

Self

State Bar Number:

Petitioner

Respondent

FOR CLERK’S USE ONLY

|

SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|||||

|

|

Case No. |

|

|||

|

|

|

|

|

|

|

Petitioner/Plaintiff |

|

ATLAS No. |

|

|||

|

|

AFFIDAVIT OF FINANCIAL INFORMATION |

||||

|

|

|

|

|

||

Respondent |

|

Affidavit of |

|

|

||

|

|

(Name of Person Whose Information is on this |

||||

|

|

Affidavit) |

||||

IMPORTANT INFORMATION ABOUT THIS DOCUMENT

WARNING TO BOTH PARTIES: This Affidavit is an important document. You must fill out this Affidavit completely, and provide accurate information. You must provide copies of this Affidavit and all other required documents to the other party and to the judge. If you do not do this, the court may order you to pay a fine.

I have read the following document and know of my own knowledge that the facts and financial information stated below are true and correct, and that any false information may constitute perjury by me. I also understand that, if I fail to provide the required information or give misinformation, the judge may order sanctions against me, including assessment of fees for fines under Rule 31, Arizona Rules of Family Law Procedure.

Date |

Signature of Person Making Affidavit |

INSTRUCTIONS

1.Complete the entire Affidavit in black ink. If the spaces provided on this form are inadequate, use separate sheets of paper to complete the answers and attach them to the Affidavit. Answer every question completely! You must complete every blank. If you do not

know the answer to a question or are guessing, please state that. If a question does not apply, write “NA” for “not applicable” to indicate you read the question. Round all amounts of money to the nearest dollar.

2.Answer the following statements YES or NO. If you mark NO, explain your answer on a separate piece of paper and attach the explanation to the Affidavit.

[ |

] YES [ |

] NO |

1. |

I listed all sources of my income. |

[ |

] YES [ |

] NO |

2. |

I attached copies of my two (2) most recent pay stubs. |

[ |

] YES [ |

] NO |

3. |

I attached copies of my federal income tax return for the last three (3) |

|

|

|

|

years, and I attached my |

|

|

|

|

income. |

©SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|

ALL RIGHTS RESERVED |

Page 1 of 7 |

AFI

Case No.

1. GENERAL INFORMATION: |

|

|

|

|

|

|||

A. Name: |

|

|

Date of Birth: |

|

||||

B. Current Address: |

|

|

|

|

|

|

||

C. Date of Marriage: |

|

Date of Divorce: |

|

|

||||

D.Last date when you and the other party lived together:

E.Full names of child(ren) common to the parties (in this case), their dates of birth:

Name |

|

Date of Birth |

|

|

|

|

|

|

|

|

|

|

|

|

F.The name, date of birth, relationship to you, and gross monthly income for each individual who lives in your household:

Name |

|

Date of Birth |

|

Relationship to you |

|

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G. Any other person for whom you contribute support: |

|

|

|

Name |

Age Relationship |

Reside With |

Court Order to |

|

to You |

You (Y/N) |

Support (Y/N) |

|

|

|

|

|

|

|

|

H. Attorney’s Fees paid in this matter $ |

|

. Source of funds |

2.EMPLOYMENT INFORMATION:

A.Your job/occupation/profession/title: Name and address of current employer:

Date employment began:

How often are you paid: [ ] Weekly [ ] Every other week [ ] Monthly [ ] Twice a month

[] Other

B.If you are not working, why not?

C.Previous employer name and address: Previous job/occupation/profession/title:

Date previous job began: |

|

Date previous job ended: |

|

|

Reason you left job: |

|

|

|

|

Gross monthly pay at previous job: $ |

|

|

||

D.Total gross income from last three (3) years’ tax returns (attach copies of pages 1 and 2 of your federal income tax returns for the last three (3) years):

Year |

|

$ |

|

Year |

|

$ |

Year |

$ |

||

|

|

|

|

|

|

|

|

|

|

|

E.Your total gross income from January 1 of this year to the date of this Affidavit

©SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|

ALL RIGHTS RESERVED |

Page 2 of 7 |

AFI

Case No.

3.YOUR EDUCATION/TRAINING: List name of school, length of time there, year of last attendance, and degree earned:

A.High School:

B.College:

C.

D.Occupational Training:

4.YOUR GROSS MONTHLY INCOME:

|

List all income you receive from any source, whether private or governmental, taxable or not. |

|||||||||

|

List all income payable to you individually or payable jointly to you and your spouse. |

|||||||||

|

Use a monthly average for items that vary from month to month. |

|

|

|

||||||

|

Multiply weekly income and deductions by 4.33. Multiply biweekly income by 2.165 to arrive at |

|||||||||

|

the total amount for the month. |

|

|

|

||||||

A. Gross salary/wages per month |

$ |

|

|

|||||||

|

|

Attach copies of your two most recent pay stubs. |

|

|

|

|||||

|

Rate of Pay $ |

|

per [ ] hour [ ] week [ ] month [ ] year |

|

|

|

||||

B. Expenses paid for by your employer: |

|

|

|

|||||||

|

1. |

Automobile |

|

|

$ |

|

|

|||

|

2. |

Auto expenses, such as gas, repairs, insurance |

$ |

|

|

|||||

|

3. |

Lodging |

|

|

$ |

|

|

|||

|

4. |

Other (Explain) |

|

|

|

$ |

|

|

||

C. Commissions/Bonuses |

$ |

|

|

|||||||

D. Tips |

|

|

$ |

|

|

|||||

E. |

$ |

|

|

|||||||

F. |

Social Security benefits |

$ |

|

|

||||||

G. |

Worker's compensation and/or disability income |

$ |

|

|

||||||

H. |

Unemployment compensation |

$ |

|

|

||||||

I. |

Gifts/Prizes |

|

|

$ |

|

|

||||

J. |

Payments from prior spouse |

$ |

|

|

||||||

K. |

Rental income (net after expenses) |

$ |

|

|

||||||

L. |

Contributions to household living expense by others |

$ |

|

|

||||||

M. Other (Explain:) |

|

|

|

$ |

|

|

||||

|

(Include dividends, pensions, interest, trust income, annuities |

|

|

|

||||||

|

or royalties.) |

|

|

|

|

|

||||

|

|

|

|

|

|

TOTAL: |

$ |

|

|

|

5.

If you are

If self employed, provide the following information: Name, address and telephone no. of business:

Type of business entity:

State and Date of incorporation: Nature of your interest:

Nature of business: Percent ownership: Number of shares of stock:

©SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|

ALL RIGHTS RESERVED |

Page 3 of 7 |

AFI

Case No.

Total issued and outstanding shares:

Gross sales/revenue last 12 months:

INSTRUCTIONS

Both parties must answer item 6 if either party asks for child support. These expenses include only those expenses for children who are common to the parties, which means one party is the birth/adoptive mother and

the other is the birth/adoptive father of the children.

6.SCHEDULE OF ALL MONTHLY EXPENSES FOR CHILDREN:

DO NOT LIST any expenses for the other party, or child(ren) who live(s) with the other party, unless you are paying those expenses.

DO NOT LIST any expenses for the other party, or child(ren) who live(s) with the other party, unless you are paying those expenses.

Use a monthly average for items that vary from month to month.

Use a monthly average for items that vary from month to month.

If you are listing anticipated expenses, indicate this by putting an asterisk (*) next to the estimated amount.

If you are listing anticipated expenses, indicate this by putting an asterisk (*) next to the estimated amount.

A.HEALTH INSURANCE:

Do you have health insurance available? Yes

No

Are you enrolled?

1. |

Total monthly cost |

$ |

2. |

Premium cost to insure you alone |

$ |

3. |

Premium cost to insure child(ren) common to the parties |

$ |

4.List all people covered by your insurance coverage:

5.Name of insurance company and Policy/Group Number:

B. DENTAL/VISION INSURANCE:

1. |

Total monthly cost |

$ |

2. |

Premium cost to insure you alone |

$ |

3. |

Premium cost to insure child(ren) common to the parties |

$ |

4.List all people covered by your insurance coverage:

5.Name of insurance company and Policy/Group Number:

C.UNREIMBURSED MEDICAL AND DENTAL EXPENSES:

(Cost to you after, or in addition to, any insurance reimbursement)

1. |

Drugs and medical supplies |

|

$ |

|

|

||

2. |

Other |

|

$ |

|

|

||

|

|

|

|

TOTAL: |

$ |

|

|

D. CHILD CARE COSTS: |

|

|

|

|

|||

1. |

Total monthly child care costs |

|

$ |

|

|

||

|

(Do not include amounts paid by D.E.S.) |

|

|

|

|

||

2. |

Name(s) of child(ren) cared for and amount per child: |

|

|

|

|||

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

©SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|

|

|||||

ALL RIGHTS RESERVED |

Page 4 of 7 |

|

|

|

|||

AFI

Case No.

3. Name(s) and address(es) of child care provider(s):

E.EMPLOYER PRETAX PROGRAM:

Do you participate in an employer program for pretax payment of child care expenses? (Cafeteria Plan)? [ ] YES [ ] NO

F.COURT ORDERED CHILD SUPPORT:

1. |

Court ordered current child support for child(ren) |

|

|

not common to the parties |

$ |

2. |

Court ordered cash medical support for child(ren) |

|

|

not common to the parties |

$ |

3. |

Amount of any arrears payment |

$ |

4. |

Amount per month actually paid in last 12 mos. |

$ |

Attach proof that you are paying

5.Name(s) and relationship of minor child(ren) who you support or who live with you, but are not common to the parties.

G. COURT ORDERED SPOUSAL MAINTENANCE/SUPPORT (Alimony):

1.Court ordered spousal maintenance/support you actually

pay to previous spouse: |

$ |

H. EXTRAORDINARY EXPENSES :

1. For Children (Educational Expense/Special Needs/Other): $ Explain:

2. For Self: |

$ |

||

|

Explain: |

|

|

|

|

|

|

INSTRUCTIONS

Both parties must answer items 7 and 8 if either party is requesting:

Spousal maintenance

Division of expenses

Attorneys’ fees and costs

Adjustment or deviation from the child support amount

Enforcement

7.SCHEDULE OF ALL MONTHLY EXPENSES:

Do NOT list any expenses for the other party, or children who live with the other party unless you are paying those expenses.

Do NOT list any expenses for the other party, or children who live with the other party unless you are paying those expenses.

Use a monthly average for items that vary from month to month.

Use a monthly average for items that vary from month to month.

If you are listing anticipated expenses, indicate this by putting an asterisk (*) next to the estimated amount.

If you are listing anticipated expenses, indicate this by putting an asterisk (*) next to the estimated amount.

©SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|

ALL RIGHTS RESERVED |

Page 5 of 7 |

AFI

|

|

|

|

|

Case No. |

||||

A. HOUSING EXPENSES: |

|

||||||||

1. |

House payment: |

|

|||||||

|

a. |

First Mortgage |

$ |

||||||

|

b. |

Second Mortgage |

$ |

||||||

|

c. |

Homeowners Association Fee |

$ |

||||||

|

d. |

Rent |

$ |

||||||

2. |

Repair & upkeep |

$ |

|||||||

3. |

Yard work/Pool/Pest Control |

$ |

|||||||

4. |

Insurance & taxes not included in house payment |

$ |

|||||||

5. |

Other (Explain) |

$ |

|||||||

|

|

|

|

|

TOTAL: |

$ |

|||

B. UTILITIES: |

|

||||||||

1. |

Water, sewer, and garbage |

$ |

|||||||

2. |

Electricity |

$ |

|||||||

3. |

Gas |

$ |

|||||||

4. |

Telephone |

$ |

|||||||

5. |

Mobile phone/pager |

$ |

|||||||

6. |

Internet Provider |

$ |

|||||||

7. |

Cable/Satellite television |

$ |

|||||||

8. |

Other (Explain:) |

|

|

$ |

|||||

|

|

|

|

|

TOTAL: |

$ |

|||

C. FOOD: |

|

|

|

|

|

|

|

|

|

1. |

Food, milk, and household supplies |

$ |

|||||||

2. |

School lunches |

$ |

|||||||

3. |

Meals outside home |

$ |

|||||||

|

|

|

|

|

TOTAL: |

$ |

|||

D. CLOTHING: |

|

||||||||

1. |

Clothing for you |

$ |

|||||||

2. |

Uniforms or special work clothes |

$ |

|||||||

3. |

Clothing for children living with you |

$ |

|||||||

4. |

Laundry and cleaning |

$ |

|||||||

|

|

|

|

|

TOTAL: |

$ |

|||

E. TRANSPORTATION OR AUTOMOBILE EXPENSES: |

|

||||||||

1. |

Car insurance |

$ |

|||||||

2. |

List all cars and individuals covered: |

|

|||||||

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

3. |

Car payment, if any |

$ |

|||||||

4. |

Car repair and maintenance |

$ |

|||||||

5. |

Gas and oil |

$ |

|||||||

6. |

Bus fare/parking fees |

$ |

|||||||

7. |

Other (explain): |

|

|

$ |

|||||

|

|

|

|

|

TOTAL: |

$ |

|||

F. MISCELLANEOUS: |

|

||||||||

1. |

School and school supplies |

$ |

|||||||

2. |

School activities or fees |

$ |

|||||||

3. Extracurricular activities of child(ren) |

$ |

|

|

©SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|

||

ALL RIGHTS RESERVED |

Page 6 of 7 |

||

AFI

|

|

|

|

|

|

Case No. |

|

||

4. |

Church/contributions |

|

|

$ |

|

|

|

||

5. |

Newspapers, magazines and books |

|

|

$ |

|

|

|

||

6. |

Barber and beauty shop |

|

|

$ |

|

|

|

||

7. |

Life insurance (beneficiary: |

|

|

) |

$ |

|

|

|

|

8. |

Disability insurance |

|

|

$ |

|

|

|

||

9. |

Recreation/entertainment |

|

|

$ |

|

|

|

||

10. |

Child(ren)'s allowance(s) |

|

|

$ |

|

|

|

||

11. |

Union/Professional dues |

|

|

$ |

|

|

|

||

12. |

Voluntary retirement contributions and savings deductions |

$ |

|

|

|

||||

13. |

Family gifts |

|

|

$ |

|

|

|

||

14. Pet Expenses |

|

|

$ |

|

|

|

|||

15. |

Cigarettes |

|

|

$ |

|

|

|

||

16. |

Alcohol |

|

|

$ |

|

|

|

||

17. |

Other (explain): |

|

|

$ |

|

|

|

||

|

|

|

|

TOTAL: |

$ |

|

|

|

|

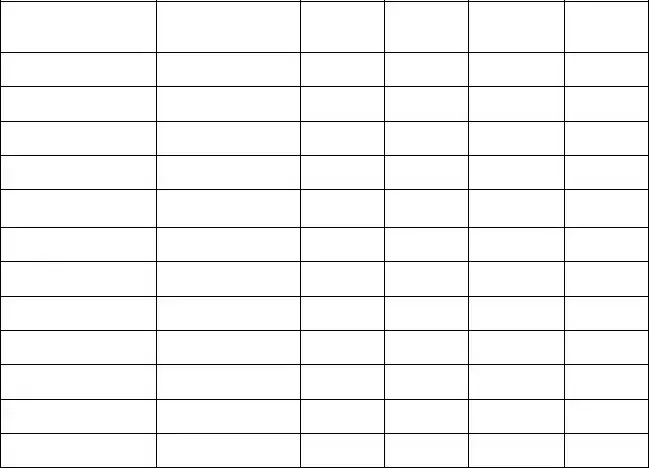

8.OUTSTANDING DEBTS AND ACCOUNTS: List all debts and installment payments you currently owe, but do not include items listed in Item 7 “Monthly Schedule of Expenses”. Follow the format below. Use additional paper if necessary.

Creditor Name

Purpose of Debt

Unpaid

Balance

Min.

Monthly

Payment

Date of

Your Last

Payment

Amount of

Your

Payment

©SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|

ALL RIGHTS RESERVED |

Page 7 of 7 |

AFI

Form Breakdown

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used to provide a detailed account of an individual's financial situation in family law cases. |

| Governing Law | The form is governed by the Arizona Rules of Family Law Procedure, specifically Rule 31. |

| Required Information | Individuals must provide accurate personal, financial, and employment information, including income and expenses. |

| Signature Requirement | The individual completing the affidavit must sign it, affirming the truthfulness of the information provided. |

| Consequences of Inaccuracy | Providing false information may lead to perjury charges and potential sanctions by the court. |

| Submission Instructions | Completed forms must be submitted to the court and shared with the opposing party, along with any required attachments. |