Fill Out Your Arizona Lsu Form

The Arizona Loan Status Update (LSU) form plays a critical role in the real estate transaction process, particularly for buyers and sellers navigating the complexities of financing. This document, updated in February 2013, is essential for keeping all parties informed about the current status of a buyer's proposed loan. Within five days of contract acceptance, the buyer is required to submit the LSU to the seller, providing a detailed overview of the loan's progress. The form includes vital information such as the lender's details, the type of loan being pursued, and the buyer's financial qualifications. It also outlines the necessary documentation that the lender must collect, including pay stubs, tax returns, and down payment sources. By ensuring that both the seller and broker receive timely updates, the LSU fosters transparency and communication, which are paramount in real estate transactions. Furthermore, the form specifies the conditions under which the buyer is relying on seller concessions and provides a framework for evaluating the buyer's financial readiness. Overall, the Arizona LSU form is a pivotal tool designed to streamline the loan process and facilitate a smoother closing experience for all involved.

Guide to Writing Arizona Lsu

Completing the Arizona Loan Status Update (LSU) form is essential for keeping all parties informed about the status of the buyer's loan. Follow these steps to ensure accurate and timely submission of the form.

- Obtain the Arizona LSU form.

- Fill in the lender’s information on lines 4 and 5, including the company name and license number.

- Provide the loan officer's name and NMLS number on line 6.

- Enter the loan officer’s address, city, state, and zip code on line 7.

- Include the loan officer’s email, phone number, and fax number on line 7.

- Enter the closing loan documents delivery date and close of escrow date on lines 8.

- List the buyer(s) and seller(s) names on lines 9 and 10, respectively.

- Fill in the premises/property address or assessor’s number on line 11.

- Complete the city, Arizona, and zip code on line 12.

- Indicate the buyer's status on line 13 (Buyer 1, Buyer 2, etc.).

- Specify the type of loan on line 18 (Conventional, FHA, VA, etc.).

- Indicate the occupancy type on line 19 (Primary, Secondary, Non-Owner Occupied).

- Choose the property type on line 20 (Single Family Residence, Condominium, etc.).

- Answer the questions regarding reliance on property sales and seller concessions on lines 21-24.

- Enter the pre-qualification loan amount on line 25 and the monthly payment on line 26.

- Fill in the maximum total monthly payment on line 28 and the interest rate on line 29.

- Check the boxes for initial requested documentation received from the buyer on lines 30-35.

- Add any additional comments on line 36.

- Ensure the buyer signs and dates the form on lines 39-40.

- Have the loan officer sign and date the form on line 67.

Browse Popular Forms

Does Arizona Have Sales Tax - This form is not for resale claims; use Form 5000A instead.

Maricopa County Superior Court Fees - Separate cases must be filed if children have different parents.

Arizona Form 285 - The taxpayer's signature on the form authenticates the request.

Common Questions

What is the purpose of the Arizona LSU form?

The Arizona Loan Status Update (LSU) form is used to provide updates on the status of a buyer's proposed loan. It ensures that the seller and broker receive timely information regarding the loan process, helping to keep all parties informed during the transaction.

When must the LSU be delivered?

The buyer is required to deliver the LSU to the seller within five days after the contract is accepted. This prompt action helps maintain transparency and keeps the transaction moving smoothly.

Who is responsible for providing updates after the initial LSU?

The lender is responsible for providing updated loan status information to the broker and seller upon request. This ongoing communication is crucial for keeping everyone informed of any changes in the loan status.

What information is included in the LSU?

The LSU includes details about the lender, loan officer, loan type, occupancy type, property type, and pre-qualification information. It also documents the buyer's financial situation, including income, assets, and debts, as well as any necessary documentation received by the lender.

What types of loans are covered by the LSU?

The LSU can cover various loan types, including Conventional, FHA, VA, USDA, and others. The specific type of loan will be indicated in the form, allowing all parties to understand the financing being utilized.

What happens if the buyer relies on seller concessions?

If the buyer is relying on seller concessions to cover loan costs, this must be clearly stated in the LSU. The amount the seller agrees to contribute will be established in the contract, ensuring that all parties are aware of the financial arrangements.

What documentation does the lender need from the buyer?

The lender typically requires various documents from the buyer, including paystubs, W-2s, personal and corporate tax returns, and documentation for down payment sources. The LSU outlines which documents have been received and any additional documentation that may be needed.

How does the buyer know if they can pre-qualify for a loan?

The LSU provides a pre-qualification amount based on the buyer's financial information. This amount is contingent upon the buyer's total monthly payment not exceeding a specified limit, which includes principal, interest, and other related costs.

What is the significance of the closing loan documents?

Closing loan documents are essential for finalizing the loan process. The LSU tracks whether these documents have been ordered and sent to the escrow company, ensuring that all necessary steps are completed before closing.

How does the closing process work?

Closing occurs when the deed is recorded at the appropriate county recorder’s office. The LSU helps track the progress of the closing process, ensuring that all conditions are met and funds are properly handled before the transaction is finalized.

Dos and Don'ts

When filling out the Arizona Loan Status Update (LSU) form, attention to detail is crucial. Here are some important do's and don'ts to keep in mind:

- Do provide accurate and complete information about the lender, including the company name, license number, and contact details.

- Do submit the form within five days of contract acceptance to ensure compliance with the contractual obligations.

- Do ensure that all required documentation, such as paystubs and tax returns, is included to avoid delays.

- Do keep a copy of the completed form for your records and future reference.

- Don't leave any sections blank; incomplete forms can lead to processing delays.

- Don't forget to check the accuracy of the loan amount and interest rate before submission.

- Don't submit the form without obtaining all necessary signatures from the buyer and loan officer.

- Don't ignore the importance of timely updates; failure to provide updates can hinder the loan process.

Similar forms

The Loan Estimate (LE) is a document that lenders provide to borrowers within three business days of receiving a loan application. Similar to the Arizona Loan Status Update (LSU), the LE outlines key information about the loan, including estimated monthly payments, interest rates, and closing costs. Both documents serve to inform borrowers about the financial implications of their loan, allowing them to make informed decisions. The LE, however, focuses on the initial cost estimates, while the LSU updates the borrower on the status of their loan application as it progresses.

The Closing Disclosure (CD) is another essential document in the home buying process. It is provided to borrowers at least three days before closing and details the final terms of the loan, including the exact closing costs and the amount of cash needed at closing. Like the LSU, the CD ensures that the borrower is fully informed about their financial obligations. However, the CD is a final summary, whereas the LSU provides ongoing updates throughout the loan process.

The Uniform Residential Loan Application (URLA) is a standardized form used by lenders to collect information from borrowers. This document is similar to the LSU in that it gathers essential information needed for loan processing, such as income, assets, and debts. While the LSU focuses on the status of the loan after application, the URLA is primarily concerned with the initial data collection necessary to assess a borrower's eligibility.

The Good Faith Estimate (GFE) was a document that provided borrowers with an estimate of the costs associated with their mortgage. Although it has been replaced by the LE, it shares similarities with the LSU in that both documents aim to provide transparency regarding loan costs. The GFE was delivered early in the process, while the LSU updates the borrower on the status of their loan as it moves through underwriting and approval.

The Truth in Lending Act (TILA) disclosure outlines the terms and costs associated with a mortgage. Similar to the LSU, this document ensures that borrowers understand their financial commitments. While the TILA focuses on the costs of borrowing, including interest rates and fees, the LSU provides real-time updates on the progress of the loan application, making it a more dynamic document in the loan process.

The Pre-Approval Letter is a document issued by lenders to indicate that a borrower has met certain criteria for a loan. This letter is similar to the LSU in that both serve to communicate the borrower’s status in the loan process. However, the Pre-Approval Letter is typically issued before a property is identified, while the LSU is used to provide updates after a property is under contract.

The Loan Commitment Letter is a formal document from the lender indicating that they are willing to provide financing under specific terms. This letter is akin to the LSU in that it confirms the lender's intent to proceed with the loan. The Loan Commitment Letter, however, is issued after the underwriting process, while the LSU keeps the borrower informed of their loan status throughout the application process.

The Appraisal Report provides an assessment of the property’s value and is a crucial part of the loan process. While the LSU updates the borrower on their loan status, the Appraisal Report informs both the lender and borrower of the property’s worth. Both documents are essential in determining whether the loan can be approved, but they serve different purposes within the process.

The Title Commitment is a document that outlines the terms under which a title insurance company will insure the title to a property. Similar to the LSU, it is a critical component of the closing process. While the LSU provides updates on the loan application status, the Title Commitment ensures that the property is free of liens and encumbrances, thus protecting the lender's investment.

Finally, the Mortgage Note is a legal document that outlines the terms of the loan agreement between the borrower and lender. It is similar to the LSU in that both documents are integral to the mortgage process. The Mortgage Note becomes relevant at closing, while the LSU serves to keep the borrower informed throughout the loan approval process.

Key takeaways

When filling out and using the Arizona Loan Status Update (LSU) form, consider the following key takeaways:

- Timeliness is crucial: Submit the LSU within five days after the contract is accepted.

- Clear identification: Clearly indicate the lender's name and license number on the form.

- Provide accurate details: Ensure all buyer and seller information, including property address, is correct.

- Documentation matters: Include necessary documentation such as pay stubs, tax returns, and down payment sources.

- Loan type specifics: Specify the type of loan and occupancy type accurately to avoid processing delays.

- Communication is key: The lender must provide updates to both the seller and broker upon request.

- Approval process: Be aware of the steps involved in obtaining loan approval, including underwriting and conditions.

- Closing requirements: Understand that closing occurs once the deed is recorded at the county recorder's office.

Common mistakes

-

Incomplete Information: Failing to provide all necessary details, such as the lender's name, license number, or contact information, can lead to delays. Make sure to fill in every required field accurately.

-

Missing Signatures: Not signing the form can invalidate it. Ensure that all required signatures from buyers and loan officers are included before submission.

-

Incorrect Dates: Entering wrong dates for the closing loan documents or the close of escrow can create confusion. Double-check all date entries for accuracy.

-

Omitting Loan Type Information: Not specifying the type of loan or occupancy can lead to misunderstandings with the lender. Clearly indicate whether it is a conventional, FHA, VA, or other type of loan.

-

Ignoring Documentation Requirements: Failing to check off the initial requested documentation can slow down the loan process. Ensure that all relevant documents are listed and provided as required.

Document Preview

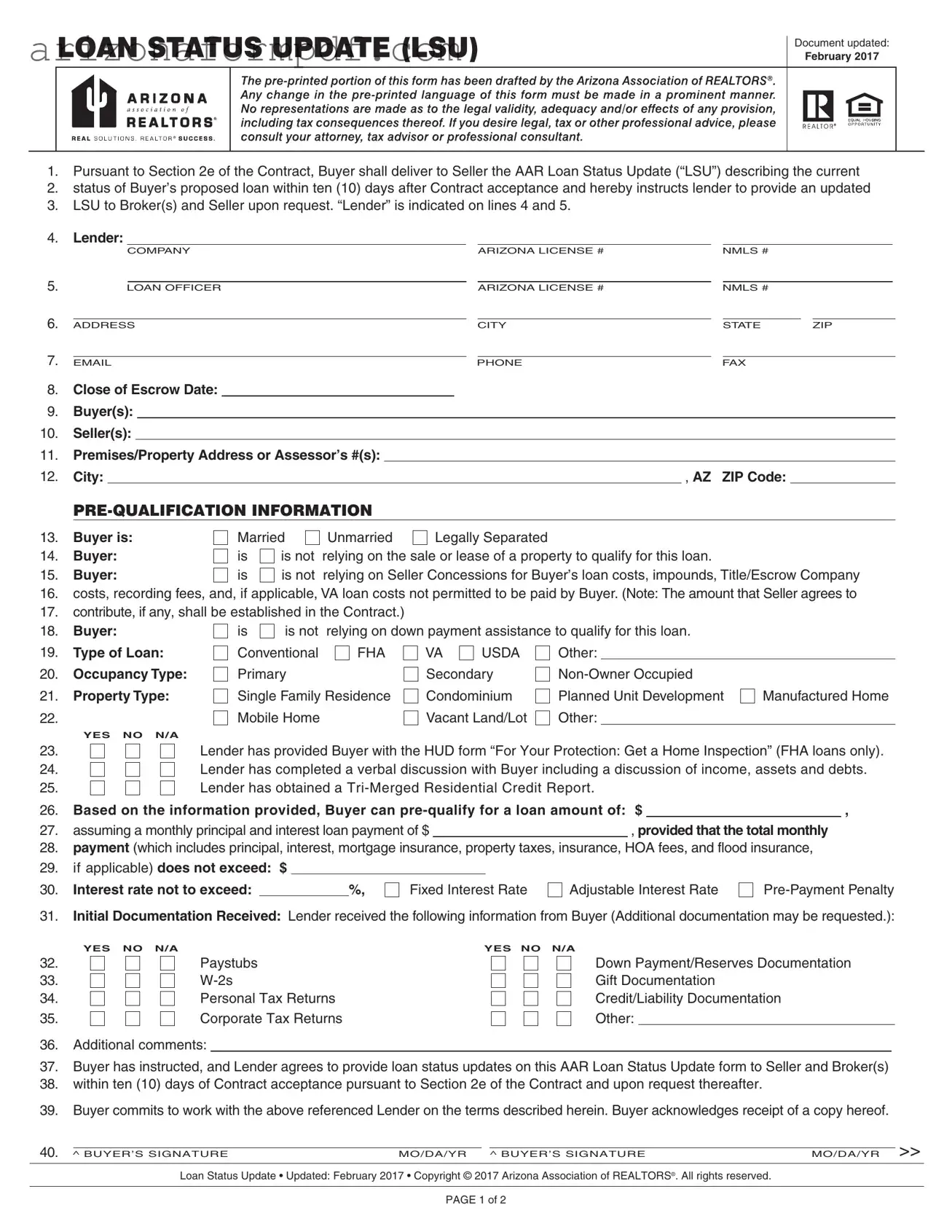

LOAN STATUS UPDATE (LSU)

Document updated:

February 2017

1.Pursuant to Section 2e of the Contract, Buyer shall deliver to Seller the AAR Loan Status Update (“LSU”) describing the current

2.status of Buyer’s proposed loan within ten (10) days after Contract acceptance and hereby instructs lender to provide an updated

3.LSU to Broker(s) and Seller upon request. “Lender” is indicated on lines 4 and 5.

4.Lender:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPANY |

|

ARIZONA LICENSE # |

NMLS # |

|

|

|

||||||||

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOAN OFFICER |

|

ARIZONA LICENSE # |

NMLS # |

|

|

|

||||||||||

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

CITY |

|

STATE |

|

ZIP |

|

|||||||||||

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHONE |

FAX |

|

|

|

|||||||||||||

8. |

Close of Escrow Date: |

|

|

|

|

|

|

|

|

|

|

|

|||||

9. |

Buyer(s): |

|

|

|

|

|

|

|

|

|

|

||||||

10. |

Seller(s): |

|

|

|

|

|

|

|

|

|

|

||||||

11. |

Premises/Property Address or Assessor’s #(s): |

|

|

|

|

|

|

|

|

|

|

||||||

12. |

City: |

|

|

|

, AZ |

ZIP Code: |

|

|

|

|

|||||||

13. |

Buyer is: |

Married |

Unmarried |

Legally Separated |

|

14. |

Buyer: |

is |

is not |

relying on the sale or lease of a property to qualify for this loan. |

|

15. |

Buyer: |

is |

is not |

relying on Seller Concessions for Buyer’s loan costs, impounds, Title/Escrow Company |

|

16.costs, recording fees, and, if applicable, VA loan costs not permitted to be paid by Buyer. (Note: The amount that Seller agrees to

17.contribute, if any, shall be established in the Contract.)

18. |

Buyer: |

is |

is not |

relying on down payment assistance to qualify for this loan. |

|

||||

19. |

Type of Loan: |

Conventional |

FHA |

VA |

USDA |

Other: |

|

|

|

20. |

Occupancy Type: |

Primary |

|

Secondary |

|

||||

21. |

Property Type: |

Single Family Residence |

Condominium |

Planned Unit Development |

Manufactured Home |

||||

22. |

|

Mobile Home |

|

Vacant Land/Lot |

Other: |

|

|

||

|

YES NO N/A |

|

|

|

|

23. |

Lender has provided Buyer with the HUD form “For Your Protection: Get a Home Inspection” (FHA loans only). |

||||

24. |

Lender has completed a verbal discussion with Buyer including a discussion of income, assets and debts. |

||||

25. |

Lender has obtained a |

|

|

|

|

26. |

Based on the information provided, Buyer can |

|

, |

||

27. |

assuming a monthly principal and interest loan payment of $ |

|

, provided that the total monthly |

|

|

28.payment (which includes principal, interest, mortgage insurance, property taxes, insurance, HOA fees, and flood insurance,

29.if applicable) does not exceed: $

30. Interest rate not to exceed: |

|

%, |

Fixed Interest Rate |

Adjustable Interest Rate |

31.Initial Documentation Received: Lender received the following information from Buyer (Additional documentation may be requested.):

YES NO N/A |

YES NO N/A |

32.

33.

34.

35.

Paystubs

Personal Tax Returns

Corporate Tax Returns

Down Payment/Reserves Documentation

Gift Documentation

Credit/Liability Documentation

Other:

36.Additional comments:

37.Buyer has instructed, and Lender agrees to provide loan status updates on this AAR Loan Status Update form to Seller and Broker(s)

38.within ten (10) days of Contract acceptance pursuant to Section 2e of the Contract and upon request thereafter.

39.Buyer commits to work with the above referenced Lender on the terms described herein. Buyer acknowledges receipt of a copy hereof.

40. |

|

|

|

|

|

>> |

^ BUYER’S SIGNATURE |

MO/DA/YR ^ BUYER’S SIGNATURE |

MO/DA/YR |

||||

|

|

|

|

|

|

|

Loan Status Update • Updated: February 2017 • Copyright © 2017 Arizona Association of REALTORS®. All rights reserved.

PAGE 1 of 2

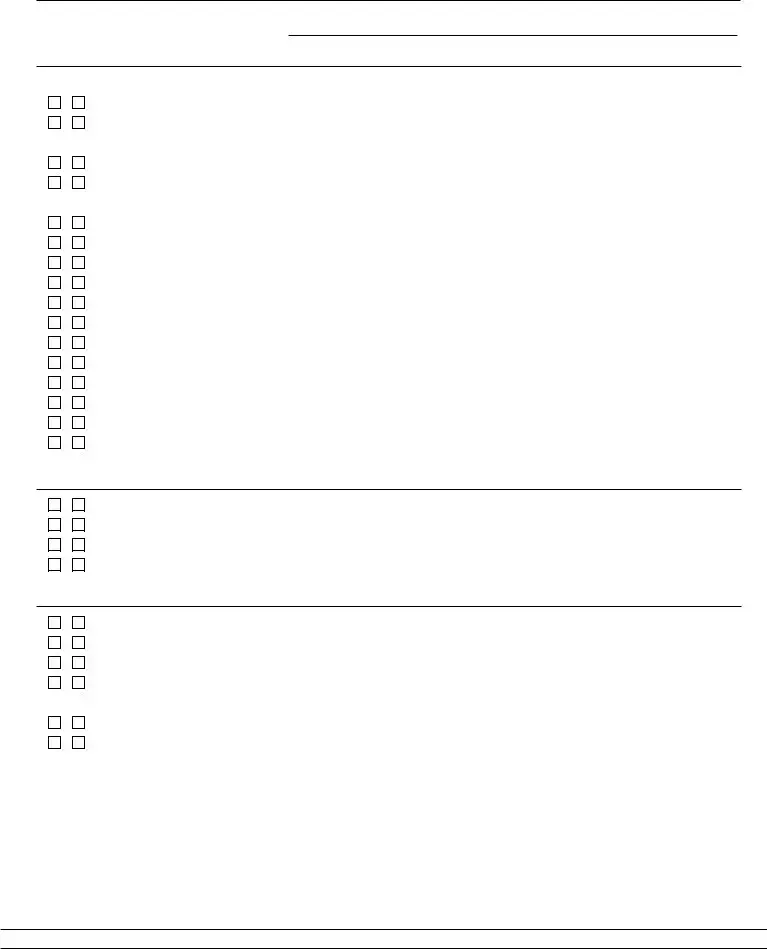

Page 2 of 2

Loan Status Update (LSU) >>

Premises/Property Address or Assessor’s #(s):

DOCUMENTATION

|

DATE |

LENDER |

YES NO |

COMPLETED |

INITIALS |

41.

42.

43.

44.

45.

46.

47.

48.

49.

50.

51.

52.

53.

54.

55.

56.

57.

58.

Lender received the Contract and all Addenda |

/ |

/ |

||||||

Lender received Buyer’s name, income, social security number, Premises address, |

|

|

|

|

|

|

||

estimate of value of the Premises, and mortgage loan amount sought |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

Lender sent Loan Estimate |

|

/ |

/ |

|||||

Buyer indicated to Lender an intent to proceed with the transaction after having |

|

|

|

|

|

|

||

received the Loan Estimate |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

Lender received a signed Form 1003 and Lender disclosures |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

Payment for the appraisal has been received |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

Lender ordered the appraisal |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

Lender identified down payment source |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

Lender received and reviewed the Title Commitment |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

Buyer locked the loan program and financing terms, including interest rate and points |

|

/ |

/ |

|||||

Lock expiration date |

|

|

|

|

|

|

|

|

Lender received the Initial Documentation listed on lines |

|

/ |

/ |

|||||

|

|

|

|

|

|

|||

Appraisal received |

|

/ |

/ |

|||||

|

|

|

|

|

|

|||

Premises/Property appraised for at least the purchase price |

|

/ |

/ |

|||||

|

|

|

|

|

|

|||

Closing Disclosure provided to Buyer |

|

/ |

/ |

|||||

|

|

|

|

|

|

|||

Closing Disclosure received by Buyer |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

UNDERWRITING AND APPROVAL

59.

60.

61.

62.

Lender submitted the loan package to the Underwriter |

|

/ |

/ |

||

|

|

|

|

|

|

Lender obtained loan approval with Prior to Document (“PTD”) Conditions |

|

/ |

/ |

||

|

|

|

|

|

|

Appraisal conditions have been met |

|

/ |

/ |

||

|

|

|

|

|

|

Buyer has loan approval without PTD Conditions |

|

/ |

/ |

||

|

|

|

|

|

|

CLOSING

63.

64.

65.

66.

67.

68.

69.

Lender ordered the Closing Loan Documents and Instructions |

|

/ |

/ |

|||

|

|

|

|

|

|

|

Lender received signed Closing Loan Documents from all parties |

|

/ |

/ |

|||

|

|

|

|

|

|

|

All Lender Quality Control Reviews have been completed |

|

/ |

/ |

|||

All Prior to Funding (“PTF”) Conditions have been met and Buyer has obtained |

|

|

|

|

|

|

loan approval without conditions |

|

/ |

/ |

|||

|

|

|

|

|

|

|

Funds have been ordered |

|

/ |

/ |

|||

|

|

|

|

|

|

|

All funds have been received by Escrow Company |

|

/ |

/ |

|||

|

|

|

|

|

|

|

70.Close of escrow occurs when the deed has been recorded at the appropriate county recorder’s office.

71. |

|

|

^ LOAN OFFICER’S SIGNATURE |

MO/DA/YR |

Loan Status Update • Updated: February 2017 • Copyright © 2017 Arizona Association of REALTORS®. All rights reserved.

PAGE 2 of 2

Form Breakdown

| Fact Name | Description |

|---|---|

| Document Title | Loan Status Update (LSU) |

| Last Updated | February 2013 |

| Governing Law | Arizona Revised Statutes, Title 33 - Property |

| Buyer Obligations | The Buyer must deliver the LSU to the Seller within five days after Contract acceptance. |

| Lender Responsibilities | The Lender must provide updated LSU to the Broker(s) and Seller upon request. |

| Loan Types | Available loan types include Conventional, FHA, VA, USDA, and others. |

| Documentation Required | Buyers must provide paystubs, tax returns, and other financial documents as requested by the Lender. |