Fill Out Your Arizona New Hire Reporting Form

The Arizona New Hire Reporting Form plays a crucial role in the state's efforts to streamline employment processes and ensure compliance with federal and state regulations. Employers must complete this form for each new employee they hire, providing essential details such as the employee's Social Security number, name, and address, as well as the employer's Federal Employer Identification Number (FEIN). This information is vital for tracking new hires and facilitating income withholding orders when necessary. Additionally, the form requires employers to indicate the employee's date of birth, date of hire, and whether medical insurance benefits are offered. Accurate completion of the form is not just a regulatory requirement; it also helps to prevent fraud and support child support enforcement initiatives. Employers can submit the form by mail or via fax, ensuring that the information reaches the Arizona New Hire Reporting Center promptly. For any questions or additional guidance, resources are available online and through a toll-free hotline.

Guide to Writing Arizona New Hire Reporting

After you complete the Arizona New Hire Reporting form, you will need to send it to the Arizona New Hire Reporting Center. You can do this by mail or by fax. Ensure that all information is accurate and complete to avoid any delays in processing.

- Gather the required information for both employer and employee sections.

- Fill in the Employer Information section:

- Enter the Federal Employer Identification Number (FEIN).

- Provide the employer name and any Doing Business As (DBA) name.

- Include the contact person's name, telephone number, and email address.

- Fill in the complete address where the Income Withholding Order will be sent, including city, state, and zip code.

- Complete the Employee Information section:

- Enter the employee's Social Security Number.

- Fill in the employee's first name, middle name, and last name.

- Provide the employee's address, including city, state, and zip code.

- Record the employee's date of birth and date of hire.

- Indicate if medical insurance is an employee benefit and if the employee is eligible for insurance benefits.

- If applicable, fill out the Optional Employee Information section in the same manner as the employee information.

- Review the entire form for accuracy and completeness.

- Decide whether to mail or fax the completed form. If mailing, send it to the Arizona New Hire Reporting Center at P.O. Box 402, Holbrook, MA 02343. If faxing, use the toll-free fax number 1-888-282-0502.

For further assistance, you can visit the Arizona New Hire website or call their toll-free number. This resource is available to help you with any questions you may have.

Browse Popular Forms

Emergency Custody Forms Arizona - Understand that not all requests may be granted as Temporary Orders are at the court's discretion.

Az State Income Tax Form - Applicants must demonstrate knowledge of specific regulatory requirements.

Arizona Tax Forms - Revising or amending this report when necessary reflects conscientious estate management.

Common Questions

What is the purpose of the Arizona New Hire Reporting form?

The Arizona New Hire Reporting form is designed to help employers report newly hired employees to the state. This process is crucial for various reasons, including ensuring compliance with child support enforcement laws and facilitating the tracking of employment for tax purposes. By reporting new hires, employers contribute to a system that helps maintain the integrity of public assistance programs and supports families in need.

Who needs to complete the Arizona New Hire Reporting form?

All employers in Arizona are required to complete this form for each new employee they hire. This includes full-time, part-time, and temporary workers. It is important to report all new hires within 20 days of their start date to avoid penalties and ensure compliance with state regulations. Even if an employee is hired for a short period, the form still needs to be submitted.

How do I submit the Arizona New Hire Reporting form?

You can submit the completed Arizona New Hire Reporting form in two ways. First, you can mail it to the Arizona New Hire Reporting Center at the address provided: P.O. Box 402, Holbrook, MA 02343. Alternatively, you can fax the form to the toll-free number 1-888-282-0502. Whichever method you choose, ensure that the form is filled out completely and accurately to avoid delays in processing.

What information is required on the form?

The Arizona New Hire Reporting form requires specific information about both the employer and the employee. Employers must provide their Federal Employer Identification Number (FEIN), name, contact details, and address. For employees, the form requires their Social Security Number, name, address, date of birth, and date of hire. Additionally, employers must indicate whether the employee is eligible for medical insurance benefits. Accurate and complete information is vital for the effective processing of the report.

Dos and Don'ts

When filling out the Arizona New Hire Reporting form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below is a list of actions to take and avoid.

- Do provide accurate employer information, including the Federal Employer Identification Number (FEIN).

- Do complete one entry for each new employee to avoid confusion.

- Do include the employee's Social Security Number, ensuring it is correctly formatted.

- Do indicate the employee's date of birth and date of hire to maintain proper records.

- Do verify that the contact information for the employer is current and complete.

- Do check the box regarding medical insurance benefits accurately to reflect the employee's eligibility.

- Don't leave any required fields blank; incomplete forms may delay processing.

- Don't use a different FEIN for reporting employee wages than the one provided on the form.

- Don't provide inaccurate or outdated contact information, as this may hinder communication.

- Don't forget to sign and date the form before submission.

- Don't submit the form without double-checking for any errors or omissions.

- Don't ignore the instructions for optional employee information; while not mandatory, it can be beneficial.

Similar forms

The W-4 Form, also known as the Employee's Withholding Certificate, serves a similar purpose to the Arizona New Hire Reporting form by collecting essential information from new employees. Employers use the W-4 to determine the correct amount of federal income tax to withhold from an employee's paycheck. Like the Arizona New Hire Reporting form, the W-4 requires personal details such as the employee's name, address, and Social Security number. Both documents aim to ensure compliance with tax regulations, facilitating accurate reporting and withholding processes.

The I-9 Form, or Employment Eligibility Verification, is another important document that parallels the Arizona New Hire Reporting form. This form verifies an employee's identity and eligibility to work in the United States. Employers must complete the I-9 for each new hire, similar to the requirement of submitting the Arizona New Hire Reporting form. Both documents require personal information, including the employee’s name and Social Security number, and both serve to protect employers from hiring individuals who are not authorized to work in the country.

The 1099 Form, specifically the 1099-MISC or 1099-NEC, is used to report payments made to independent contractors and is somewhat similar to the Arizona New Hire Reporting form in that it collects essential information about individuals receiving payments. While the Arizona form focuses on new employees, the 1099 form is used for reporting non-employee compensation. Both documents require identifying information, such as names and Social Security numbers, and play a crucial role in ensuring compliance with tax obligations.

The State Unemployment Insurance (SUI) form is another document that shares similarities with the Arizona New Hire Reporting form. Employers must submit SUI forms to report wages paid to employees, which helps determine unemployment benefits eligibility. Both forms require detailed employee information, including names and Social Security numbers, and both are vital for maintaining compliance with state regulations regarding employment and benefits.

The Employee Benefits Enrollment Form is akin to the Arizona New Hire Reporting form in that it collects information related to employee benefits, such as health insurance. While the Arizona form includes questions about medical insurance benefits, the enrollment form is specifically designed for employees to select their benefits upon hiring. Both documents aim to streamline the onboarding process and ensure that employees receive the benefits they are entitled to, reinforcing the importance of accurate reporting and compliance.

Finally, the Payroll Authorization Form is similar to the Arizona New Hire Reporting form as it establishes the employee's consent for payroll deductions and direct deposits. This form gathers essential information, including the employee's bank details and Social Security number, much like the Arizona form. Both documents facilitate the accurate processing of payroll and ensure that employees are paid correctly and on time, contributing to a smooth employment experience.

Key takeaways

When filling out the Arizona New Hire Reporting form, it is important to keep a few key points in mind to ensure compliance and efficiency.

- Complete Each Section Accurately: Ensure that all required fields, such as the Federal Employer Identification Number (FEIN), employer name, and employee information, are filled out correctly. Inaccuracies can lead to delays in processing.

- Submit in a Timely Manner: The form should be submitted within 20 days of the employee's hire date. Timely reporting helps in the management of child support cases and other benefits.

- Choose the Right Submission Method: You can either mail the completed form to the Arizona New Hire Reporting Center or fax it using the toll-free number provided. Choose the method that best suits your needs.

- Keep Records: Maintain a copy of the submitted form for your records. This can be helpful for future reference and in case of any discrepancies.

By following these guidelines, employers can ensure that they are meeting their obligations while also supporting their employees effectively.

Common mistakes

-

Incorrect Federal Employer Identification Number (FEIN): Failing to use the correct FEIN can lead to issues with reporting. Ensure that the number matches the one used for quarterly wage reporting.

-

Missing Employer Name: Not providing the employer's name can cause delays. Always include the full legal name of the business.

-

Incomplete Employee Information: Omitting any details such as Social Security Number or date of hire can result in the form being rejected. Double-check that all required fields are filled out.

-

Incorrect Address for Income Withholding Order: Providing the wrong address can lead to issues with receiving important documents. Make sure the address is accurate and complete.

-

Failure to Indicate Medical Insurance Eligibility: Not answering the questions about medical insurance benefits can cause confusion. Be sure to clearly mark "Yes" or "No" as applicable.

-

Using Outdated Forms: Submitting an outdated version of the form can lead to complications. Always use the most current version available.

-

Neglecting Optional Information: While optional, providing additional employee information can be beneficial. Consider including it if possible.

-

Not Mailing or Faxing to the Correct Address: Ensure that the form is sent to the correct Arizona New Hire Reporting Center address. Double-check the mailing or faxing details before sending.

Document Preview

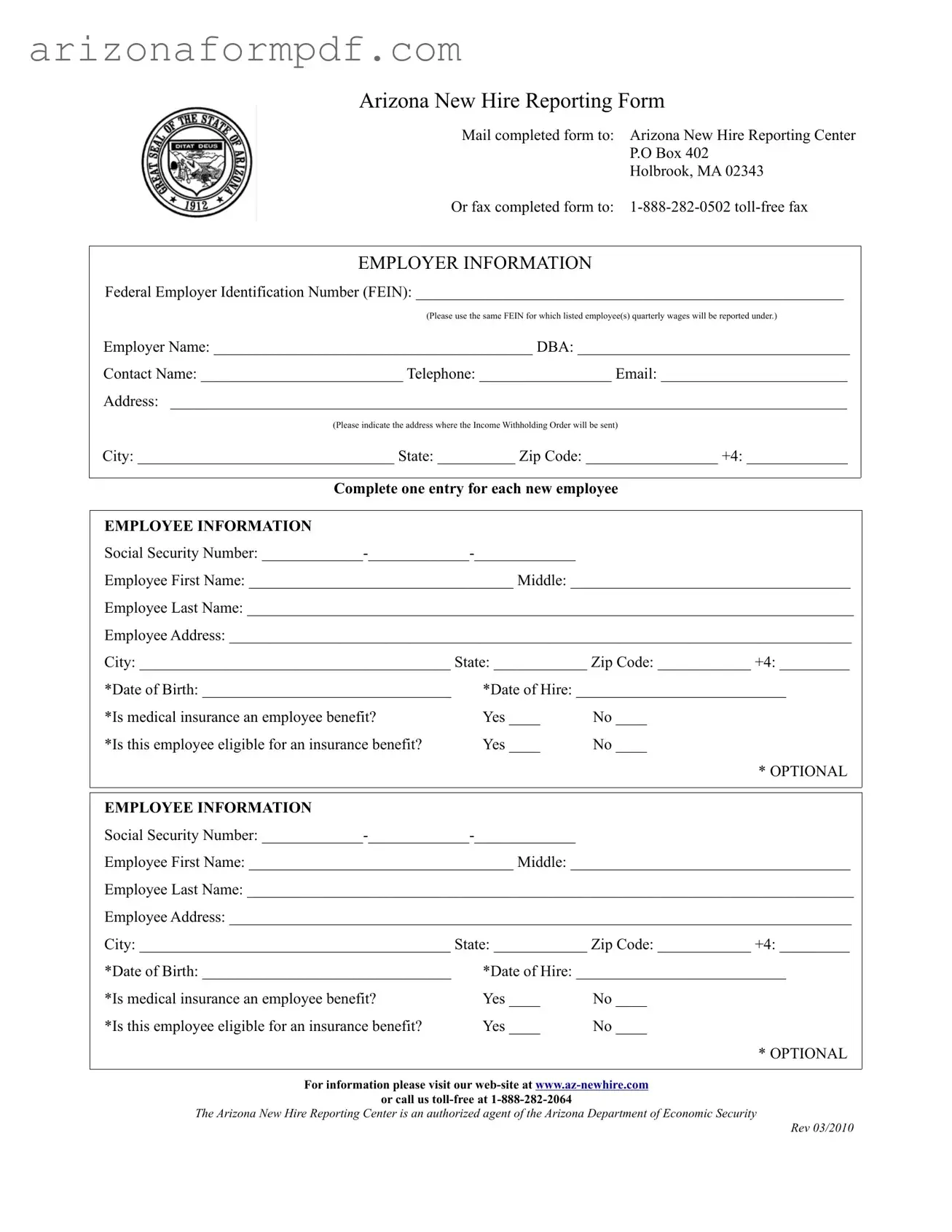

Arizona New Hire Reporting Form

Mail completed form to: Arizona New Hire Reporting Center

P.O Box 402

Holbrook, MA 02343

Or fax completed form to:

EMPLOYER INFORMATION

Federal Employer Identification Number (FEIN): _______________________________________________________

(Please use the same FEIN for which listed employee(s) quarterly wages will be reported under.)

Employer Name: _________________________________________ DBA: ___________________________________

Contact Name: __________________________ Telephone: _________________ Email: ________________________

Address: _______________________________________________________________________________________

(Please indicate the address where the Income Withholding Order will be sent)

City: _________________________________ State: __________ Zip Code: _________________ +4: _____________

Complete one entry for each new employee

EMPLOYEE INFORMATION

Social Security Number:

Employee First Name: __________________________________ Middle: ____________________________________

Employee Last Name: ______________________________________________________________________________

Employee Address: ________________________________________________________________________________

City: ________________________________________ State: ____________ Zip Code: ____________ +4: _________

*Date of Birth: ________________________________ |

*Date of Hire: ___________________________ |

|

*Is medical insurance an employee benefit? |

Yes ____ |

No ____ |

*Is this employee eligible for an insurance benefit? |

Yes ____ |

No ____ |

* OPTIONAL

EMPLOYEE INFORMATION

Social Security Number:

Employee First Name: __________________________________ Middle: ____________________________________

Employee Last Name: ______________________________________________________________________________

Employee Address: ________________________________________________________________________________

City: ________________________________________ State: ____________ Zip Code: ____________ +4: _________

*Date of Birth: ________________________________ |

*Date of Hire: ___________________________ |

|

*Is medical insurance an employee benefit? |

Yes ____ |

No ____ |

*Is this employee eligible for an insurance benefit? |

Yes ____ |

No ____ |

* OPTIONAL

For information please visit our

or call us

The Arizona New Hire Reporting Center is an authorized agent of the Arizona Department of Economic Security

Rev 03/2010

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The Arizona New Hire Reporting Form is designed to report newly hired employees to the state, helping in the enforcement of child support and unemployment insurance laws. |

| Governing Law | This reporting requirement is governed by the Arizona Revised Statutes, specifically ARS § 25-511. |

| Submission Methods | Employers can submit the completed form by mail to the Arizona New Hire Reporting Center or via fax to a toll-free number. |

| Employer Information | Employers must provide their Federal Employer Identification Number (FEIN), name, and contact information on the form. |

| Employee Information | Each new employee's Social Security Number, name, address, date of birth, and date of hire must be included in the report. |

| Medical Insurance Questions | The form includes optional questions regarding medical insurance benefits for the new employee. |

| Deadline | Employers are required to report new hires within 20 days of their start date to comply with state regulations. |

| Contact Information | For assistance, employers can visit the Arizona New Hire website or call the toll-free number provided on the form. |