Fill Out Your Arizona Repossession Affidavit Form

The Arizona Repossession Affidavit form plays a crucial role in the process of reclaiming vehicles when a borrower defaults on their loan. This form is primarily used by lienholders, who are the legal owners of the vehicle, to document the repossession of the vehicle. It requires detailed information, including the Vehicle Identification Number (VIN), the year and make of the vehicle, and the names of the registered owners. Additionally, the affidavit must state the repossession date and certify that the vehicle is physically located in Arizona. By signing the affidavit, the lienholder affirms their legal ownership and acknowledges that they have followed all applicable laws during the repossession process. The form also includes a Bill of Sale section, where the lienholder can transfer ownership of the vehicle to a buyer, providing essential details such as the sale date and the buyer's information. Importantly, the affidavit requires an odometer statement to accurately reflect the vehicle's mileage, which is a legal requirement to prevent fraud. Failure to provide accurate information can lead to serious consequences, including fines or imprisonment. This comprehensive document not only protects the rights of the lienholder but also ensures compliance with state regulations, making it a vital component of vehicle repossession in Arizona.

Guide to Writing Arizona Repossession Affidavit

Once you have gathered all necessary information, you can begin filling out the Arizona Repossession Affidavit form. This form is essential for documenting the repossession of a vehicle and transferring ownership legally. Make sure to complete each section accurately to avoid any issues down the line.

- Obtain the Form: Download or print the Arizona Repossession Affidavit form from the Arizona Department of Transportation website.

- Vehicle Information: Fill in the Vehicle Identification Number (VIN), year, and make of the vehicle in the designated fields.

- Registered Owner Names: Print the names of all registered owners of the vehicle clearly.

- Repossession Date: Enter the date when the vehicle was repossessed.

- Title State: Indicate the state where the vehicle title is held.

- Certification Statement: Read the certification statement carefully, confirming that you are the legal owner and lienholder of the vehicle. This section does not require additional information but is important for legal acknowledgment.

- Lienholder Information: Provide the name of the lienholder company and the name of the lienholder agent. Make sure to include the lienholder's signature.

- Bill of Sale Section: In this section, write the name of the buyer and the sale date. Include the buyer's street address, city, state, and zip code.

- New Lienholder Information: If applicable, write the name of the new lienholder. If there is no new lienholder, simply write "NONE." Include the lien date.

- Odometer Statement: Fill in the odometer reading, selecting the appropriate box for mileage type. Be honest about the mileage to avoid legal issues.

- Seller Information: Print your name and provide your signature along with the date. Include your street address, city, state, and zip code.

- Buyer Information: The buyer must print their name and sign the form, along with the date.

After completing the form, review it thoroughly for any errors or omissions. Once you are confident that everything is accurate, you can submit the affidavit to the appropriate authorities or keep it for your records as required.

Browse Popular Forms

Does Arizona Have Income Tax - Filing a new A-4 is necessary if tax circumstances change during the year.

How to Check Credits for School - Allow adequate time for processing your request.

Common Questions

What is the purpose of the Arizona Repossession Affidavit form?

The Arizona Repossession Affidavit form serves as a legal document that confirms the repossession of a vehicle by a lienholder. This form is essential for providing proof that the lienholder has the right to reclaim the vehicle due to the owner's default on payment or other contractual obligations. It ensures that the repossession process adheres to state laws and protects the rights of all parties involved.

Who needs to fill out the Arizona Repossession Affidavit?

The lienholder, or the legal owner of the vehicle, is responsible for completing the Arizona Repossession Affidavit. This includes financial institutions or individuals who hold a lien on the vehicle. It is crucial that the lienholder accurately provides all required information, including the vehicle identification number and the details of the repossession, to ensure compliance with Arizona law.

What information is required on the form?

The form requires specific details about the vehicle, including the Vehicle Identification Number (VIN), year, make, and the names of the registered owners. Additionally, the repossession date and the lienholder's information must be included. The affidavit also necessitates an odometer reading to verify the vehicle's mileage at the time of repossession, which is important for ownership transfer purposes.

What are the consequences of providing false information on the affidavit?

Providing false information on the Arizona Repossession Affidavit can lead to serious legal repercussions. Both federal and state laws impose penalties for inaccurate odometer statements or any misleading details. This may include fines and even imprisonment, emphasizing the importance of honesty and accuracy when completing the form.

How does the affidavit protect the lienholder?

The affidavit serves as a protective measure for the lienholder by documenting the repossession process. By certifying that the vehicle was repossessed according to the terms of the lien and applicable laws, the lienholder establishes legal grounds for the repossession. Additionally, the affidavit states that the State of Arizona and its agencies will not be held liable for relying on the contents of the affidavit, further safeguarding the lienholder's interests.

Dos and Don'ts

When filling out the Arizona Repossession Affidavit form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do ensure that all vehicle information, including the Vehicle Identification Number (VIN), is accurate.

- Do clearly print the names of the registered owners to avoid any confusion.

- Do specify the repossession date and make sure it aligns with the timeline of events.

- Do include your lienholder company name and the name of the lienholder agent for proper identification.

- Do accurately complete the odometer statement to comply with federal and state laws.

- Don't leave any sections of the form blank; incomplete forms may be rejected.

- Don't provide false information, especially regarding the odometer reading, as this can lead to serious legal consequences.

- Don't forget to sign and date the affidavit; an unsigned document is not valid.

- Don't use sequential bills of sale, as they will not be accepted.

By following these guidelines, you can ensure that your affidavit is completed correctly and efficiently, helping to facilitate a smooth repossession process.

Similar forms

The Arizona Repossession Affidavit form shares similarities with the Bill of Sale document. Both serve as legal instruments for the transfer of ownership of a vehicle. The Bill of Sale includes details such as the vehicle identification number, the names of the buyer and seller, and the sale date. Like the Repossession Affidavit, it requires signatures from both parties to validate the transaction. The primary difference lies in the context; while the Bill of Sale indicates a voluntary transfer, the Repossession Affidavit signifies a reclaiming of the vehicle due to default on a loan or lease.

Another document comparable to the Arizona Repossession Affidavit is the Lien Release form. This form is used to officially release a lien on a vehicle once the associated debt has been satisfied. Similar to the Repossession Affidavit, the Lien Release confirms the legal standing of the lienholder and the status of the vehicle. Both documents require the lienholder's signature and are essential for ensuring clear title transfer, but the Lien Release occurs after the debt is paid, while the Repossession Affidavit is executed when the vehicle is reclaimed.

The Affidavit of Ownership is also akin to the Arizona Repossession Affidavit. This document is used when an individual claims ownership of a vehicle, often in situations where the title is lost or not available. Both documents affirm the legal ownership of a vehicle and require the owner to certify their claims under penalty of perjury. The main distinction is that the Affidavit of Ownership is typically used to establish ownership, while the Repossession Affidavit is used to reclaim a vehicle due to non-payment.

Another related document is the Odometer Disclosure Statement. This form is required during the sale or transfer of a vehicle to document the odometer reading at the time of the transaction. Both the Odometer Disclosure Statement and the Repossession Affidavit emphasize the importance of accurate information and legal compliance. However, the Odometer Disclosure Statement focuses specifically on mileage, while the Repossession Affidavit addresses the circumstances surrounding the repossession of the vehicle.

The Vehicle Title is another document that bears similarities to the Arizona Repossession Affidavit. The title serves as proof of ownership and includes details about the vehicle and its registered owner. Both documents are critical in establishing ownership rights. However, the title is issued by the state and reflects the current owner, whereas the Repossession Affidavit is a statement by the lienholder asserting their right to reclaim the vehicle due to default.

The Security Agreement is also relevant to the discussion. This document outlines the terms under which a borrower secures a loan with collateral, typically a vehicle. Both the Security Agreement and the Repossession Affidavit involve the lienholder’s rights concerning the vehicle. The Security Agreement details the obligations of the borrower, while the Repossession Affidavit is a declaration that the lienholder has exercised their right to reclaim the vehicle due to the borrower’s default.

Lastly, the Power of Attorney for Vehicle Transactions is comparable to the Arizona Repossession Affidavit. This document grants authority to another individual to act on behalf of the vehicle owner in various transactions, including repossessions. Both documents require signatures and establish a legal relationship between the parties involved. The key difference is that the Power of Attorney allows someone else to act on behalf of the owner, while the Repossession Affidavit is a statement of action taken by the lienholder to reclaim the vehicle.

Key takeaways

When filling out the Arizona Repossession Affidavit form, it is important to keep several key points in mind. Understanding these takeaways can help ensure a smooth process.

- Legal Ownership: Confirm that you are the legal owner and lienholder of the vehicle. This is crucial for the validity of the affidavit.

- Vehicle Location: The vehicle must be physically located in Arizona at the time of repossession.

- Repossession Date: Clearly indicate the date when the repossession took place. This establishes a timeline for all parties involved.

- Accurate Information: Fill out the vehicle details, including the Vehicle Identification Number (VIN), year, and make, accurately to avoid complications.

- Odometer Reading: Provide an accurate odometer reading. Misrepresentation can lead to serious legal consequences.

- Bill of Sale: If selling the vehicle post-repossession, complete the Bill of Sale section with the buyer's information and sale date.

- New Lienholder: If applicable, list the name of the new lienholder. If there is none, simply write "NONE."

- Signatures Required: Ensure that both the seller and buyer sign the document. This confirms their agreement to the terms.

- Sequential Bills of Sale: Remember that sequential bills of sale will not be accepted. Only one bill of sale per transaction is valid.

By keeping these points in mind, you can navigate the process of completing the Arizona Repossession Affidavit form with confidence. Always double-check your entries for accuracy and completeness to avoid any potential issues down the line.

Common mistakes

-

Inaccurate Vehicle Information: Failing to provide the correct Vehicle Identification Number (VIN), year, or make of the vehicle can lead to complications. Ensure all details match official documents.

-

Missing Signatures: Both the lienholder and the seller must sign the affidavit. Neglecting to obtain a signature can render the document invalid.

-

Incorrect Mileage Reporting: Providing an incorrect odometer reading or failing to check the appropriate box regarding mileage can result in legal consequences. It is crucial to report the mileage accurately.

-

Omitting Buyer Information: All buyer details, including name, address, and signature, must be included. Missing this information can delay the transfer of ownership.

-

Failure to Certify Ownership: The affidavit requires a certification that the signer is the legal owner and lienholder. Skipping this step can lead to disputes over ownership.

-

Not Following State Guidelines: Ignoring the specific requirements set by Arizona law regarding repossession can lead to fines or legal issues. Familiarity with these guidelines is essential.

Document Preview

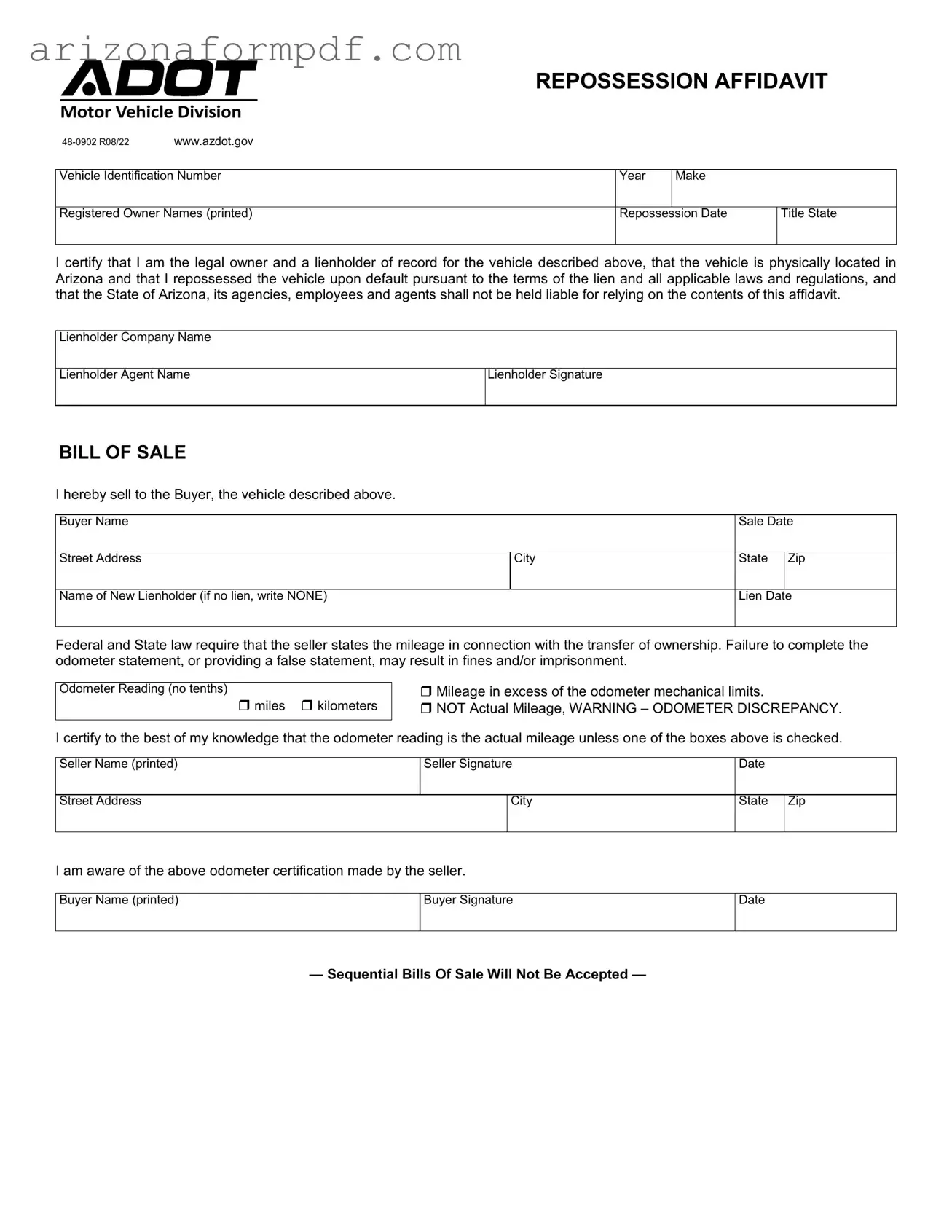

REPOSSESSION AFFIDAVIT

Vehicle Division

www.azdot.gov |

|

|

|

|

|

|

|

|

|

Vehicle Identification Number |

Year |

Make |

|

|

|

|

|

I |

|

Registered Owner Names (printed) |

Repossession Date |

Title State |

||

|

|

|

|

I |

I certify that I am the legal owner and a lienholder of record for the vehicle described above, that the vehicle is physically located in Arizona and that I repossessed the vehicle upon default pursuant to the terms of the lien and all applicable laws and regulations, and that the State of Arizona, its agencies, employees and agents shall not be held liable for relying on the contents of this affidavit.

Lienholder Company Name |

|

|

|

|

|

|

|

Lienholder Agent Name |

Lienholder Signature |

|

|

|

I |

|

|

BILL OF SALE |

|

|

|

I hereby sell to the Buyer, the vehicle described above. |

|

|

|

|

|

|

|

Buyer Name |

|

Sale Date |

|

|

|

|

|

Street Address |

City |

State |

Zip |

|

I |

|

I |

Name of New Lienholder (if no lien, write NONE) |

|

Lien Date |

|

|

|

|

|

Federal and State law require that the seller states the mileage in connection with the transfer of ownership. Failure to complete the odometer statement, or providing a false statement, may result in fines and/or imprisonment.

Odometer Reading (no tenths)

miles kilometers

Mileage in excess of the odometer mechanical limits.

NOT Actual Mileage, WARNING – ODOMETER DISCREPANCY.

I certify to the best of my knowledge that the odometer reading is the actual mileage unless one of the boxes above is checked.

Seller Name (printed)

Seller Signature

Date

Street Address

City

State Zip

I am aware of the above odometer certification made by the seller.

Buyer Name (printed)

Buyer Signature

Date

— Sequential Bills Of Sale Will Not Be Accepted —

Form Breakdown

| Fact Name | Description |

|---|---|

| Governing Law | The Arizona Repossession Affidavit is governed by Arizona Revised Statutes § 47-9203 and § 47-9501, which outline the rights and responsibilities of lienholders in repossession scenarios. |

| Vehicle Identification | The affidavit requires the Vehicle Identification Number (VIN), year, and make of the vehicle to ensure proper identification during the repossession process. |

| Legal Owner Certification | The form includes a certification statement where the lienholder confirms their legal ownership and that they have repossessed the vehicle according to the lien terms. |

| Odometer Disclosure | Federal and state laws mandate that the seller must disclose the vehicle's mileage during the ownership transfer. Failure to do so can lead to serious penalties. |

| Liability Disclaimer | The affidavit includes a disclaimer stating that the State of Arizona and its agencies are not liable for the contents of the affidavit, protecting them from potential legal issues. |

| Signature Requirements | Both the lienholder and the buyer must sign the affidavit, ensuring that all parties acknowledge the terms of the sale and the vehicle's condition. |