Attorney-Verified Articles of Incorporation Document for the State of Arizona

The Arizona Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in the state. This form serves as the foundation for your business entity, outlining essential details such as the corporation's name, duration, and purpose. It requires the identification of the statutory agent, who will act as the point of contact for legal matters. Additionally, the form includes sections for the number of shares the corporation is authorized to issue, as well as the names and addresses of the initial directors. Completing this form accurately is vital, as it not only facilitates the legal formation of your corporation but also ensures compliance with state regulations. Understanding the components and requirements of the Arizona Articles of Incorporation will streamline the process and pave the way for your business's success.

Guide to Writing Arizona Articles of Incorporation

After completing the Arizona Articles of Incorporation form, you will need to submit it to the Arizona Corporation Commission along with the required filing fee. Ensure all information is accurate to avoid delays in processing.

- Obtain the Arizona Articles of Incorporation form from the Arizona Corporation Commission's website or office.

- Fill in the name of your corporation. Ensure the name is unique and complies with Arizona naming requirements.

- Provide the address of the corporation's initial known place of business in Arizona.

- List the name and address of the statutory agent. This person or entity will receive legal documents on behalf of the corporation.

- Indicate the purpose of your corporation. Be clear and concise about the nature of your business activities.

- Specify the number of shares the corporation is authorized to issue. Include any par value if applicable.

- Include the names and addresses of the incorporators. These individuals are responsible for setting up the corporation.

- Sign and date the form. Ensure all required signatures are present before submission.

- Prepare the filing fee. Check the current fee amount on the Arizona Corporation Commission's website.

- Submit the completed form and payment to the Arizona Corporation Commission by mail or in person.

Other Arizona Forms

Parental Power of Attorney Arizona - Helps to avoid delays in care provisions during parental absence.

Residential Lease Agreement Arizona - It may address the procedure for dealing with emergencies related to the property.

Common Questions

What is the Arizona Articles of Incorporation form?

The Arizona Articles of Incorporation form is a legal document that establishes a corporation in the state of Arizona. This form must be filed with the Arizona Corporation Commission. It outlines essential information about the corporation, such as its name, purpose, and the address of its principal office. Completing this form is a crucial step in the process of forming a corporation.

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in Arizona must file the Articles of Incorporation. This includes for-profit businesses, non-profit organizations, and professional corporations. By filing this document, the founders formally register their corporation with the state, allowing them to operate legally.

What information is required to complete the Articles of Incorporation?

To complete the Articles of Incorporation, you will need to provide several key pieces of information. This includes the corporation's name, which must be unique and not already in use. You will also need to specify the corporation's purpose, the address of the principal office, and the name and address of the statutory agent. Additionally, information about the corporation's initial directors may be required.

How much does it cost to file the Articles of Incorporation in Arizona?

The filing fee for the Articles of Incorporation in Arizona varies depending on the type of corporation being formed. As of October 2023, the fee for a standard for-profit corporation is typically around $60. Non-profit corporations may have different fees. It's important to check the Arizona Corporation Commission's website for the most current fee schedule.

How long does it take for the Articles of Incorporation to be processed?

The processing time for the Articles of Incorporation can vary. Generally, if filed online, the processing can take a few business days. If submitted by mail, it may take longer, often up to two weeks or more. Expedited processing options may be available for an additional fee, allowing for faster approval.

Can I file the Articles of Incorporation online?

Yes, Arizona allows for the online filing of the Articles of Incorporation. This can be done through the Arizona Corporation Commission's website. Online filing is often quicker and more efficient than submitting paper forms by mail. It also provides immediate confirmation of your filing.

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are filed and approved, the corporation is officially formed. You will receive a stamped copy of the Articles from the Arizona Corporation Commission. Following this, the corporation must comply with other requirements, such as obtaining an Employer Identification Number (EIN) from the IRS and adhering to state and local business regulations.

Dos and Don'ts

When filling out the Arizona Articles of Incorporation form, it's important to follow certain guidelines to ensure your application is processed smoothly. Here’s a list of things you should and shouldn't do:

- Do provide accurate information for all required fields.

- Do include the name of your corporation exactly as you want it to appear.

- Do specify the purpose of your corporation clearly.

- Do ensure that the registered agent's information is current and correct.

- Don't leave any required fields blank; this can delay processing.

- Don't use a name that is too similar to an existing corporation in Arizona.

- Don't forget to sign and date the form before submission.

Similar forms

The Articles of Incorporation form in Arizona is similar to the Certificate of Incorporation used in many other states. Both documents serve as foundational legal papers that establish a corporation's existence. They typically include essential information such as the corporation's name, purpose, registered agent, and the number of shares authorized. While the terminology may vary slightly from state to state, the primary function remains the same: to create a legal entity that can operate independently of its owners.

Another document that bears similarities is the Bylaws of a corporation. While the Articles of Incorporation lay the groundwork for the corporation's formation, the Bylaws provide the internal rules and guidelines for managing the corporation. They outline the roles of directors and officers, procedures for meetings, and how decisions are made. Together, these documents ensure that a corporation operates smoothly and in accordance with both state laws and its own established rules.

The Limited Liability Company (LLC) Articles of Organization is another comparable document. Like the Articles of Incorporation, this form is necessary for establishing a legal business entity. It includes details such as the LLC's name, address, and the designated registered agent. Both documents serve to protect the owners from personal liability, but they cater to different types of business structures, with LLCs offering more flexibility in management and tax treatment.

The Partnership Agreement also shares some similarities, especially in terms of defining the structure of a business entity. While not a formal incorporation document, this agreement outlines the roles, responsibilities, and profit-sharing arrangements among partners. It is crucial for ensuring that all parties are on the same page regarding the operation of the business, much like how Articles of Incorporation set the stage for corporate governance.

The Certificate of Good Standing is another document that is often associated with the Articles of Incorporation. This certificate verifies that a corporation has been properly registered and is compliant with state regulations. It serves as proof that the corporation is authorized to conduct business and has fulfilled all necessary obligations, much like how the Articles of Incorporation confirm the corporation's legal existence.

The Statement of Information is similar in that it provides essential details about a corporation after its formation. This document typically includes updated information about the business's address, officers, and directors. While the Articles of Incorporation establish the corporation, the Statement of Information ensures that the state has current data on file, which is vital for transparency and compliance.

The Employer Identification Number (EIN) application, while not a formation document, is closely related to the process of starting a corporation. Obtaining an EIN is necessary for tax purposes and is often one of the first steps a corporation takes after filing its Articles of Incorporation. This number allows the corporation to hire employees, open bank accounts, and file tax returns, making it an essential part of the business setup process.

Finally, the Business License is a document that, while not directly related to incorporation, is crucial for operating legally. After filing the Articles of Incorporation, a corporation must often obtain local and state business licenses to ensure compliance with regulations. This license confirms that the business meets all local requirements and is authorized to operate in its chosen location, similar to how Articles of Incorporation confirm the business's legal status.

Key takeaways

Filling out and using the Arizona Articles of Incorporation form is a crucial step for anyone looking to establish a corporation in the state. Here are key takeaways to consider:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation, outlining its structure and purpose.

- Choose a Unique Name: The corporation's name must be distinguishable from existing entities registered in Arizona. Conduct a name search to ensure availability.

- Designate a Statutory Agent: Every corporation must appoint a statutory agent who will receive legal documents on behalf of the corporation.

- Specify the Corporation’s Duration: Indicate whether the corporation will exist indefinitely or for a specified period.

- Outline the Business Purpose: Clearly define the business activities the corporation will engage in. This helps clarify the scope of operations.

- Include Initial Directors: List the names and addresses of the initial directors, as they will govern the corporation until the first annual meeting.

- File with the Arizona Corporation Commission: Submit the completed form along with the required filing fee to the Arizona Corporation Commission for processing.

- Maintain Compliance: After incorporation, ensure ongoing compliance with state regulations, including annual reports and tax obligations.

By following these key points, individuals can navigate the process of incorporating a business in Arizona more effectively.

Common mistakes

-

Incorrect Entity Name: Failing to ensure that the chosen name for the corporation is unique and not already in use by another entity in Arizona can lead to rejection of the application.

-

Missing Registered Agent Information: Not providing accurate details about the registered agent, including their name and address, can result in processing delays.

-

Inaccurate Purpose Statement: Writing a vague or overly broad purpose statement may cause confusion. It is important to clearly define the business's primary activities.

-

Improper Number of Directors: Not meeting the minimum requirement for the number of directors can lead to issues. Arizona requires at least one director, but this should be verified based on the corporation's structure.

-

Failure to Include Initial Capital Structure: Omitting details about the corporation’s capital structure, such as the number of shares and their par value, can delay approval.

-

Not Signing the Document: Forgetting to sign the Articles of Incorporation is a common mistake. Ensure that the form is signed by the incorporator to validate the submission.

-

Ignoring Filing Fees: Not including the correct filing fee or misunderstanding the payment process can result in rejection. Always verify the current fee schedule before submission.

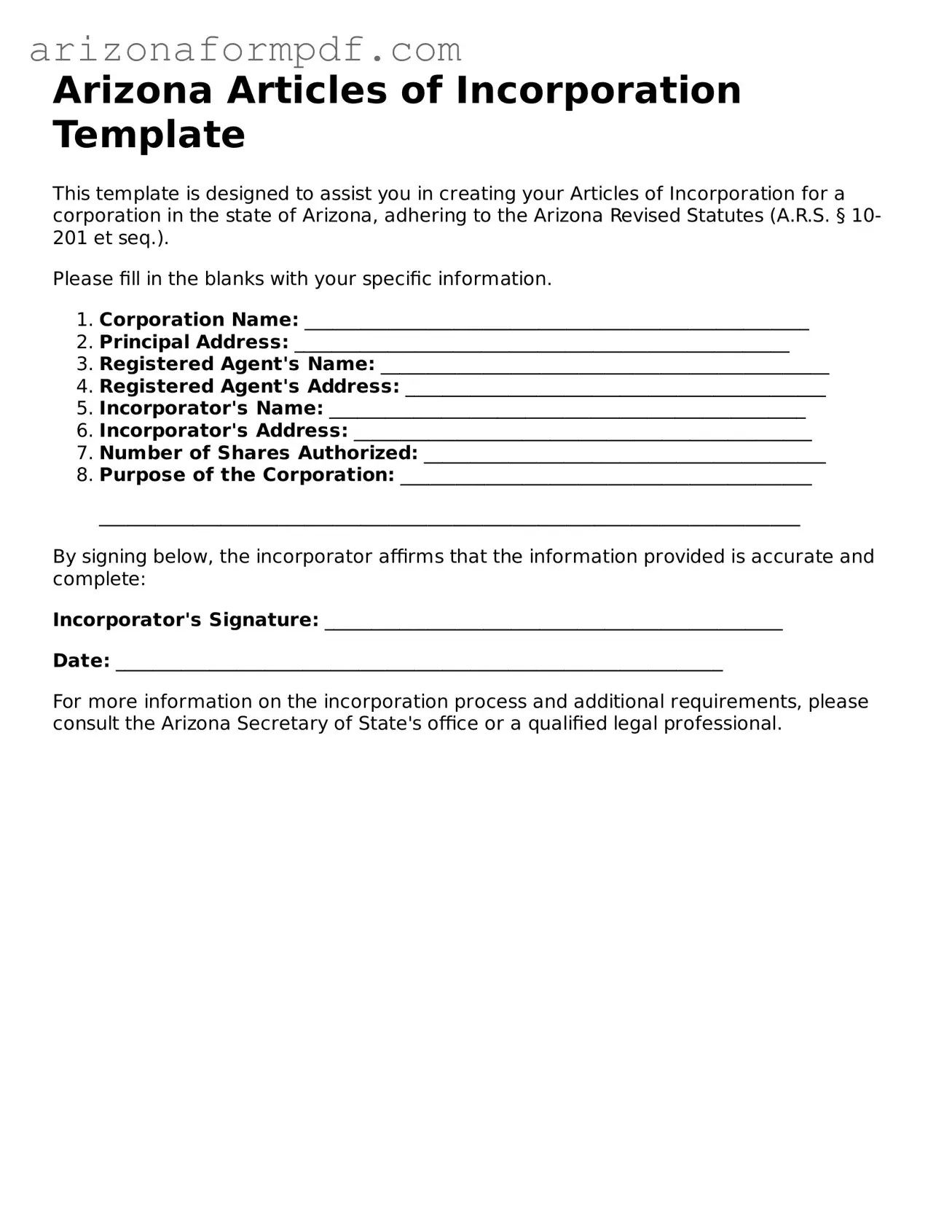

Document Preview

Arizona Articles of Incorporation Template

This template is designed to assist you in creating your Articles of Incorporation for a corporation in the state of Arizona, adhering to the Arizona Revised Statutes (A.R.S. § 10-201 et seq.).

Please fill in the blanks with your specific information.

- Corporation Name: ______________________________________________________

- Principal Address: _____________________________________________________

- Registered Agent's Name: ________________________________________________

- Registered Agent's Address: _____________________________________________

- Incorporator's Name: ___________________________________________________

- Incorporator's Address: _________________________________________________

- Number of Shares Authorized: ___________________________________________

-

Purpose of the Corporation: ____________________________________________

___________________________________________________________________________

By signing below, the incorporator affirms that the information provided is accurate and complete:

Incorporator's Signature: _________________________________________________

Date: _________________________________________________________________

For more information on the incorporation process and additional requirements, please consult the Arizona Secretary of State's office or a qualified legal professional.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Arizona Articles of Incorporation form is used to create a corporation in the state of Arizona. |

| Governing Law | The form is governed by the Arizona Revised Statutes, Title 10, Chapter 1. |

| Filing Requirement | Filing the Articles of Incorporation with the Arizona Corporation Commission is mandatory for incorporation. |

| Filing Fee | A filing fee is required, which varies depending on the type of corporation being formed. |

| Information Needed | The form requires information such as the corporation's name, address, and the name and address of the statutory agent. |

| Corporate Name | The name of the corporation must be unique and not similar to existing entities in Arizona. |

| Statutory Agent | A statutory agent must be designated to receive legal documents on behalf of the corporation. |

| Duration | The Articles of Incorporation can specify a duration for the corporation, or it can be perpetual. |

| Share Structure | The form may require details about the corporation's share structure, including the number of shares and their value. |

| Submission Methods | Articles of Incorporation can be submitted online, by mail, or in person at the Arizona Corporation Commission. |