Fill Out Your Az 140 Form

The Arizona Form 140 is an essential document for residents who need to file their personal income tax returns in the state. Designed specifically for full-year residents, this form is necessary for individuals and couples who meet certain criteria, such as having a taxable income of $50,000 or more, receiving active duty military pay, or claiming specific tax credits. Unlike its simplified counterparts, Form 140A and Form 140EZ, Form 140 allows for itemized deductions and adjustments to income, making it suitable for those with more complex financial situations. Additionally, the form includes various schedules and instructions to help taxpayers navigate the filing process, including the Form 140 Schedule A for itemized deductions and the Form 204 for extension requests. The Arizona Department of Revenue emphasizes the importance of understanding the differences between federal and state tax laws, as changes in federal legislation may impact how residents should complete their state returns. Taxpayers are encouraged to stay informed about these potential changes, as well as the implications for same-sex couples, who face unique filing requirements under Arizona law. With the option to file online, taxpayers can take advantage of faster refunds and error-checking features, making the process more efficient. Overall, understanding the nuances of Form 140 is crucial for ensuring compliance and maximizing potential tax benefits.

Guide to Writing Az 140

Filling out the Arizona Form 140 is an essential step for full-year residents who need to file their personal income tax returns. Once completed, you will be able to submit your tax return to the Arizona Department of Revenue. Follow these steps to ensure you fill out the form accurately.

- Begin by downloading the Arizona Form 140 from the Arizona Department of Revenue website.

- Enter your personal information at the top of the form, including your name, address, and Social Security number.

- If you are married and filing jointly, provide your spouse's information as well.

- Fill in your federal adjusted gross income. This figure is crucial as it serves as the starting point for your Arizona tax return.

- Complete the section on Arizona adjustments. This includes any necessary modifications to your federal adjusted gross income.

- Calculate your Arizona taxable income by subtracting any deductions or exemptions from your adjusted gross income.

- Determine your tax liability using the Arizona tax tables provided in the form instructions.

- If applicable, fill out any additional schedules, such as the Form 140 Schedule A for itemized deductions.

- Review any credits you may qualify for and include them in the appropriate section.

- Sign and date the form. If filing jointly, your spouse must also sign.

- Make a copy of the completed form for your records before submitting it.

- File your completed Form 140 by mail or electronically, depending on your preference.

Browse Popular Forms

Unclaimed Property Arizona - Ensure accuracy to prevent delays in processing claims.

Azpost Login - Applicants must complete all sections and provide accurate details.

Az Unclaimed - Notify property owners of all reported items beforehand.

Common Questions

What is the AZ Form 140?

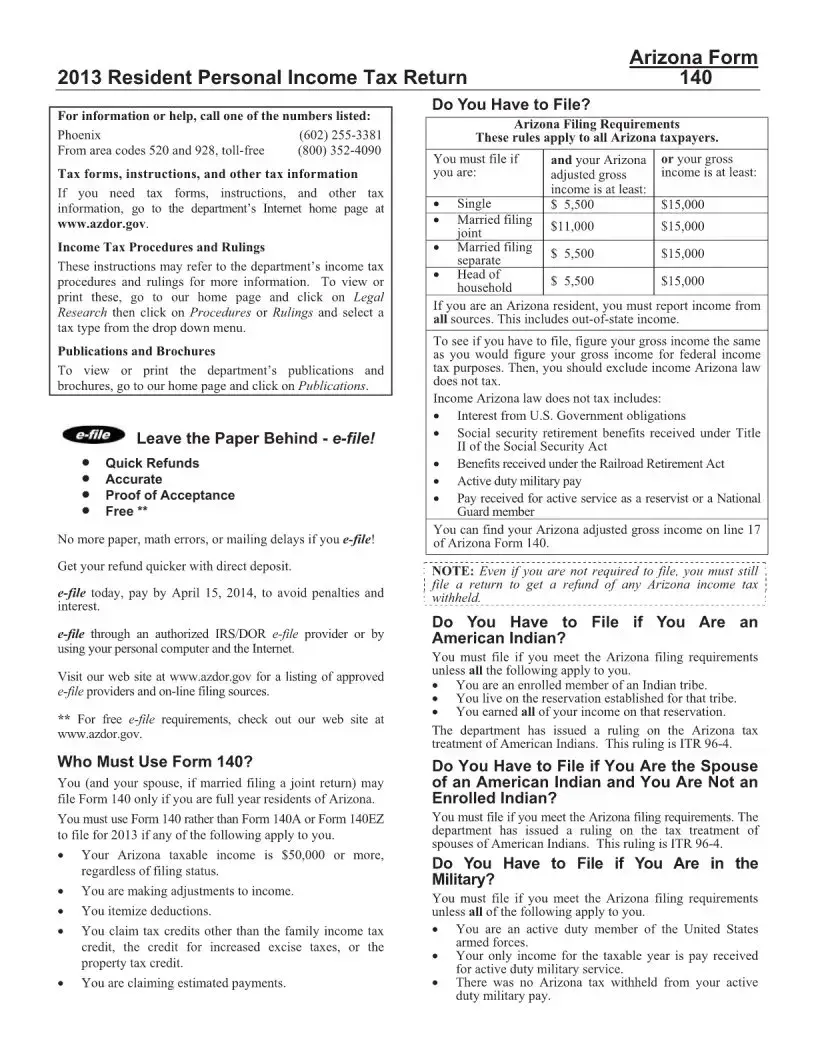

The AZ Form 140 is the Resident Personal Income Tax Return used by individuals who are full-year residents of Arizona. This form is necessary for reporting income and calculating tax obligations. It is specifically designed for those whose taxable income meets certain criteria, such as being $50,000 or more, or for individuals who received military pay or need to make adjustments to their income.

Who should use Form 140 instead of Form 140A or Form 140EZ?

Taxpayers must use Form 140 if their Arizona taxable income is $50,000 or more, if they received active duty military pay, if they are making adjustments to income, or if they itemize deductions. Additionally, those claiming tax credits other than the family income tax credit, property tax credit, or credit for increased excise taxes must also file Form 140.

How does federal adjusted gross income affect my Arizona tax return?

The starting point for your Arizona tax return is your federal adjusted gross income (AGI). However, it is important to note that the federal AGI used on your Arizona return may differ from that on your federal tax return. This discrepancy can arise from changes in federal tax law that the Arizona legislature may or may not adopt.

What should I do if federal tax law changes affect my Arizona return?

If there are federal tax law changes that apply to your return, you have several options. You can wait to file your Arizona return until the legislature addresses these changes, file assuming the changes will be adopted, or file without considering the changes. Each option carries specific requirements, such as paying 90% of the tax due by the original due date if you choose to file for an extension.

Are there special considerations for same-sex married couples filing in Arizona?

Yes, same-sex married couples face unique filing requirements in Arizona. While the IRS recognizes same-sex marriages, Arizona law does not. Consequently, individuals in same-sex marriages cannot file using the married filing jointly or married filing separately statuses on their Arizona returns. This distinction is crucial for compliance with state tax laws.

What is the standard deduction for Arizona residents in 2013?

For the tax year 2013, the Arizona standard deduction has been indexed for inflation. A single taxpayer or a married taxpayer filing separately can claim a standard deduction of $4,945. For heads of household or married couples filing jointly, the standard deduction is $9,883.

Where can I find more information about my refund status?

To check the status of your refund, you can visit the Arizona Department of Revenue website at www.aztaxes.gov. This site provides a dedicated section for tracking refunds, ensuring taxpayers can easily access information about their filings and any potential refunds due.

Dos and Don'ts

When filling out the Arizona Form 140, there are some important dos and don’ts to keep in mind. Here’s a simple guide to help you navigate the process smoothly.

- Do ensure you are a full-year resident of Arizona before using Form 140.

- Do double-check your federal adjusted gross income, as it may differ from what you report on your federal tax return.

- Do use the correct form if your taxable income is $50,000 or more, or if you have specific military pay.

- Do file your return online for faster processing and refunds.

- Don’t assume that federal tax law changes will automatically apply to your Arizona return.

- Don’t forget to research any federal changes that might affect your filing.

Following these guidelines will help you fill out the form correctly and avoid potential issues. Stay organized, and take your time to review everything before submitting your return.

Similar forms

The Arizona Form 140 is similar to the Federal Form 1040, which serves as the standard individual income tax return for U.S. taxpayers. Both forms require individuals to report their income, claim deductions, and calculate their tax liability. While the 1040 is used at the federal level, the Form 140 is specifically designed for Arizona residents. Both forms also allow for various credits and deductions, but they differ in terms of state-specific regulations and adjustments that must be considered when filing.

Another document akin to Form 140 is the Arizona Form 140A, which is a simplified version of the full Form 140. This form is intended for taxpayers with less complex financial situations, such as those with lower income levels or fewer deductions. While both forms serve the purpose of filing state income taxes, Form 140A limits the types of deductions and credits that can be claimed, making it easier for those who qualify to complete their tax return.

The Arizona Form 140EZ is yet another related document, designed for even simpler tax situations. This form is the most straightforward option for filing Arizona state taxes and is available for individuals with a taxable income below a certain threshold. Like Form 140A, it streamlines the filing process by allowing only basic deductions and credits, making it ideal for those who may not have itemized deductions or complex financial circumstances.

Form 204, the Arizona Extension Request, shares similarities with Form 140 in that it allows taxpayers to request additional time to file their state income tax return. While Form 140 is the actual return, Form 204 is a critical document for those who need more time, enabling them to avoid penalties for late filing. Both forms require accurate reporting of income and other financial details, but they serve different purposes in the tax filing process.

Form 140 Schedule A is a companion document to Form 140 that allows taxpayers to itemize their deductions. This schedule is essential for those who have eligible expenses that exceed the standard deduction. Both forms work together to ensure that taxpayers can accurately report their financial situations and maximize their deductions, though Schedule A is specifically focused on itemized deductions.

The IRS Form 8862, which is used to claim the Earned Income Tax Credit (EITC) after a disallowance, is comparable to Form 140 in that it addresses specific tax credits. While Form 140 allows Arizona residents to claim various credits, including state-specific ones, Form 8862 is focused on federal tax credits and is crucial for taxpayers who have previously faced issues with their EITC claims. Both forms require accurate reporting and documentation to ensure compliance with tax regulations.

Form 1040-SR, designed for seniors, parallels Form 140 in that it caters to a specific demographic with unique tax considerations. Both forms allow individuals to report their income and claim deductions, but Form 1040-SR includes features tailored for older taxpayers, such as a larger font and simplified options for reporting retirement income. This makes it easier for seniors to navigate their tax responsibilities, similar to how Form 140 addresses Arizona residents' needs.

The Arizona Form 131, which is used for claiming a property tax credit, is related to Form 140 as it also pertains to tax benefits available to residents. While Form 140 covers overall income tax returns, Form 131 specifically targets property tax relief. Both forms require residents to provide detailed information about their financial situation, but they focus on different aspects of tax liability and benefits.

Form 1099-MISC, used to report miscellaneous income, shares a connection with Form 140 in that it provides essential income information that must be reported on state tax returns. Taxpayers who receive income reported on a 1099-MISC must include that income when filing their Form 140, ensuring that all earnings are accounted for. Both forms are integral to the overall tax reporting process, with the 1099-MISC serving as a source of income documentation.

Lastly, the IRS Form W-2 is similar to Form 140 in that it reports wages and salary income. Employees receive a W-2 from their employers, detailing their earnings and taxes withheld. This information is crucial for completing Form 140, as it helps taxpayers accurately report their income for state tax purposes. Both forms rely on accurate income reporting to determine tax liability, making them interconnected in the tax filing process.

Key takeaways

When filling out and using the Arizona Form 140, keep these key takeaways in mind:

- Eligibility: You can only file Form 140 if you are a full-year resident of Arizona.

- Income Threshold: Use Form 140 if your Arizona taxable income is $50,000 or more.

- Military Pay: Active duty military pay and reservist pay qualify you to file this form.

- Itemized Deductions: If you itemize deductions, Form 140 is necessary.

- Tax Credits: Use Form 140 if you claim tax credits beyond the family income tax credit, property tax credit, or excise tax credit.

- Estimated Payments: If you are claiming estimated payments, you must file Form 140.

- Filing Online: Consider filing online for a faster, easier, and free experience.

- Direct Deposit: Opt for direct deposit to receive your refund more quickly.

- Federal Adjusted Gross Income: Be aware that your federal adjusted gross income may differ from what you report on your Arizona return.

- Same-Sex Couples: Same-sex married couples cannot file jointly in Arizona due to state laws.

Understanding these points will help ensure a smoother filing process and compliance with Arizona tax regulations.

Common mistakes

-

Incorrect Filing Status: Many individuals mistakenly select the wrong filing status. It is essential to choose the correct status, such as single, married filing jointly, or head of household, as it impacts tax calculations and deductions. Carefully review your marital status and ensure it aligns with the options available on the form.

-

Omitting Income Sources: Some taxpayers forget to include all sources of income. This can lead to discrepancies and potential penalties. Be diligent in reporting all income, including wages, self-employment earnings, and any other taxable income. Every dollar counts, and accuracy is crucial.

-

Ignoring Deductions and Credits: Failing to take advantage of available deductions and credits is a common oversight. Taxpayers may overlook itemized deductions or credits for which they qualify. Review the eligibility criteria for deductions, such as medical expenses or educational credits, to maximize your refund.

-

Miscalculating Adjusted Gross Income: Errors in calculating your federal adjusted gross income (AGI) can lead to significant issues. This figure serves as the foundation for your Arizona return. Ensure that you accurately transfer this information from your federal return, as mistakes can affect your tax liability.

Document Preview

Form Breakdown

| Fact Name | Description |

|---|---|

| Eligibility | Form 140 is for full-year residents of Arizona only. |

| Income Threshold | Taxpayers with an Arizona taxable income of $50,000 or more must use Form 140. |

| Active Duty Military | Members of the U.S. Armed Forces and reservists must use Form 140 if they received active duty pay. |

| Itemized Deductions | Taxpayers who itemize deductions must file Form 140 instead of Form 140A or 140EZ. |

| Same-Sex Couples | Same-sex married couples cannot file jointly in Arizona due to state law. |

| Standard Deduction | The standard deduction for 2013 is $4,945 for singles and $9,883 for joint filers, adjusted for inflation. |