Fill Out Your Az 8879 Form

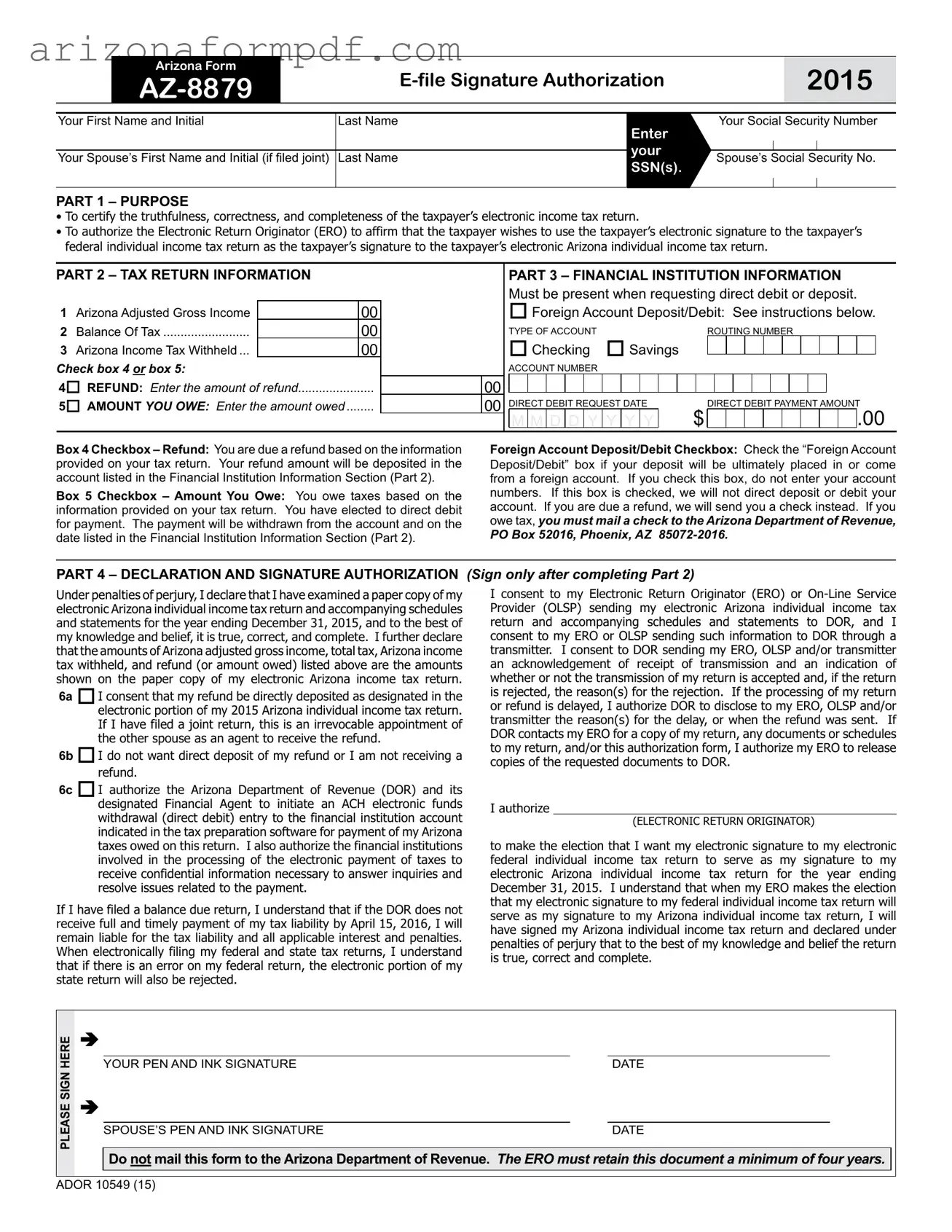

The Arizona Form AZ-8879, known as the E-file Signature Authorization, plays a crucial role in the electronic filing of individual income tax returns in Arizona. This form is designed to certify the accuracy and completeness of a taxpayer's electronic return while authorizing the Electronic Return Originator (ERO) to submit the return on behalf of the taxpayer. It requires essential personal information, including the taxpayer's Social Security number and, if applicable, their spouse's information when filing jointly. The form also outlines the financial aspects of the tax return, such as the Arizona adjusted gross income, any tax balance owed, and the amount of Arizona income tax withheld. Taxpayers must indicate whether they expect a refund or owe taxes, and if they choose direct deposit for refunds, they must provide their financial institution details. Additionally, the AZ-8879 includes a declaration section where taxpayers affirm the truthfulness of their return under penalties of perjury. This form is not submitted to the Arizona Department of Revenue but must be retained by the ERO for a minimum of four years, ensuring compliance and accountability in the tax filing process.

Guide to Writing Az 8879

Completing the AZ 8879 form is an essential step in the e-filing process for your Arizona individual income tax return. This form serves as a signature authorization, allowing you to electronically file your tax return. Here’s how to fill it out properly.

- Begin with your personal information. Enter your first name and initial, followed by your last name. If filing jointly, include your spouse’s first name and initial, along with their last name.

- In the section labeled "Your Social Security Number," input your Social Security Number (SSN). If applicable, enter your spouse’s SSN in the designated space.

- Proceed to Part 2. Fill in your Arizona Adjusted Gross Income, Balance of Tax, and Arizona Income Tax Withheld amounts.

- Choose either box 4 or box 5 to indicate your tax situation. If you expect a refund, check box 4 and enter the refund amount. If you owe taxes, check box 5 and enter the amount owed.

- In Part 3, provide your financial institution information. Indicate whether it’s a checking or savings account, and enter the routing number and account number.

- If you wish to set up a direct debit, specify the direct debit request date and the payment amount.

- Move to Part 4. Read the declaration carefully. After ensuring all information is correct, sign the form in the designated area. Include the date of your signature.

- If filing jointly, your spouse must also sign and date the form in the appropriate space.

- Remember, do not mail this form to the Arizona Department of Revenue. Instead, your Electronic Return Originator (ERO) will retain it for a minimum of four years.

After completing the form, ensure all details are accurate before submitting it electronically through your ERO. This will facilitate the timely processing of your tax return and any applicable refunds or payments.

Browse Popular Forms

How to Make Contracts for Business - Potential conflicts of interest are addressed to maintain ethical standards within the transaction.

Arizona 676 - The form was last revised in October 2007 for current use.

Common Questions

What is Arizona Form AZ-8879?

Arizona Form AZ-8879, also known as the E-file Signature Authorization, is a document that allows taxpayers to authorize their Electronic Return Originator (ERO) to file their Arizona individual income tax return electronically. It certifies the accuracy and completeness of the return and serves as the taxpayer's electronic signature.

Who needs to complete Form AZ-8879?

Taxpayers who are filing their Arizona individual income tax return electronically must complete Form AZ-8879. This includes individuals filing jointly with a spouse. Both taxpayers need to sign the form if filing jointly.

What information is required on Form AZ-8879?

The form requires personal information such as the taxpayer's name, Social Security number, and the spouse's details if applicable. It also includes financial information like Arizona adjusted gross income, balance of tax, and tax withheld. Additionally, taxpayers must indicate whether they expect a refund or owe taxes.

How is the direct deposit or debit information used?

Taxpayers can provide their financial institution details for direct deposit of refunds or for direct debit of taxes owed. This includes specifying the type of account, routing number, and account number. If a foreign account is involved, specific instructions must be followed.

What happens if I check the foreign account box?

If the foreign account box is checked, the Arizona Department of Revenue will not process direct deposits or debits. Instead, taxpayers will receive a check for any refunds, and payments owed must be mailed to the Arizona Department of Revenue.

What does the declaration and signature section entail?

This section requires taxpayers to declare under penalties of perjury that the information provided is accurate and complete. Taxpayers must sign the form after completing the relevant sections, confirming their consent for direct deposit or debit as applicable.

How long must the ERO keep Form AZ-8879?

The ERO is required to retain Form AZ-8879 for a minimum of four years. This ensures that there is a record of the taxpayer's authorization for electronic filing.

Can I mail Form AZ-8879 to the Arizona Department of Revenue?

No, Form AZ-8879 should not be mailed to the Arizona Department of Revenue. Instead, it must be kept by the ERO as part of their records.

What if there is an error on my federal return?

If there is an error on your federal return, the electronic portion of your Arizona return may also be rejected. It is crucial to ensure that both returns are accurate to avoid complications.

What should I do if I have questions about completing Form AZ-8879?

If you have questions about completing Form AZ-8879, it is advisable to consult with a tax professional or the ERO assisting with your tax return. They can provide guidance specific to your situation.

Dos and Don'ts

When filling out the Arizona Form AZ-8879, here are some important dos and don'ts to keep in mind:

- Do ensure that all personal information is accurate, including names and Social Security Numbers.

- Do review your tax return carefully before signing the form.

- Do sign the form only after completing all relevant sections.

- Do confirm your choice for direct deposit or payment methods.

- Do keep a copy of the signed form for your records.

- Don't forget to check the boxes for refund or amount owed.

- Don't enter account numbers if you check the "Foreign Account Deposit/Debit" box.

- Don't mail the form to the Arizona Department of Revenue; it must be retained by the ERO.

- Don't neglect to provide your spouse’s information if filing jointly.

Similar forms

The IRS Form 8879 serves a similar purpose to the Arizona Form AZ-8879, as both are used for e-filing tax returns. The IRS Form 8879, known as the E-file Signature Authorization, allows taxpayers to authorize their Electronic Return Originator (ERO) to file their federal income tax return electronically. Like the AZ-8879, it requires the taxpayer’s signature to confirm the accuracy of the return and to provide the ERO with permission to use the taxpayer's electronic signature. Both forms aim to streamline the e-filing process while ensuring that the information submitted is truthful and complete.

Another document that shares similarities with the AZ-8879 is the IRS Form 1040. This form is the standard individual income tax return used by U.S. taxpayers. While the AZ-8879 is specific to Arizona, the Form 1040 captures essential tax information, including income, deductions, and tax credits. Both forms require personal information, such as Social Security numbers and income details, and they serve as foundational documents for filing taxes, albeit at different levels of government.

The W-2 form is also comparable to the AZ-8879 in that it provides critical information needed for tax filing. Employers use the W-2 to report wages paid to employees and the taxes withheld from them. When completing the AZ-8879, taxpayers must reference their W-2s to accurately report their income and tax withholdings. This connection underscores the importance of accurate documentation in the tax filing process.

The 1099 form is another document that aligns with the AZ-8879. This form is used to report various types of income other than wages, salaries, or tips. Independent contractors and freelancers commonly receive 1099 forms to report their earnings. Similar to the AZ-8879, the information on a 1099 must be accurately reported on the tax return, making both documents essential for ensuring compliance with tax laws.

The Power of Attorney (POA) form can also be seen as similar to the AZ-8879, as it allows taxpayers to designate someone else to act on their behalf regarding tax matters. While the AZ-8879 authorizes the ERO to file a return electronically, a POA grants broader authority, which can include discussing tax issues with the IRS or state tax authorities. Both documents facilitate communication and action in the realm of tax filing, albeit in different capacities.

Lastly, the IRS Form 4506-T, Request for Transcript of Tax Return, bears resemblance to the AZ-8879 in its role in the tax process. This form allows taxpayers to request a transcript of their tax returns, which can be useful for verifying income or resolving discrepancies. While the AZ-8879 is focused on the authorization of e-filing, both forms serve to ensure that accurate and complete information is maintained in the taxpayer's records, aiding in transparency and compliance.

Key takeaways

Filling out and using the Arizona Form AZ-8879 is crucial for ensuring the proper electronic filing of your state income tax return. Here are key takeaways to consider:

- Purpose of the Form: The AZ-8879 certifies the accuracy of your electronic tax return and authorizes the Electronic Return Originator (ERO) to use your electronic signature.

- Social Security Numbers: Provide your Social Security Number and, if applicable, your spouse’s Social Security Number when filing jointly.

- Tax Return Information: Accurately report your Arizona Adjusted Gross Income, balance of tax, and any Arizona income tax withheld.

- Refund or Amount Owed: Indicate whether you are expecting a refund or owe taxes by checking the appropriate box and entering the amounts.

- Direct Deposit Information: If you choose direct deposit for your refund, ensure you fill out the financial institution information completely.

- Foreign Accounts: If your refund will be deposited into a foreign account, check the corresponding box and do not enter account numbers.

- Declaration and Signature: Sign the form only after completing all necessary sections to affirm the accuracy of your tax return.

- Joint Filers: If filing jointly, note that your spouse will be appointed as an agent for receiving the refund if you select direct deposit.

- Authorization for Payment: Authorize the Arizona Department of Revenue to initiate direct debit payments for any taxes owed.

- Retention of Form: The ERO must keep the AZ-8879 for a minimum of four years. Do not send this form to the Arizona Department of Revenue.

By following these guidelines, you can ensure a smoother process for filing your Arizona income tax return electronically.

Common mistakes

-

Incorrect Personal Information: Failing to provide accurate names or Social Security numbers can lead to significant delays or rejections.

-

Missing Signatures: Both taxpayers must sign the form. A missing signature can invalidate the authorization.

-

Wrong Financial Institution Details: Entering incorrect routing or account numbers can result in failed direct deposits or debits.

-

Not Checking the Right Boxes: Selecting the wrong option for refund or amount owed can cause confusion and processing issues.

-

Failure to Review Information: Not double-checking the entered amounts for Arizona adjusted gross income or taxes owed may lead to errors.

-

Ignoring Direct Deposit Instructions: If opting for direct deposit, ensure you understand the implications of checking the foreign account box.

-

Not Keeping a Copy: Failing to retain a copy of the completed form can create problems if questions arise later.

-

Submitting Without Completing Part 2: Always complete Part 2 before signing. This step is crucial for validating the information provided.

Document Preview

Arizona Form

2015 |

||

|

|

|

|

|

|

Your First Name and Initial |

Last Name |

Your Spouse’s First Name and Initial (if filed joint) Last Name

PART 1 – PURPOSE

Your Social Security Number

Enter

your Spouse’s Social Security No.

SSN(s).

•To certify the truthfulness, correctness, and completeness of the taxpayer’s electronic income tax return.

•To authorize the Electronic Return Originator (ERO) to affirm that the taxpayer wishes to use the taxpayer’s electronic signature to the taxpayer’s federal individual income tax return as the taxpayer’s signature to the taxpayer’s electronic Arizona individual income tax return.

PART 2 – TAX RETURN INFORMATION

1 |

Arizona Adjusted Gross Income |

00 |

2 |

Balance Of Tax |

00 |

3 |

Arizona Income Tax Withheld ... |

00 |

Check box 4 or box 5: |

|

|

4 REFUND: ENTER THE AMOUNT OF REFUND |

||

5 AMOUNT YOU OWE: ENTER THE AMOUNT OWED |

||

PART 3 – FINANCIAL INSTITUTION INFORMATION

Must be present when requesting direct debit or deposit.

Foreign Account Deposit/Debit: See instructions below.

|

|

|

TYPE OF ACCOUNT |

|

|

ROUTING NUMBER |

|||||||||||||||||||||||||

|

|

|

Checking Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

DIRECT DEBIT REQUEST DATE |

|

|

|

DIRECT DEBIT PAYMENT AMOUNT |

|

|||||||||||||||||||||||

|

|

|

M |

M |

D |

D |

Y |

Y |

Y |

Y |

|

$ |

|

|

|

|

|

|

|

|

.00 |

||||||||||

Box 4 Checkbox – Refund: You are due a refund based on the information provided on your tax return. Your refund amount will be deposited in the account listed in the Financial Institution Information Section (Part 2).

Box 5 Checkbox – Amount You Owe: You owe taxes based on the information provided on your tax return. You have elected to direct debit for payment. The payment will be withdrawn from the account and on the date listed in the Financial Institution Information Section (Part 2).

Foreign Account Deposit/Debit Checkbox: Check the “Foreign Account Deposit/Debit” box if your deposit will be ultimately placed in or come from a foreign account. If you check this box, do not enter your account numbers. If this box is checked, we will not direct deposit or debit your account. If you are due a refund, we will send you a check instead. If you owe tax, you must mail a check to the Arizona Department of Revenue,

PO Box 52016, Phoenix, AZ

PART 4 – DECLARATION AND SIGNATURE AUTHORIZATION (Sign only after completing Part 2)

Under penalties of perjury, I declare that I have examined a paper copy of my electronic Arizona individual income tax return and accompanying schedules and statements for the year ending December 31, 2015, and to the best of my knowledge and belief, it is true, correct, and complete. I further declare that the amounts of Arizona adjusted gross income, total tax, Arizona income tax withheld, and refund (or amount owed) listed above are the amounts shown on the paper copy of my electronic Arizona income tax return.

6a I consent that my refund be directly deposited as designated in the electronic portion of my 2015 Arizona individual income tax return. If I have filed a joint return, this is an irrevocable appointment of the other spouse as an agent to receive the refund.

6b I do not want direct deposit of my refund or I am not receiving a refund.

6c I authorize the Arizona Department of Revenue (DOR) and its designated Financial Agent to initiate an ACH electronic funds withdrawal (direct debit) entry to the financial institution account indicated in the tax preparation software for payment of my Arizona taxes owed on this return. I also authorize the financial institutions involved in the processing of the electronic payment of taxes to receive confidential information necessary to answer inquiries and resolve issues related to the payment.

If I have filed a balance due return, I understand that if the DOR does not receive full and timely payment of my tax liability by April 15, 2016, I will remain liable for the tax liability and all applicable interest and penalties. When electronically filing my federal and state tax returns, I understand that if there is an error on my federal return, the electronic portion of my state return will also be rejected.

I consent to my Electronic Return Originator (ERO) or

I authorize

(ELECTRONIC RETURN ORIGINATOR)

to make the election that I want my electronic signature to my electronic federal individual income tax return to serve as my signature to my electronic Arizona individual income tax return for the year ending December 31, 2015. I understand that when my ERO makes the election that my electronic signature to my federal individual income tax return will serve as my signature to my Arizona individual income tax return, I will have signed my Arizona individual income tax return and declared under penalties of perjury that to the best of my knowledge and belief the return is true, correct and complete.

HERE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YOUR PEN AND INK SIGNATURE |

|

DATE |

|

||

SIGN |

|

|

|

|

|

|

PLEASE |

|

|

|

|

||

|

|

|

|

|

|

|

|

SPOUSE’S PEN AND INK SIGNATURE |

|

DATE |

|

||

|

|

|

|

|

|

|

|

|

Do not mail this form to the Arizona Department of Revenue. The ERO must retain this document a minimum of four years. |

|

|||

|

|

|

|

|

|

|

ADOR 10549 (15)

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | The AZ-8879 form is used to authorize the use of an electronic signature for filing Arizona individual income tax returns. |

| Taxpayer Certification | By signing the form, taxpayers certify that their electronic tax return is true, correct, and complete. |

| Direct Deposit Option | Taxpayers can choose to have their refund directly deposited into their bank account, if applicable. |

| Payment of Taxes | If taxes are owed, the form allows for a direct debit payment from the taxpayer's financial institution. |

| Foreign Accounts | Taxpayers must check a box if their deposit or debit is related to a foreign account, which changes how payments are processed. |

| Retention Requirement | The Electronic Return Originator (ERO) must keep the AZ-8879 form for at least four years after filing. |

| Governing Law | This form is governed by Arizona Revised Statutes, Title 43, which pertains to taxation. |