Fill Out Your Az Tpt 1 Form

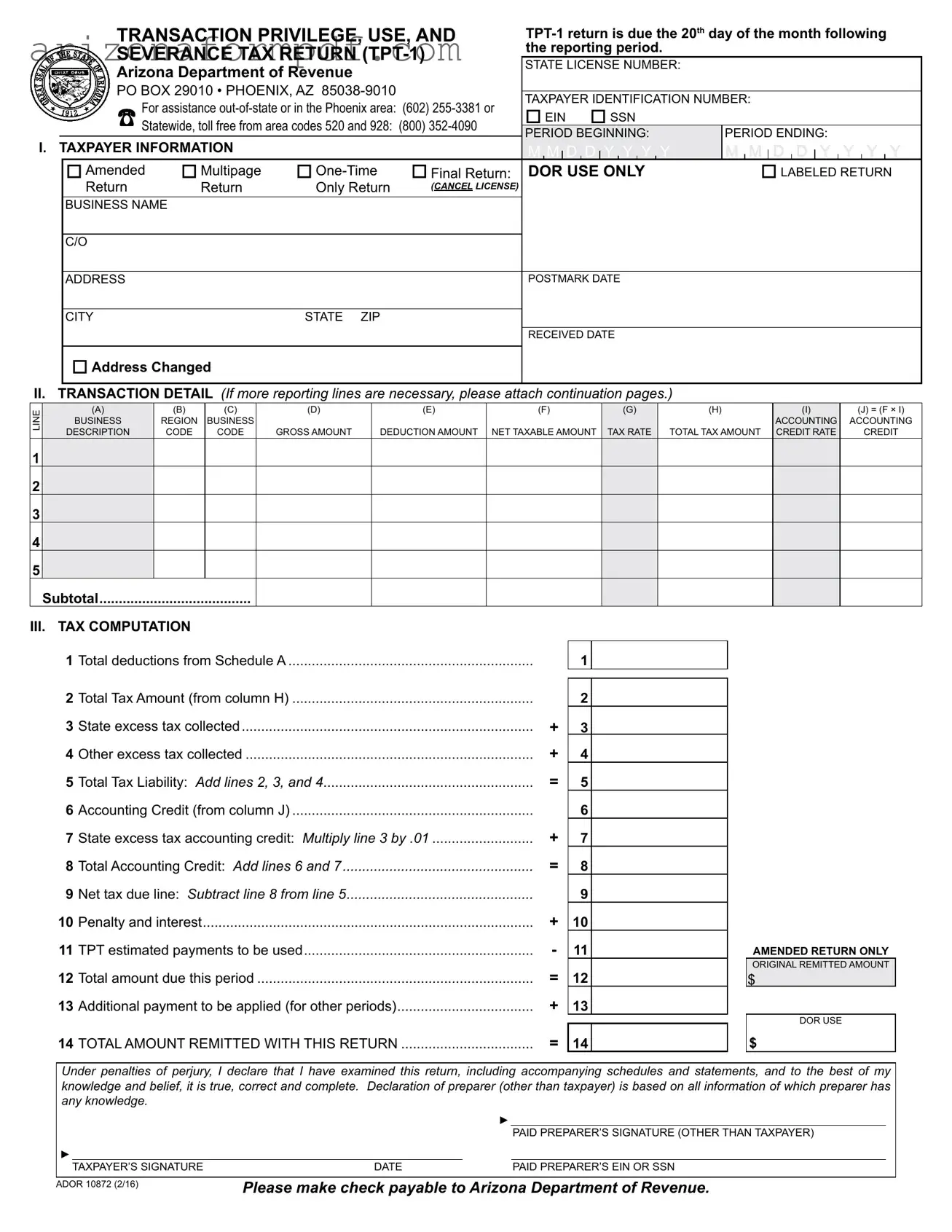

The Arizona Transaction Privilege, Use, and Severance Tax Return (TPT-1) is a crucial document for businesses operating within the state. It serves multiple purposes, primarily enabling the reporting of transaction privilege taxes, use taxes, and severance taxes. This form must be submitted by the 20th day of the month following the reporting period. Key components of the TPT-1 include taxpayer information, transaction details, and tax computation sections. Taxpayers are required to provide their state license number and taxpayer identification number, ensuring accurate identification. The form also includes sections for itemizing deductions, which must be supported by detailed documentation. Incorrect or unsubstantiated deductions can lead to penalties, emphasizing the importance of accuracy. Additionally, the TPT-1 allows for the reporting of various business activities across different regions, with specific codes designated for each type of transaction. Understanding the nuances of this form is essential for compliance and effective tax management in Arizona.

Guide to Writing Az Tpt 1

Filling out the AZ TPT-1 form is essential for reporting transaction privilege, use, and severance taxes in Arizona. Once completed, the form must be submitted by the 20th day of the month following the reporting period. This ensures compliance with state tax regulations and helps maintain accurate financial records.

- Obtain the AZ TPT-1 form from the Arizona Department of Revenue website or your local office.

- Fill in your State License Number and Taxpayer Identification Number (either EIN or SSN).

- Indicate the reporting period by entering the start and end dates in the format MM/DD/YYYY.

- Choose the appropriate options for return type (Amended, Multipage, One-Time, or Final Return).

- Provide your business name, address, city, state, and ZIP code.

- Complete the Transaction Detail section by entering the required information in the provided columns for each transaction.

- Calculate the subtotal for the transaction details and enter it in the designated space.

- Proceed to the Tax Computation section. Here, fill in the total deductions, total tax amounts, and other relevant figures.

- Compute the net tax due by subtracting any accounting credits from your total tax liability.

- If applicable, include any penalties, interest, or additional payments.

- Sign the form, ensuring that both the taxpayer and any paid preparer sign and provide their respective identification numbers.

- Make a check payable to the Arizona Department of Revenue for the total amount due, if applicable.

- Submit the completed form to the Arizona Department of Revenue at the provided address.

Browse Popular Forms

What Is Post Training - AGAIN, submitting this form to the wrong entity is prohibited.

Arizona State Taxes Form - Users can benefit from online filing for a quicker application process.

Common Questions

What is the Az Tpt 1 form?

The Az Tpt 1 form is a tax return used in Arizona for reporting Transaction Privilege, Use, and Severance Taxes. This form must be submitted to the Arizona Department of Revenue by the 20th day of the month following the reporting period. It is essential for businesses operating in Arizona to ensure compliance with state tax regulations.

Who needs to file the Az Tpt 1 form?

Any business that engages in taxable activities in Arizona must file the Az Tpt 1 form. This includes those who sell goods or services subject to Transaction Privilege Tax. Additionally, businesses that have a severance tax obligation must also complete this form.

What information is required on the Az Tpt 1 form?

The form requires various pieces of information, including the taxpayer's identification number, business name, and address. It also asks for transaction details, such as gross amounts, deductions, and net taxable amounts for each business region and accounting code. Accurate completion of all sections is crucial for proper tax calculation.

What are the consequences of not filing the Az Tpt 1 form on time?

Failure to file the Az Tpt 1 form by the deadline can result in penalties and interest. The amount of these penalties may increase based on the duration of the delay. Timely filing helps avoid additional costs and ensures compliance with Arizona tax laws.

How do I calculate the total tax liability on the Az Tpt 1 form?

Total tax liability is calculated by adding the total tax amounts from the transaction details section, any state excess tax collected, and other excess tax collected. Deductions and credits must then be subtracted to determine the net tax due. Accurate calculations are vital to avoid underpayment or overpayment.

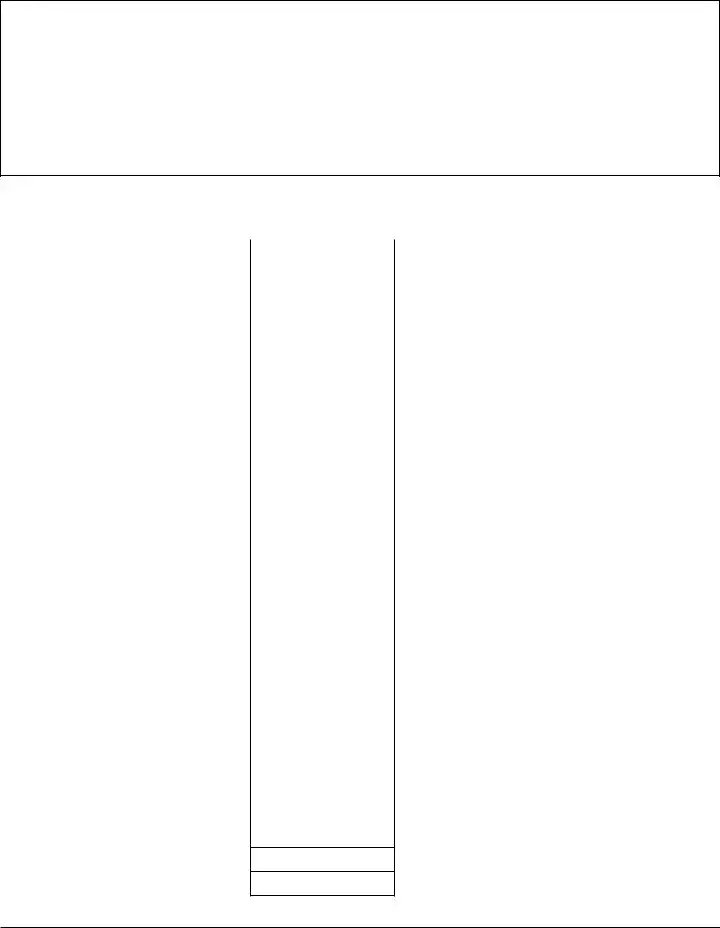

What is Schedule A, and why is it important?

Schedule A is a section of the Az Tpt 1 form where taxpayers must itemize their deduction amounts by category. It is crucial because the total deductions listed on Schedule A must equal the total deductions reported on the main form. Inaccurate or unsubstantiated deductions can lead to disallowance and potential penalties.

Can I amend my Az Tpt 1 form after submission?

Yes, taxpayers can file an amended Az Tpt 1 form if corrections are necessary. The form has an option to indicate that it is an amended return. It is important to clearly state the reasons for the amendment and ensure that all corrections are accurately reflected in the new submission.

Where can I find assistance if I have questions about the Az Tpt 1 form?

For assistance, taxpayers can contact the Arizona Department of Revenue. In-state taxpayers can call (602) 255-3381, while those calling from area codes 520 and 928 can use the toll-free number (800) 352-4090. The department's website also provides resources and additional guidance regarding the form and its requirements.

Dos and Don'ts

When filling out the Az Tpt 1 form, there are several key practices to follow to ensure accuracy and compliance. Here’s what you should and shouldn’t do:

- Do double-check all entries for accuracy before submission.

- Do use the correct taxpayer identification number, whether it’s your EIN or SSN.

- Do ensure that all deduction amounts are itemized properly in Schedule A.

- Do submit the form by the 20th of the month following the reporting period.

- Do sign and date the form to validate your submission.

- Don't leave any sections blank; fill in all required fields.

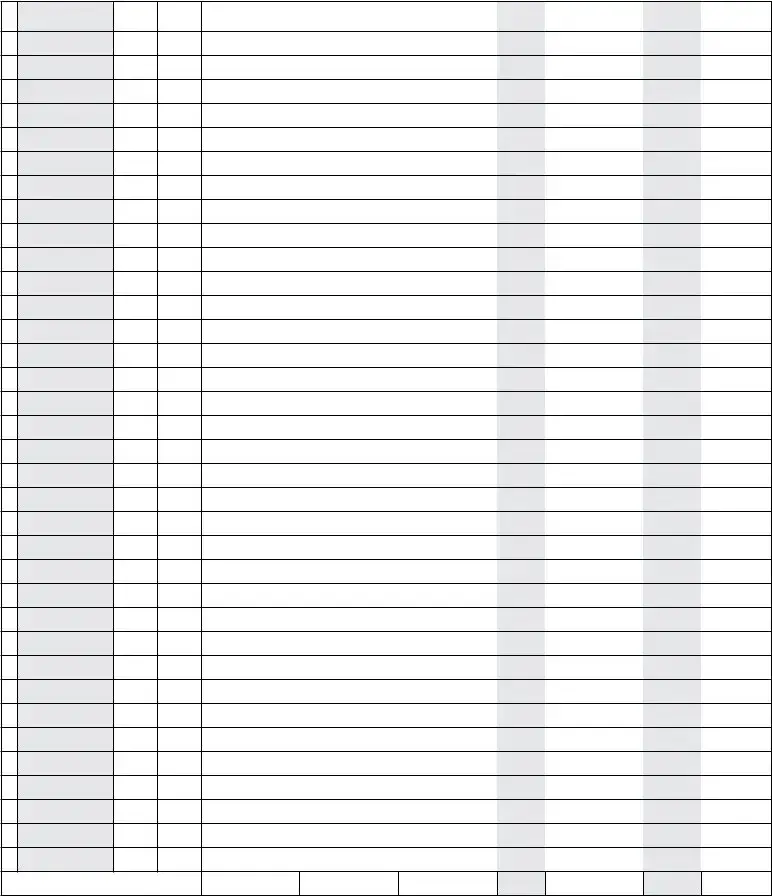

- Don't forget to attach any necessary continuation pages if you have multiple transactions.

Following these guidelines will help you avoid common pitfalls and ensure your return is processed smoothly.

Similar forms

The Arizona Transaction Privilege Tax (TPT) Return, commonly known as the TPT-1 form, shares similarities with the Sales Tax Return, often used in various states across the U.S. Both documents are designed to report taxes collected on sales of goods and services. They require taxpayers to provide details about gross sales, deductions, and the net taxable amount. Just as the TPT-1 form requires the taxpayer to report the total tax liability, a Sales Tax Return also necessitates the calculation of tax due based on sales made during a specific period. Both forms aim to ensure compliance with tax regulations, providing a structured way for businesses to report their tax obligations to the state.

Another document akin to the TPT-1 is the Use Tax Return. This form is utilized by individuals or businesses that purchase items without paying sales tax at the point of sale. Similar to the TPT-1, the Use Tax Return requires the reporting of the purchase price, the applicable tax rate, and the total tax owed. Both forms emphasize the importance of accurate reporting and timely submission to avoid penalties. They serve to ensure that tax obligations are met, whether through sales tax collected or use tax owed, thereby maintaining fairness in the tax system.

The Severance Tax Return also bears resemblance to the TPT-1 form. This document is specifically for businesses involved in extracting natural resources, such as oil and gas. Like the TPT-1, it requires detailed reporting of gross revenue, deductions, and the calculation of tax owed based on the extracted resources. Both forms aim to capture the economic activity of businesses and ensure that appropriate taxes are remitted to the state. The structure of the Severance Tax Return, with its focus on resource extraction, parallels the TPT-1's focus on transactions, highlighting the diverse ways states collect revenue from different sectors.

Finally, the Income Tax Return shares certain characteristics with the TPT-1 form. While the Income Tax Return focuses on an individual's or business's overall earnings and applicable tax, both forms require detailed information about financial transactions. Each document necessitates the reporting of gross amounts, deductions, and tax calculations. Moreover, both emphasize the importance of accuracy and completeness in reporting to avoid potential penalties. The Income Tax Return, like the TPT-1, serves as a critical tool for the state to assess and collect taxes based on the economic activities of its residents and businesses.

Key takeaways

Filling out the Arizona Transaction Privilege, Use, and Severance Tax Return (TPT-1) form can seem daunting, but understanding its key components can make the process smoother. Here are some important takeaways:

- Deadline Awareness: The TPT-1 form is due by the 20th day of the month following the reporting period. Ensure you meet this deadline to avoid penalties.

- Accurate Identification: Use your State License Number and Taxpayer Identification Number (EIN or SSN) correctly. These numbers are essential for processing your return.

- Amended Returns: If you need to correct a previous submission, check the "Amended" box on the form. This indicates to the Arizona Department of Revenue that you are making changes.

- Transaction Details: Report all transactions accurately in Section II. If you have more transactions than the form allows, attach continuation pages as needed.

- Deduction Itemization: Complete Schedule A for any deductions. Each deduction must be itemized and must match the amounts reported in Section II. Incorrect deductions can lead to penalties.

- Net Tax Calculation: Carefully calculate your total tax liability. This includes adding up all tax amounts and subtracting any credits. Double-check your math to ensure accuracy.

- Signature Requirement: Don’t forget to sign the form! Both the taxpayer and any paid preparer must sign and date the return to validate it.

By keeping these points in mind, you can navigate the TPT-1 form more confidently and ensure compliance with Arizona tax regulations.

Common mistakes

-

Incorrect Taxpayer Identification Number: Failing to provide the correct Taxpayer Identification Number (EIN or SSN) can lead to processing delays and potential penalties.

-

Missing Signatures: Both the taxpayer and the paid preparer must sign the form. Omitting signatures can result in the return being considered incomplete.

-

Improper Calculation of Deductions: Deductions must be itemized accurately in Schedule A. Inaccurate deductions will be disallowed, leading to increased tax liability.

-

Failure to Use the Correct Business Region and Accounting Codes: Each transaction must include the appropriate region and business codes. Using incorrect codes can cause errors in tax calculations.

-

Not Meeting the Deadline: The TPT-1 form is due on the 20th of the month following the reporting period. Late submissions may incur penalties and interest.

-

Incorrect Tax Rates: Tax rates can change. Using outdated rates can result in underpayment or overpayment of taxes.

-

Neglecting to Attach Required Schedules: If additional transactions or deductions are reported, relevant schedules must be attached. Failure to do so may lead to processing issues.

Document Preview

TRANSACTION PRIVILEGE, USE, AND |

||

SEVERANCE TAX RETURN |

the reporting period. |

|

STATE LICENSE NUMBER: |

||

Arizona Department of Revenue |

||

|

PO BOX 29010 • PHOENIX, AZ |

|

TAXPAYER IDENTIFICATION NUMBER: |

|

|

|

|

||

FOR ASSISTANCE |

(602) |

|

|

|

|

|||

EIN |

SSN |

|

|

|

|

|

||

STATEWIDE, TOLL FREE FROM AREA CODES 520 AND 928: (800) |

PERIOD BEGINNING: |

PERIOD ENDING: |

|

|

|

|||

|

|

|

|

|

||||

I. TAXPAYER INFORMATION |

|

M M D D Y Y Y Y |

M M D D |

Y |

Y |

Y |

Y |

|

Amended |

Multipage |

Final Return: DOR USE ONLY |

LABELED RETURN |

|||

Return |

Return |

Only Return |

(CANCEL LICENSE) |

|

||

BUSINESS NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

C/O |

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

POSTMARK DATE |

|

|

|

|

|

|

|

|

CITY |

|

STATE ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECEIVED DATE |

|

Address Changed

II. TRANSACTION DETAIL (If more reporting lines are necessary, please attach continuation pages.)

LINE |

(A) |

(B) |

(C) |

(D) |

(E) |

(F) |

(G) |

(H) |

(I) |

(J) = (F × I) |

BUSINESS |

REGION |

BUSINESS |

|

|

|

|

|

ACCOUNTING |

ACCOUNTING |

|

|

|

|

|

|

|

|||||

|

DESCRIPTION |

CODE |

CODE |

GROSS AMOUNT |

DEDUCTION AMOUNT |

NET TAXABLE AMOUNT |

TAX RATE |

TOTAL TAX AMOUNT |

CREDIT RATE |

CREDIT |

1

2

3

4

5

Subtotal.......................................

III. TAX COMPUTATION |

|

|

|

|

|

|

|

Total deductions from Schedule A |

|

|

|

|

|

1 |

|

1 |

|

|

|

|

|

Total Tax Amount (from column H) |

|

|

|

|

|

2 |

|

2 |

|

|

|

|

3 |

State excess tax collected |

+ |

3 |

|

|

|

4 |

Other excess tax collected |

+ |

4 |

|

|

|

5 |

Total Tax Liability: Add lines 2, 3, and 4 |

= |

5 |

|

|

|

6 |

Accounting Credit (from column J) |

|

6 |

|

|

|

7 |

..........................State excess tax accounting credit: Multiply line 3 by .01 |

+ |

7 |

|

|

|

8 |

Total Accounting Credit: Add lines 6 and 7 |

= |

8 |

|

|

|

9 |

Net tax due line: Subtract line 8 from line 5 |

|

9 |

|

|

|

10 |

Penalty and interest |

+ |

10 |

|

|

|

11 |

TPT estimated payments to be used |

- |

11 |

|

|

AMENDED RETURN ONLY |

|

|

|

|

|

|

ORIGINAL REMITTED AMOUNT |

12 |

Total amount due this period |

= |

12 |

|

|

$ |

13 |

Additional payment to be applied (for other periods) |

+ |

13 |

|

|

|

14 TOTAL AMOUNT REMITTED WITH THIS RETURN |

= |

14

DOR USE

$

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

►

PAID PREPARER’S SIGNATURE (OTHER THAN TAXPAYER)

►

TAXPAYER’S SIGNATURE |

DATE |

PAID PREPARER’S EIN OR SSN |

ADOR 10872 (2/16)

Please make check payable to Arizona Department of Revenue.

Transaction Privilege, Use, and Severance Tax Return |

LICENSE NO. ______________________ |

|

|

Schedule A: Deduction Detail Information

The deduction amounts that have been listed on the lines in Section II, Column E must be itemized by category for each Region Code and Business Code reported. The total of the amounts listed in Schedule A must equal the total of the Deduction Amounts listed on page 1. (See page 4 of the

Deduction Codes for itemizing deductions, with a paraphrased description of the deduction (or exemption), are listed at www.azdor.gov. Some of the codes may be used for more than one business code. Several additional Deduction Codes, as well as the statutory wording and any administrative guidance for each deduction code, are provided on the Department’s web site. The actual text of the statutory deduction, exemption or exclusion is controlling for amounts taken as deductions on Form

|

|

|

|

SCHEDULE A |

|

|

Deduction Detail |

|

|

|

|

|

|

|

|

|

|

LINE |

(K) |

(L) |

(M) |

(N) |

(O) |

|

|

DEDUCTION |

DEDUCTION |

DESCRIPTION OF |

|

|

REGION CODE |

BUSINESS CODE |

CODE |

AMOUNT |

DEDUCTION CODE |

|

|

|

|

|

|

1 |

|

|

|

|

|

2 |

|

|

|

|

|

3 |

|

|

|

|

|

4 |

|

|

|

|

|

5 |

|

|

|

|

|

6 |

|

|

|

|

|

7 |

|

|

|

|

|

8 |

|

|

|

|

|

9 |

|

|

|

|

|

10 |

|

|

|

|

|

11 |

|

|

|

|

|

12 |

|

|

|

|

|

13 |

|

|

|

|

|

14 |

|

|

|

|

|

15 |

|

|

|

|

|

16 |

|

|

|

|

|

17 |

|

|

|

|

|

18 |

|

|

|

|

|

19 |

|

|

|

|

|

20 |

|

|

|

|

|

21 |

|

|

|

|

|

22 |

|

|

|

|

|

23 |

|

|

|

|

|

ASubtotal of Deductions ..............................

BDeduction Totals from Additonal Page(s) ..

CTotal Deductions (line A + line B = line C)..

Total Must Equal Total on Page 1, Section III, line 1

ADOR 10872 (2/16)

Transaction Privilege, Use, and Severance Tax Return |

LICENSE NO. ______________________ |

|

|

TRANSACTION DETAIL (ADDITIONAL TRANSACTIONS)

LINE

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

(A)

BUSINESS

DESCRIPTION

(B)(C)

REGION BUSINESS

CODE CODE

(D) |

(E) |

(F) |

(G) |

(H) |

(I) |

(J) = (F × I) |

|

|

|

|

|

ACCOUNTING |

ACCOUNTING |

GROSS AMOUNT |

DEDUCTION AMOUNT |

NET TAXABLE AMOUNT |

TAX RATE |

TOTAL TAX AMOUNT |

CREDIT RATE |

CREDIT |

|

|

|

|

|

|

|

Subtotal ....................................

ADOR 10872 (2/16)

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | The TPT-1 form is used for reporting transaction privilege, use, and severance taxes in Arizona. |

| Filing Deadline | Returns are due on the 20th day of the month following the end of the reporting period. |

| State License Number | Taxpayers must include their state license number on the form, issued by the Arizona Department of Revenue. |

| Taxpayer Identification | Taxpayers need to provide either an Employer Identification Number (EIN) or a Social Security Number (SSN). |

| Business Information | The form requires detailed taxpayer information, including business name, address, and contact details. |

| Transaction Detail Section | Section II requires detailed reporting of transactions, including gross amounts, deductions, and tax rates. |

| Deduction Codes | Taxpayers must itemize deductions using specific deduction codes, which can be found on the Arizona Department of Revenue's website. |

| Net Tax Calculation | The form includes a section for calculating net tax due, factoring in deductions and any credits. |

| Governing Law | The TPT-1 form is governed by Arizona Revised Statutes Title 42, which outlines tax obligations in the state. |