Attorney-Verified Deed in Lieu of Foreclosure Document for the State of Arizona

In Arizona, homeowners facing financial difficulties may find themselves considering various options to avoid foreclosure. One such option is the Deed in Lieu of Foreclosure, a legal process that allows homeowners to transfer ownership of their property back to the lender voluntarily. This arrangement can provide a way to resolve a mortgage default without the lengthy and often stressful foreclosure process. The Deed in Lieu of Foreclosure form outlines the terms of this transfer, including the property description, the parties involved, and any outstanding mortgage obligations. By completing this form, homeowners can potentially alleviate the burden of debt and protect their credit from the more severe impacts of foreclosure. Additionally, lenders may benefit from this process by reducing their costs associated with foreclosure proceedings. Understanding the key elements of this form is crucial for homeowners seeking a fresh start while navigating the complexities of real estate and mortgage law in Arizona.

Guide to Writing Arizona Deed in Lieu of Foreclosure

After completing the Arizona Deed in Lieu of Foreclosure form, the next step involves submitting it to the appropriate parties. This typically includes the lender and possibly the county recorder's office, depending on local requirements. Ensure you keep copies for your records and confirm receipt with the lender.

- Obtain the Arizona Deed in Lieu of Foreclosure form from a reliable source, such as a legal website or local courthouse.

- Fill in the names of the parties involved. This includes the borrower(s) and the lender.

- Provide a detailed description of the property. Include the address and any relevant identifying information.

- Indicate the reason for the deed in lieu of foreclosure. This may involve a brief explanation of your financial situation.

- Sign the document in the presence of a notary public. Ensure that all required signatures are included.

- Make copies of the signed form for your records.

- Submit the completed form to the lender and any required local authorities. Confirm that they have received it.

Other Arizona Forms

Arizona Non-compete Law - Failure to comply with the Non-compete Agreement can harm the employee's reputation.

Contractor Contract Sample - This document serves to establish mutual consent and understanding of the project details.

Common Questions

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process that allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure. This option can help the homeowner avoid the lengthy and stressful foreclosure process while allowing the lender to recover the property without going through court proceedings.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits to consider. First, it can be a quicker process than foreclosure, allowing homeowners to resolve their situation faster. Second, it often results in less damage to the homeowner's credit score compared to a foreclosure. Additionally, lenders may be more willing to negotiate terms, such as forgiving any remaining debt after the property transfer, which can provide financial relief.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are potential drawbacks. Homeowners may still face tax implications, as forgiven debt can be considered taxable income. Furthermore, not all lenders accept Deeds in Lieu of Foreclosure, and eligibility requirements may vary. It’s essential to communicate with your lender to understand their specific policies and requirements.

How do I initiate a Deed in Lieu of Foreclosure?

To initiate this process, contact your lender to express your interest in a Deed in Lieu of Foreclosure. Prepare to provide documentation regarding your financial situation and the property. The lender will review your request and may require a formal application. If approved, both parties will sign the necessary documents to transfer ownership.

Will I be able to rent or buy another home after a Deed in Lieu of Foreclosure?

While it is possible to rent or buy another home after a Deed in Lieu of Foreclosure, it may take some time. The impact on your credit score can affect your ability to secure a mortgage or rental agreement. Typically, lenders may require a waiting period before you can qualify for a new loan, which can range from a few years to several years, depending on the lender's policies.

Dos and Don'ts

When filling out the Arizona Deed in Lieu of Foreclosure form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do: Provide accurate property information, including the address and legal description.

- Do: Ensure all parties involved in the transaction sign the document.

- Do: Review the form for completeness before submission.

- Do: Keep a copy of the completed form for your records.

- Do: Consult with a real estate professional if you have questions about the process.

- Don't: Leave any sections of the form blank.

- Don't: Sign the document without understanding its implications.

- Don't: Use outdated forms; always obtain the latest version.

- Don't: Submit the form without verifying that all required information is included.

- Don't: Ignore deadlines for submission to avoid complications.

Similar forms

The Arizona Deed in Lieu of Foreclosure form is similar to a Mortgage Release. A Mortgage Release, also known as a Satisfaction of Mortgage, occurs when a borrower pays off their mortgage in full. Once the mortgage is satisfied, the lender provides a document confirming that the borrower has met their obligations. Both documents signify the end of a borrower's responsibility to the lender, but a Deed in Lieu is often used when the borrower cannot continue making payments and chooses to transfer the property back to the lender instead of going through a lengthy foreclosure process.

Another document that shares similarities is the Short Sale Agreement. In a short sale, a homeowner sells their property for less than the amount owed on the mortgage, with the lender's approval. Like a Deed in Lieu, a short sale helps the borrower avoid foreclosure. However, in a short sale, the property is sold to a third party rather than being directly transferred to the lender. Both options aim to relieve the borrower of their mortgage burden while minimizing losses for the lender.

The Loan Modification Agreement is also comparable. This document outlines changes to the original terms of a mortgage, often to make payments more manageable for the borrower. While a Deed in Lieu of Foreclosure results in the borrower giving up the property, a loan modification allows the borrower to keep their home by adjusting the payment terms. Both documents are tools to help borrowers who are struggling financially but differ in their end results.

A Bankruptcy Filing is another document that can relate to the Deed in Lieu of Foreclosure. When individuals face overwhelming debt, they may choose to file for bankruptcy to seek relief. In some cases, this can lead to the discharge of mortgage debts. Both bankruptcy and a Deed in Lieu aim to provide a fresh start for the borrower, but bankruptcy involves a legal process that can affect credit ratings for years, while a Deed in Lieu is a more straightforward transfer of property.

The Property Settlement Agreement can also be likened to the Deed in Lieu. This document is often used in divorce proceedings to divide property between spouses. If one spouse cannot keep the property, they may agree to transfer it to the other party or sell it. In both cases, the goal is to resolve ownership issues and relieve financial burdens. However, a Deed in Lieu specifically addresses mortgage obligations, while a Property Settlement Agreement deals with personal property division.

The Quitclaim Deed is another document that bears similarities. This legal instrument allows a property owner to transfer their interest in a property to another party without making any guarantees about the title. In a Deed in Lieu of Foreclosure, the borrower is transferring their ownership back to the lender, effectively relinquishing any claims to the property. Both documents facilitate the transfer of property ownership but differ in context and purpose.

The Foreclosure Notice is also related to the Deed in Lieu of Foreclosure. A Foreclosure Notice is a formal declaration that a borrower has defaulted on their mortgage, initiating the foreclosure process. While a Deed in Lieu serves as an alternative to foreclosure, both documents arise from the borrower's inability to meet mortgage obligations. The Deed in Lieu can help avoid the negative consequences of a foreclosure notice by allowing for a more amicable resolution.

Lastly, the Warranty Deed is similar in that it is a legal document used to transfer ownership of property. A Warranty Deed guarantees that the seller holds clear title to the property and has the right to sell it. In contrast, a Deed in Lieu of Foreclosure does not provide such guarantees, as the borrower is transferring the property back to the lender due to financial hardship. Both documents facilitate property transfers but differ in the assurances they provide regarding ownership and title.

Key takeaways

When considering the Arizona Deed in Lieu of Foreclosure form, it is essential to understand its implications and requirements. Here are key takeaways to guide you through the process:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer property ownership to the lender to avoid foreclosure.

- Eligibility Requirements: Not all properties qualify. Ensure that your mortgage is in default and that the lender agrees to this arrangement.

- Consult Legal Advice: Before proceeding, seek legal counsel to understand the potential impact on your credit and future homeownership.

- Gather Necessary Documentation: Collect all relevant documents, including mortgage statements and proof of income, to support your case.

- Negotiate Terms: Discuss with your lender any potential forgiveness of debt or other terms that may benefit you during this process.

- Complete the Form Accurately: Fill out the Deed in Lieu of Foreclosure form carefully, ensuring all information is correct to avoid delays.

- File the Deed Properly: Once completed, submit the deed to the appropriate county recorder’s office to ensure it is legally recognized.

Following these steps can help streamline the process and mitigate potential complications associated with a Deed in Lieu of Foreclosure in Arizona.

Common mistakes

-

Inaccurate Property Description: One common mistake is failing to provide a precise description of the property. The legal description should match the information on the property deed. Omitting details can lead to confusion and delays.

-

Incorrect Names: People often make errors in the names of the parties involved. Ensure that the names of the borrower and lender are spelled correctly and match the names on the original loan documents.

-

Not Including All Necessary Signatures: All parties must sign the document for it to be valid. Missing signatures can render the deed ineffective. Double-check that everyone involved has signed.

-

Failure to Notarize: Some individuals forget to have the deed notarized. A notarized document is often required for it to be legally binding. This step is crucial to avoid future disputes.

-

Ignoring State Requirements: Each state has specific requirements for deeds in lieu of foreclosure. Failing to comply with Arizona’s regulations can lead to complications. Review state laws carefully before submission.

-

Not Consulting a Professional: Many people attempt to complete the form without legal guidance. This can result in mistakes that are easily avoidable. Consulting a legal professional can help ensure accuracy and compliance.

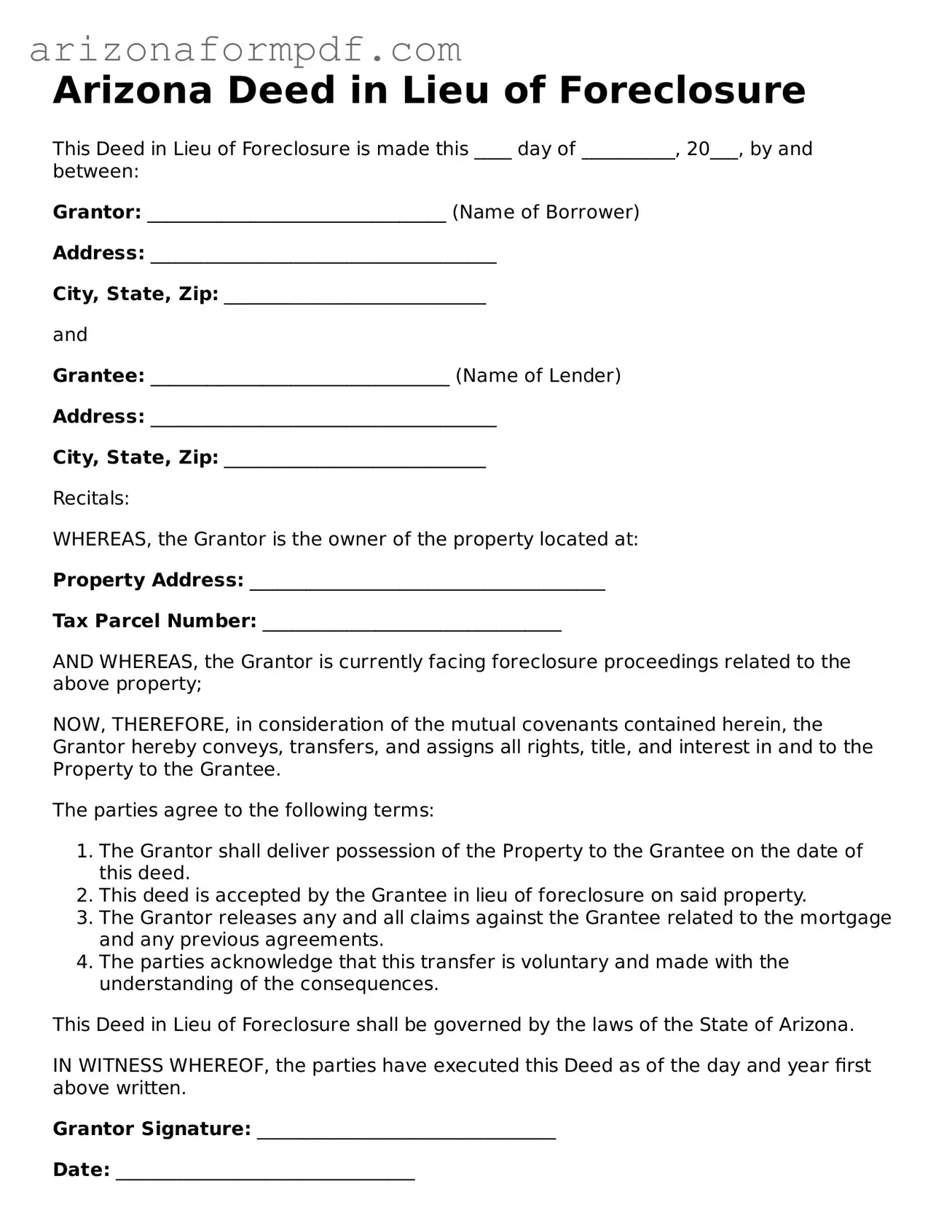

Document Preview

Arizona Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is made this ____ day of __________, 20___, by and between:

Grantor: ________________________________ (Name of Borrower)

Address: _____________________________________

City, State, Zip: ____________________________

and

Grantee: ________________________________ (Name of Lender)

Address: _____________________________________

City, State, Zip: ____________________________

Recitals:

WHEREAS, the Grantor is the owner of the property located at:

Property Address: ______________________________________

Tax Parcel Number: ________________________________

AND WHEREAS, the Grantor is currently facing foreclosure proceedings related to the above property;

NOW, THEREFORE, in consideration of the mutual covenants contained herein, the Grantor hereby conveys, transfers, and assigns all rights, title, and interest in and to the Property to the Grantee.

The parties agree to the following terms:

- The Grantor shall deliver possession of the Property to the Grantee on the date of this deed.

- This deed is accepted by the Grantee in lieu of foreclosure on said property.

- The Grantor releases any and all claims against the Grantee related to the mortgage and any previous agreements.

- The parties acknowledge that this transfer is voluntary and made with the understanding of the consequences.

This Deed in Lieu of Foreclosure shall be governed by the laws of the State of Arizona.

IN WITNESS WHEREOF, the parties have executed this Deed as of the day and year first above written.

Grantor Signature: ________________________________

Date: ________________________________

Grantee Signature: ________________________________

Date: ________________________________

State of Arizona

County of ________________________________

On this ____ day of __________, 20___, before me, a Notary Public, personally appeared __________________ as Grantor and __________________ as Grantee, to me known to be the persons described in and who executed the foregoing instrument, and acknowledged that they executed the same as their free and voluntary act and deed.

Notary Public Signature: ________________________________

My commission expires: ________________________________

Form Specs

| Fact Name | Description |

|---|---|

| Definition | An Arizona Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Laws | This form is governed by Arizona Revised Statutes, specifically Title 33, which outlines property law and the processes related to real estate transactions. |

| Benefits | Utilizing this form can help borrowers avoid the lengthy and often costly foreclosure process, while also allowing lenders to quickly recover their investment. |

| Considerations | Before proceeding with a Deed in Lieu, borrowers should be aware of potential tax implications and the impact on their credit score. |