Attorney-Verified Deed Document for the State of Arizona

When it comes to transferring property ownership in Arizona, understanding the Arizona Deed form is essential. This legal document serves as the official record of the transfer, ensuring that the new owner is recognized under state law. Various types of deeds exist, including warranty deeds, quitclaim deeds, and special warranty deeds, each serving different purposes and offering varying levels of protection for the buyer. The Arizona Deed form must include specific information, such as the names of the parties involved, a legal description of the property, and the date of transfer. Additionally, it requires signatures from both the grantor and grantee, and in most cases, it must be notarized to be legally binding. Filing the deed with the county recorder's office is a crucial step, as it makes the transfer public and provides notice to any potential buyers or creditors. Understanding these components can empower you to navigate the process smoothly, ensuring that your property transaction is secure and compliant with Arizona laws.

Guide to Writing Arizona Deed

Filling out the Arizona Deed form is an important step in transferring property ownership. Once completed, the form must be submitted to the appropriate county recorder's office for processing. Make sure to double-check your entries for accuracy, as any mistakes could delay the transfer.

- Obtain the Form: Download the Arizona Deed form from a reliable source or visit your local county recorder's office to get a physical copy.

- Identify the Parties: Fill in the names of the current owner(s) (grantor) and the new owner(s) (grantee). Ensure that the names are spelled correctly and match official identification.

- Property Description: Provide a complete legal description of the property. This may include the parcel number, lot number, and any other identifying details. You can find this information on your property tax statement or title deed.

- Consideration: State the amount of money or other consideration being exchanged for the property. If it’s a gift, you can indicate that as well.

- Signatures: Ensure that all grantors sign the form. If there are multiple owners, each must provide their signature. Notarization may be required, so check local requirements.

- Date the Document: Write the date when the deed is signed. This is important for record-keeping purposes.

- Submit the Form: Take the completed deed to your local county recorder’s office for filing. Be prepared to pay any associated fees.

Other Arizona Forms

Divorce Contract Template - The document can be submitted to the court for approval as part of the divorce process.

Arizona New Hire - Employees can find guidance on timekeeping and payroll procedures.

Arizona Boat Registration Requirements - Often a straightforward form that can be completed quickly.

Common Questions

What is an Arizona Deed form?

An Arizona Deed form is a legal document used to transfer ownership of real estate in the state of Arizona. This form records the change in ownership from one party to another and is essential for establishing legal rights to the property. There are different types of deeds, such as warranty deeds and quitclaim deeds, each serving a specific purpose in the transfer process.

What information is required to complete an Arizona Deed form?

To fill out an Arizona Deed form, you will need several key pieces of information. This includes the names and addresses of the grantor (the current owner) and the grantee (the new owner), a legal description of the property, and the date of the transfer. Additionally, you may need to provide information about any liens or encumbrances on the property. Accurate details ensure the deed is valid and enforceable.

How do I file an Arizona Deed form?

Filing an Arizona Deed form involves a few straightforward steps. First, you must sign the deed in front of a notary public. Once notarized, the next step is to file the deed with the county recorder's office in the county where the property is located. There may be a small filing fee, so be prepared to pay that when you submit the document. After filing, the deed becomes part of the public record.

Are there any taxes associated with transferring property in Arizona?

Yes, there may be taxes involved when transferring property in Arizona. The most common tax is the transfer tax, which is assessed based on the sale price or the value of the property being transferred. Additionally, if the property is sold, capital gains tax may apply. It’s advisable to consult with a tax professional to understand your specific tax obligations related to the transfer.

Dos and Don'ts

When filling out the Arizona Deed form, it's essential to approach the task with care. Here are some important dos and don'ts to keep in mind:

- Do ensure that all required fields are completed accurately.

- Do use clear and legible handwriting or type the information.

- Do double-check the legal descriptions of the property to avoid errors.

- Do sign the deed in the presence of a notary public.

- Don't leave any sections blank; fill in all applicable areas.

- Don't use abbreviations or informal language in the legal descriptions.

By following these guidelines, you can help ensure that your Arizona Deed form is filled out correctly, which can facilitate a smoother transaction process.

Similar forms

The Arizona Deed form shares similarities with the Warranty Deed. A Warranty Deed guarantees that the seller has clear title to the property and the right to sell it. This type of deed also provides a promise to defend the title against any claims. Both documents facilitate the transfer of property ownership, but the Warranty Deed offers additional protections for the buyer, ensuring that they are safeguarded against potential future disputes regarding the title.

Another document that resembles the Arizona Deed is the Quitclaim Deed. Unlike the Warranty Deed, a Quitclaim Deed transfers whatever interest the seller has in the property without any guarantees. This means that if the seller has a claim to the property, it is transferred, but if they do not, the buyer receives nothing. Both deeds are used for transferring property, but the Quitclaim Deed is often used in situations where the parties know each other well, such as between family members.

The Special Warranty Deed is also comparable to the Arizona Deed. This type of deed provides a limited guarantee, ensuring that the seller has not encumbered the property during their ownership. While the seller does not guarantee against issues that may have arisen before they owned the property, they do assure the buyer that they have not created any problems during their tenure. This document strikes a balance between the comprehensive protection of a Warranty Deed and the minimal assurances of a Quitclaim Deed.

The Bargain and Sale Deed is another document that shares characteristics with the Arizona Deed. This deed conveys the property without any warranties regarding the title. It implies that the seller has ownership but does not guarantee it against claims. This type of deed is often used in foreclosure sales or tax sales, where the seller may not have full knowledge of the property's history. While it facilitates the transfer of ownership, buyers should proceed with caution due to the lack of guarantees.

A Grant Deed is also similar to the Arizona Deed. This document conveys property ownership and includes implied warranties that the seller has not transferred the property to anyone else and that the property is free from encumbrances, except as disclosed. The Grant Deed provides more assurance than a Quitclaim Deed but less than a Warranty Deed. It is often used in residential real estate transactions, offering a middle ground in terms of protection.

The Trustee's Deed is another document that can be compared to the Arizona Deed. This deed is used when a property is transferred by a trustee, typically during a foreclosure or estate settlement. The Trustee's Deed conveys the property without warranties, similar to a Quitclaim Deed. However, it often includes a statement that the trustee has the authority to sell the property, providing some assurance to the buyer regarding the legitimacy of the transaction.

The Deed of Trust, while slightly different in purpose, is also related to the Arizona Deed. This document secures a loan with real property as collateral. It involves three parties: the borrower, the lender, and a trustee. While it does not transfer ownership outright, it establishes a lien on the property. In the event of default, the lender can initiate foreclosure. Both documents are essential in real estate transactions, but they serve different functions regarding ownership and security.

The Bill of Sale is similar in that it also serves to transfer ownership, but it pertains specifically to personal property rather than real estate. This document provides proof of the transaction and outlines the terms of the sale. While the Arizona Deed focuses on real property, both documents fulfill the need for a formal agreement to establish ownership and protect the rights of the parties involved.

Lastly, the Affidavit of Title is comparable to the Arizona Deed in that it is often used in conjunction with property transfers. This document is a sworn statement by the seller affirming their ownership of the property and disclosing any liens or encumbrances. While it does not transfer ownership itself, it provides additional assurance to the buyer regarding the title's status. Both documents are vital in ensuring a smooth transaction and protecting the interests of the buyer.

Key takeaways

When dealing with real estate in Arizona, understanding how to properly fill out and use a deed form is crucial. Here are some key takeaways to keep in mind:

- Understand the Purpose: A deed is a legal document that transfers ownership of property from one party to another. Make sure you know why you need it.

- Choose the Correct Type of Deed: Arizona recognizes several types of deeds, including warranty deeds and quitclaim deeds. Each serves a different purpose, so select the one that fits your needs.

- Identify the Parties: Clearly state the names of the grantor (the person transferring the property) and the grantee (the person receiving the property). Accuracy is essential.

- Provide a Legal Description: Include a precise legal description of the property. This is not just the address; it should detail the boundaries and any relevant identifiers.

- Signatures Matter: The deed must be signed by the grantor. If there are multiple grantors, all must sign unless otherwise specified.

- Notarization Requirement: Arizona law requires that the deed be notarized. This adds an extra layer of authenticity and can help prevent disputes later on.

- Recording the Deed: After filling out and signing the deed, it should be recorded with the county recorder’s office. This step is vital for establishing public notice of the property transfer.

- Consider Tax Implications: Transferring property can have tax consequences. Be sure to consult with a tax professional to understand any potential liabilities.

- Keep Copies: Always retain copies of the completed deed and any related documents for your records. This will be useful for future reference or in case of disputes.

By following these guidelines, you can ensure that your experience with the Arizona deed form is smooth and legally sound.

Common mistakes

-

Incorrect Names: People often misspell names or use nicknames instead of legal names. Ensure that all names match the names on official identification documents.

-

Missing Signatures: Failing to sign the deed can invalidate it. All parties involved in the transfer must provide their signatures.

-

Wrong Property Description: An inaccurate or vague description of the property can lead to confusion. Use the legal description found in the property’s title or prior deed.

-

Improper Notarization: Not having the deed notarized correctly can result in rejection. Ensure that the notary public signs and stamps the document as required.

-

Failure to Include Consideration: Omitting the consideration (the value exchanged) can create issues. Clearly state the amount or value being exchanged for the property.

-

Incorrect Date: Providing an incorrect date can complicate matters. Always double-check that the date of signing is accurate and reflects the intended transaction date.

-

Not Reviewing Local Requirements: Different counties may have specific requirements for deeds. Check local regulations to ensure compliance.

-

Neglecting to Record the Deed: Failing to file the deed with the county recorder can lead to ownership disputes. Always record the deed promptly after signing.

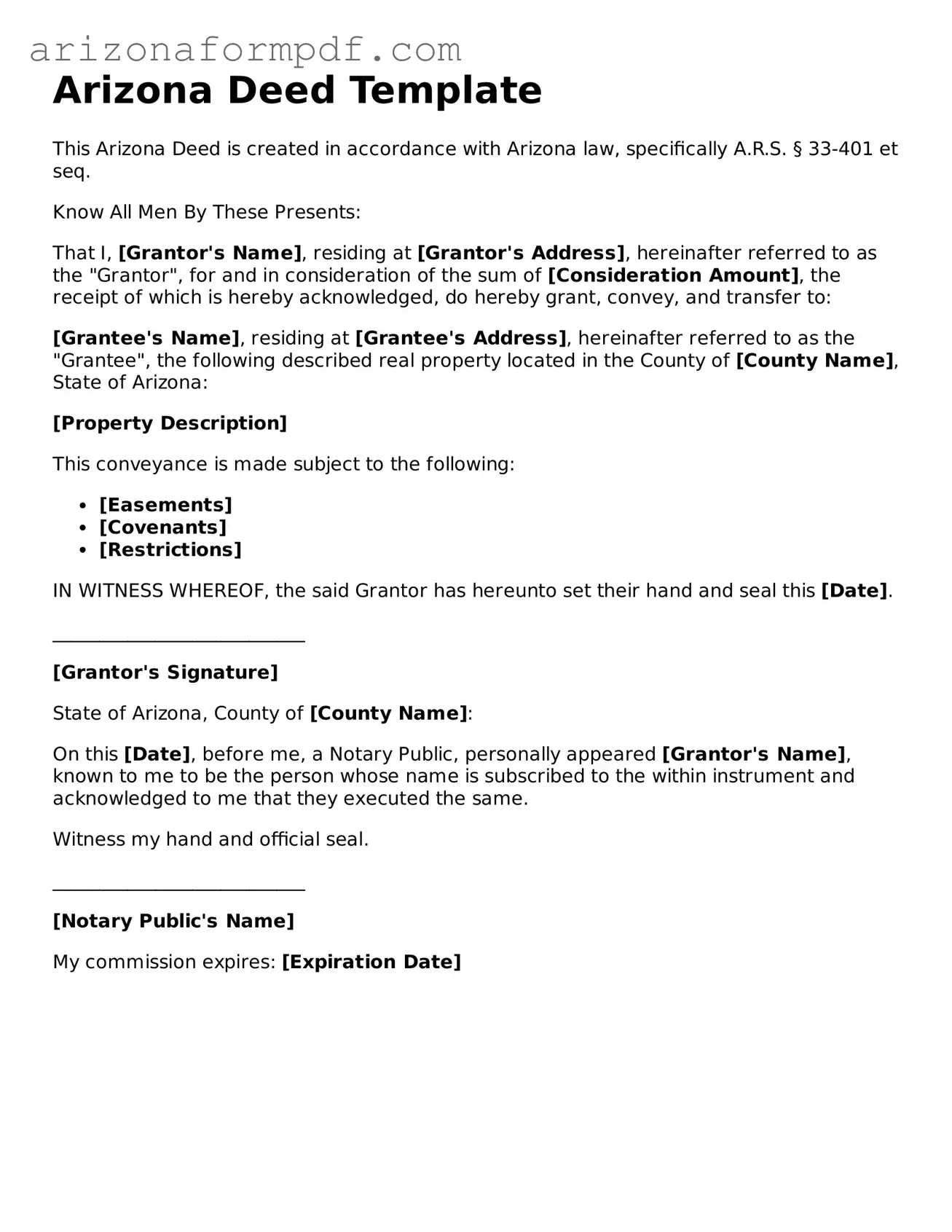

Document Preview

Arizona Deed Template

This Arizona Deed is created in accordance with Arizona law, specifically A.R.S. § 33-401 et seq.

Know All Men By These Presents:

That I, [Grantor's Name], residing at [Grantor's Address], hereinafter referred to as the "Grantor", for and in consideration of the sum of [Consideration Amount], the receipt of which is hereby acknowledged, do hereby grant, convey, and transfer to:

[Grantee's Name], residing at [Grantee's Address], hereinafter referred to as the "Grantee", the following described real property located in the County of [County Name], State of Arizona:

[Property Description]

This conveyance is made subject to the following:

- [Easements]

- [Covenants]

- [Restrictions]

IN WITNESS WHEREOF, the said Grantor has hereunto set their hand and seal this [Date].

___________________________

[Grantor's Signature]

State of Arizona, County of [County Name]:

On this [Date], before me, a Notary Public, personally appeared [Grantor's Name], known to me to be the person whose name is subscribed to the within instrument and acknowledged to me that they executed the same.

Witness my hand and official seal.

___________________________

[Notary Public's Name]

My commission expires: [Expiration Date]

Form Specs

| Fact Name | Description |

|---|---|

| Governing Law | The Arizona Deed form is governed by Arizona state law, specifically Title 33 of the Arizona Revised Statutes. |

| Types of Deeds | Common types of deeds in Arizona include warranty deeds, quitclaim deeds, and special warranty deeds. |

| Execution Requirements | For a deed to be valid in Arizona, it must be signed by the grantor and notarized. |

| Recording | Deeds must be recorded in the county where the property is located to provide public notice of ownership. |

| Consideration | While consideration is often included in the deed, it is not a requirement for the deed to be valid. |

| Legal Description | A legal description of the property must be included in the deed to clearly identify the parcel being transferred. |