Attorney-Verified Durable Power of Attorney Document for the State of Arizona

In the realm of personal and financial planning, the Arizona Durable Power of Attorney (DPOA) form serves as a crucial tool for ensuring your wishes are honored, even when you can no longer communicate them yourself. This legal document allows you to designate a trusted individual, known as your agent, to manage your affairs on your behalf. Whether it’s handling financial transactions, making healthcare decisions, or managing real estate, the DPOA empowers your chosen representative to act in your best interest. It remains effective even if you become incapacitated, which is a significant advantage over other types of power of attorney forms. Understanding the specific requirements and nuances of the Arizona DPOA is vital, as it can help you avoid potential pitfalls and ensure that your intentions are clearly laid out. As life is unpredictable, having this form in place can provide peace of mind, knowing that you have a reliable person ready to step in when needed. The process of creating and executing this document may seem daunting, but it is essential for safeguarding your future and ensuring that your financial and medical preferences are respected.

Guide to Writing Arizona Durable Power of Attorney

Completing the Arizona Durable Power of Attorney form is an important step in designating someone to make decisions on your behalf. This guide will walk you through the necessary steps to ensure that the form is filled out correctly and meets all requirements.

- Obtain the Arizona Durable Power of Attorney form. You can find this form online or through legal service providers.

- Begin by entering your name and address at the top of the form. This identifies you as the principal.

- Next, specify the name and address of the person you are appointing as your agent. This individual will have the authority to act on your behalf.

- Clearly outline the powers you wish to grant your agent. You can choose to give them broad authority or limit their powers to specific decisions.

- Indicate whether the power of attorney is effective immediately or if it should only take effect upon a specific event, such as your incapacitation.

- Sign and date the form in the designated area. Your signature validates the document.

- Have the form notarized. This step is crucial for the document to be legally binding in Arizona.

- Make copies of the completed and notarized form. Distribute these copies to your agent and any relevant institutions, such as banks or healthcare providers.

After completing these steps, your Durable Power of Attorney form will be ready for use. Ensure that your appointed agent understands their responsibilities and that you keep a copy for your records.

Other Arizona Forms

Az Mvd Bill of Sale - If applicable, note any existing liens on the item sold.

Rental Application Forms Free - Indicate your preference for lease length and renewal terms.

Common Questions

What is a Durable Power of Attorney in Arizona?

A Durable Power of Attorney is a legal document that allows you to appoint someone to make decisions on your behalf if you become unable to do so. This can include financial decisions, medical care, and other important matters. The term "durable" means that the authority granted continues even if you become incapacitated. It’s important to choose someone you trust to act in your best interests.

How do I create a Durable Power of Attorney in Arizona?

To create a Durable Power of Attorney in Arizona, you must fill out a specific form that meets state requirements. This form should clearly state your intentions and include the names of the person you are appointing as your agent. After completing the form, you must sign it in front of a notary public. It is advisable to keep copies of the document for your records and provide a copy to your agent and any relevant institutions.

Can I revoke a Durable Power of Attorney in Arizona?

Yes, you can revoke a Durable Power of Attorney at any time as long as you are mentally competent. To revoke it, you should create a written notice stating that you are canceling the previous document. It’s important to inform your agent and any institutions that had a copy of the original document. Keeping a record of the revocation is also a good practice.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, a court may appoint a guardian or conservator to make decisions on your behalf. This process can be lengthy and may not align with your wishes. Having a Durable Power of Attorney in place allows you to choose someone you trust to manage your affairs, making the process smoother and more personal.

Dos and Don'ts

When filling out the Arizona Durable Power of Attorney form, it's important to approach the task with care and consideration. This document grants someone the authority to make decisions on your behalf, so accuracy and clarity are essential. Here’s a list of six things you should and shouldn’t do:

- Do ensure you understand the powers you are granting. Familiarize yourself with the specific authorities you are bestowing upon your agent.

- Do choose a trusted individual as your agent. This person should be someone you can rely on to act in your best interest.

- Do sign the document in front of a notary public. This step adds an extra layer of authenticity and can help avoid potential disputes.

- Do keep a copy of the completed form in a safe place. You may need to refer to it in the future or provide it to your agent.

- Don’t leave any sections blank. Incomplete forms can lead to confusion or misinterpretation of your intentions.

- Don’t rush the process. Take your time to review the document thoroughly before signing it.

Similar forms

The Arizona Durable Power of Attorney (DPOA) is similar to a General Power of Attorney (GPOA). Both documents allow one person to act on behalf of another in legal and financial matters. However, the key difference lies in durability. A GPOA typically becomes void if the principal becomes incapacitated, while a DPOA remains effective even if the principal loses the ability to make decisions. This ensures that the designated agent can continue to manage affairs without interruption.

Another document that shares similarities with the DPOA is the Medical Power of Attorney (MPOA). While the DPOA focuses on financial and legal matters, the MPOA specifically grants authority to make healthcare decisions. Both forms empower an agent to act on behalf of the principal, but the MPOA is limited to medical contexts. This distinction is crucial for individuals who want to separate their financial and health care decision-making processes.

The Living Will is also akin to the DPOA, although it serves a different purpose. A Living Will outlines an individual's wishes regarding medical treatment in situations where they are unable to communicate their preferences. While the DPOA allows an agent to make decisions, a Living Will provides guidance on what those decisions should be, particularly at the end of life. Together, they ensure that both financial and medical preferences are respected.

The Revocable Trust shares some characteristics with the DPOA in that both can facilitate the management of a person's assets. A Revocable Trust allows individuals to place their assets in a trust during their lifetime, with the ability to change or dissolve it as needed. In contrast, a DPOA grants authority to an agent to manage assets directly. Both documents can help avoid probate, but they function in different ways to achieve that goal.

A Healthcare Proxy is another document that is similar to the DPOA. It designates someone to make medical decisions on behalf of an individual if they are unable to do so themselves. Like the MPOA, the Healthcare Proxy is focused on health care, but it may not include broader financial powers. This distinction is important for those who want to ensure that their medical decisions are made by someone they trust while still maintaining a separate financial agent through a DPOA.

The Financial Power of Attorney is closely related to the DPOA, as both allow an agent to handle financial matters. However, a Financial Power of Attorney may be more limited in scope, often specifying particular transactions or types of decisions. The DPOA is generally broader, allowing for a wider range of actions. Individuals should choose the document that best fits their needs for financial management.

The Guardianship document is another related concept. While the DPOA allows someone to manage affairs while the principal is alive, a Guardianship may be established when an individual is unable to care for themselves. A court appoints a guardian to make decisions for the individual, which can include medical and financial matters. The DPOA, on the other hand, is a proactive measure that allows individuals to designate their own agents without court intervention.

The Advance Directive is similar to the DPOA in that it encompasses a range of decisions regarding an individual's health care preferences. It typically includes a Living Will and a Healthcare Proxy, allowing individuals to express their wishes about medical treatment and appoint someone to make decisions on their behalf. While the DPOA focuses on financial matters, the Advance Directive ensures that health care choices align with the individual's values and desires.

Finally, the Will is a document that, while fundamentally different in function, shares some similarities with the DPOA in terms of authority over assets. A Will dictates how a person's assets will be distributed after death, whereas a DPOA is effective during a person's lifetime. Both documents are essential for comprehensive estate planning, ensuring that an individual's wishes are honored both in life and after passing.

Key takeaways

When considering the Arizona Durable Power of Attorney form, it is essential to understand its significance and the implications of filling it out correctly. Here are five key takeaways to keep in mind:

- Understanding Authority: The form allows you to designate someone you trust to make decisions on your behalf if you become unable to do so. This authority can cover financial matters, healthcare decisions, or both.

- Durability Feature: Unlike a regular power of attorney, the durable version remains effective even if you become incapacitated. This ensures that your designated agent can act on your behalf when you need it most.

- Choosing Your Agent: It is crucial to select a reliable and trustworthy individual as your agent. This person will have significant power over your financial and personal affairs, so choose wisely.

- Clear Instructions: When filling out the form, provide clear and specific instructions regarding the powers you are granting. Ambiguities can lead to confusion and potential disputes later on.

- Revocation Process: You have the right to revoke the Durable Power of Attorney at any time, as long as you are still competent. Make sure to communicate this decision clearly to your agent and any relevant parties.

Common mistakes

-

Not naming a specific agent. Many people simply list "my spouse" or "my children" without naming a specific individual. This can lead to confusion.

-

Failing to specify the powers granted. Some individuals do not clearly outline what powers they are giving their agent. This can result in misunderstandings about what the agent can and cannot do.

-

Not signing the document. A common oversight is forgetting to sign the Durable Power of Attorney. Without a signature, the document is not valid.

-

Neglecting to date the form. It’s crucial to include the date of signing. An undated document can create complications later.

-

Not having witnesses or notarization. Arizona requires that the Durable Power of Attorney be signed in the presence of a notary or witnesses. Failing to do so can invalidate the document.

-

Using outdated forms. Laws can change. Using an outdated form may lead to issues with validity. Always ensure you have the most current version.

-

Not discussing the decision with the agent. Some people fill out the form without consulting the person they intend to appoint. This can lead to surprises and misunderstandings.

-

Overlooking alternate agents. It’s wise to name an alternate agent in case the primary agent cannot serve. Failing to do so can create gaps in authority.

-

Ignoring state-specific requirements. Each state has its own laws regarding Durable Power of Attorney. Not adhering to Arizona's specific requirements can render the document ineffective.

-

Not reviewing the document periodically. Life changes, and so do circumstances. Regularly reviewing the Durable Power of Attorney ensures it reflects current wishes and conditions.

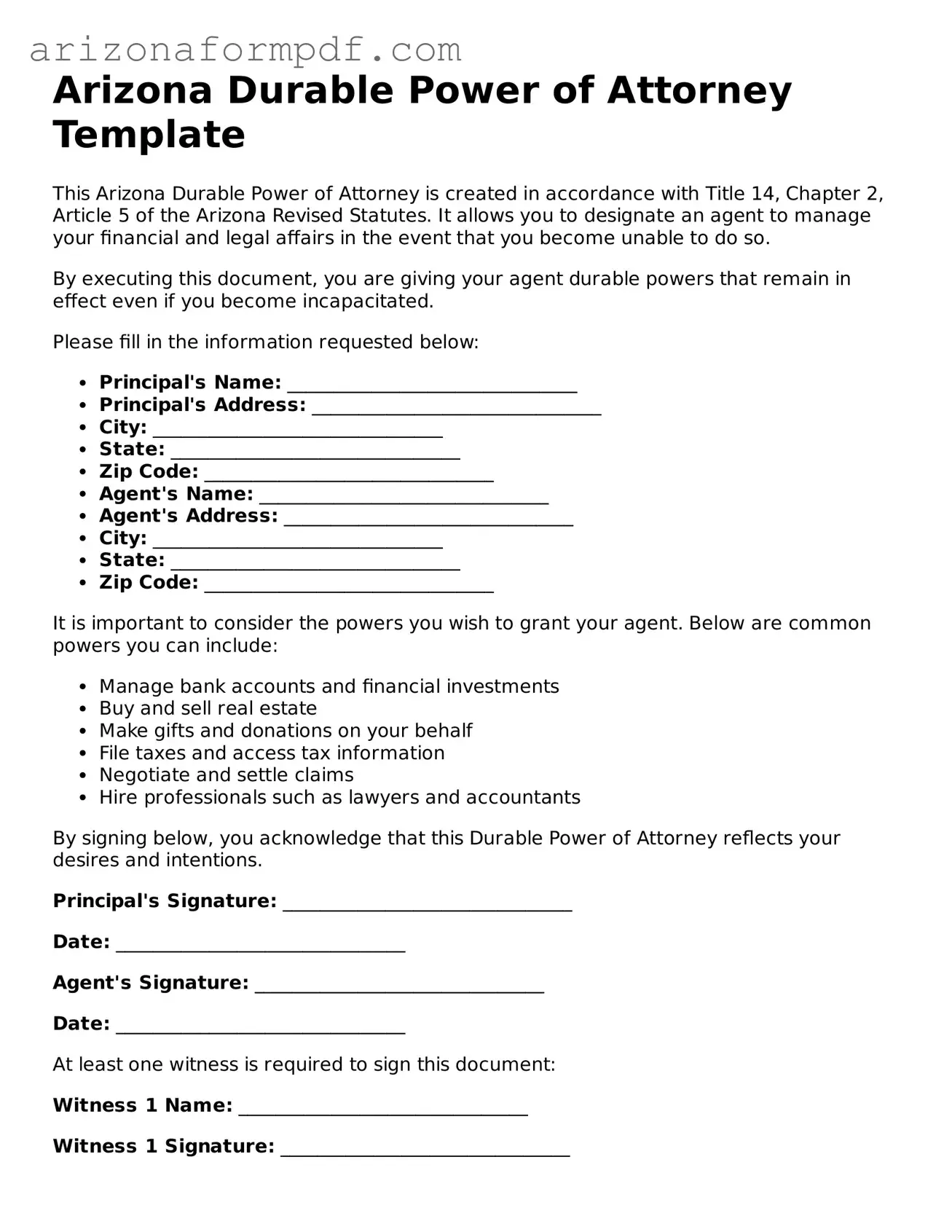

Document Preview

Arizona Durable Power of Attorney Template

This Arizona Durable Power of Attorney is created in accordance with Title 14, Chapter 2, Article 5 of the Arizona Revised Statutes. It allows you to designate an agent to manage your financial and legal affairs in the event that you become unable to do so.

By executing this document, you are giving your agent durable powers that remain in effect even if you become incapacitated.

Please fill in the information requested below:

- Principal's Name: _______________________________

- Principal's Address: _______________________________

- City: _______________________________

- State: _______________________________

- Zip Code: _______________________________

- Agent's Name: _______________________________

- Agent's Address: _______________________________

- City: _______________________________

- State: _______________________________

- Zip Code: _______________________________

It is important to consider the powers you wish to grant your agent. Below are common powers you can include:

- Manage bank accounts and financial investments

- Buy and sell real estate

- Make gifts and donations on your behalf

- File taxes and access tax information

- Negotiate and settle claims

- Hire professionals such as lawyers and accountants

By signing below, you acknowledge that this Durable Power of Attorney reflects your desires and intentions.

Principal's Signature: _______________________________

Date: _______________________________

Agent's Signature: _______________________________

Date: _______________________________

At least one witness is required to sign this document:

Witness 1 Name: _______________________________

Witness 1 Signature: _______________________________

Date: _______________________________

Witness 2 Name: _______________________________

Witness 2 Signature: _______________________________

Date: _______________________________

This durable power of attorney revokes any prior powers of attorney executed by you.

Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney in Arizona allows an individual (the principal) to appoint someone else (the agent) to make decisions on their behalf, even if the principal becomes incapacitated. |

| Governing Law | The Arizona Durable Power of Attorney is governed by Arizona Revised Statutes, Title 14, Chapter 5. |

| Durability | This form remains effective even if the principal becomes unable to manage their affairs due to illness or disability, hence the term "durable." |

| Agent's Authority | The agent can be granted broad or limited powers, depending on the principal's wishes, which must be clearly outlined in the document. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |