Fill Out Your Gao W 9 Arizona Form

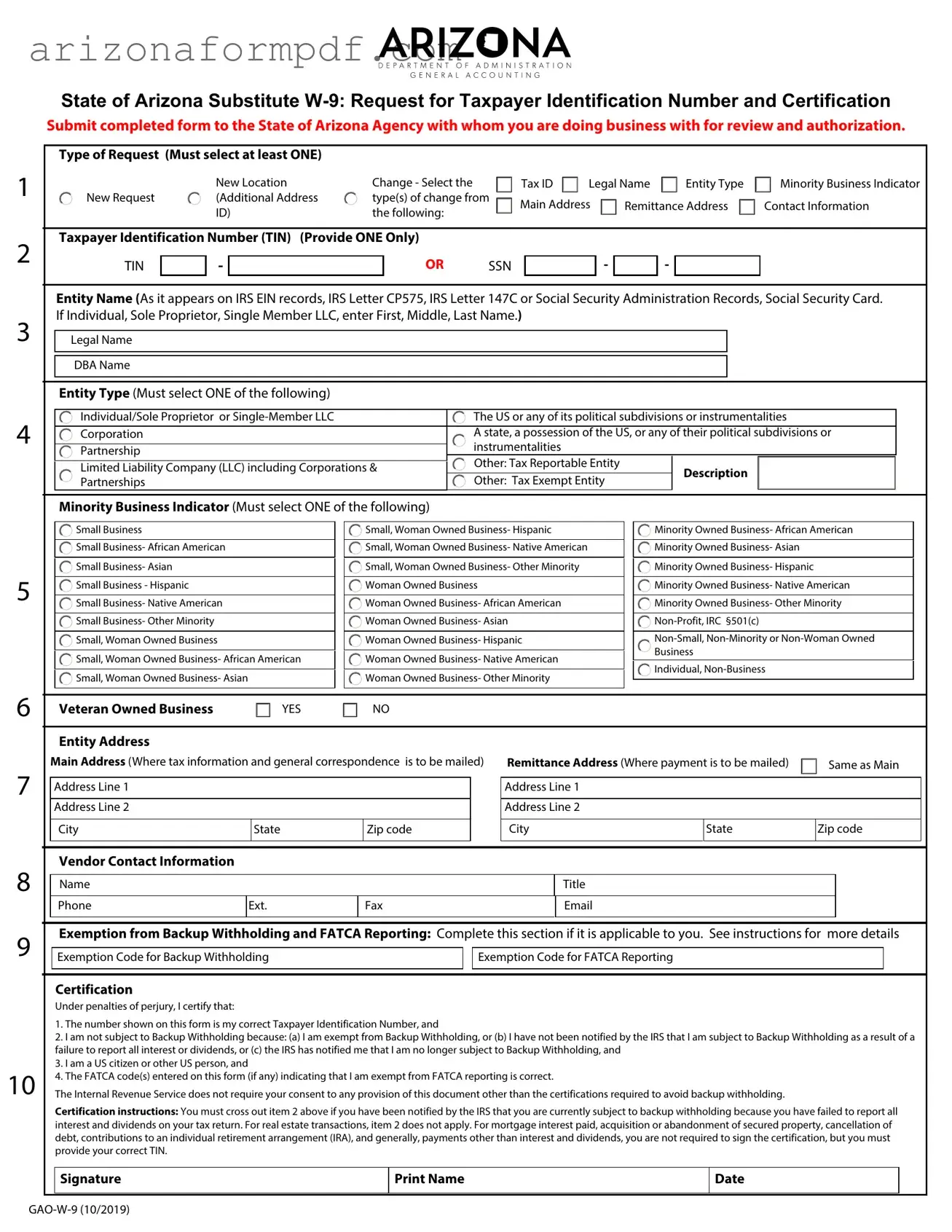

The GAO W-9 Arizona form serves as a vital tool for individuals and entities wishing to engage in business with the State of Arizona. This form, officially known as the Substitute W-9, is essential for collecting accurate taxpayer identification numbers (TINs) from vendors and payees. By submitting this form, individuals and organizations help ensure compliance with IRS regulations, which mandate that the state withhold a portion of payments if a certified TIN is not provided. The form requires various details, including the type of request, entity name, and taxpayer identification number, among other important information. Additionally, it includes sections to indicate business classifications, such as minority or veteran-owned status, which can facilitate access to state contracts and opportunities. Completing the GAO W-9 accurately not only aids in the smooth processing of payments but also promotes transparency and accountability in state financial dealings.

Guide to Writing Gao W 9 Arizona

Completing the GAO W-9 form for Arizona requires careful attention to detail. This form is essential for providing your taxpayer identification information to the State of Arizona, ensuring that you can conduct business without issues related to tax reporting. Follow these steps to fill out the form accurately.

- Select the type of request at the top of the form. You must choose at least one option, such as "New Request" or "Location Change."

- Enter your Taxpayer Identification Number (TIN) or Social Security Number (SSN). Ensure it is the correct nine-digit number.

- Provide your legal name as it appears on IRS records. If you are an individual, include your first, middle, and last name. If applicable, also enter your "Doing Business As" (DBA) name.

- Choose your entity type from the list provided. Options include "Individual/Sole Proprietor," "Corporation," "Partnership," and others.

- Select your minority business indicator if applicable. You must choose one option from the provided categories.

- Indicate whether you are a veteran-owned business by selecting "Yes" or "No."

- Fill in your main address where tax information and correspondence will be sent. If the remittance address is the same, check the box provided.

- Provide your contact information, including your name, title, phone number, fax number, and email address.

- If applicable, complete the exemptions section for Backup Withholding and FATCA Reporting. Enter any relevant exemption codes.

- Sign and date the certification section at the bottom of the form. Make sure to print your name as well.

After completing the form, submit it to the appropriate State of Arizona agency with which you are doing business. This submission is crucial for ensuring that your taxpayer information is correctly recorded and that you remain compliant with state tax regulations.

Browse Popular Forms

Arizona Financial - This form collects vital personal and financial details from parties involved in legal proceedings in Arizona.

Class 6 Misdemeanor - The Class 6 felony should not have involved serious physical injury inflicted intentionally or knowingly.

Is There Income Tax in Arizona - Complete the form using legible writing, either by hand or computer.

Common Questions

What is the GAO W-9 Arizona form used for?

The GAO W-9 Arizona form, officially known as the Substitute W-9, is a request for your Taxpayer Identification Number (TIN) and certification. This form is essential for anyone doing business with the State of Arizona. By submitting this form, you help the state report income paid to you or your organization accurately. Additionally, it helps avoid backup withholding, which could mean losing a portion of your payments to taxes if your TIN is not provided.

Who needs to complete the GAO W-9 Arizona form?

Any vendor or payee wishing to conduct business with the State of Arizona must complete the GAO W-9 form. This includes individuals, sole proprietors, partnerships, corporations, and various types of entities. If you are receiving payments from the state, it is crucial to fill out this form to ensure your payments are processed without unnecessary tax deductions.

What information do I need to provide on the form?

When filling out the GAO W-9 Arizona form, you will need to provide several key pieces of information. This includes your Taxpayer Identification Number (TIN), which can be your Social Security Number (SSN) or Employer Identification Number (EIN). You will also need to enter your legal name as it appears on IRS records, indicate your entity type, and provide your business address. Additionally, if applicable, you should select your minority business status and indicate whether you are a veteran-owned business.

What happens if I don’t submit the GAO W-9 form?

If you fail to submit the GAO W-9 form, the State of Arizona is required by the IRS to withhold 28% of all payments made to you. This backup withholding is a precautionary measure to ensure that the state can collect any taxes owed if your TIN is not provided. Therefore, submitting this form is not just a formality; it’s a critical step to ensure you receive your full payments without unnecessary deductions.

How do I certify my information on the GAO W-9 form?

Certification on the GAO W-9 form is done by signing and dating the form. By signing, you confirm that the TIN you provided is correct, that you are not subject to backup withholding, and that you are a U.S. citizen or other U.S. person. It’s important to read the certification statements carefully and cross out any items that do not apply to your situation, especially if you have been notified by the IRS about backup withholding.

Dos and Don'ts

When filling out the GAO W-9 Arizona form, there are several important practices to keep in mind. Here’s a list of what you should and shouldn’t do:

- Do ensure that your Taxpayer Identification Number (TIN) is accurate and complete.

- Do select the appropriate type of request that reflects your current situation.

- Do enter your legal name exactly as it appears on official IRS documents.

- Do provide a valid mailing address for correspondence and payments.

- Do review the certification section carefully before signing.

- Don't leave any sections blank that are required; incomplete forms may delay processing.

- Don't use outdated information; always refer to the latest guidelines.

- Don't forget to check the minority business indicator if it applies to you.

- Don't submit the form without ensuring that your contact information is correct.

Similar forms

The IRS Form W-9 serves a similar purpose to the GAO W-9 Arizona form, as both documents are designed to collect taxpayer identification information. The W-9 form is used by individuals and entities to provide their Taxpayer Identification Number (TIN) to businesses or government agencies that are required to report payments made to them. This form is essential for ensuring accurate tax reporting and avoiding backup withholding. Both forms require the individual or entity to certify that the TIN provided is correct and that they are not subject to backup withholding, thereby serving as a crucial document for tax compliance.

The 1099 form is another document that shares similarities with the GAO W-9 Arizona form. While the GAO W-9 is used to collect information, the 1099 form is utilized to report income paid to independent contractors, freelancers, and other non-employees. When a business pays an individual or entity that is not an employee, it must issue a 1099 form at the end of the tax year to report the total amount paid. The information collected through the W-9, including the TIN and legal name, is necessary for accurately completing the 1099 form, making the two documents interconnected in the tax reporting process.

The Arizona Form 1099-MISC is specifically tailored for reporting miscellaneous income in the state of Arizona. Like the GAO W-9 Arizona form, it requires the taxpayer's identification information to ensure accurate reporting of payments made to vendors or contractors. Both forms are essential for compliance with tax regulations, as the information on the 1099-MISC relies on the data provided in the W-9. This connection underscores the importance of the W-9 in the broader context of tax documentation and reporting.

The IRS Form SS-4, which is the application for an Employer Identification Number (EIN), also parallels the GAO W-9 Arizona form in its function. While the W-9 collects existing taxpayer identification information, the SS-4 is used to request a new EIN, which is necessary for businesses to report taxes and hire employees. Both forms require detailed information about the entity, including its legal name and structure. The SS-4 is critical for new businesses, while the W-9 is vital for ongoing tax compliance, illustrating their respective roles in the lifecycle of a business's tax obligations.

Key takeaways

When dealing with the State of Arizona Substitute W-9 Form, understanding its components is crucial for smooth business transactions. Here are some key takeaways:

- Purpose of the Form: The Substitute W-9 Form is essential for providing your Taxpayer Identification Number (TIN) to the State of Arizona. This allows the state to report any income paid to you or your organization accurately.

- Correct Information is Vital: Ensure that the name and TIN you provide match the records of the IRS or the Social Security Administration. Inaccurate information can lead to delays and potential backup withholding.

- Entity Type Matters: You must select the appropriate entity type that reflects your business structure. This selection impacts how the state processes your information and payments.

- Minority Business Indicators: If applicable, select the appropriate minority business indicator. This can be beneficial for accessing certain programs or opportunities within the state.

- Backup Withholding Awareness: Be aware that if you do not provide a certified TIN, the state may withhold 28% of your payments. Understanding the implications of backup withholding can help you manage your finances more effectively.

By following these key points, you can navigate the process of filling out the Gao W-9 Arizona form with confidence. Proper completion of this form is a step toward ensuring your business operations run smoothly with the state.

Common mistakes

-

Not Selecting the Correct Type of Request: Failing to select at least one option from the Type of Request section can lead to delays in processing your form. Ensure you clearly indicate whether it’s a new request or a change.

-

Incorrect Taxpayer Identification Number (TIN): Entering an incorrect TIN or SSN can result in significant issues. Always double-check your number to ensure accuracy.

-

Using an Incorrect Legal Name: The name you provide must match the name on IRS records. If it does not, your form may be rejected, causing complications with your business dealings.

-

Neglecting to Select an Entity Type: It is essential to select only one entity type that corresponds with your TIN. Omitting this step can lead to confusion and processing errors.

-

Failing to Provide Complete Address Information: Make sure to fill in all required address fields. Incomplete addresses can delay correspondence and payments.

-

Ignoring Backup Withholding and FATCA Exemptions: If applicable, ensure you complete the exemption sections accurately. Misunderstanding these requirements can lead to unnecessary withholding.

-

Not Signing and Dating the Form: Your certification is critical. Without your signature and date, the form is incomplete and cannot be processed. Always remember to sign before submission.

Document Preview

1

2

3

4

State of Arizona Substitute

Submit completed form to the State of Arizona Agency with whom you are doing business with for review and authorization.

Type of Request (Must select at least ONE)

|

|

New Location |

Change - Select the |

|

|

Tax ID |

|

Legal Name |

|

Entity Type |

|

|

Minority Business Indicator |

|||||||||

New Request |

|

(Additional Address |

type(s) of change from |

|

Main Address |

|

|

Remittance Address |

|

|

Contact Information |

|||||||||||

|

|

|

|

|

||||||||||||||||||

|

|

ID) |

the following: |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer Identification Number (TIN) (Provide ONE Only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

TIN |

|

|

|

OR |

SSN |

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

||

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Entity Name (As it appears on IRS EIN records, IRS Letter CP575, IRS Letter 147C or Social Security Administration Records, Social Security Card. If Individual, Sole Proprietor, Single Member LLC, enter First, Middle, Last Name.)

Legal Name

DBA Name

Entity Type (Must select ONE of the following)

|

Individual/Sole Proprietor or |

The US or any of its political subdivisions or instrumentalities |

|

|

|

|

|

|

Corporation |

A state, a possession of the US, or any of their political subdivisions or |

|

|

|

instrumentalities |

|

|

Partnership |

|

|

|

|

Other: Tax Reportable Entity |

|

|

Limited Liability Company (LLC) including Corporations & |

Description |

|

|

|||

|

|

||

|

Partnerships |

Other: Tax Exempt Entity |

|

|

|

||

Minority Business Indicator (Must select ONE of the following)

5

Small Business

Small Business

Small Business- African American

Small Business- African American

Small Business- Asian

Small Business- Asian

Small Business - Hispanic

Small Business - Hispanic

Small Business- Native American

Small Business- Native American

Small Business- Other Minority

Small Business- Other Minority

Small, Woman Owned Business

Small, Woman Owned Business

Small, Woman Owned Business- African American

Small, Woman Owned Business- African American

Small, Woman Owned Business- Asian

Small, Woman Owned Business- Asian

Small, Woman Owned Business- Hispanic

Small, Woman Owned Business- Hispanic

Small, Woman Owned Business- Native American

Small, Woman Owned Business- Native American

Small, Woman Owned Business- Other Minority

Small, Woman Owned Business- Other Minority

Woman Owned Business

Woman Owned Business

Woman Owned Business- African American

Woman Owned Business- African American

Woman Owned Business- Asian

Woman Owned Business- Asian

Woman Owned Business- Hispanic

Woman Owned Business- Hispanic

Woman Owned Business- Native American

Woman Owned Business- Native American

Woman Owned Business- Other Minority

Woman Owned Business- Other Minority

Minority Owned Business- African American

Minority Owned Business- African American

Minority Owned Business- Asian

Minority Owned Business- Asian

Minority Owned Business- Hispanic

Minority Owned Business- Hispanic

Minority Owned Business- Native American

Minority Owned Business- Native American

Minority Owned Business- Other Minority

Minority Owned Business- Other Minority

Non-Profit,

Non-Profit,

Individual,

Individual,

6

7

8

9

10

|

Veteran Owned Business |

|

|

|

YES |

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entity Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Main Address (Where tax information and general correspondence is to be mailed) |

Remittance Address (Where payment is to be mailed) |

|

Same as Main |

||||||||||||

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address Line 1 |

|

|

|

|

|

|

|

|

Address Line 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address Line 2 |

|

|

|

|

|

|

|

|

Address Line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

City |

|

State |

|

|

Zip code |

|

City |

State |

|

Zip code |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vendor Contact Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Phone |

Ext. |

|

|

Fax |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exemption from Backup Withholding and FATCA Reporting: Complete this section if it is applicable to you. See instructions for more details

Exemption Code for Backup Withholding |

|

Exemption Code for FATCA Reporting |

|

|

|

Certification

Under penalties of perjury, I certify that:

1.The number shown on this form is my correct Taxpayer Identification Number, and

2.I am not subject to Backup Withholding because: (a) I am exempt from Backup Withholding, or (b) I have not been notified by the IRS that I am subject to Backup Withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to Backup Withholding, and

3.I am a US citizen or other US person, and

4.The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct.

The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding.

Certification instructions: You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN.

Signature |

Print Name |

Date |

|

|

|

The State of Arizona Substitute

The State of Arizona (State), like all organizations that file an information return with the IRS, must obtain your correct Taxpayer Identification Number (TIN) to report income paid to you or your organization. The State uses the Substitute

Part 1 - Type of Request: Select only one.

Part 2 - Taxpayer Identification Number (TIN): Enter your

Part 3 - Entity Name: Enter the legal name as it appears on IRS EIN records, IRS Letter CP575, IRS Letter 147C or Social Security Administration Records, Social Security Card. If Individual, Sole Proprietor, Single Member LLC, enter First, Middle, Last Name. Enter your DBA in the designated line if applicable.

Part 4 - Entity Type: Select only one for TIN given.

Part 5 - Minority Business Indicator: Select only one for TIN given.

Part 6 - Veteran Owned Business: Select only one for TIN given.

Part 7 - Entity Address: List the locations for tax reporting purposes and where payments should be mailed.

Part 8 - Entity Contact Information: List the contact information.

Part 9 - Backup Withholding and FATCA Exemptions: If you are exempt from Backup Withholding and/or FATCA reporting, enter in the Exemptions box, any code(s) that may apply to you.

Backup Withholding Exemption Codes: Generally, Individuals (including Sole Proprietors) are not exempt from Backup Withholding. Additionally, Corporations are not exempt from Backup Withholding when supplying legal or medical services. If you do not fall under the categories below, leave this field blank. The following codes identify payees that are exempt from Backup Withholding:

Code 1: An organization exempt from tax under section 501(a), any IRA, or a custodial account under section 403(b) (7) if the account satisfies the requirements of section 401(f) (2)

Code 2: The United States or any of its agencies or instrumentalities

Code 3: A state, the District of Columbia, a possession of the United States, or any of their political subdivisions or Instrumentalities

Code 4: A foreign government or any of its political subdivisions, agencies, or instrumentalities

Code 5: A corporation

Code 6: A dealer in securities or commodities required to register in the United States, the District of Columbia, or a possession of the United States Code 7: A futures commission merchant registered with the Commodity Futures Trading Commission

Code 8: A real estate investment trust

Code 9: An entity registered at all times during the tax year under the Investment Company Act of 1940

Code 10: A common trust fund operated by a bank under section 584(a)

Code 11: A financial institution

Code 12: A middleman known in the investment community as a nominee or custodian

Code 13: A trust exempt from tax under section 664 or described in section 4947

FATCA Exemption Codes: The following codes identify payees that are exempt from reporting under FATCA. These codes apply to persons submitting this form for accounts maintained outside of the United States by certain foreign financial institutions. If you are only submitting this form for an account you hold in the United States, leave this field blank. The following codes identify payees that are exempt from FATCA Reporting:

Code A: An organization exempt from tax under section 501(a) or any individual retirement plan as defined in section 7701(a) (37)

Code B: The United States or any of its agencies or instrumentalities

Code C: A state, the District of Columbia, a possession of the United States, or any of their political subdivisions or instrumentalities

Code D: A corporation the stock of which is regularly traded on one or more established securities markets, as described in Reg. section

Code E: A corporation that is a member of the same expanded affiliated group as a corporation described in Reg. section

Code F: A dealer in securities, commodities, or derivative financial instruments (including notional principal contracts, futures, forwards, and options) that is registered as such under the laws of the United States or any state

Code G: A real estate investment trust

Code H: A regulated investment company as defined in section 851 or an entity registered at all times during the tax year under the Investment Company Act of 1940

Code I: A common trust fund as defined in section 584(a)

Code J: A bank as defined in section 581 Code K: A broker

Code L: A trust exempt from tax under section 664 or described in section 4947(a) (1)

Code M: A

Part 10 - Certification: Please sign, date and provide preparer's name in appropriate space.

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The Gao W 9 Arizona form is used to request a taxpayer's identification number and certification for tax reporting purposes. |

| Submission | Completed forms must be submitted to the specific State of Arizona agency you are doing business with for review and authorization. |

| Entity Types | Users must select one entity type, such as Individual, Corporation, or Partnership, when filling out the form. |

| Minority Business Indicator | Applicants can indicate their minority status by selecting from various categories, including Small Business and Woman Owned Business. |

| Backup Withholding | The form includes a certification section where individuals confirm they are not subject to backup withholding as mandated by IRS regulations. |