Attorney-Verified Independent Contractor Agreement Document for the State of Arizona

In the state of Arizona, the Independent Contractor Agreement form serves as a crucial document that outlines the relationship between a business and an independent contractor. This agreement is essential for clarifying the expectations and responsibilities of both parties involved, thus minimizing the potential for misunderstandings or disputes. Key components of the form typically include the scope of work, payment terms, and deadlines, which help ensure that the contractor knows what is expected and when. Additionally, the agreement often addresses confidentiality, intellectual property rights, and liability, providing a framework that protects both the contractor and the hiring entity. By establishing clear guidelines, the Arizona Independent Contractor Agreement fosters a professional environment that can lead to successful collaborations, while also safeguarding the interests of both parties. Understanding the nuances of this document is vital for anyone engaging in contract work within the state, as it not only delineates the working relationship but also serves as a legal safeguard in case issues arise.

Guide to Writing Arizona Independent Contractor Agreement

Completing the Arizona Independent Contractor Agreement form requires attention to detail and a clear understanding of the information needed. After filling out this form, both parties will have a written record of the agreement, which can help clarify expectations and responsibilities.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the contractor and the hiring party. Ensure that all information is accurate and current.

- Specify the scope of work. Clearly outline the services the contractor will provide.

- Indicate the payment terms. This includes the amount to be paid, the method of payment, and the schedule for payments.

- Include the duration of the agreement. State the start and end dates of the contract.

- Detail any specific requirements or conditions that must be met during the contract period.

- Both parties should review the completed form for accuracy and completeness.

- Finally, have both parties sign and date the agreement to make it legally binding.

Other Arizona Forms

Commercial Lease Agreement Arizona - The lease often includes a force majeure clause, which releases parties from obligations during unforeseen events.

5 Day Eviction Notice Arizona - Helps landlords maintain responsibility and order.

Common Questions

What is an Arizona Independent Contractor Agreement?

An Arizona Independent Contractor Agreement is a legal document that outlines the terms and conditions between a business and an independent contractor. This agreement clarifies the nature of the working relationship, including the scope of work, payment terms, and responsibilities of both parties. It serves to protect both the contractor and the hiring entity by clearly defining expectations and reducing the risk of misunderstandings.

Why is it important to have an Independent Contractor Agreement?

Having an Independent Contractor Agreement is crucial for several reasons. First, it establishes clear expectations regarding the work to be performed, deadlines, and payment. This clarity helps prevent disputes. Second, it can protect your business from potential liabilities. If the relationship is not clearly defined, there may be legal implications regarding employment status. Lastly, a well-drafted agreement can provide a framework for resolving disputes should they arise, thus saving time and resources in the long run.

What key elements should be included in the agreement?

Key elements of an Arizona Independent Contractor Agreement should include the following: a detailed description of the services to be provided, payment terms (including rates and schedules), the duration of the agreement, and termination conditions. Additionally, it’s wise to include confidentiality clauses, ownership of work products, and any necessary compliance with state and federal laws. These elements help ensure that both parties are on the same page and can refer back to the agreement if questions arise.

Can an Independent Contractor Agreement be modified after it is signed?

Yes, an Independent Contractor Agreement can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised agreement. This practice helps maintain clarity and ensures that everyone is aware of the updated terms. Open communication is key to a successful working relationship, and addressing changes promptly can help prevent misunderstandings.

Dos and Don'ts

When completing the Arizona Independent Contractor Agreement form, it is essential to approach the process with care. Here are some important dos and don’ts to consider:

- Do read the entire agreement carefully before filling it out.

- Do ensure all personal and business information is accurate and up to date.

- Do include a clear description of the services to be provided.

- Do specify the payment terms, including rates and deadlines.

- Do keep a copy of the signed agreement for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any required fields blank; this can delay the process.

- Don't use vague language when describing services; clarity is key.

- Don't forget to review the agreement with a legal professional if needed.

By following these guidelines, you can help ensure that your Independent Contractor Agreement is completed correctly and effectively. This will provide clarity for both parties involved and help prevent potential disputes in the future.

Similar forms

The Arizona Independent Contractor Agreement is similar to the Employment Agreement, which outlines the terms of employment between an employer and an employee. While an Employment Agreement typically includes benefits, job responsibilities, and termination clauses, the Independent Contractor Agreement focuses on the scope of work, payment terms, and project duration. Both documents aim to clarify expectations, but the Independent Contractor Agreement emphasizes the contractor's autonomy and lack of employee benefits.

Another document that shares similarities is the Non-Disclosure Agreement (NDA). An NDA protects confidential information shared between parties, ensuring that sensitive data remains private. In both agreements, confidentiality is a key concern. However, the NDA is specifically focused on protecting intellectual property and proprietary information, while the Independent Contractor Agreement may include confidentiality clauses as part of the overall project terms.

The Service Agreement is also comparable, as it defines the terms under which services are provided. Both documents specify the nature of the work, payment structures, and timelines. The primary difference lies in the context; a Service Agreement can apply to various service providers, while the Independent Contractor Agreement is tailored specifically for independent contractors, emphasizing their independent status.

The Consulting Agreement is another similar document. This agreement details the terms between a consultant and a client, outlining the consultant's responsibilities and compensation. Like the Independent Contractor Agreement, it focuses on deliverables and timelines. However, the Consulting Agreement often includes specific performance metrics and milestones, which may not be as detailed in an Independent Contractor Agreement.

The Partnership Agreement bears resemblance as well. This document outlines the terms of collaboration between two or more parties. While both agreements define roles and responsibilities, a Partnership Agreement typically involves shared ownership and profits, whereas an Independent Contractor Agreement delineates a more transactional relationship with defined boundaries between contractor and client.

The Vendor Agreement is similar in that it establishes the terms between a business and a vendor providing goods or services. Both documents address payment terms, delivery schedules, and quality standards. However, a Vendor Agreement often focuses on the supply of products, whereas the Independent Contractor Agreement is centered on service provision and project-based work.

The Franchise Agreement also shares characteristics with the Independent Contractor Agreement, particularly in terms of defining the relationship between the franchisor and franchisee. Both documents set forth expectations and obligations. However, a Franchise Agreement typically involves a broader business model and ongoing support from the franchisor, while the Independent Contractor Agreement is more focused on a specific project or service.

The Letter of Agreement can also be compared to the Independent Contractor Agreement. This document serves as a written confirmation of the terms of a verbal agreement. Both documents outline expectations and responsibilities, but a Letter of Agreement is usually less formal and may not cover all the details found in a more comprehensive Independent Contractor Agreement.

Lastly, the Memorandum of Understanding (MOU) is similar in that it outlines an agreement between two or more parties. An MOU typically serves as a preliminary agreement that sets the stage for future contracts. While both documents clarify intentions and responsibilities, an MOU is often non-binding, whereas the Independent Contractor Agreement is a legally enforceable contract.

Key takeaways

When filling out and using the Arizona Independent Contractor Agreement form, keep these key takeaways in mind:

- Clarity is essential. Clearly define the scope of work, including specific tasks and deadlines. This helps both parties understand their responsibilities.

- Payment terms matter. Outline how and when the contractor will be compensated. Include details on rates, payment methods, and any expenses that may be reimbursed.

- Independent status is crucial. Make sure to emphasize that the contractor is not an employee. This distinction affects tax obligations and liability.

- Review and update regularly. As projects evolve, revisit the agreement to ensure it remains relevant. This keeps both parties aligned and protects their interests.

Common mistakes

-

Incorrectly Identifying the Parties: One common mistake is failing to clearly identify both the contractor and the hiring party. It's essential to provide full names and addresses to avoid confusion later on.

-

Missing Scope of Work: Another frequent error is not detailing the specific tasks or services the contractor will perform. A vague description can lead to misunderstandings about expectations and deliverables.

-

Neglecting Payment Terms: Many people forget to specify how and when the contractor will be paid. Clearly outlining payment schedules, methods, and amounts helps prevent disputes over compensation.

-

Ignoring Termination Clauses: Some individuals overlook the importance of including termination conditions. Without these, it may be unclear how either party can end the agreement if necessary.

-

Failing to Include Tax Responsibilities: It's crucial to clarify who is responsible for taxes. Contractors are typically responsible for their own taxes, but this should be explicitly stated to avoid any misunderstandings.

-

Not Reviewing for Compliance: Lastly, individuals often forget to check that the agreement complies with Arizona laws. Ensuring that the form adheres to state regulations can save time and legal issues down the road.

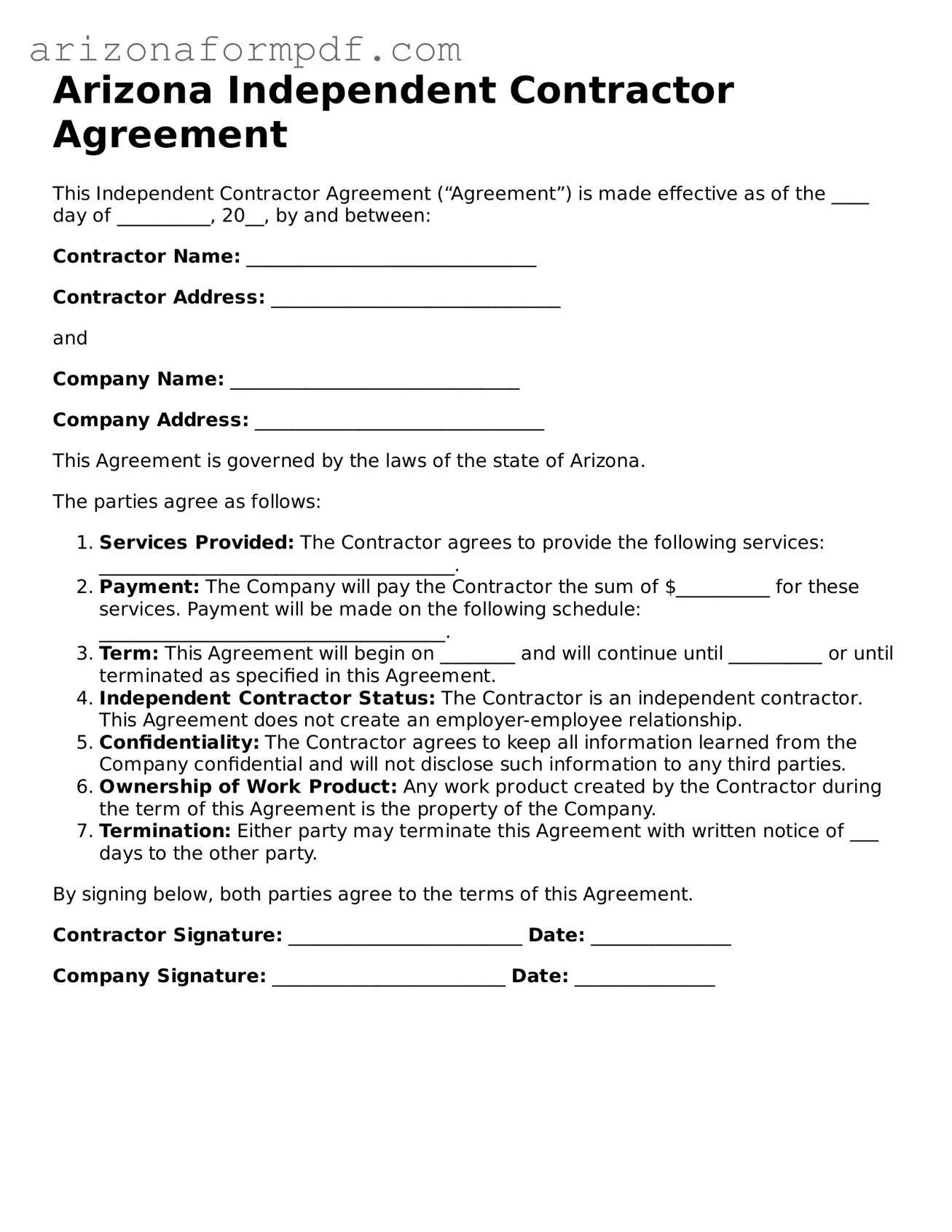

Document Preview

Arizona Independent Contractor Agreement

This Independent Contractor Agreement (“Agreement”) is made effective as of the ____ day of __________, 20__, by and between:

Contractor Name: _______________________________

Contractor Address: _______________________________

and

Company Name: _______________________________

Company Address: _______________________________

This Agreement is governed by the laws of the state of Arizona.

The parties agree as follows:

- Services Provided: The Contractor agrees to provide the following services: ______________________________________.

- Payment: The Company will pay the Contractor the sum of $__________ for these services. Payment will be made on the following schedule: _____________________________________.

- Term: This Agreement will begin on ________ and will continue until __________ or until terminated as specified in this Agreement.

- Independent Contractor Status: The Contractor is an independent contractor. This Agreement does not create an employer-employee relationship.

- Confidentiality: The Contractor agrees to keep all information learned from the Company confidential and will not disclose such information to any third parties.

- Ownership of Work Product: Any work product created by the Contractor during the term of this Agreement is the property of the Company.

- Termination: Either party may terminate this Agreement with written notice of ___ days to the other party.

By signing below, both parties agree to the terms of this Agreement.

Contractor Signature: _________________________ Date: _______________

Company Signature: _________________________ Date: _______________

Form Specs

| Fact Name | Description |

|---|---|

| Definition | The Arizona Independent Contractor Agreement is a legal document outlining the terms of engagement between a business and an independent contractor. |

| Governing Law | This agreement is governed by Arizona state law, specifically under Title 23 of the Arizona Revised Statutes, which pertains to labor laws. |

| Purpose | The primary purpose of this agreement is to clarify the relationship between the contractor and the business, ensuring both parties understand their rights and obligations. |

| Tax Implications | Independent contractors are responsible for their own taxes, which distinguishes them from employees who have taxes withheld by their employers. |

| Termination Clause | The agreement typically includes a termination clause that outlines the conditions under which either party can end the contract. |

| Payment Terms | Payment terms must be clearly defined, including the method of payment and the schedule, to avoid disputes later. |

| Confidentiality | Many agreements include confidentiality provisions to protect sensitive information shared during the course of the contractor's work. |

| Scope of Work | It is crucial to detail the scope of work in the agreement to ensure both parties have a clear understanding of the tasks to be performed. |

| Liability and Insurance | Independent contractors may be required to carry their own liability insurance, protecting both the contractor and the business from potential claims. |