Attorney-Verified Last Will and Testament Document for the State of Arizona

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In Arizona, this legal document serves as a guide for distributing your assets, appointing guardians for minor children, and designating an executor to manage your estate. The Arizona Last Will and Testament form is straightforward, allowing individuals to outline their final wishes clearly. It includes sections for naming beneficiaries, specifying how property should be divided, and addressing any debts or taxes owed. Additionally, the form provides space for appointing a personal representative, who will oversee the execution of the will. Understanding the key components of this form is crucial for anyone looking to secure their legacy and provide peace of mind for their loved ones. By taking the time to complete this document, individuals can ensure that their assets are distributed according to their preferences, thus avoiding potential disputes and confusion among family members.

Guide to Writing Arizona Last Will and Testament

After gathering your personal information and deciding on your wishes for asset distribution, you can proceed to fill out the Arizona Last Will and Testament form. This form is essential for ensuring that your wishes are respected after your passing. Follow these steps carefully to complete the document accurately.

- Begin by writing your full name at the top of the form. Ensure it matches your identification documents.

- Next, include your current address. This should be the place where you reside permanently.

- Indicate your date of birth. This information helps to confirm your identity.

- Designate an executor for your will. This person will be responsible for carrying out your wishes. Include their full name and address.

- List your beneficiaries. These are the individuals or organizations who will receive your assets. Clearly state their names and relationships to you.

- Detail your assets. Be specific about what each beneficiary will receive. This may include property, bank accounts, or personal belongings.

- Include any special instructions. If there are particular wishes regarding your funeral or other matters, write them down.

- Sign and date the form at the bottom. Your signature must be your own, and it should be done in the presence of witnesses.

- Have at least two witnesses sign the document. They should also provide their addresses. Ensure they are not beneficiaries of the will.

Once you have completed the form, store it in a safe place. Consider discussing your wishes with your executor and beneficiaries to avoid confusion later. Regularly review and update the will as necessary to reflect any changes in your life or relationships.

Other Arizona Forms

Arizona Boat Registration Requirements - Often used in conjunction with other documents during the sale process.

Parental Power of Attorney Arizona - A foundational document for responsible stewardship of a child's well-being.

What Does Property Deed Look Like - Properties may be held in trusts, necessitating a specialized deed for transfer.

Common Questions

What is a Last Will and Testament in Arizona?

A Last Will and Testament is a legal document that outlines how an individual's assets and affairs should be handled after their death. In Arizona, this document allows you to designate beneficiaries, appoint an executor, and specify guardianship for minor children, ensuring your wishes are followed and reducing potential disputes among heirs.

Who can create a Last Will and Testament in Arizona?

In Arizona, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. This means that the individual must understand the nature of their actions and the consequences of making a will. Additionally, the will must be signed and witnessed according to Arizona law to be valid.

What are the requirements for a valid will in Arizona?

To be valid, a will in Arizona must be in writing and signed by the testator (the person making the will). It must also be witnessed by at least two individuals who are not beneficiaries. These witnesses must be present at the same time when the testator signs the will or acknowledges their signature. If these requirements are met, the will is generally considered valid in Arizona.

Can I change my will after it has been created?

Yes, you can change your will at any time as long as you are of sound mind. To make changes, you can either create a new will that revokes the previous one or add a codicil, which is an amendment to the existing will. It's important to follow the same legal formalities for signing and witnessing as required for the original will to ensure the changes are valid.

What happens if I die without a will in Arizona?

If you die without a will, you are considered to have died "intestate." In this case, Arizona law dictates how your assets will be distributed. Generally, your estate will be divided among your closest relatives, such as a spouse, children, or parents. However, this distribution may not align with your wishes, highlighting the importance of having a will.

Can I revoke my will in Arizona?

Yes, you can revoke your will in Arizona. This can be done by creating a new will that explicitly states that it revokes any prior wills or by physically destroying the existing will. Additionally, a written declaration that revokes the will can also be executed. It is advisable to inform your executor or family members about the revocation to avoid confusion.

Is it necessary to have a lawyer to create a will in Arizona?

While it is not legally required to have a lawyer to create a will in Arizona, consulting one is highly recommended. A lawyer can ensure that the will complies with state laws, reflect your intentions clearly, and address any complex issues, such as tax implications or unique family situations. This can help prevent future legal challenges and ensure your wishes are honored.

How can I ensure my will is properly executed?

To ensure your will is properly executed, follow these steps: sign the will in the presence of at least two witnesses who are not beneficiaries, and have them sign as well. Store the will in a safe place and inform your executor and family members of its location. Regularly review and update the will as necessary to reflect any changes in your circumstances or wishes.

Dos and Don'ts

When filling out the Arizona Last Will and Testament form, it's important to approach the process with care. Here are some key dos and don'ts to keep in mind:

- Do ensure that you are of sound mind and at least 18 years old.

- Do clearly identify yourself and your beneficiaries.

- Do be specific about how you want your assets distributed.

- Do sign your will in the presence of at least two witnesses.

- Do keep your will in a safe place and inform your executor where it is located.

- Don't use vague language that could lead to confusion.

- Don't forget to date your will.

- Don't leave out any important assets or debts.

- Don't try to fill out the form under duress or pressure.

- Don't neglect to review and update your will as circumstances change.

Similar forms

The Arizona Last Will and Testament form shares similarities with a Living Will. A Living Will outlines an individual's preferences regarding medical treatment in case they become incapacitated and cannot communicate their wishes. While a Last Will primarily deals with the distribution of assets after death, both documents reflect personal choices and intentions regarding one's life and legacy. They serve to ensure that an individual's desires are honored, whether in health decisions or the distribution of property.

Another document akin to the Last Will is the Durable Power of Attorney. This legal document allows a person to designate someone else to make financial or medical decisions on their behalf if they are unable to do so. Like a Last Will, a Durable Power of Attorney is about planning for the future, ensuring that one's wishes are respected and that a trusted individual is in place to act in their best interest during challenging times.

A Revocable Living Trust is also similar to a Last Will. This document allows individuals to place their assets into a trust during their lifetime, which can then be managed by a trustee. Upon the individual's death, the assets in the trust are distributed according to their wishes, similar to how a Last Will operates. Both documents help in the management and distribution of assets, but a Revocable Living Trust can avoid probate, making the process potentially quicker and less public.

The Codicil is another document that relates closely to a Last Will. A Codicil is a legal amendment that modifies an existing will without the need to create an entirely new document. It allows individuals to update their wishes or make small changes, such as adding or removing beneficiaries. This flexibility is crucial for adapting to life changes while maintaining the original intent of the will.

A Living Trust, while similar to a Revocable Living Trust, is specifically designed to manage assets during an individual's lifetime and distribute them after death. It allows for a seamless transition of assets without the need for probate. Like a Last Will, it ensures that an individual's wishes regarding their estate are carried out, but it also provides benefits during their lifetime, such as avoiding court intervention if they become incapacitated.

The Advance Healthcare Directive is another document that parallels the Last Will. This directive combines elements of a Living Will and a Durable Power of Attorney for healthcare. It allows individuals to express their healthcare preferences and appoint someone to make medical decisions on their behalf if they cannot do so. Both documents emphasize the importance of personal choices and provide guidance to loved ones during difficult times.

A Testamentary Trust is similar in that it is created through a Last Will. This type of trust is established upon an individual's death and is used to manage assets for beneficiaries, often minors or individuals unable to manage their finances. The Last Will outlines the creation of the Testamentary Trust, ensuring that the individual's wishes regarding the management and distribution of their estate are fulfilled even after their passing.

Another related document is the Joint Will. This is a single will executed by two individuals, typically spouses, that outlines their mutual wishes regarding asset distribution. While it serves a similar purpose to a Last Will, a Joint Will can complicate matters if one party wishes to change their wishes after the other has passed. Both documents reflect the intentions of individuals regarding their estates, but a Joint Will may require additional considerations for future changes.

Lastly, the Pour-Over Will is a document that works in conjunction with a Revocable Living Trust. It ensures that any assets not placed in the trust during an individual’s lifetime are transferred into the trust upon their death. This type of will provides an additional layer of security, making certain that all assets are managed according to the individual’s wishes, similar to a Last Will, but with the added benefit of trust management.

Key takeaways

Creating a Last Will and Testament is an important step in ensuring that your wishes are honored after your passing. In Arizona, there are specific guidelines to follow when filling out this document. Here are key takeaways to consider:

- The form must be signed by you, the testator, in the presence of at least two witnesses.

- It is essential that the witnesses are not beneficiaries of the will to avoid potential conflicts of interest.

- Clearly identify yourself and your residence in the document to avoid any confusion about your identity.

- List your assets and specify how you want them distributed among your beneficiaries.

- Designate an executor who will be responsible for carrying out the terms of your will.

- Consider including a clause for guardianship if you have minor children.

- Ensure the will is dated to establish its validity and to distinguish it from any prior wills.

- Store the completed will in a safe place, and inform your executor and family members of its location.

- Review and update your will periodically, especially after major life events such as marriage, divorce, or the birth of a child.

- Consulting with an attorney can provide additional guidance and ensure compliance with Arizona laws.

By following these guidelines, individuals can create a clear and effective Last Will and Testament that reflects their wishes and provides peace of mind for their loved ones.

Common mistakes

-

Not Clearly Identifying the Testator: One common mistake is failing to clearly identify the person making the will, known as the testator. It's essential to include the full legal name and address. This ensures that there is no confusion about who the will belongs to.

-

Overlooking Witness Signatures: Arizona law requires that a will be signed by at least two witnesses. Some individuals forget to include these signatures or do not ensure that the witnesses are present at the same time. Without proper witnessing, the will may be deemed invalid.

-

Not Updating the Will: Life changes, such as marriage, divorce, or the birth of children, can affect how assets should be distributed. Failing to update the will to reflect these changes can lead to unintended distributions, leaving loved ones unprotected.

-

Ambiguous Language: Using vague or unclear terms can create confusion about intentions. For example, phrases like “my personal belongings” can lead to disputes over what exactly is meant. Clarity is key to ensuring that the testator’s wishes are honored.

-

Not Including a Residual Clause: A residual clause explains what happens to any remaining assets after specific bequests are made. Omitting this clause can result in leftover assets being distributed according to state law, rather than the testator's wishes.

Document Preview

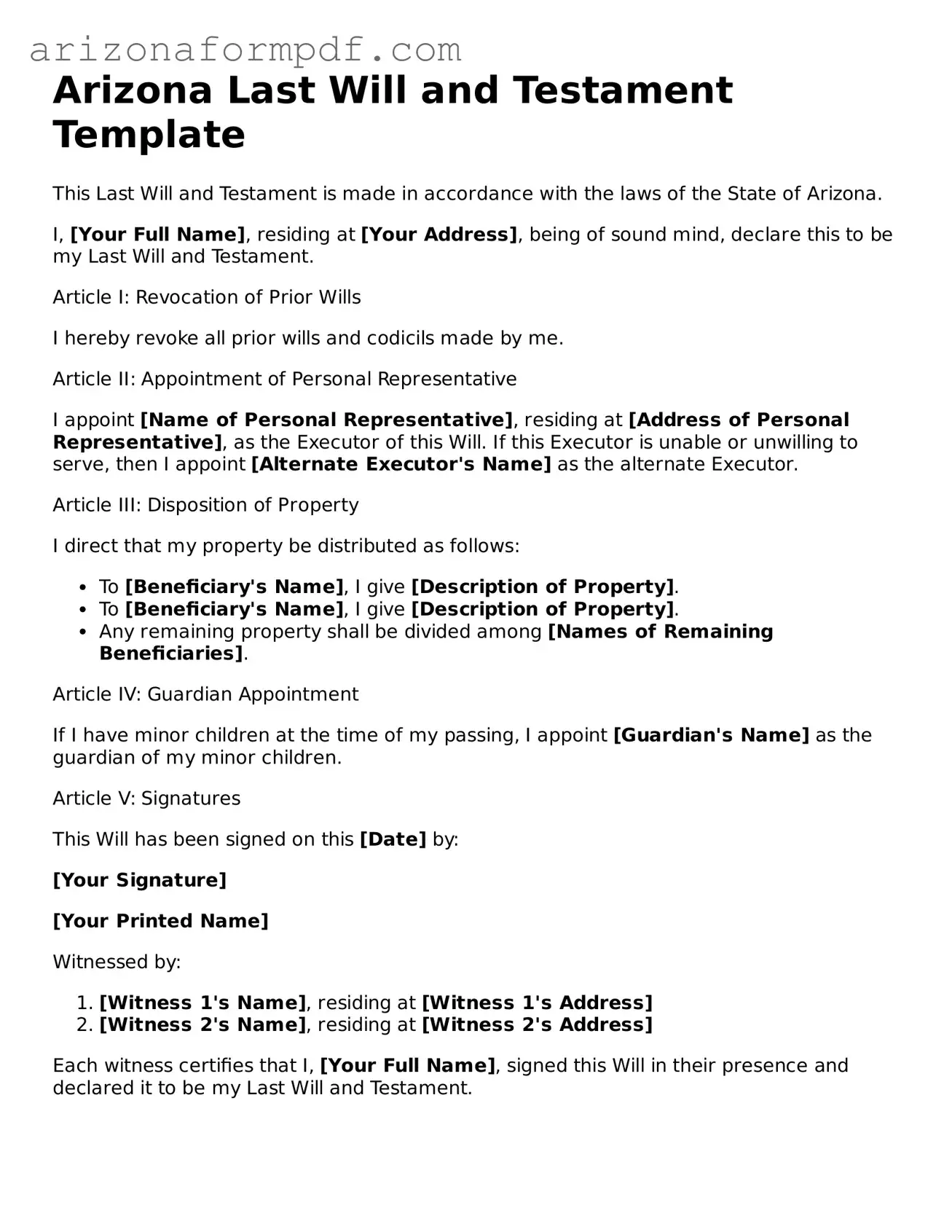

Arizona Last Will and Testament Template

This Last Will and Testament is made in accordance with the laws of the State of Arizona.

I, [Your Full Name], residing at [Your Address], being of sound mind, declare this to be my Last Will and Testament.

Article I: Revocation of Prior Wills

I hereby revoke all prior wills and codicils made by me.

Article II: Appointment of Personal Representative

I appoint [Name of Personal Representative], residing at [Address of Personal Representative], as the Executor of this Will. If this Executor is unable or unwilling to serve, then I appoint [Alternate Executor's Name] as the alternate Executor.

Article III: Disposition of Property

I direct that my property be distributed as follows:

- To [Beneficiary's Name], I give [Description of Property].

- To [Beneficiary's Name], I give [Description of Property].

- Any remaining property shall be divided among [Names of Remaining Beneficiaries].

Article IV: Guardian Appointment

If I have minor children at the time of my passing, I appoint [Guardian's Name] as the guardian of my minor children.

Article V: Signatures

This Will has been signed on this [Date] by:

[Your Signature]

[Your Printed Name]

Witnessed by:

- [Witness 1's Name], residing at [Witness 1's Address]

- [Witness 2's Name], residing at [Witness 2's Address]

Each witness certifies that I, [Your Full Name], signed this Will in their presence and declared it to be my Last Will and Testament.

Form Specs

| Fact Name | Details |

|---|---|

| Legal Requirement | In Arizona, a Last Will and Testament must be in writing and signed by the testator (the person making the will) to be valid. |

| Witnesses | The will must be signed by at least two witnesses who are present at the same time, ensuring that they also sign the document. |

| Revocation | A will can be revoked in Arizona by creating a new will, by a physical act (like tearing or burning the document), or by a written declaration. |

| Governing Laws | The Arizona Last Will and Testament is governed by Arizona Revised Statutes, Title 14, Chapter 2. |