Attorney-Verified Promissory Note Document for the State of Arizona

The Arizona Promissory Note form serves as a crucial document in financial transactions, providing a clear framework for borrowing and lending money. This form outlines the borrower's commitment to repay a specified amount, along with any interest, by a predetermined date. It typically includes essential details such as the names of the parties involved, the loan amount, interest rate, and repayment schedule. Additionally, it may specify the consequences of default, ensuring both parties understand their rights and obligations. The simplicity of the form belies its importance, as it protects the lender's investment while providing the borrower with a structured repayment plan. Understanding the nuances of this document can prevent disputes and foster trust between lenders and borrowers.

Guide to Writing Arizona Promissory Note

Once you have gathered all necessary information, you can proceed to fill out the Arizona Promissory Note form. This document is essential for outlining the terms of a loan agreement between a lender and a borrower. Completing it accurately ensures that both parties understand their obligations and rights.

- Begin by entering the date at the top of the form. This is the date when the note is created.

- Next, clearly state the name of the borrower. This should include the full legal name as it appears on official documents.

- Following the borrower's name, provide their address. Ensure that this is a current and valid address.

- Now, enter the name of the lender. Like the borrower, this should be the full legal name.

- After the lender's name, include their address. Accuracy is important here as well.

- Specify the principal amount of the loan in numbers and words. This amount is what the borrower agrees to pay back.

- Outline the interest rate. Indicate whether it is fixed or variable and include the percentage rate.

- Detail the repayment terms. This includes the schedule for payments—monthly, quarterly, or otherwise—and the total duration of the loan.

- Include any late fees or penalties for missed payments. Clearly state the conditions under which these fees will apply.

- Sign the document. The borrower must sign the note to indicate agreement with the terms. If applicable, the lender should also sign.

- Consider having the document notarized. While this is not always necessary, it can add an extra layer of validity.

Once the form is completed, both parties should keep a copy for their records. This will help in case any disputes arise in the future regarding the terms of the loan.

Other Arizona Forms

What Is an Nda - A Non-disclosure Agreement helps define the scope of confidential information shared.

Vehicle Bill of Sale Arizona - Validates the transaction if kept in secure records by both parties.

Common Questions

What is a Promissory Note in Arizona?

A Promissory Note is a written financial instrument that contains a promise by one party to pay a specified sum of money to another party under agreed-upon terms. In Arizona, this document typically outlines the amount borrowed, the interest rate, repayment schedule, and any consequences for defaulting on the loan. It serves as both a legal agreement and a record of the transaction.

Who can use a Promissory Note in Arizona?

Any individual or business can use a Promissory Note in Arizona. This includes personal loans between friends or family members, business loans, or any situation where one party lends money to another. It is important that both parties understand the terms and conditions outlined in the note to ensure clarity and prevent disputes.

What are the essential elements of a valid Promissory Note in Arizona?

For a Promissory Note to be considered valid in Arizona, it must include certain key elements: the names of the borrower and lender, the principal amount, the interest rate (if applicable), the repayment terms, and the signatures of both parties. Additionally, it may include provisions for late fees, default consequences, and any collateral securing the loan.

Is a Promissory Note legally binding in Arizona?

Yes, a properly executed Promissory Note is legally binding in Arizona. This means that if one party fails to meet the terms of the agreement, the other party can take legal action to enforce the note. It is advisable to keep a copy of the signed note and any related documentation to support any claims that may arise in the future.

Can I modify a Promissory Note after it has been signed?

Yes, modifications to a Promissory Note can be made after it has been signed, but both parties must agree to the changes. It is recommended to document any amendments in writing and have both parties sign the modified agreement. This helps to ensure that all parties are clear on the new terms and reduces the risk of misunderstandings.

What happens if I default on a Promissory Note in Arizona?

If a borrower defaults on a Promissory Note in Arizona, the lender has several options. These may include demanding immediate payment of the remaining balance, charging late fees, or pursuing legal action to recover the owed amount. The specific consequences for defaulting should be clearly outlined in the Promissory Note itself, so both parties are aware of the potential outcomes.

Dos and Don'ts

When filling out the Arizona Promissory Note form, it is essential to follow certain guidelines to ensure the document is valid and enforceable. Here are some key dos and don’ts:

- Do clearly state the names of the borrower and lender at the top of the form.

- Do specify the loan amount in both numerical and written form to avoid confusion.

- Do outline the repayment terms, including the interest rate and payment schedule.

- Do include any late fees or penalties for missed payments to protect the lender's interests.

- Do ensure that both parties sign and date the document to confirm their agreement.

- Don’t leave any sections of the form blank; incomplete information can lead to disputes.

- Don’t use ambiguous language; clarity is crucial in legal documents.

- Don’t forget to have the document notarized if required, as this adds an extra layer of authenticity.

- Don’t overlook the importance of keeping a copy for both parties after signing.

Similar forms

The Arizona Promissory Note is similar to a Loan Agreement, which outlines the terms and conditions of a loan between a lender and a borrower. While a promissory note focuses on the borrower's promise to repay the loan, a loan agreement includes additional details such as the loan amount, interest rate, repayment schedule, and any collateral involved. This comprehensive approach ensures both parties understand their obligations and rights, reducing the potential for disputes later on.

Another document that shares similarities is the Mortgage Agreement. This legal document secures a loan by using real property as collateral. Like a promissory note, it involves a borrower’s commitment to repay the loan. However, a mortgage agreement also includes specific terms regarding the property, such as foreclosure procedures if the borrower defaults. This added layer of security provides lenders with assurance that they can reclaim their investment if necessary.

A Security Agreement is yet another related document. It is used when a borrower pledges personal property as collateral for a loan. Similar to a promissory note, it establishes the borrower's obligation to repay the debt. The key difference lies in the type of collateral involved. A security agreement details the rights of the lender to seize the collateral if the borrower fails to meet their repayment obligations, ensuring the lender has a claim to specific assets.

The Installment Agreement is also akin to a promissory note. This document outlines a borrower’s promise to pay back a loan in fixed installments over a specified period. While a promissory note may not specify payment frequency, an installment agreement clearly defines the payment schedule, including due dates and amounts. This structure helps borrowers manage their finances by providing a predictable repayment plan.

Next, the Lease Agreement bears similarities to a promissory note, particularly in the context of rent payments. In a lease agreement, a tenant agrees to pay rent to a landlord for the use of property. Much like a promissory note, it establishes a financial obligation, but it also includes terms regarding property use, duration of the lease, and responsibilities for maintenance. This ensures both parties understand their commitments and rights throughout the lease period.

The Loan Disclosure Statement also shares common ground with the Arizona Promissory Note. This document provides borrowers with essential information about the loan terms, including interest rates, fees, and repayment schedules. While a promissory note is a binding promise to repay, the disclosure statement is designed to inform borrowers, ensuring they fully understand the financial implications of their loan before signing.

A Forbearance Agreement is another document that can be compared to a promissory note. This agreement allows borrowers to temporarily pause or reduce their loan payments due to financial hardship. Similar to a promissory note, it acknowledges the borrower's obligation to repay the debt. However, it also outlines new terms for repayment, providing flexibility for borrowers while ensuring lenders still have a framework to recover their funds in the future.

Finally, the Guaranty Agreement is related to a promissory note in that it involves a third party who agrees to take responsibility for the borrower’s debt if they default. While the promissory note binds the borrower to repay the loan, the guaranty adds an additional layer of security for the lender. This document provides assurance that even if the primary borrower fails to meet their obligations, the lender has recourse to recover the funds from the guarantor.

Key takeaways

When filling out and using the Arizona Promissory Note form, it’s essential to understand the key elements involved. Here are some important takeaways to keep in mind:

- Understand the Purpose: A promissory note is a written promise to pay a specified amount of money to a designated person or entity under agreed-upon terms.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that all parties are easily identifiable.

- Specify the Loan Amount: Clearly indicate the total amount of money being borrowed. This figure should be accurate to avoid any confusion later.

- Detail the Interest Rate: Include the interest rate being charged on the loan. This can be fixed or variable, but it must be clearly defined.

- Set the Repayment Terms: Outline how and when the borrower will repay the loan. This includes payment frequency, due dates, and any grace periods.

- Include Late Fees: Specify any late fees that will apply if payments are not made on time. This encourages timely repayment.

- Address Prepayment Options: Indicate whether the borrower can pay off the loan early without penalties. This can be an attractive option for borrowers.

- Signatures Required: Both the borrower and the lender must sign the note. This signifies their agreement to the terms outlined in the document.

- Consider Notarization: While not always required, having the document notarized can provide additional legal protection and validate the agreement.

- Keep Copies: After the note is signed, both parties should retain copies for their records. This ensures that everyone has access to the terms of the agreement.

By following these guidelines, you can effectively fill out and utilize the Arizona Promissory Note form. Understanding these key points will help ensure a smooth lending process.

Common mistakes

-

Incomplete Information: Failing to fill in all required fields can lead to delays or invalidation of the note. Ensure that all sections are completed accurately.

-

Incorrect Dates: Entering the wrong date can create confusion regarding the terms of the loan. Double-check the date to ensure it reflects the correct agreement.

-

Missing Signatures: Both the borrower and lender must sign the document. Without these signatures, the note may not be enforceable.

-

Ambiguous Terms: Using vague language can lead to misunderstandings. Clearly define the loan amount, interest rate, and repayment schedule.

-

Ignoring State Requirements: Different states have specific rules regarding promissory notes. Familiarize yourself with Arizona's requirements to avoid issues.

-

Not Keeping Copies: Failing to retain a copy of the signed note can result in complications later. Always keep a copy for your records.

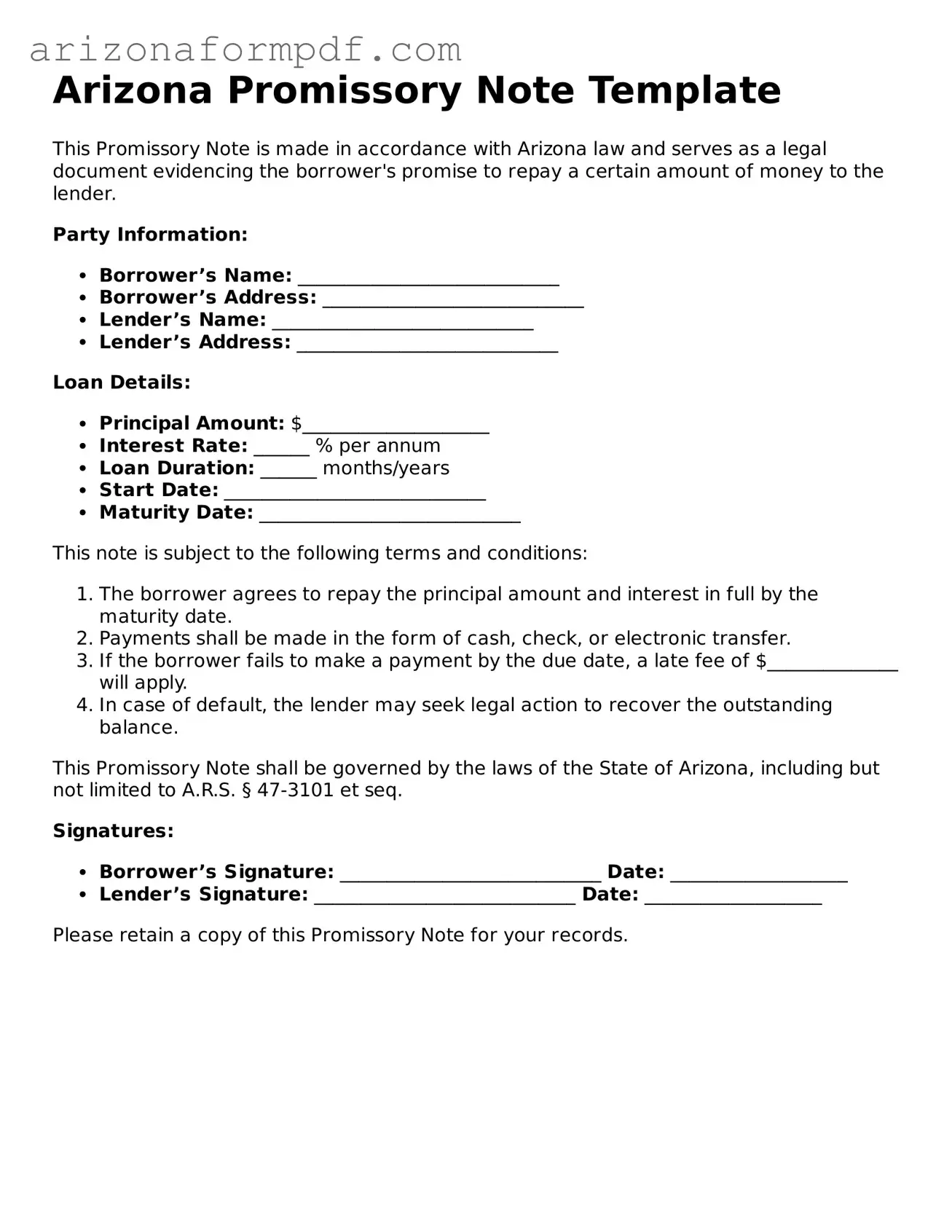

Document Preview

Arizona Promissory Note Template

This Promissory Note is made in accordance with Arizona law and serves as a legal document evidencing the borrower's promise to repay a certain amount of money to the lender.

Party Information:

- Borrower’s Name: ____________________________

- Borrower’s Address: ____________________________

- Lender’s Name: ____________________________

- Lender’s Address: ____________________________

Loan Details:

- Principal Amount: $____________________

- Interest Rate: ______ % per annum

- Loan Duration: ______ months/years

- Start Date: ____________________________

- Maturity Date: ____________________________

This note is subject to the following terms and conditions:

- The borrower agrees to repay the principal amount and interest in full by the maturity date.

- Payments shall be made in the form of cash, check, or electronic transfer.

- If the borrower fails to make a payment by the due date, a late fee of $______________ will apply.

- In case of default, the lender may seek legal action to recover the outstanding balance.

This Promissory Note shall be governed by the laws of the State of Arizona, including but not limited to A.R.S. § 47-3101 et seq.

Signatures:

- Borrower’s Signature: ____________________________ Date: ___________________

- Lender’s Signature: ____________________________ Date: ___________________

Please retain a copy of this Promissory Note for your records.

Form Specs

| Fact Name | Description |

|---|---|

| Definition | An Arizona Promissory Note is a written promise to pay a specified amount of money to a designated party at a specified time or on demand. |

| Governing Law | The Arizona Promissory Note is governed by Arizona Revised Statutes, Title 47, which covers the Uniform Commercial Code. |

| Requirements | To be valid, the note must include the amount, interest rate, payment schedule, and signatures of the parties involved. |

| Enforceability | A properly executed promissory note is legally enforceable in Arizona, allowing the lender to take legal action if the borrower defaults. |