Attorney-Verified Small Estate Affidavit Document for the State of Arizona

The Arizona Small Estate Affidavit is a valuable tool for individuals dealing with the estate of a deceased person whose assets fall below a certain threshold. This form streamlines the process of transferring property without the need for formal probate proceedings, making it easier for heirs and beneficiaries to claim their inheritance. By using this affidavit, a person can assert their right to the decedent's assets, provided that the total value of the estate does not exceed the limit set by Arizona law. The affidavit must include essential information, such as the decedent's details, a list of assets, and an affirmation that the claimant is entitled to the property. Additionally, it requires the signatures of all interested parties, ensuring that everyone involved is in agreement. Understanding the requirements and proper use of the Small Estate Affidavit can save time and reduce legal expenses, allowing families to focus on healing during a difficult time.

Guide to Writing Arizona Small Estate Affidavit

Completing the Arizona Small Estate Affidavit form is a straightforward process that allows individuals to claim assets of a deceased person without the need for formal probate proceedings. Once the form is filled out correctly, it can be submitted to the appropriate court or financial institution to facilitate the transfer of assets.

- Begin by obtaining the Arizona Small Estate Affidavit form. You can find it online or at your local courthouse.

- At the top of the form, enter the name of the deceased individual, their date of death, and their last known address.

- Provide your name and contact information as the affiant, the person completing the affidavit.

- List all the assets that are being claimed. This may include bank accounts, real estate, or personal property. Be specific and include account numbers or property descriptions where applicable.

- Indicate whether there are any outstanding debts or claims against the estate. If so, provide details about these debts.

- Sign the affidavit in the presence of a notary public. The notary will verify your identity and witness your signature.

- Make copies of the completed and notarized affidavit for your records and for submission to relevant parties.

- Submit the affidavit to the appropriate court or financial institution, along with any required documentation, such as a death certificate.

After submitting the affidavit, you may need to follow up with the court or financial institution to ensure that the assets are transferred as requested. Be prepared to provide additional information if necessary.

Other Arizona Forms

Ars 14-3971 - By filling out an Affidavit of Service, the server acknowledges their responsibilities and commitments.

General Power of Attorney Arizona - A General Power of Attorney can be tailored to fit your specific needs and responsibilities.

Arizona New Hire - The handbook instructs on the proper use of company IT resources.

Common Questions

What is the Arizona Small Estate Affidavit?

The Arizona Small Estate Affidavit is a legal document that allows individuals to claim assets of a deceased person without going through the full probate process. This form is typically used when the total value of the deceased's estate is below a certain threshold, which is currently set at $100,000 for personal property and $75,000 for real property.

Who is eligible to use the Small Estate Affidavit?

Any individual who is an heir or a beneficiary of the deceased person's estate may use the Small Estate Affidavit. Eligibility is contingent upon the total value of the estate being below the specified limits and the individual must not be aware of any pending probate proceedings.

What assets can be claimed using the Small Estate Affidavit?

The Small Estate Affidavit can be used to claim various types of assets, including bank accounts, vehicles, and personal property. However, it cannot be used for real property if the total value exceeds $75,000 or if the property is subject to a mortgage or other liens.

How do I complete the Small Estate Affidavit?

To complete the Small Estate Affidavit, you must fill out the form with accurate information regarding the deceased, the estate, and the assets you wish to claim. The form requires signatures from individuals who are entitled to inherit from the estate, affirming their agreement with the affidavit's contents.

Where do I submit the Small Estate Affidavit?

The completed Small Estate Affidavit should be submitted to the financial institutions or entities holding the deceased's assets. This may include banks, car dealerships, or other relevant parties. It is advisable to keep copies of the affidavit for your records.

Is there a fee associated with filing the Small Estate Affidavit?

There is typically no fee for filing the Small Estate Affidavit itself, as it is not filed with the court. However, some institutions may have their own processing fees when you present the affidavit to claim assets. It is important to check with each institution for their specific policies.

Can the Small Estate Affidavit be contested?

What happens if the estate value exceeds the Small Estate Affidavit limits?

If the total value of the estate exceeds the limits set for the Small Estate Affidavit, the heirs or beneficiaries must initiate a formal probate process. This involves filing a petition with the court to manage and distribute the estate's assets according to the law and the deceased's wishes.

Dos and Don'ts

Filling out the Arizona Small Estate Affidavit form can be a straightforward process if you follow the right steps. Here are nine important dos and don'ts to consider when completing this form.

- Do ensure you are eligible to use the Small Estate Affidavit by confirming the total value of the estate is below the state limit.

- Do accurately list all assets that are part of the estate, including bank accounts, real estate, and personal property.

- Do provide the correct names and addresses of all heirs and beneficiaries.

- Do sign the affidavit in front of a notary public to ensure its validity.

- Do keep copies of the completed affidavit and any supporting documents for your records.

- Don't omit any required information, as this could delay the processing of the affidavit.

- Don't use the form for estates that exceed the value limit set by Arizona law.

- Don't forget to check for any specific county requirements that may apply to your situation.

- Don't submit the affidavit without ensuring all signatures are properly notarized.

By following these guidelines, you can navigate the process more smoothly and increase the likelihood of a successful outcome.

Similar forms

The Arizona Small Estate Affidavit is similar to the Affidavit of Heirship, which is used to establish the rightful heirs of a deceased person’s estate. This document is particularly useful when the deceased did not leave a will. By providing a sworn statement from individuals who know the family history, this affidavit helps clarify who is entitled to inherit property, much like the Small Estate Affidavit helps simplify the transfer of assets without the need for probate.

Another related document is the Will. A Will outlines an individual’s wishes regarding the distribution of their assets after death. While a Will is a formal document that goes through probate, the Small Estate Affidavit serves as a more streamlined approach for smaller estates. Both documents aim to ensure that a person's assets are distributed according to their wishes, but the Small Estate Affidavit can expedite the process when the estate is below a certain value.

The Personal Representative's Affidavit shares similarities with the Small Estate Affidavit in that it is often used to facilitate the distribution of a deceased person's assets. This document is filed by an appointed personal representative who is responsible for managing the estate. Like the Small Estate Affidavit, it allows for the transfer of assets without going through the lengthy probate process, making it a useful tool for smaller estates.

The Affidavit of Collection of Personal Property is another document that resembles the Small Estate Affidavit. This affidavit allows individuals to collect personal property from a deceased person without needing to go through probate. It is often used when the deceased's estate consists solely of personal items, such as bank accounts or vehicles, making it a practical option for those dealing with smaller estates.

The Transfer on Death Deed (TOD) is a document that allows property owners to designate beneficiaries who will receive their property upon their death. While the Small Estate Affidavit is used after a person passes away, the TOD allows for a smoother transition of property ownership without the need for probate. Both documents simplify the transfer process and help avoid complications during estate settlement.

The Living Trust is another estate planning tool that shares some characteristics with the Small Estate Affidavit. A Living Trust allows individuals to place their assets into a trust during their lifetime, with instructions on how those assets should be distributed after death. While a Small Estate Affidavit is used for smaller estates, a Living Trust can provide a more comprehensive estate management solution, avoiding probate altogether.

The Petition for Probate is a formal request to the court to open a probate case for a deceased person's estate. While the Small Estate Affidavit is designed for smaller estates that do not require probate, the Petition for Probate is necessary for larger estates. Both documents address the distribution of assets, but the Petition for Probate involves a more complex legal process.

The Declaration of Trust is similar in that it outlines how assets are to be managed and distributed. This document can help avoid probate, similar to the Small Estate Affidavit, but it is typically used for more complex estate planning. Both documents serve to clarify the intentions of the deceased and ensure that assets are handled according to their wishes.

Finally, the Power of Attorney can be compared to the Small Estate Affidavit in that it designates someone to make decisions on behalf of another person. While the Small Estate Affidavit comes into play after death, a Power of Attorney is effective during a person’s lifetime. Both documents empower individuals to manage assets, but they operate in different contexts—one during life and the other after death.

Key takeaways

When dealing with the Arizona Small Estate Affidavit form, it's important to keep a few key points in mind. This form simplifies the process of transferring assets without going through probate. Here are some essential takeaways:

- Eligibility Criteria: The estate must not exceed a certain value, which is set by Arizona law. Familiarize yourself with this limit to determine if the affidavit can be used.

- Required Information: You will need to provide detailed information about the deceased, including their name, date of death, and a description of the assets involved.

- Signature Requirement: The affidavit must be signed by the person claiming the assets. This individual must be an heir or a person entitled to the property.

- Asset Transfer: Once the affidavit is completed and notarized, it can be presented to institutions holding the deceased's assets, such as banks or title companies, to facilitate the transfer.

- Legal Advice: Although the form is designed to be straightforward, consider consulting with a legal professional if you have any uncertainties or specific circumstances that may complicate the process.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details. This can include missing the decedent's full name, date of death, or the specific assets involved.

-

Incorrect Asset Valuation: It's common to miscalculate the value of the estate's assets. Ensure that all assets are accurately valued to avoid complications later.

-

Not Meeting the Eligibility Requirements: Some people mistakenly believe they qualify for the affidavit without meeting Arizona's criteria. Familiarize yourself with the limits on asset value and the number of heirs.

-

Failing to Sign the Affidavit: A signature is essential. Some individuals forget to sign the form, which can lead to delays in the process.

-

Neglecting to Notify Heirs: It's important to inform all heirs about the affidavit. Failing to do so can result in disputes or challenges to the estate distribution.

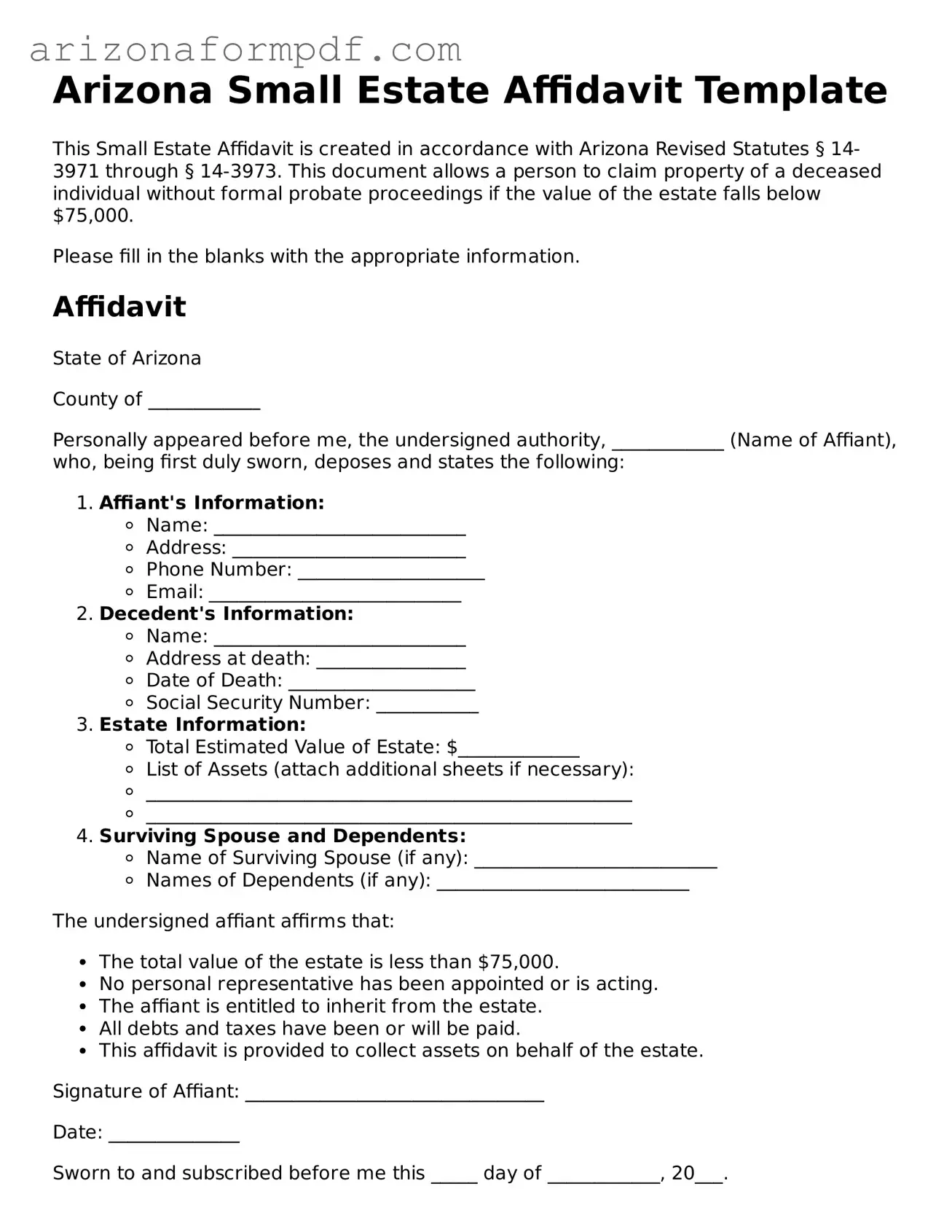

Document Preview

Arizona Small Estate Affidavit Template

This Small Estate Affidavit is created in accordance with Arizona Revised Statutes § 14-3971 through § 14-3973. This document allows a person to claim property of a deceased individual without formal probate proceedings if the value of the estate falls below $75,000.

Please fill in the blanks with the appropriate information.

Affidavit

State of Arizona

County of ____________

Personally appeared before me, the undersigned authority, ____________ (Name of Affiant), who, being first duly sworn, deposes and states the following:

- Affiant's Information:

- Name: ___________________________

- Address: _________________________

- Phone Number: ____________________

- Email: ___________________________

- Decedent's Information:

- Name: ___________________________

- Address at death: ________________

- Date of Death: ____________________

- Social Security Number: ___________

- Estate Information:

- Total Estimated Value of Estate: $_____________

- List of Assets (attach additional sheets if necessary):

- ____________________________________________________

- ____________________________________________________

- Surviving Spouse and Dependents:

- Name of Surviving Spouse (if any): __________________________

- Names of Dependents (if any): ___________________________

The undersigned affiant affirms that:

- The total value of the estate is less than $75,000.

- No personal representative has been appointed or is acting.

- The affiant is entitled to inherit from the estate.

- All debts and taxes have been or will be paid.

- This affidavit is provided to collect assets on behalf of the estate.

Signature of Affiant: ________________________________

Date: ______________

Sworn to and subscribed before me this _____ day of ____________, 20___.

Notary Public: ________________________________

My Commission Expires: _____________________

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Arizona Small Estate Affidavit is used to simplify the transfer of assets for estates that meet certain criteria. |

| Governing Law | This form is governed by Arizona Revised Statutes § 14-3971 through § 14-3975. |

| Eligibility | To qualify, the total value of the estate must not exceed $75,000, excluding real property. |

| Real Property | If the estate includes real property, the total value must not exceed $100,000. |

| Filing Requirements | The affidavit must be signed by the person claiming the assets and notarized. |

| Timeframe | It can be filed immediately after the death of the estate owner, provided the conditions are met. |

| Asset Types | The affidavit can be used for various types of assets, including bank accounts and personal property. |

| Heirs | Only heirs or beneficiaries named in the will or by law can use this affidavit to claim assets. |

| Limitations | The affidavit cannot be used for estates that involve disputes or claims against the estate. |

| Legal Assistance | While not required, consulting with an attorney can help ensure the affidavit is completed correctly. |