Attorney-Verified Transfer-on-Death Deed Document for the State of Arizona

The Arizona Transfer-on-Death Deed form is an important legal tool that allows property owners to designate beneficiaries who will receive their real estate upon their death, without the need for probate. This straightforward process ensures that your property can be transferred directly to your chosen heirs, streamlining what can often be a complicated and lengthy procedure. By filling out this form, you can maintain control over your property during your lifetime while providing clarity and peace of mind for your loved ones after you pass. The deed must be properly executed and recorded to be valid, and it is essential to understand the implications of this decision, including how it interacts with other estate planning documents. Additionally, beneficiaries do not have any rights to the property until the owner has passed away, which helps protect the owner's interests while they are still living. Understanding the nuances of the Transfer-on-Death Deed can empower property owners in Arizona to make informed decisions about their estate planning needs.

Guide to Writing Arizona Transfer-on-Death Deed

After obtaining the Arizona Transfer-on-Death Deed form, you will need to complete it accurately to ensure that your property transfer wishes are documented. Following the completion of the form, it must be signed and recorded with the appropriate county recorder's office.

- Begin by entering the date at the top of the form.

- Provide your name as the current owner of the property.

- List the address of the property you wish to transfer.

- Include the legal description of the property. This information can typically be found on the property deed or tax records.

- Identify the beneficiary or beneficiaries who will receive the property upon your death. Include their full names and addresses.

- Sign the form in the presence of a notary public. Ensure that the notary signs and stamps the document as well.

- Make copies of the completed and notarized form for your records.

- Submit the original form to the county recorder's office in the county where the property is located. Be aware of any recording fees that may apply.

Other Arizona Forms

Can You Get a Dnr at Any Age - Allows patients to exercise their right to refuse resuscitation in specific situations.

Arizona Boat Registration Requirements - Can be an important tool for resolving future ownership claims.

Common Questions

What is a Transfer-on-Death Deed in Arizona?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Arizona to designate beneficiaries who will receive their property upon the owner's death. This deed does not transfer ownership during the owner's lifetime, allowing the owner to retain full control over the property until death.

How does a Transfer-on-Death Deed work?

When the property owner passes away, the designated beneficiary automatically inherits the property without the need for probate. The TOD Deed must be properly executed and recorded with the county recorder's office to be valid. This process simplifies the transfer of property and can save time and costs associated with probate proceedings.

Who can be named as a beneficiary in a Transfer-on-Death Deed?

Any individual or entity can be named as a beneficiary in a TOD Deed. This includes family members, friends, or even charitable organizations. However, it is important to ensure that the beneficiary is legally capable of inheriting property and that their information is accurately recorded in the deed.

Can I change or revoke a Transfer-on-Death Deed after it has been created?

Yes, property owners can change or revoke a TOD Deed at any time during their lifetime. To do this, the owner must create a new TOD Deed or file a revocation form with the county recorder's office. It is crucial to follow the proper legal procedures to ensure that the changes are valid.

Are there any limitations on the type of property that can be transferred using a Transfer-on-Death Deed?

In Arizona, a TOD Deed can be used for most types of real estate, including residential and commercial properties. However, it cannot be used for personal property such as vehicles or bank accounts. Additionally, the property must be held in the owner's name and cannot be subject to certain encumbrances, such as a mortgage that prohibits transfer.

What are the tax implications of a Transfer-on-Death Deed?

Generally, the property transferred via a TOD Deed is not subject to income tax at the time of transfer. However, the beneficiary may be responsible for property taxes and other related expenses once they inherit the property. It is advisable for beneficiaries to consult a tax professional to understand their specific tax obligations.

Do I need an attorney to create a Transfer-on-Death Deed?

While it is not legally required to have an attorney to create a TOD Deed, consulting with one can be beneficial. An attorney can provide guidance on the specific requirements and help ensure that the deed is executed correctly, minimizing the risk of future disputes or issues.

How do I record a Transfer-on-Death Deed in Arizona?

To record a TOD Deed, the property owner must complete the deed form, sign it in front of a notary, and then submit it to the county recorder's office in the county where the property is located. There may be a small fee for recording the deed. It is important to keep a copy of the recorded deed for personal records.

What happens if there are multiple beneficiaries named in a Transfer-on-Death Deed?

If multiple beneficiaries are named, the property will be divided among them according to the terms specified in the deed. If the deed does not specify how the property should be divided, Arizona law will govern the distribution. It is advisable to clearly outline the intentions in the deed to prevent any misunderstandings among beneficiaries.

Dos and Don'ts

When filling out the Arizona Transfer-on-Death Deed form, it's crucial to approach the task with care. This legal document allows property owners to designate beneficiaries who will receive their property upon their death, bypassing probate. Here are some important do's and don'ts to keep in mind:

- Do ensure accuracy: Double-check all names, addresses, and legal descriptions of the property. Mistakes can lead to complications later.

- Do sign in front of a notary: Proper notarization is essential. This step adds credibility and ensures the document is legally binding.

- Do inform your beneficiaries: It's wise to discuss your intentions with those you are naming as beneficiaries. This can prevent confusion and potential disputes in the future.

- Do keep a copy: Retain a signed copy of the deed for your records. This will be helpful for both you and your beneficiaries.

- Don't leave it incomplete: Ensure all required sections of the form are filled out completely. An incomplete form may not be valid.

- Don't forget to update the deed: If your circumstances change, such as a change in beneficiaries, make sure to update the deed accordingly.

- Don't ignore state laws: Familiarize yourself with Arizona's specific requirements for Transfer-on-Death Deeds to avoid any legal issues.

- Don't assume it’s irrevocable: Understand that you can revoke or change the deed at any time before your death, as long as you follow the proper procedures.

Similar forms

The Arizona Transfer-on-Death Deed (TOD) form is similar to a Last Will and Testament in that both documents facilitate the transfer of property upon the death of the owner. A Last Will outlines how an individual's assets should be distributed after their passing. However, the TOD allows for the direct transfer of property without the need for probate, which can streamline the process and reduce costs for beneficiaries. Both documents require the owner to clearly specify their intentions regarding asset distribution, but the TOD takes effect immediately upon signing, while a will only becomes effective after the owner's death.

Another document comparable to the TOD is a Living Trust. A Living Trust allows individuals to place their assets in a trust during their lifetime, which can then be distributed to beneficiaries upon their death without going through probate. Like the TOD, a Living Trust can help avoid probate, but it requires more formalities to establish and maintain. The key difference lies in the management of assets; a Living Trust may involve ongoing management by a trustee, whereas a TOD simply transfers ownership at death.

A Beneficiary Designation form is also similar to the Arizona TOD Deed. This document is commonly used for financial accounts, insurance policies, and retirement plans to designate who will receive the asset upon the account holder's death. Like the TOD, a beneficiary designation allows for a straightforward transfer of assets without probate. However, it is limited to specific types of accounts and does not apply to real estate, which is where the TOD is particularly useful.

The Joint Tenancy with Right of Survivorship agreement shares similarities with the TOD as well. In a joint tenancy arrangement, two or more individuals hold title to property together, and upon the death of one owner, the surviving owner automatically inherits the deceased's share. Both documents serve to bypass probate, but joint tenancy requires the co-ownership of the property, while a TOD allows for a single owner to designate a beneficiary without requiring joint ownership.

The Community Property Agreement is another document that bears resemblance to the TOD. In community property states like Arizona, spouses may own property jointly. Upon the death of one spouse, the surviving spouse typically retains ownership of the community property. While both documents facilitate the transfer of property, the Community Property Agreement is specifically designed for married couples and addresses the division of assets acquired during the marriage, whereas the TOD is applicable to any individual seeking to transfer real estate.

A Power of Attorney (POA) can also be likened to the TOD in terms of asset management. A POA allows an individual to appoint someone else to manage their financial affairs while they are alive. Although the TOD focuses on transferring property after death, both documents empower individuals to control their assets. The main distinction is that a POA is active during the principal's lifetime, whereas the TOD only takes effect upon death.

The Affidavit of Heirship is another document that can be compared to the Arizona TOD Deed. This affidavit serves to establish the heirs of a deceased individual, allowing them to claim ownership of the deceased's property without going through probate. Like the TOD, the Affidavit of Heirship simplifies the transfer process. However, the Affidavit is often used when there is no will or TOD in place, making it a secondary option for asset transfer.

The Life Estate Deed is similar to the TOD in that it allows for the transfer of property while retaining certain rights during the owner's lifetime. A Life Estate Deed grants an individual the right to use and occupy the property until their death, at which point the property automatically transfers to the designated beneficiaries. Both documents facilitate a smooth transfer of property, but the Life Estate Deed involves more complexity regarding rights and responsibilities during the owner's lifetime.

Lastly, the Quitclaim Deed can be compared to the Arizona TOD Deed. A Quitclaim Deed is used to transfer ownership of property without any guarantees regarding the title. While it can be executed during a person's lifetime to transfer property to another individual, the TOD is specifically designed for posthumous transfers. Both documents can effectively change property ownership, but the Quitclaim Deed lacks the same streamlined process for transferring property upon death that the TOD provides.

Key takeaways

When considering the Arizona Transfer-on-Death Deed, it’s essential to understand its implications and requirements. Here are key takeaways to keep in mind:

- The Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate.

- This deed must be recorded with the county recorder’s office where the property is located to be effective.

- Property owners can designate one or more beneficiaries, providing flexibility in estate planning.

- Beneficiaries do not have any rights to the property until the owner passes away.

- It is crucial to ensure that the deed is filled out correctly to avoid any legal complications later on.

- Property owners can revoke or change the deed at any time before their death, offering control over the transfer process.

- Consulting with a legal professional can help clarify any questions regarding the deed's impact on estate taxes or other financial considerations.

- Once the owner dies, the beneficiaries must file a death certificate along with the deed to transfer ownership officially.

Common mistakes

-

Incorrectly Identifying the Property: Failing to provide a complete and accurate legal description of the property can lead to complications. It is crucial to include the exact address and any relevant parcel numbers.

-

Missing Signatures: The deed must be signed by the owner(s) of the property. Omitting a signature can render the deed invalid. All owners must sign if the property is jointly owned.

-

Not Notarizing the Document: In Arizona, a Transfer-on-Death Deed must be notarized. Neglecting to have the deed notarized can prevent it from being legally recognized.

-

Failure to Record the Deed: After completing the deed, it must be recorded with the county recorder’s office. If not recorded, the transfer may not take effect upon the owner’s death.

-

Inaccurate Beneficiary Information: Providing incorrect details about the beneficiary can create issues. Full names and addresses should be listed clearly to avoid confusion.

-

Not Understanding the Implications: Some individuals overlook the potential consequences of a Transfer-on-Death Deed. It is essential to understand how it affects estate planning and tax implications.

-

Neglecting to Update the Deed: Life changes, such as marriage, divorce, or the death of a beneficiary, necessitate updates to the deed. Failing to revise the deed can lead to unintended outcomes.

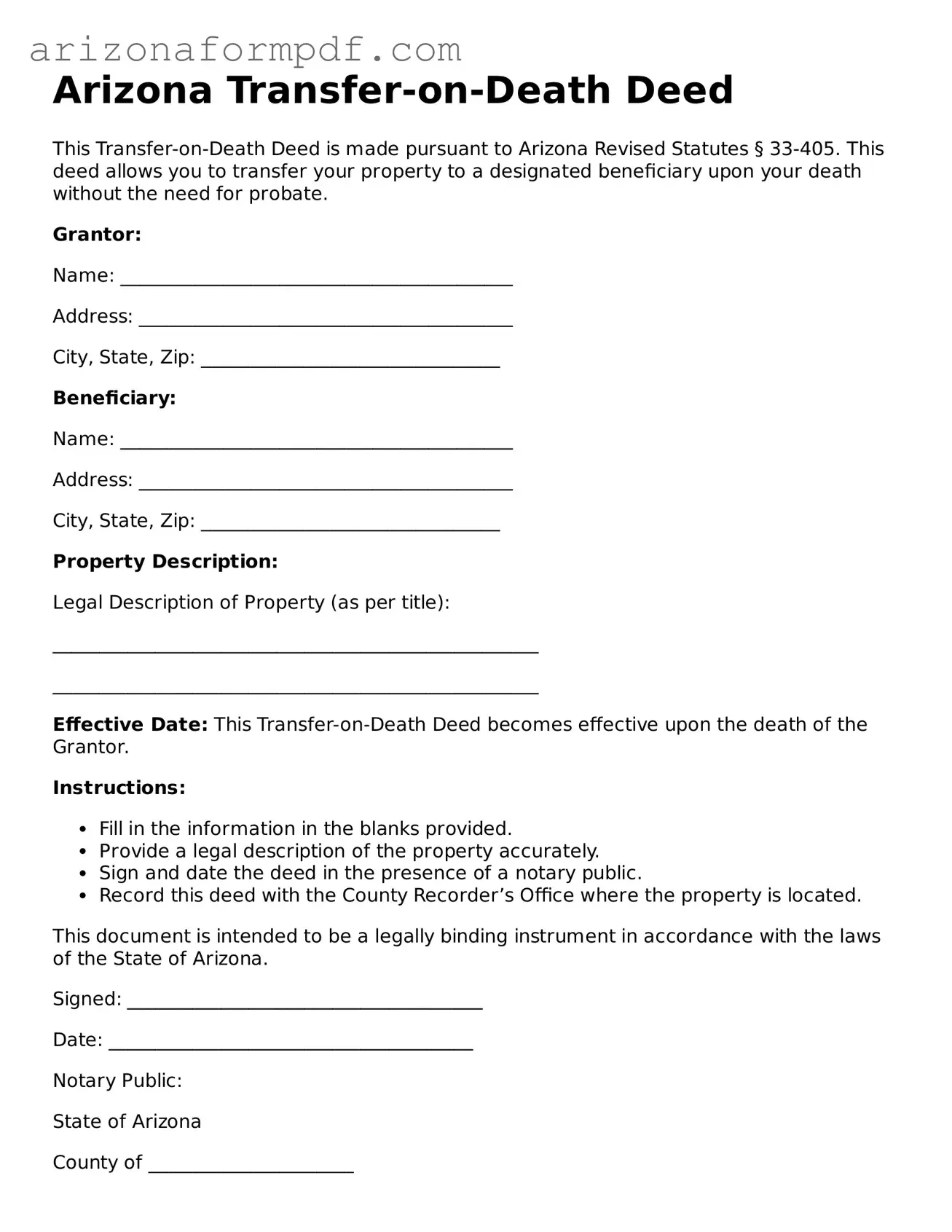

Document Preview

Arizona Transfer-on-Death Deed

This Transfer-on-Death Deed is made pursuant to Arizona Revised Statutes § 33-405. This deed allows you to transfer your property to a designated beneficiary upon your death without the need for probate.

Grantor:

Name: __________________________________________

Address: ________________________________________

City, State, Zip: ________________________________

Beneficiary:

Name: __________________________________________

Address: ________________________________________

City, State, Zip: ________________________________

Property Description:

Legal Description of Property (as per title):

____________________________________________________

____________________________________________________

Effective Date: This Transfer-on-Death Deed becomes effective upon the death of the Grantor.

Instructions:

- Fill in the information in the blanks provided.

- Provide a legal description of the property accurately.

- Sign and date the deed in the presence of a notary public.

- Record this deed with the County Recorder’s Office where the property is located.

This document is intended to be a legally binding instrument in accordance with the laws of the State of Arizona.

Signed: ______________________________________

Date: _______________________________________

Notary Public:

State of Arizona

County of ______________________

Subscribed and sworn before me this _____ day of ___________, 20__.

Notary Signature: ___________________________

My Commission Expires: _____________________

Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows an individual to transfer real property to a beneficiary upon their death without the property going through probate. |

| Governing Law | The TOD deed in Arizona is governed by Arizona Revised Statutes § 33-405. |

| Eligibility | Any individual who owns real property in Arizona can create a TOD deed, provided they are of sound mind and at least 18 years old. |

| Beneficiary Designation | Multiple beneficiaries can be named, and the property can be divided among them in specified shares. |

| Revocation | A TOD deed can be revoked at any time by the owner, provided they follow the proper procedures outlined in state law. |

| Filing Requirements | The TOD deed must be recorded with the county recorder's office where the property is located to be valid. |

| Tax Implications | Transfer-on-Death deeds do not affect the property owner's tax situation until their death, at which point the beneficiary may face property tax reassessment. |